Investor Success: Measure in Dollars, not (Per)Cents

You can’t control the markets, but a big part of your success in investing for retirement is entirely in your own hands.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The concept of “investing success,” as it often appears in the media, is a tangled web to me. Every time I read something about the topic, I can’t help but feel that the authors are confusing two very different efforts: investment success and investor success.

Yes, this is nuanced, but yes, it matters. Too often, investment success is defined in either absolute or relative returns (which is another nuance for another time). While I understand why a portfolio manager would focus on higher returns, I’d argue that this shouldn’t be the benchmark for success for the typical investor. Instead, they should be focused on building the wealth they need to fulfill the objectives that matter most to them. Wealth is measured in dollars, not percents.

Your Savings Rate Is a Huge Factor in Your Success as an Investor

Sure, better returns build more wealth faster, but higher returns are not essential to building wealth. Investing is a partnership between an investor and the markets, where an investor provides the capital and the markets provide the prospects for a return on that capital. Understanding this relationship introduces a most important point for building wealth — capital contributions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A portfolio’s value can grow through both capital contributions and the return on capital, but only one part of this equation can grow wealth reliably: our capital contributions, or more generally, our savings. It’s our contribution to our own investment success and importantly, unlike the investment returns we seek, its benefits are both more certain and within our control.

Contributing More to Savings vs. Taking More Risk

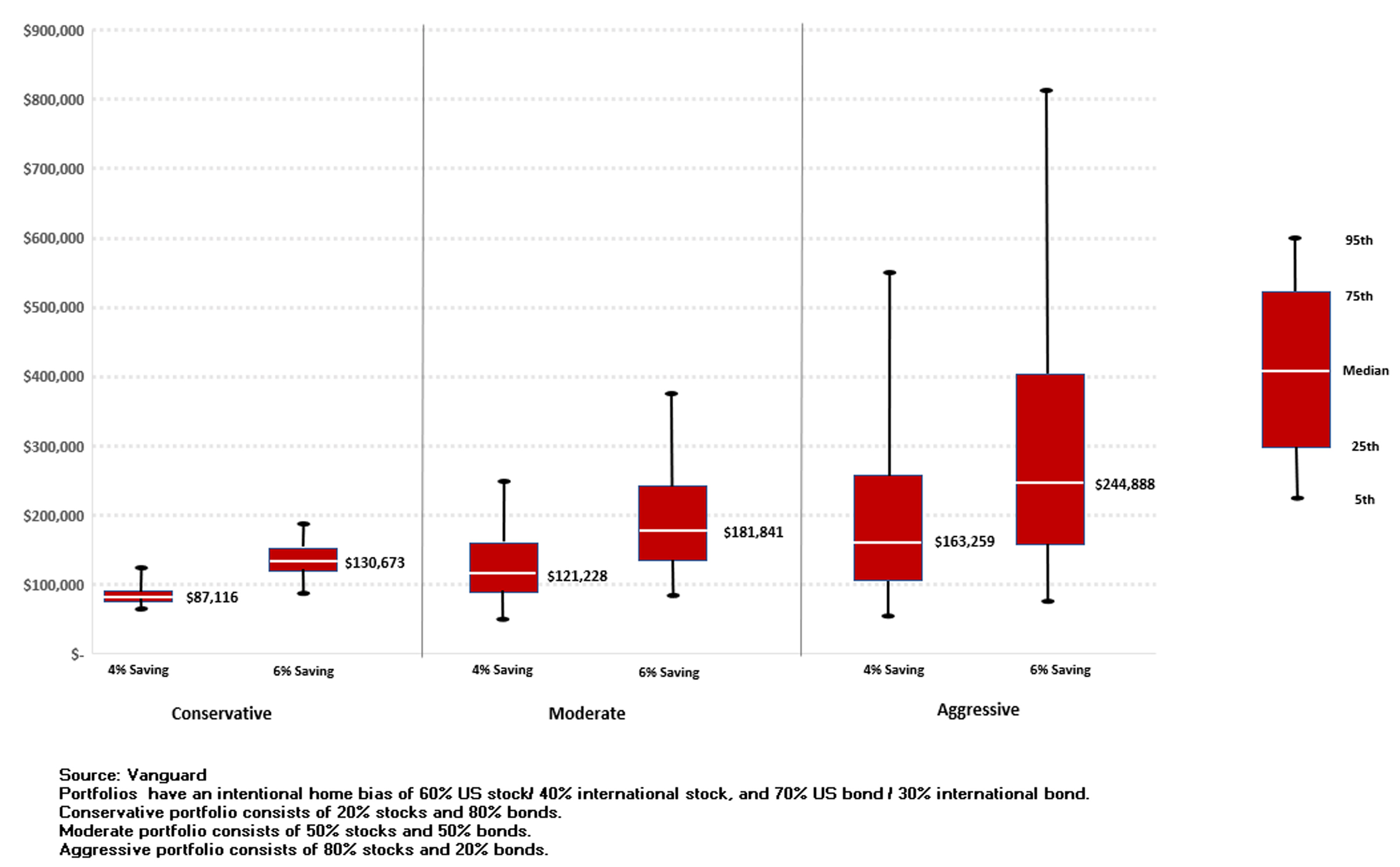

As illustrated in the figure below, moving from a more conservative asset allocation (50% stocks/50% bonds) to a more aggressive one (80% stocks/20% bonds) tends to widen the range of expected outcomes. At any asset allocation choice, higher savings levels contribute to higher best, worst, and median expected outcomes, due to the higher levels of capital contributions.

What is often overlooked, however, is that higher levels of capital contributions allow investors to improve their expected outcomes not only relative to the same asset allocation, but also relative to a higher risk allocation. For example, for the 50% stocks/50% bonds portfolio, a 6% contribution rate provides a better range of total potential outcomes than a 4% savings rate for the same asset allocation and for the majority of expected outcomes in even riskier allocations.

Higher returns are welcomed, but they are a less reliable source of asset growth and wealth creation.

A most extreme version of this scenario played itself out on the national stage when the Powerball lottery offered a $1 billion-plus jackpot. While the lottery gave a player a chance for a fabulous return on their $2 ticket, probability-wise, a player’s wealth would increase more certainly if they didn’t play the lottery at all (since they’re most likely to lose their whole “investment” in lottery tickets).

The Bottom Line for Investors

Investing involves tradeoffs, and an important part of the financial planning process is for an investor to define their willingness to forgo spending now to improve their prospects for building wealth that can provide for their future needs. This is critically important, as a higher savings rate provides a higher probability of investor success. This is due to the partial shift in responsibility for building wealth from the less certain returns from risky assets to a more certain stream of capital contributions.

In the end, if an investor is trying to maximize future wealth, we believe a marginally higher savings rate, rather than a substantially higher risk portfolio, will be more likely to lead to investor success.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Don Bennyhoff, CFA®, serves as the Chairman of the Investment Committee and Director of Investor Education at Liberty Wealth Advisors, a $1.7B RIA. An industry expert who spent over 22 years at The Vanguard Group, Don was a Founding Member of Vanguard’s Investment Strategy Group, and served as a Senior Investment Strategist.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.