Analysts Call Uber a "Strong Buy" as It Makes Its S&P 500 Debut

The Uber-in-the-S&P 500 trade may have run its course, but the Street remains uber bullish on Uber stock as a long-term holding.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In what appears to be a case of "buy the rumor, sell the news," Uber Technologies (UBER) stock languished in its Monday debut as a component of the S&P 500 even as the market enjoyed broad-based gains.

Fair enough. UBER stock is up about 7% since S&P Dow Jones Indices said on December 1 the ridesharing company would replace Alaska Air Group (ALK) in the most commonly used benchmark for U.S. equity performance. That beat the broader market by four percentage points.

Also note that Uber was already on a roll when it was tapped for the S&P 500. Shares added more than 50% between the market's October nadir and mid-December – a period in which the broader market rose 15%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That Uber stock should take a breather on the day it actually became a member of the S&P 500 is no big deal. The pop UBER stock got from being picked for the benchmark index may have run its course, but being a member of the S&P 500 also helps in the long term.

That's because the S&P 500 is the most widely tracked index in the world. Indeed, more than $11.4 trillion in assets are indexed or benchmarked to the S&P 500, according to S&P Dow Jones Indices. The market's three largest exchange-traded funds – SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV) and Vanguard 500 Index Fund (VOO) – collectively command more than a trillion dollars in assets under management. Anytime a company is included in the S&P 500, every investment vehicle following the index has to buy its stock.

Wall Street is Uber bullish

The Uber-in-the-S&P 500 trade is over, but Wall Street analysts remain uber bullish on Uber stock as a longer term holding, too.

Of the 48 analysts issuing opinions on Uber stock surveyed by S&P Global Market Intelligence, 32 rate it at Strong Buy, 14 say Buy and two call it a Hold. That works out to a rare consensus recommendation of Strong Buy. The Street is particularly excited about Uber's growth prospects. Analysts forecast Uber to generate average annual earnings per share (EPS) growth of 68% over the next three to five years.

Such an outsized growth rate makes Uber stock, trading at 54 times the Street's 2024 EPS forecast, a screaming bargain at current levels, bulls say.

"Uber is the largest company in the ridesharing industry, and the second-largest player in food delivery," writes Argus Research analyst Bill Selesky, who rates UBER at Buy. "We expect both businesses to perform strongly in Q4 2023 and in 2024, as ridership has now rebounded to pre-pandemic levels."

Selesky adds that Uber reported 21% growth in gross bookings in its most recent quarter, while trip frequency rose by 25%. Uber also posted "solid" free cash flow of $905 million, the analyst notes.

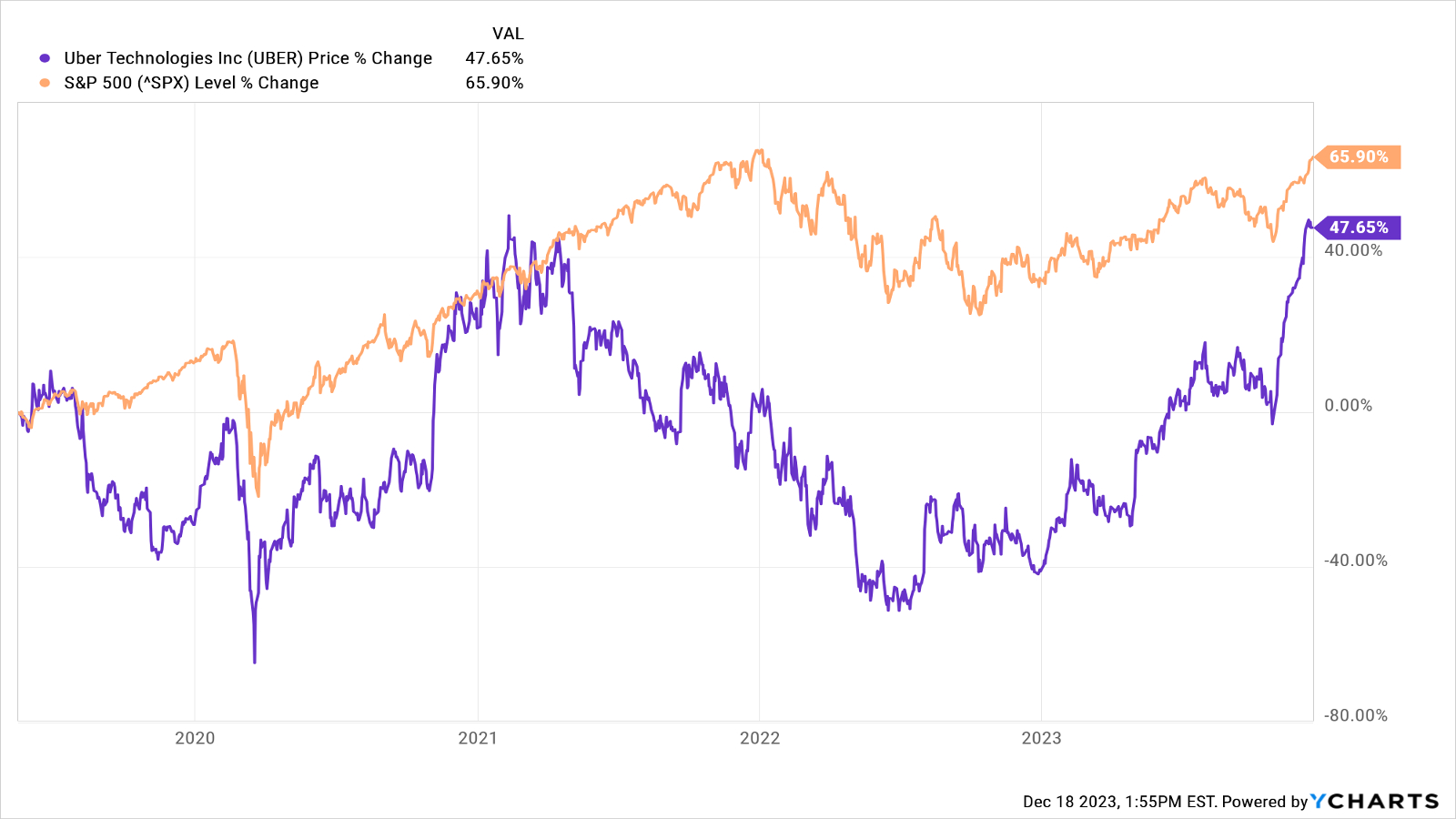

Uber stock added 150% for the year-to-date through December 18, vs a gain of 24% for the broader market. However, as you can see in the chart below, shares still lag the S&P 500 by a wide margin since Uber went public in 2019.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

Stocks Retreat as Bubble Worries Ramp Up: Stock Market Today

Stocks Retreat as Bubble Worries Ramp Up: Stock Market TodayValuation concerns took hold on Wall Street today, sending Palantir and its fellow tech stocks lower.

-

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending Concerns

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending ConcernsMarkets seesawed amid worries over massive costs for artificial intelligence and mixed economic news.

-

Why Uber Stock Is Falling After Earnings

Why Uber Stock Is Falling After EarningsUber stock is lower Wednesday as the ride-hailing firm's soft first-quarter outlook offsets its strong fourth-quarter results. Here's what you need to know.

-

Stock Market Today: Stocks Pause as Investors Assess Fed Policy

Stock Market Today: Stocks Pause as Investors Assess Fed PolicyThe Federal Reserve met expectations with a quarter-point rate cut.

-

Stock Market Today: Stocks Struggle After Meta, Microsoft Earnings

Stock Market Today: Stocks Struggle After Meta, Microsoft EarningsAll three major indexes closed lower on Thursday, making for a grim Halloween.

-

Is Uber Stock a Buy, Hold or Sell After Earnings?

Is Uber Stock a Buy, Hold or Sell After Earnings?Uber stock is sinking Thursday after the ride-hailing firm came up short of a key Q3 metric, but analysts have yet to adjust their ratings. Here's what you need to know.

-

Stock Market Today: Dow Gains 522 Points in Fed-Fueled Session

Stock Market Today: Dow Gains 522 Points in Fed-Fueled SessionThe blue chip index closed above the psychologically significant 42,000 level for the first time ever Thursday.