Analysts' Top S&P 500 Dividend Stocks to Buy Now

Analysts' top-rated dividend stocks in the S&P 500 yielding at least 3% include blue-chip stalwarts such as Coca-Cola, CVS Health and Chevron.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's easy to forget about the importance of dividends when the market is notching new all-time highs. And while no old saw is a substitute for a comprehensive wealth management plan, there really is something to the cliche about high-quality dividend stocks never going out of style.

Dividends really do matter. Although such regular payouts to shareholders have become much less popular over the decades, dividends still account for a critical share of the market's total return (price change plus dividends).

Since 1960, 69% of the total return of the S&P 500 can be attributed to reinvested dividends and compounding, according to a study by Hartford Funds. And while companies may not pay dividends like they used to, dividends have still fueled nearly a quarter of the S&P 500's annualized total returns so far this decade.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Interestingly, the case for dividends actually gets more compelling when the market is making new highs and valuations are getting stretched.

"Dividends have historically played a significant role in total return," the Hartford Funds report notes, "particularly when average annual equity returns were lower than 10% during a decade."

Sadly, average annual equity returns are indeed looking to be pretty poor over the next 10 years, at least by one highly regarded measure. The S&P 500 Shiller cyclically adjusted price/earnings ratio (CAPE) has a solid track record of forecasting long-term annualized returns. At its current level, Shiller CAPE gives the broader market an implied annualized total return of 3.9% over the next 10 years.

That's pretty crummy considering the S&P 500 delivered an annualized total return of more than 12% over the past decade. It also suggests that dividend stocks as an asset class could be very helpful to buy and hold these days.

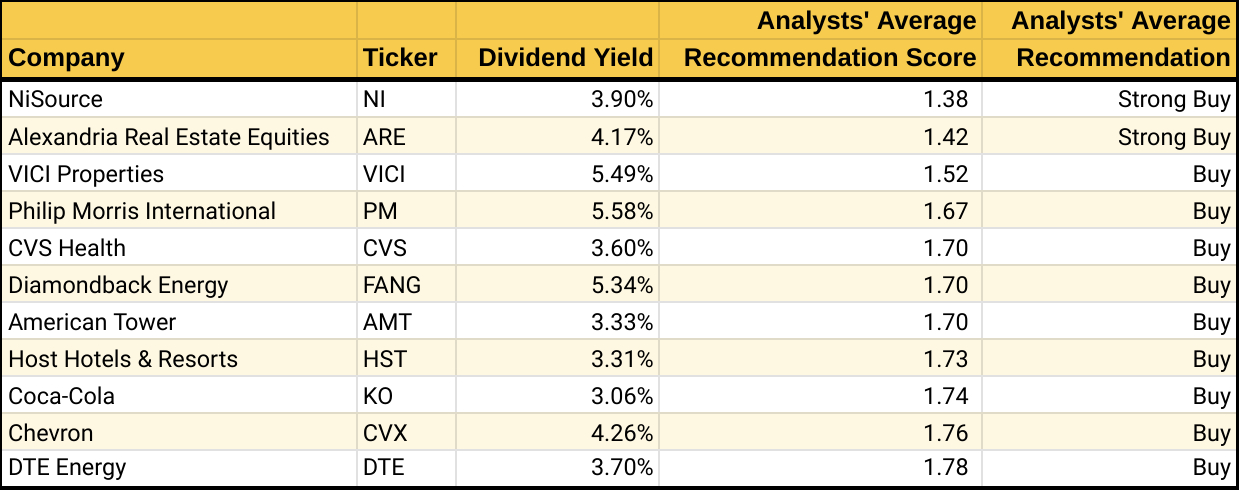

Wall Street's top S&P 500 dividend stocks

In order to find Wall Street's top dividend stocks to buy now, we used S&P Global Market Intelligence to screen the S&P 500 index for analysts' highest rated names yielding at least 3% as of January 19.

A note on the ratings system: S&P Global Market Intelligence surveys analysts' stock recommendations and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. Any score of 2.5 or lower means that analysts, on average, rate the stock a Buy. The closer the score gets to 1.0, the stronger the Buy call. In other words, lower scores are better than higher scores.

We used a 3% yield as our lower bound because that's essentially twice the S&P 500's yield of 1.49%.

If you're looking to add Buy-rated dividend stocks to your portfolio, the names listed below are the best the S&P 500 has to offer, according to industry analysts.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

Risk Is Off Again, Dow Falls 397 Points: Stock Market Today

Risk Is Off Again, Dow Falls 397 Points: Stock Market TodayMarket participants are weighing still-solid earnings against both expectations and an increasingly opaque economic picture.