A Simple Trick for Better Investing: Stop Timing the Market

Investors who stay the course are rewarded for their patience and discipline, enjoying the benefits of compounding returns over time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investing can be thrilling — chasing market rallies, buying and selling on hot tips and trying to outperform the broader market. But many investors get caught up in trading, convinced they can time the market and beat the averages. In reality, this rarely works. Few investors can reliably predict market movements over any meaningful timeframe, and waiting for the perfect moment to invest often results in missed opportunities.

Think you can predict when to get in or out? History shows otherwise — market timing often fails, even for the pros.

For most investors, the advice is simple — staying invested is far more effective for building wealth than trying to catch market dips or pullbacks. Instead of waiting for the “right time” to deploy money, focus on staying the course and taking advantage of the market's long-term upward trend.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

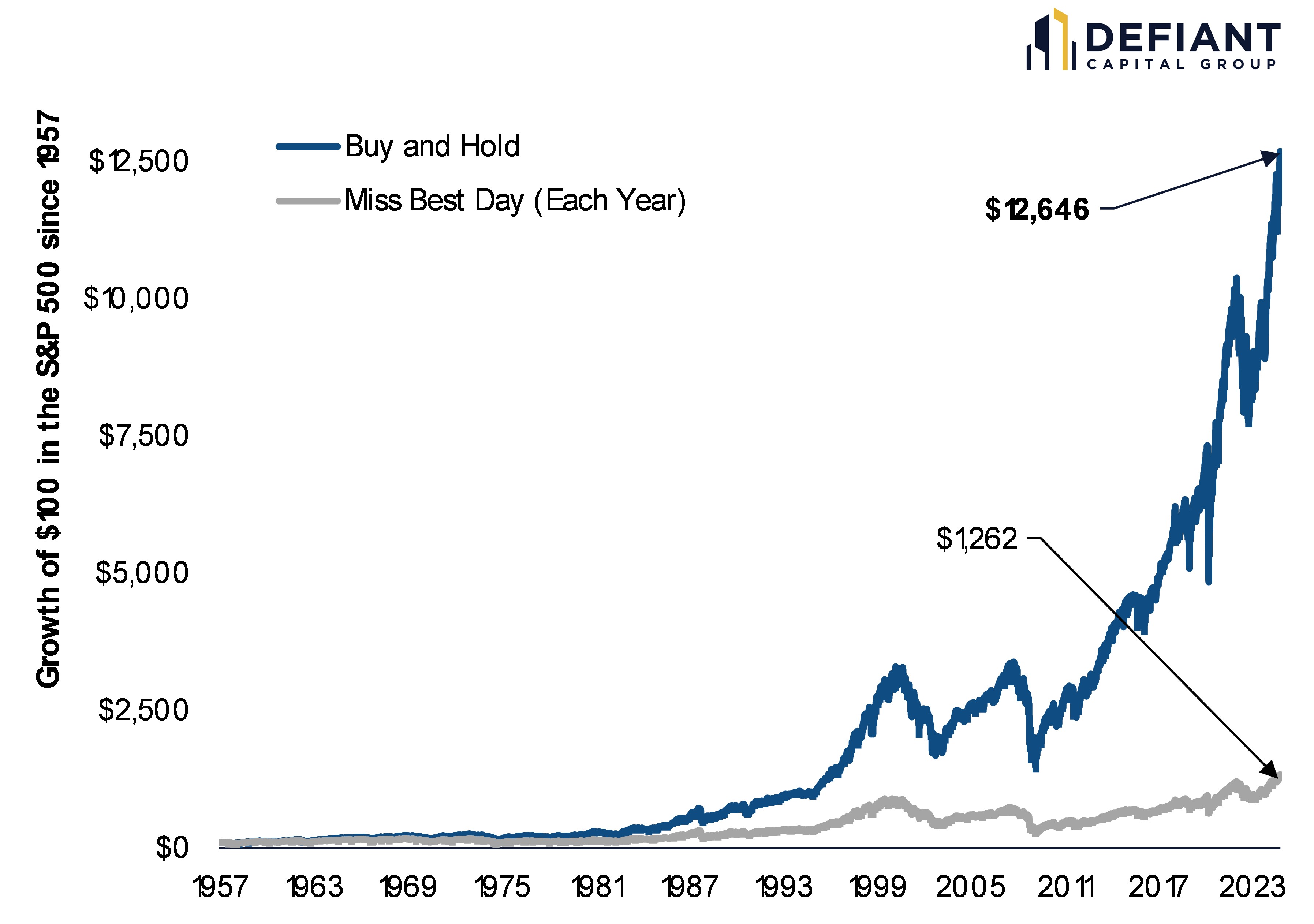

In this article, we'll explore why it's more important to get (and stay) invested vs trying to time a market bottom, and how by staying invested, even during periods of market volatility, long-term investors have historically outperformed market-timers by more than 800%.

Missed opportunities: The cost of missing the best days

The single most compelling reason to stay invested is the negative compound impact of missing just a handful of the market's best days over time. Missing a single day might not seem like a big deal over 10 or 20 years, but in reality it can be.

Based on historical S&P 500 performance, if an investor missed only the single best-performing day each year, their annual returns would be significantly reduced compared to a buy-and-hold investor. In fact, an investor who stayed fully invested in the S&P 500 over time likely experienced returns up to 800% higher compared to someone trying to time the market (and missing the best day each year).

Missing the single best day each year can have devasting effects on long-term wealth generation:

The same holds true for missing the single best and worst days each year. Even if you were able to successfully predict the worst day each year and move to cash, you would likely also miss the best day. This is because outsized performance days tend to cluster (more on this below). In this scenario, you would likely outperform the buy-and-hold strategy, but by only 30% over a period of 60-plus years. Furthermore, the constant trading and realization of gains/losses would likely result in lower net of tax returns.

The S&P 500 has a long history of dramatic daily movements, and these major upswings often occur amid periods of high volatility, making it nearly impossible to predict. The lesson here is simple: The best days in the market are often clustered with the worst, and by trying to avoid losses, you could be missing out on the most significant gains. Instead, think long-term, and when really bad days occur, use them as opportunities to invest more.

The best and worst days: The trap of market timing

The market's best and worst days are often like twins — inseparable and unpredictable. This creates an emotional roller coaster for investors, making market timing nearly impossible. In fact, in over 63% of years (since 1957), the best day occurred after the worst day, highlighting the unpredictable swings that make trying to properly time the market so difficult. Furthermore, the best day typically occurs within two months of the worst day, and during the time in between the two dates, the market is positive on over 47% of those days.

This clustering of the best and worst days makes market timing incredibly challenging. Investors who try to avoid bad days often end up missing the best days, losing out on a significant portion of gains. Missing just a few key days can dramatically reduce your long-term returns.

Staying fully invested and contributing regularly allows the power of compounding to work for you without the stress of timing. And when markets do decline? More on that below.

Drawdowns: Risk or opportunity?

Drawdowns are part of the market ride — terrifying, unpredictable, but often the gateway to future gains. Many investors wrongly sell during a market downturn, only to then sit on the sidelines and wait for the "right" opportunity to reinvest. But the problem with selling is that now those losses have materialized, and you'll need to earn even more than the loss to make it back (this is the darker side of compounding — when you sell during a downturn, the losses compound against you, making it harder to recover).

However, here's what the data tells us. If you hold through a drawdown, the market has an 87% chance of being positive 12 months later. In fact, the market tends to deliver an average return of 21% in the 12 months following a drawdown vs the average drawdown of 14%. This return is more than enough to offset the decline and generate positive gains.

Those who stay invested, and especially those who have the capacity to deploy more capital during downturns, are positioned to build generational wealth. Even if you don't buy at the exact bottom, investing during a decline has historically yielded positive returns in the following year. This highlights the importance of viewing market declines not as signals to exit, but as opportunities to invest more and benefit from the recovery.

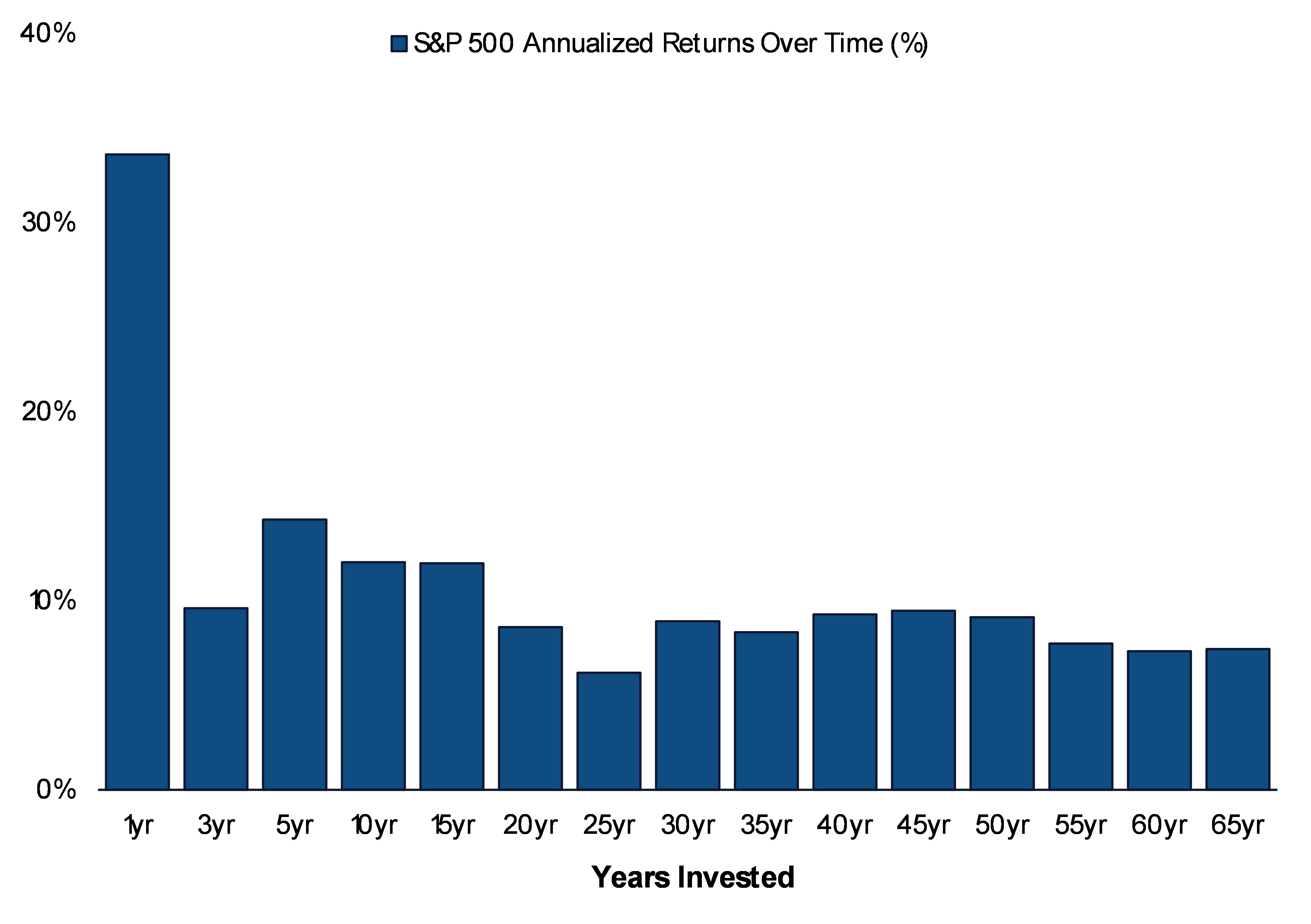

The power of staying the course: Annual returns over time

When it comes to investing, patience pays off. Despite the ups and downs, the long-term trend of the S&P 500 is consistently positive, rewarding those who stay the course. The chart below shows annualized returns over years and decades, highlighting the resilience of the market. The longer you stay invested in the stock market, the more consistent the returns become:

Staying invested increases your chances of stable, positive returns. This consistency becomes clear when looking at rolling returns over longer periods. For example, while any given year might be volatile, staying invested for a decade or more dramatically improves the probability of positive returns. It is time in the market that matters more than trying to time the market. Investors who stay the course are rewarded for their patience and discipline, enjoying the benefits of compounding returns over time.

Conclusion: Stay invested for the long run

If there's one lesson from decades of market data, it's this: Staying invested is the key to building lasting wealth. Market volatility can be unsettling, but reacting to short-term swings by trying to time entries and exits is a recipe for underperformance. The biggest gains often come on the heels of the biggest losses, and missing out on even a few key days can have a profound impact on your overall returns.

Instead of focusing on timing the market, focus on time in the market. Adopt a long-term perspective, stay disciplined and take advantage of downturns as opportunities to add to your investments. By doing so, you'll be in the best position to reap the benefits of the market's growth over time and achieve your financial goals.

Related Content

- Four Historical Patterns in the Markets for Investors to Know

- Managing a Concentrated Stock Position: Too Much of a Good Thing

- Four Signs It's Time to Sell a Stock

- Capital Gains Tax Explained: What It Is and How Much You Pay

- The Wash Sale Rule: Six Things You Need to Know

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jonathan Dane is the Founder of Defiant Capital Group and is responsible for leading the firm’s business strategy and investment management activities. He serves as the firm’s Chief Investment Officer and leads all strategic investment decision-making including portfolio construction, manager due diligence and selection and deployment of client capital. In addition, he serves on several advisory boards, including the Advisory Board of Institutional Investor’s RIA Institute and as a Strategic Advisor to 1787 Ventures and Quinn, an AI-powered financial planning technology.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.