6 AI Stocks to Watch for Rapid Growth

Artificial intelligence is becoming more ingrained in our everyday lives. Here are six names that could profit on this quickly expanding space.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

First it was mainframe computers, then personal computers (PCs), then smartphones. Technology comes in waves and the dawning of artificial intelligence (AI) and AI stocks has captured the imagination of investors.

And well it should.

AI is transformative not just for the investment landscape, but it will change how we live and work. As demand for this technology grows, it seems likely that so too will interest in AI stocks.

There will be winners and losers to be sure, but overall many more winners.

Some companies will benefit from the development of AI, such as chipmakers and software developers. But many, many more companies will become winners because of easy, economical access to AI – or high performance computing (HPC) or machine learning (ML), take your pick – that will make them better, faster and more profitable.

While some AI developers like semiconductor or software companies are easy to spot as probable winners, others are less obvious.

Below, we highlight six AI stocks from both camps that merit the attention of investors who want to profit from the next wave in technology.

Data is as of June 14.

- Market value: $43.7 billion

- Year-to-date performance: 4.2%

At its core, Pinterest (PINS, $68.67) is a data and AI company, according to its former chief technology officer, Vanja Josifovski.

While artificial intelligence can be deployed in any social media ecosystem, it can be particularly effective with Pinterest because users go to the site seeking knowledge, and not necessarily engagement.

Using AI to find images, organize videos and make recommendations provides a hyper-personalized learning experience that not only keeps users coming back, but attracts new ones, too.

And as far as AI stocks go, this one is seeing massive growth.

In the first quarter of 2021, global monthly active users (MAUs) grew 30% year-over-year to 478 million. Revenues surged 78% from the year prior to $485 million.

Still the company has yet to turn a profit, though 2021 is the year PINS will pivot to profitability, if analyst estimates are correct.

This might put the artificial intelligence stock into the category of prudent speculation, but it should be noted that Pinterest isn't exactly gasping its way into profitability. It is sporting a strong set of financials, with some $2 billion in cash and marketable securities and no long-term debt.

The company's liquid assets are 10 times current liabilities. As Pinterest seeks to achieve profitability, investors can draw comfort from the fact that it has the financial resources to do it.

Nvidia

- Market value: $449.0 billion

- Year-to-date performance: 38.0%

Graphics chipmaker Nvidia (NVDA, $720.75) is one of the best AI stocks around.

NVDA is the undisputed leader in making the processors that drive AI and is well-positioned to capitalize on the rise of artificial intelligence.

One indicator that Nvidia is on the leading edge of AI innovation: The company spent about 20% of its sales on research and development (R&D), according to a recent Securities and Exchange Commission (SEC) filing. By comparison, Apple (AAPL) spends less than 10%.

Another indicator that Nvidia is on the leading edge of the rise in AI is its growth in sales and earnings per share (EPS). For the 12 months ended Jan. 31, they were up 53% and 55%, respectively. Further, the first quarter showed acceleration, with sales and earnings up 13% and 31% from the previous quarter, respectively.

It's important to remember that Nvidia began life as a graphics processing company, and today, that segment still makes up roughly 60% of sales. But AI is coming on strong. For the 12 months ended January 2021, AI sales grew to 40% of total sales, up from 30% the prior period. In 2019, AI-related sales were just 13%, though the company broke out its segments differently then.

The next frontier for artificial intelligence is enterprise software, which will put it into the hands of large corporations that heretofore could not harness or afford it. Capitalizing on this opportunity will take lots of cash, and fortunately, NVDA has loads of it.

The company's more than $12 billion in cash is 12 times the debt due this year – with no more debt due until 2026 – and three times current liabilities. Meanwhile, sales, earnings and cash flow have been growing at an annual average of 19%, 42% and 35%, respectively for the last five years.

A pending deal to buy Arm Limited from SoftBank for $40 billion could further solidify Nvidia's leadership position in AI.

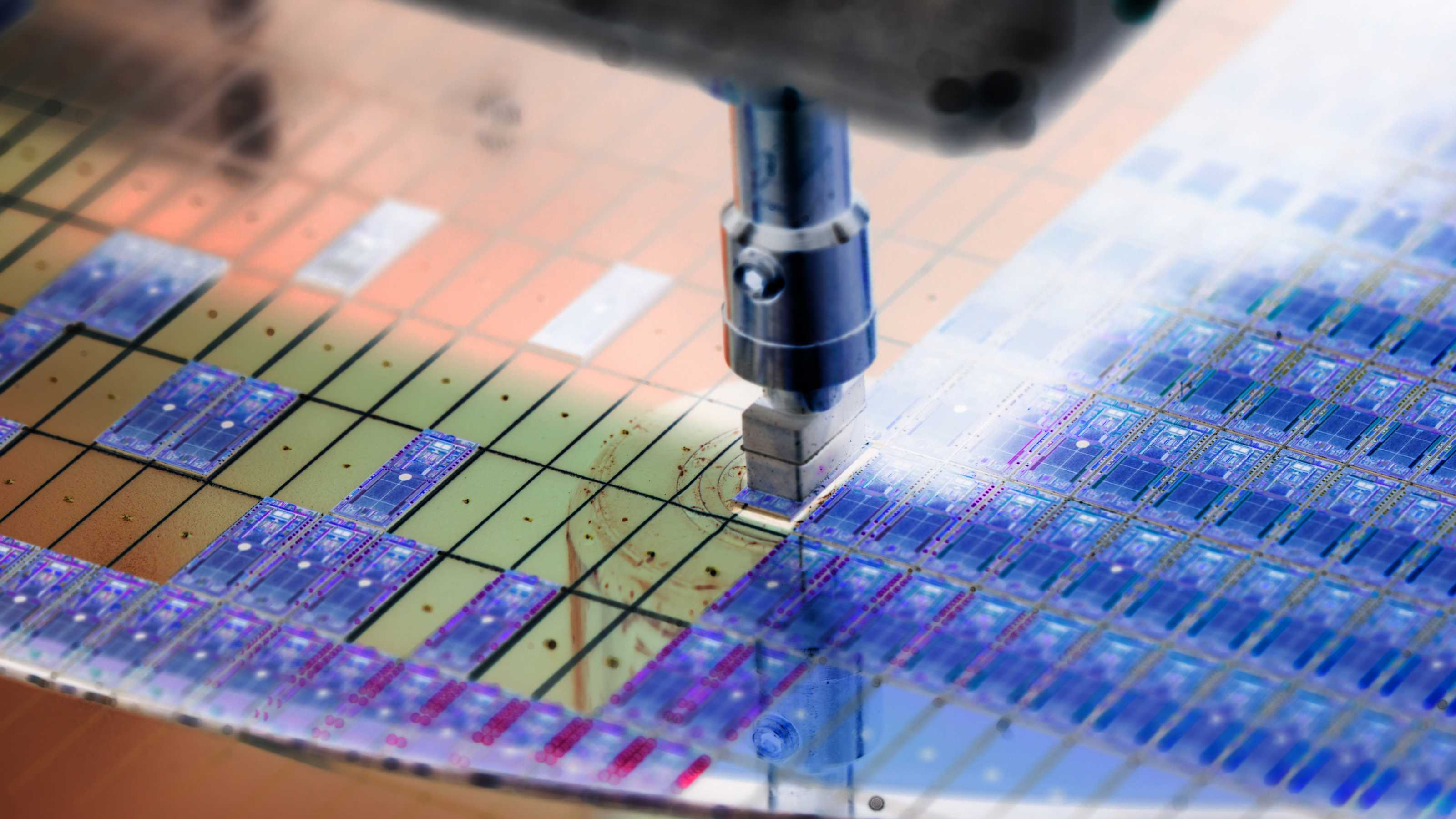

Taiwan Semiconductor

- Market value: $565.8 billion

- Year-to-date performance: 11.0%

Taiwan Semiconductor (TSM, $120.99) is another undisputed leader among AI stocks.

It makes integrated circuits for AI leader Nvidia, but also others who want to knock off NVDA and become kingpins in their own right, such as Advanced Micro Devices (AMD) and Qualcomm (QCOM).

Everyone who wants to get a foothold in AI does business with Taiwan Semiconductor.

And TSM is a monster: It makes 24% of the world's semiconductors. The company doesn't break out AI sales, but it does break out high performance computing, which refers to the most demanding processing tasks, including artificial intelligence. HPC accounts for about 60% of the company's sales. The HPC segment grew at 33% in 2020, compared to overall sales growth of 25%, which is notable because it was a difficult year for chipmakers due to the pandemic and a shortage of chips in general.

Right now, TSM's biggest problem is figuring out how to keep up with demand.

Per Bloomberg, Taiwan Semiconductor CEO C.C. Wei wrote in a letter to customers that the company's fabrication facilities have been "running at over 100% utilization over the past 12 months." To meet this demand, TSM announced that it will spend $100 billion over the next three years "to increase capacity to support the manufacturing and R&D of advanced semiconductor technologies."

The company doesn't say how it will finance this spending, but its financial strength offers options. Right now, TSM is sitting on $25 billion in cash, with about $8 billion in debt due, of which $5.7 billion is due this year. With some $68 billion in shareholder equity, Taiwan Semiconductor could take on loads more debt and still remain conservatively levered.

Taiwan Semiconductor is a dividend grower, too. The current yield is about 1.5%, and has been growing at more than 22% average annually for the last five years.

DocuSign

- Market value: $50.1 billion

- Year-to-date performance: 15.7%

Few investors might have imagined there was a business in getting signatures on a contract. But DocuSign (DOCU, $257.26) did just that, growing into a $50 billion behemoth, with a stock price that has gone up almost sevenfold since its April 2018 initial public offering (IPO).

And now, AI may power the next leg of growth for the company.

The 2020 acquisition of Seal Software, an AI company, means that DocuSign is not just helping businesses and individuals get contracts signed, but also assisting them in analyzing and managing contractual agreements.

One way that Seal's technology puts the "intelligence" in "artificial intelligence" is by going beyond keyword searches to compare critical clauses and terms in contracts side-by-side to spot risks and opportunities.

By almost any metric, DocuSign is growing – a plus when one is considering investing in AI stocks.

Revenues have doubled since 2018 to $1.5 billion, and if the company hits its guidance for 2021, it will have tripled its revenues since the IPO. DocuSign's customer base, which is approaching 1 million users, grew 51% last year. This is about equal to the new customer additions DOCU saw from its founding in 2013 through its IPO five years later.

What AI adds to this equation is stickiness. By helping customers manage agreements and protect them from what might be lurking within, DocuSign is in a position to keep them for life.

All of this enthusiasm should be tempered, however, given that DocuSign has yet to turn a profit using GAAP (generally accepted accounting principles) conventions. However, it is reporting profits on a non-GAAP basis and is cash-flow positive. Further, its first-quarter loss of about $11 million (4 cents per share) was much narrower than the 26-cent per-share loss a year ago.

DocuSign is sitting on more than $750 million in cash with just $20 million in debt due this year. There is a scary looking $780-million liability on DOCU's balance sheet, but this represents the unearned portion of annual contract revenue. As such, ceteris paribus, the company has the cash on hand to painlessly fund moderate losses as it turns the corner for a bright future abetted by AI.

Microsoft and Amazon.com

- MSFT market value: $1.9 trillion

- MSFT year-to-date performance: 16.9%

- AMZN market value: $1.7 trillion

- AMZN year-to-date performance: 3.9%

Microsoft (MSFT, $259.89) and Amazon.com (AMZN, $3,383.87) are both capitalizing on AI. For investors who want to take advantage of its growth, both AI stocks deserve a closer look.

And they're worth looking at together because, in both cases, the opportunity comes through their cloud businesses, which increasingly rely upon artificial intelligence to deliver AI-powered computing to business, governments and institutions.

At Microsoft, it is the company's so-called intelligent cloud segment known as Azure. And at AMZN, it's Amazon Web Services (AWS).

Over at Microsoft, it is important to keep in mind that while Azure is just a third of the company's revenues, it is MSFT's fastest growing business. Azure revenues have increased 50% since 2018, versus the more pedestrian productivity and personal computing segments, which are growing, but not as fast.

By comparison, AWS constitutes just 12% of AMZN's sales, but it is the largest contributor to the company's operating earnings. For 2020, AWS operating income of $13.5 billion was 59% of total operating income.

Unlike MSFT, AI is not just a service for Amazon.com, but is more deeply embedded in how the company does business – impacting everything from order flow to recommendations to the conversion of Alexa commands into orders and profits.

Also noteworthy, Microsoft and Amazon have some of the strongest balance sheets among mega-techs. Together, the two companies are sitting on more than $200 billion in cash. Of course with MSFT and AMZN, there are a variety of forces impacting the businesses that go well beyond AI, and include everything from consumer sentiment to antitrust actions.

Still, for investors who want to profit from AI stocks, MSFT and AMZN offer well-funded and well-protected on ramps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.