4 Ways to Dilute a Concentrated Stock Risk

For investors, it’s possible to have too much of a good thing, and it can be disastrous to have too much of a bad thing. Is your portfolio overweighted in a single stock? Here’s how to tell and some strategies to help regain your balance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors may have seen a large run-up in their technology stocks. Stocks like Apple, Facebook, Google and Amazon all have had a great run. However, there is a reason for the saying “Don’t put all your eggs in one basket.” It may have something to do with the risk of owning too much of one stock.

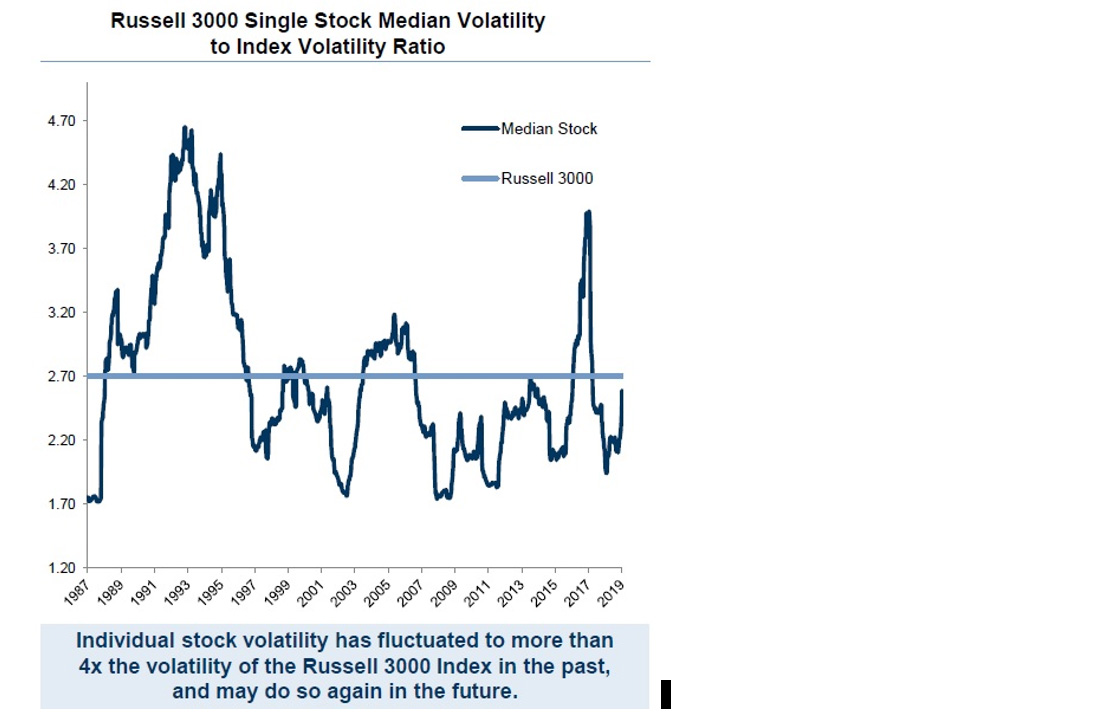

According to a recent Goldman Sachs Asset Management study, 23% of the stocks in the Russell 3000 Index (a broad measure of the U.S. stock market) lost more than a fifth of their value in an average calendar year from 1986-2019. The study found the average stock was more than three times as volatile as the Russell 3000 index itself (Source: FactSet, GSAM).

Source: Goldman Sachs Asset Management

Given the research from Goldman Sachs, investors with a large concentration in one stock may be on a wild and risky ride in the years ahead.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Volatility is a measure of risk, or how much the stock price fluctuates. If a single stock is more than three times as volatile as the index, brace yourself for a wild ride. Volatility on the upside is a good thing. Negative volatility, or price decreases — as in case of Boeing, which is down 38% in the past year — can lead to steep losses (Source: Morningstar). That is why investment advisers preach diversification. Spreading the risk around different stocks can mitigate the effects any one stock has on the whole portfolio.

How Much Is Too Much of One Stock?

Despite research to the contrary, some investors are overweighted to one stock. When one stock is more than 10% of the portfolio, we call this a concentrated stock position, and a red flag goes up. There may be several reasons for the concentrated stock position. Some can't sell their company stock due to employer restrictions. Others don't want to pay the income tax on the gain. Some think the stock may go higher.

Investors should not underestimate the risk of owning too much of one stock – see Lehman Brothers, WorldCom, Enron, Pier One, Frontier Communications and Hertz to name a few examples.

What to Do about an Overweighted Portfolio

If you are concerned about the risk one large stock position has on your retirement nest egg (as you should be), here are four solutions to consider:

Gift Shares to Charity

Gifting stock to a qualified charity is one idea. Donating appreciated shares allows you to get rid of the stock and not incur the tax from selling. You want to gift the shares with the lowest cost-basis or the largest taxable gain.

Sell with Tax-Loss Harvesting in Mind

Before you sell the stock, see if you can use losses in other parts of the portfolio to offset the taxable gain. We call this tax-loss harvesting. This can only be done in non-retirement accounts. We manage several portfolios that actively harvest losses throughout the year when they come up. We try to match the harvested losses to the gain incurred from selling the concentrated stock position. This helps reduce the net taxable gain at the end of the year. The smaller the taxable gain, the less tax owed, which is a good thing.

Taxpayers can also deduct $3,000 of losses from their federal taxable income each year. Unused losses are carried forward to future years on your federal tax return, and some states may allow you to carry forward unused losses on your state tax return as well.

Exchange Fund

For more sophisticated and wealthy investors, an Exchange Fund swaps your stock for a pool of diversified stocks. Since it is a swap, and not a sale, there is no immediate income tax due. The benefit is the new pool of stocks provides greater diversification. Exchange Funds are relatively new, available only to Qualified Purchasers (defined as those with investable assets greater than $5 million) and illiquid — generally a seven-year lock-up.

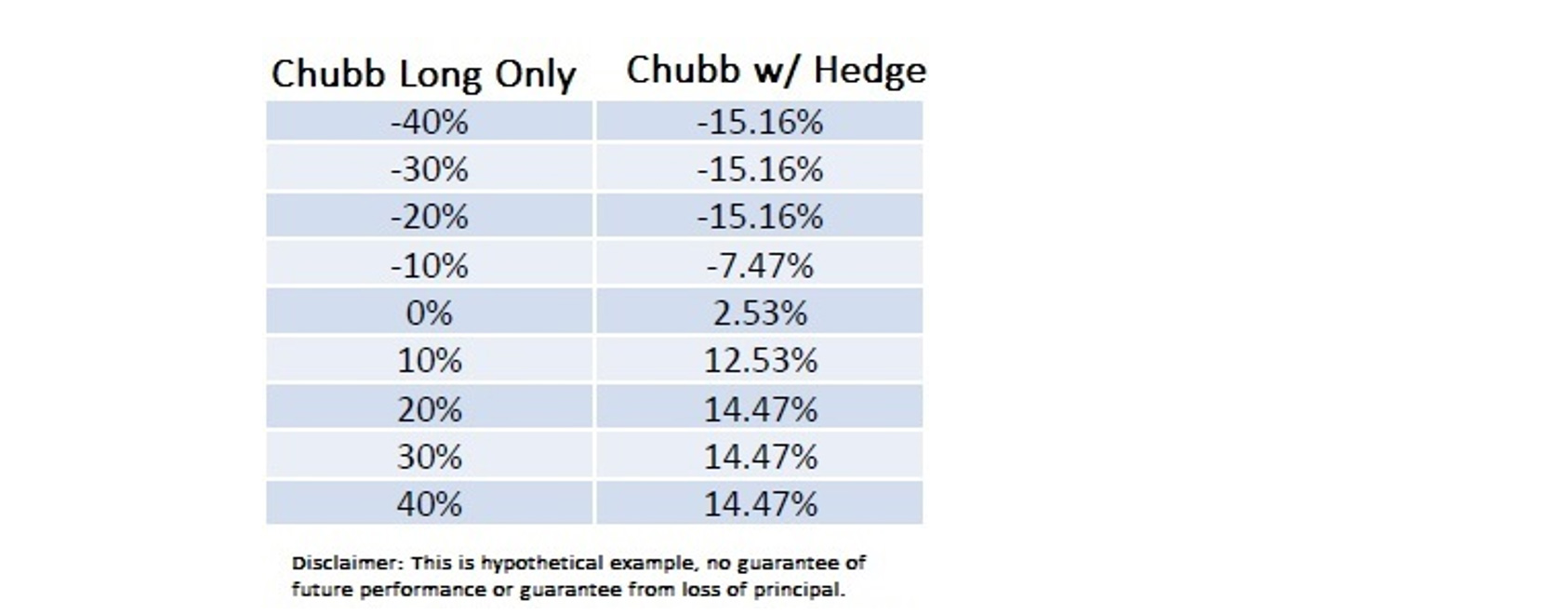

Zero-Cost Collar

Investors can also use options to mitigate the downside of a stock's loss. One strategy is a "zero-cost collar." A zero cost-collar involves writing a call option — selling a call — and using the income to buy a put option on the underlying stock. Buying the put option gives you the right to sell the stock at a predetermined price. That comes in handy if the stock price drops. Writing the call option provides income to buy the put option, hence the "zero-cost."

It doesn’t always work out to a zero-cost, but it is usually close. The figure above illustrates a collar strategy with Chubb Stock (ticker symbol CB). Remember: Options involve risk, are complicated, and can reduce your upside. It's best to consult with an experienced professional before implementing.

The Biggest Risk

The biggest risk, in my opinion, is not having a plan to deal with a concentrated stock position. Letting the years go by without doing anything only complicates the problem. The stock position may get larger and the tax bill higher. In my opinion, a diversified portfolio should not have more than 10% of the assets in any one stock.

Luckily, as described above, there are several ways to manage a large stock position in a tax-efficient and smart way. It all starts with a plan.

The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Investment advisory and financial planning services are offered through Summit Financial, LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Legal and/or tax counsel should be consulted before any action is taken.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.