The Good News About Recessions for Investors

Yes, an official recession is possible, but based on previous recessions, there could be reasons for investors to smile. With that in mind, here are three ways to position your portfolio now – and one major mistake not to make.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Are we going into a recession? This question has been in the news and on the minds of investors for months, and the recent announcement that GDP has decreased for the second straight quarter makes the question even more pressing.

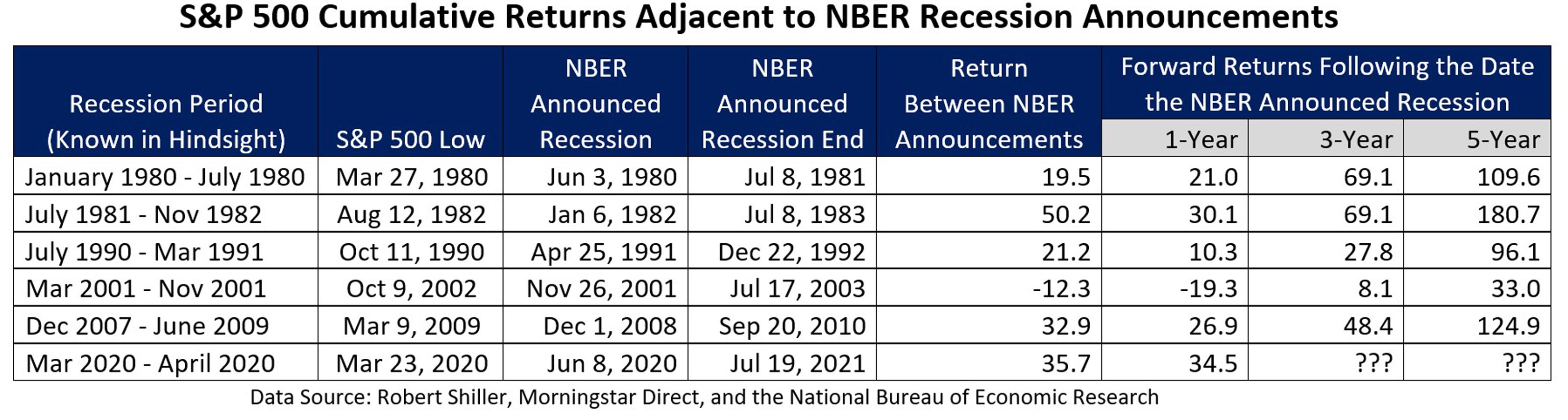

A recession implies trouble for investors. Many believe that once a recession is announced, the stock market will drop sharply – and so changes will be needed to their portfolios to weather the storm. But history indicates a different scenario. Instead of dropping further when a recession is officially announced, the market often moves up.

That is because, in part, recessions are often declared several months after they have started. The National Bureau of Economic Research, a private, non-partisan organization, makes this call after analyzing many economic data points that take time to collect. This information includes, but is not limited to GDP growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why Now May Not Be the Time to Be Defensive

But research by CI Brightworth in Atlanta shows that once an official recession is announced, much, if not all of the market’s downturn has already taken place. So, getting more defensive after a recession is announced may be the worst thing an investor can do.

In three of the last six recessions since 1980, the stock market hit a bottom before the recession was officially recognized. Even more important for investors, after those six recessions, the market quickly moved up five times – ranging from 10.3% to 34.5% only one year following the recession announcement. Strong gains continued for three and five years after a recession was declared – in three cases, the gains topped 100%.

So, what does this mean for investors? The data show that taking defensive actions when a recession is announced has worked poorly in five of the six last recessions. A defensive action ranges from reducing exposure to stocks all the way to the “big mistake” of shifting the entire portfolio to cash.

So, what is an investor to do? Here are three recommendations:

Stop Trying to Time the Market

Trying to get into and out of the stock market is a fool’s errand and one of the biggest wealth destroying actions an investor can take. The market is forward looking and moves prior to the underlying economy. If you’re trying to move into and out of the market based on what’s happening in the economy, you are more likely to do the wrong thing at the wrong time and harm – not improve – your returns.

Stay Disciplined

If you are investing new money, either through your 401(k) plan, individual retirement accounts (IRA) or other plans, continue to follow your long-term investment strategy. You should be excited about the opportunity to buy more stocks when they are “on sale.” If it feels painful to add money to a falling market, consider automating your contributions and investments so you can reap the benefits of lower valuations without contemplating the market’s every move.

Add Stocks to Your Portfolio When They are Down

Use the downturn to rebalance your portfolio by selling assets that have performed the best and buying the assets hardest hit by the market’s tumble. For example, this could mean selling investments in some commodities and real estate while picking up high-quality stocks that have lost a significant amount of money this year. Rebalancing your portfolio is one of the most effective ways to ensure you follow the classic adage of buying low and selling high.

No one knows when the next recession will arrive or how the market will respond when it does. However, by following these key steps, investors can be prepared for any further volatility while also helping to favorably position themselves on the other side.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nick Fazio is an Investment Analyst at CI Brightworth in Atlanta. He provides quantitative and qualitative analysis of current and new investments, communicates the firm’s investment philosophy and outlook with advisers and clients, and conducts investment research on behalf of the CI Brightworth Investment Committee. He also serves as an analyst on CI Brightworth’s US Large Cap stock strategy. Nick holds a B.S. in Business Administration from the Georgia Institute of Technology and is a Certified Public Accountant.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.