(A Little) Greed Is Good When It Comes to Investing

Investors seem to feel only a little greedier than usual right now, and when investors feel that way, there are usually positive stock market returns ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s a certain appeal to being a contrarian investor. Zigging when others are zagging. Going against the herd. And when you’re proven right, it feels pretty darn good (and can pay off handsomely).

One of the first adages contrarian investors learn comes from Warren Buffett. In his 1986 letter to Berkshire Hathaway shareholders, Buffett wrote about being fearful when others are greedy, and greedy when others are fearful.

Such moments are easy to recall. Maybe you bought Bitcoin near its 2021 top, when fear of missing out (FOMO) was in full swing. Or you saw a huge opportunity to buy stocks in March 2020, during the COVID crash … but couldn’t bring yourself to pull the trigger.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Those tops and bottoms burn into our memories. But when it comes to investing around them, there’s a problem: They are rare.

It’s been nearly 36 years since 1987’s Black Monday stock market crash. From that time period up until today, the United States has had five bull and bear market cycles. That means 10 days of tops and bottoms. Over 36 years.

How are we to invest the rest of the time?

It turns out, when others are greedy, being fearful can cost you. Big-time.

How investor sentiment has changed

This is particularly important to keep in mind today, because investor sentiment has dramatically changed compared to a year ago. One way to measure this is the American Association of Individual Investors (AAII) Sentiment Survey. Every week, the AAII polls individual investors about their sentiment on the market for the next six months. Investors can indicate whether they are bullish, bearish or neutral.

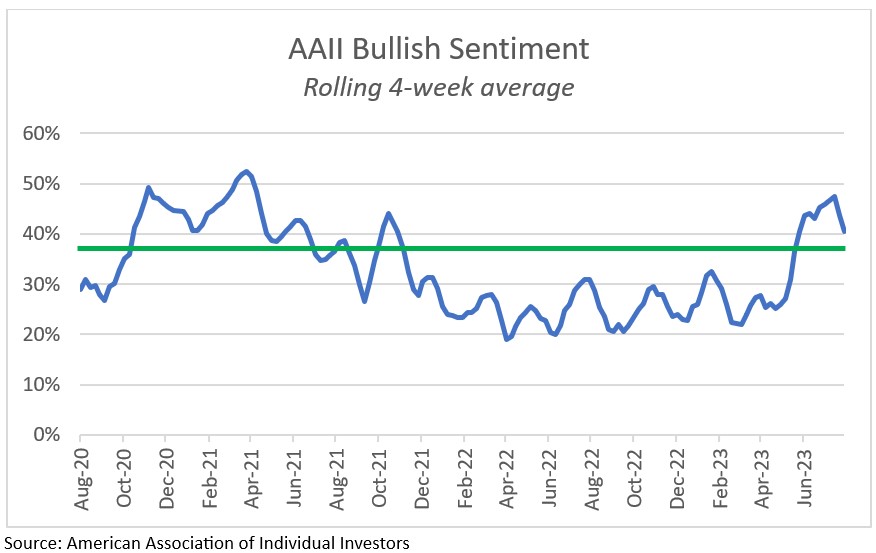

The chart below shows how bullish investor sentiment has changed over the past three years. The long-term average for bullish sentiment is 37.5% (the green line), so anything above that level could be considered more optimistic than usual.

There was plenty of optimism going around in 2021. There’s nothing like reaching new all-time highs to get investors feeling good about the stock market. The party ended in 2022, and naturally, investors were less enthused.

In hindsight, it’s easy to see that this is the exact opposite of how investors should have been feeling. They felt great when stocks were about to go over a cliff. Then they hated stocks right before the market was about to take off.

Is it time to look for the exits now?

When the market seems dismal, having perspective and keeping calm can be a huge advantage. In our mid-year letter to SAM clients in 2022, we noted that investors were unbelievably pessimistic, with AAII bullish sentiment at its lowest point in 30 years. Lower than the early days of COVID. Lower than the 2008 Global Financial Crisis. Lower than the bursting of the tech bubble.

We told our clients that “the type of market pullback we’re seeing today is what leads to big gains in the future.” That has proven to be correct. But how should investor sentiment be guiding decisions in today’s market?

The contrarian in you might be thinking that with investors feeling good about stocks again, it’s time to look for the nearest exit doors. But not so fast. Investors’ bullish sentiment over the past month has averaged 40.5%. That’s only a little higher than the long-term historical average of 37.5%.

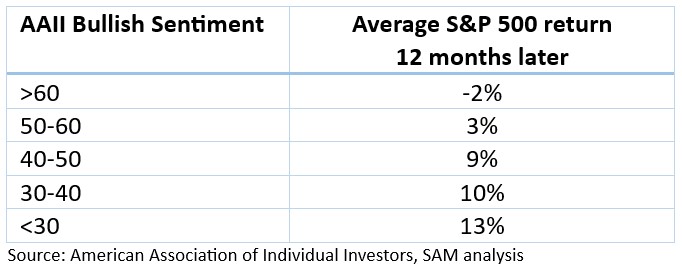

In other words, investors are only a little greedier than usual. And it turns out, when investors are feeling just a little greedy, there are usually positive returns ahead.

Sure, you might do a little better if you buy when bullish sentiment is down in the dumps. But the reality is, it doesn’t happen that often. The market goes up more often than it goes down. And as mentioned, the market going up makes investors feel more bullish.

Bull markets often end when investors have reached a state of euphoria. Today, investors are slightly more optimistic than average. And there are still plenty of bull market skeptics!

We’re certainly a long way away from euphoria. Now is not the time to be fearful. Or greedy. As we’re telling SAM clients: Now is the time to stick to your investment plan. And if you don’t have a well-thought-out plan geared toward reaching your financial goals, there’s no time like the present!

related content

- Three Investments That Put Your Money to Work With Less Risk

- Dividends Are in a Rut

- 5 Stocks Warren Buffett Is Buying (and 8 He's Selling)

- Four Random Facts and Thoughts About Warren Buffett

- The 12 Best Stocks to Buy Now

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.