Timely Tips for Investors to Deal with Today’s Worst Challenges

When it comes to your retirement savings, in unpredictable times it’s good to have a few well-respected investing rules of thumb to fall back on for reassurance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors are facing two significant challenges right now: stock market volatility and high inflation. For instance, the Dow recently saw its worst daily percentage drop since October 2020, falling almost 1,000 points, or 2.8%, on April 22. And inflation spiked to 8.5% in March, the highest it has been in 40 years.

To help investors navigate these challenges and make informed decisions regarding their portfolios, Janus Henderson is pleased to offer the following time-tested tips.

1. Stock market corrections are normal

A stock market correction is defined as a decline in stock prices of at least 10% from the previous high. As of April 26, 2022, the S&P 500 index was at 4,214, which was down approximately 12% from its record close of 4,796 set on Jan. 3. While declines like this may be unnerving to many investors, there is some good news. First, since 1946 there have been 29 occurrences where the S&P 500 declined between 10% and 20%. In these cases, the average time to recover these losses was only four months. Second, while market drops of at least 10% are common, market drops of 20% or more are not. There have been nine occurrences of declines of between 20% and 40%, and only three occurrences of a decline greater than 40%.

While there are no guarantees that these observations will be repeated, long-term investors may find peace of mind in knowing that the historical record works in their favor.

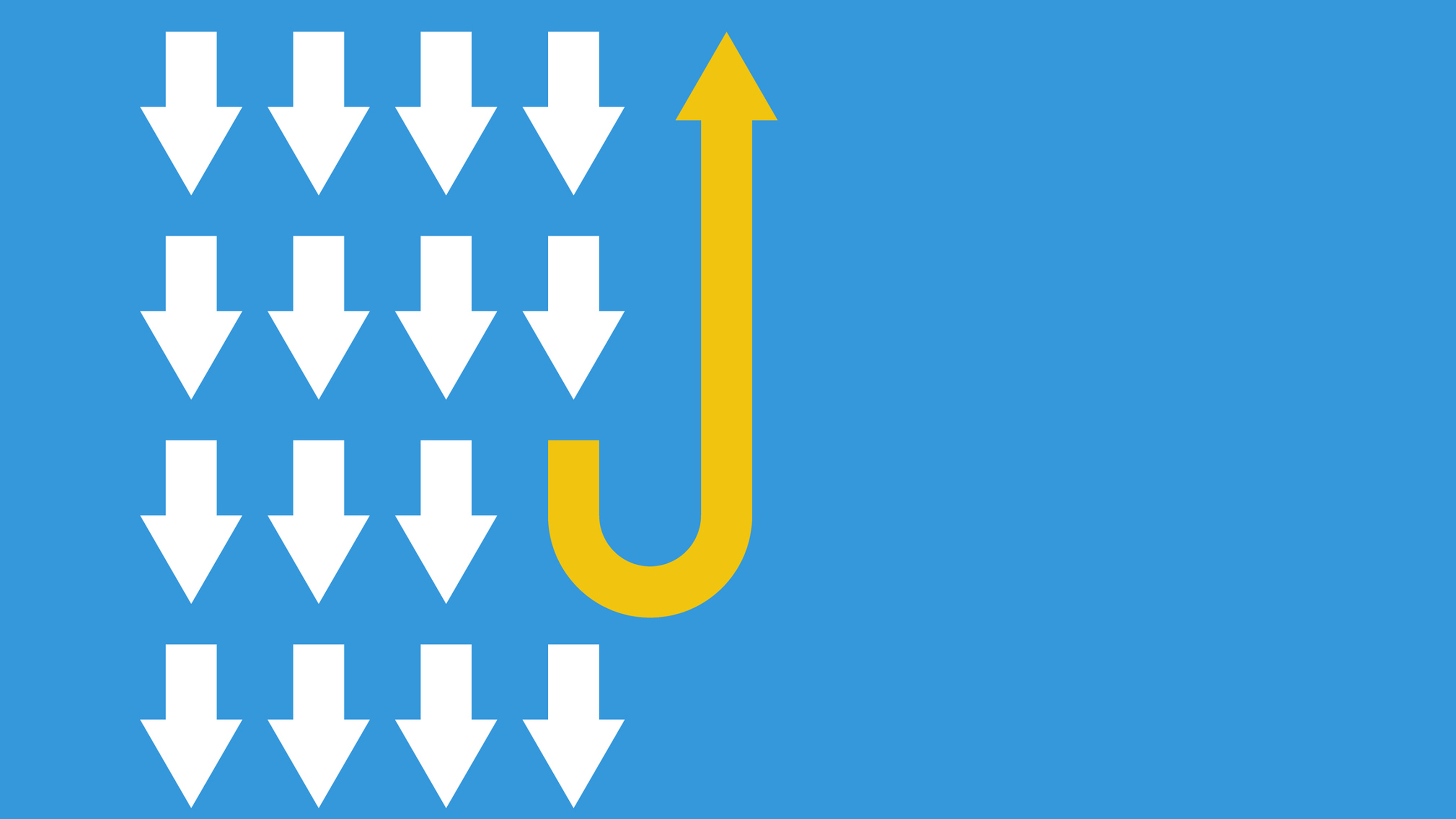

2. Time in the market, not market timing

In uncertain markets, it’s important for long-term investors to maintain perspective. This includes avoiding the market-timing trap. Attempting to time the market is considered a trap because long-term returns have historically been attributable to a relatively small number of trading days. Being out of the market on these days could dramatically reduce returns over time and may even result in losses.

Consider a $10,000 investment in the S&P 500 from 1999 through 2021. If the money was fully invested during the entire period, the ending value would be $59,799. On the other hand, if the 10 best days of the market were missed over this 22-year period, the ending value of the original investment would be roughly half ($27,398). What’s more, if the 40 best days were missed, the investor would have incurred a loss of approximately $4,000.* Therefore, to successfully time the market, investors have to be right twice: knowing when to buy and when to sell.

3. Declining stock prices may actually be beneficial

A temporary decline in stock market prices may provide long-term investors certain benefits. Through dollar cost averaging inside an employer sponsored retirement plan, more shares are being purchased on market dips, thus lowering a participant’s average cost. The lower the average cost, the easier it may be to experience gains over time. Additionally, for investors with positions outside a retirement plan, losses may be harvested to offset potential capital gains. If losses exceed gains, up to $3,000 can be used to offset ordinary income. Any remaining unused losses may be carried forward indefinitely to future years.

Lastly, long-term investors might consider converting part of their traditional IRA or 401(k) to a Roth IRA or Roth 401(k). Ordinary income taxes are due in the year of the conversion, but the future growth is income tax-free. Individual securities that have declined in value but are still viable long-term investments may be good candidates for a Roth conversion.

4. Higher interest rates may spell trouble for certain bond investments

It is widely expected that the Federal Reserve will continue to slowly raise short-term interest rates. Because bond prices generally move in the opposite direction of interest rates, some investors may be questioning the wisdom of continuing to hold these investments. We continue to believe that some investors may consider holding at least a portion of their portfolio in bonds because bonds – particularly those from highly rated creditors – can help provide capital preservation and buoy a portfolio’s value during times of crisis and extreme market volatility.

A key to holding bonds in this environment, however, is to manage duration, which is a measure of a bond value’s sensitivity to interest rate changes. Generally, in a rising rate environment, investors prefer short-duration bonds, which are less sensitive to rate changes than long-duration bonds. Another strategy is to consider bonds that pay a floating interest rate. Unlike a bond that pays a fixed coupon, the yield paid on a floating-rate security will fluctuate in tandem with the general interest rate environment. While many ETFs and mutual funds offer low-duration or floating-rate bonds, investors might also consider a single multi-sector income manager who combines several of these strategies in a single fund.

5. Strategies to keep up with inflation

Beyond long-term investments, such as stocks and bonds, many investors are feeling the adverse effects of inflation in their everyday lives. The consumer price index for February 2022 has risen 7.9% from a year ago, the highest increase since January 1982 – and in March it jumped to 8.5%. While wages have also increased, they have not kept pace with rising prices, as inflation-adjusted earnings declined 2.7% from March 2021 to March 2022, according to the U.S. Bureau of Labor Statistics. Investors who are concerned that higher-than-normal inflation will persist may wish to consider some of the following financial planning strategies.

- First, in a highly inflationary environment, it is generally better to own a home than to rent. A fixed-rate mortgage is paid with dollars that will be worth less in the future, while rent is subject to annual inflationary adjustments. Additionally, real estate such as a primary residence can hold its value in an inflationary environment. Prospective homeowners should act soon, however, while mortgage rates are still low by historical standards.

- Another strategy to consider is to take steps to improve your home’s energy efficiency, such as replacing old windows and doors, adding an extra layer of insulation in the attic, upgrading old kitchen appliances, and installing a programmable thermostat. Depending upon your budget, you might also consider purchasing a more fuel-efficient automobile. Given ongoing supply chain challenges, it may also make sense to stock up on certain non-perishable and emergency supplies. Make these purchases sooner rather than later while the value of the dollar is worth more. Finally, household budgets may need to be revamped and adjusted accordingly.

While 2022 is off to a challenging start in the financial markets, now is not the time for long-term investors to press the panic button. Quite the contrary, there are a number of proactive steps investors can take today that can help ensure they stay on track to meeting their long-term goals and objectives. The geopolitical unrest in Eastern Europe, rising interest rates and an inflationary environment, however, suggest that it may be prudent for investors to re-evaluate how their portfolios are presently constructed and consider adjusting their spending habits to help reduce the impact of rising prices.

*Source: Bloomberg. This shows the hypothetical return of a $10,000 investment in the S&P 500 Total Return Index from Jan. 1, 1999, to Dec. 31, 2021, not including taxes, fees or costs. It has been adjusted to show the impact on overall performance if that investment was taken out of the market after significant periods of volatility, thereby missing the subsequent market rebounds. Note: Hypothetical performance shown here is for illustrative purposes only and does not represent actual performance of any client account. No representation is made that hypothetical returns would be similar to actual performance. Past performance does not predict future returns.

The opinions and views expressed are as of the date published and are subject to change. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

C-0322-42504 12-30-22

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Matt Sommer is a Managing Director and Head of Specialist Consulting Group at Janus Henderson Investors. His team consists of various subject matter experts across several disciplines, including retirement planning, wealth advisory, practice management and investment strategies. They provide clients actionable insight and expertise they can implement into their business practice to retain and gain clients. Prior to joining Janus in 2010, Dr. Sommer spent 17 years at Morgan Stanley Wealth Management and its predecessors, Citi Global Wealth Management and Smith Barney, during which time his roles included director of financial planning and director of retirement planning.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.