Don’t Bank on the Safety of Bonds in a Pandemic

Bond yields are too low to follow the old investing playbook. Here are some tips to restructure the bond side of your portfolio today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Today’s market environment requires that we talk candidly about bonds. While investors over the years have turned to bonds for safety, unfortunately they’ve never been riskier than they are right now.

Over long periods of time, bonds have generated lower returns and lower risk than equities. Bonds also had low correlation with equities, which generates diversification return. Generally, bonds are thought of as safe. Over the last 50 or so years, the 10-year U.S. government bond has produced average annual returns of around 7%.

Ah, the good old days. If you purchased a 10-year U.S. government bond on Oct. 1, 2020, the bond would have yielded 0.68%. In other words, over the next 10 years you would expect to get an average annual return of 0.68%. That’s about 90% less than the average returns over the past 50 years. It’s also pretty close to zero.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the beginning of this year, the U.S. bond yielded 1.88%. Year to date those same bonds have delivered total returns of around 7%. How? Well, the yield went down from 1.88% to 0.68%. When the yield goes down, the price of the bond goes up, and vice versa: When rates rise, bonds fall in price.

So, the yield is 0.68%. If you buy a bond for $100, and you get a 0.68% return for a year, you then will have $100.68. But did you really make money? There is a concept called “real return,” which takes the effect of inflation into account. If inflation were zero, then yes, you made 68 cents. But what if inflation were 1.8%, as it was in 2019? Well, the $100 would only be worth $98.88. You would have lost purchasing power.

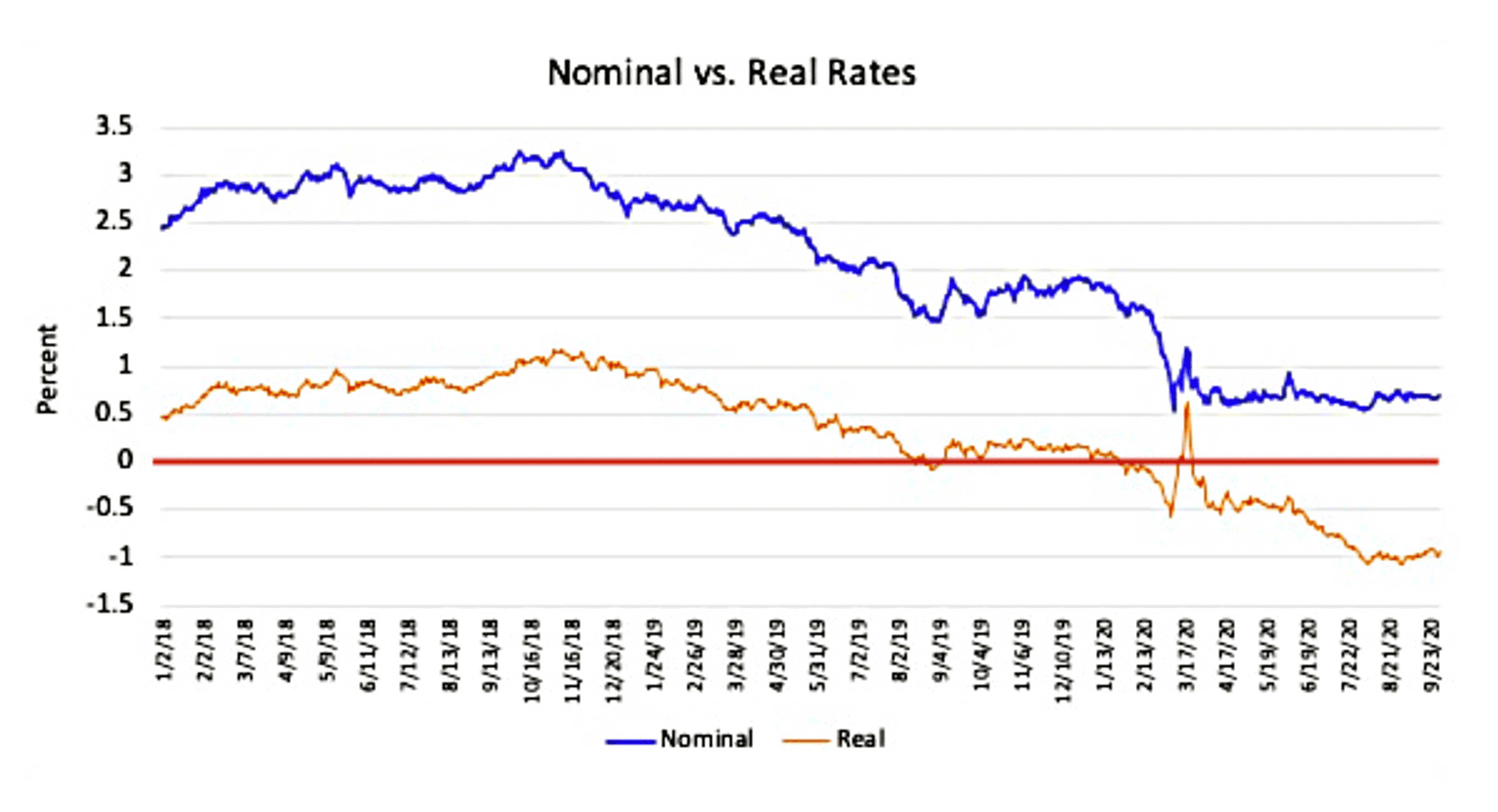

Where do we stand today, not only with nominal rates, but real rates? Certainly negative! Below is the yield on the 10-year bond since 2018, as well as the real rate of return. The orange line indicates the real rates bond holders have been seeing, and the dark red line delineates between positive and negative returns.

So, an owner of a U.S. government bond can expect to lose purchasing power. And the nominal yield of 0.68% is near the lowest on record. If rates and inflation stay where they are, U.S. bonds are likely to be a poor investment. If inflation rears its head within a decade, they are likely to be very harmful to our purchasing power. The same remains true if rates rise over the decade. Low upside, large downside. It seems that bonds have never in history been as risky as they are today.

We say, “No thanks.”

What to Do? In the Face of Uncertainty, Diversify

If you asked me a few years ago whether we would have all-time-low nominal rates, negative real rates, along with exploding government debt, I would have thought it unlikely. That scenario never happened before, and it is tough to figure out why investors would accept those conditions rather than move their wealth into other assets. Plain, old U.S. government bonds are unappealing (another word for “risky”). Since yields on developed international bonds are no better, international bonds, when denominated in U.S. dollars, are unappealing as well.

If we are unlikely to make money from owning plain old U.S. government bonds, what can we do? Diversify. If we buy international bonds (with comparably low yields) denominated in international currencies, and if the value of the dollar drops, these bonds may rise. The same goes for emerging market bonds, which have the added benefit of higher yields. How about inflation-adjusted bonds? If inflation rises, these bonds may do well. Floating rate bonds may benefit if rates rise. The time for a plain old U.S. bond portfolio is gone (not that we had one of those portfolios before). When I discuss bonds with colleagues in the industry, the prevailing answer is “we are just holding our nose and keeping the same portfolio as before.” I find that unacceptable.

As such, the composition of your bond portfolio should be changing just as dramatically as yields have changed. All of these sources of diversification should be considered. Changing times require a new game plan.

- Underweight traditional U.S. government bonds.

- Overweight inflation-protected bonds like TIP for U.S. bonds and WIP for international bonds. Floating rate bonds like USFR. International currency bonds like BWX for developed markets and EMLC for emerging markets.

- Take a higher cash position. At least cash won’t lose value if rates rise.

Why You Shouldn’t Reach for Yield

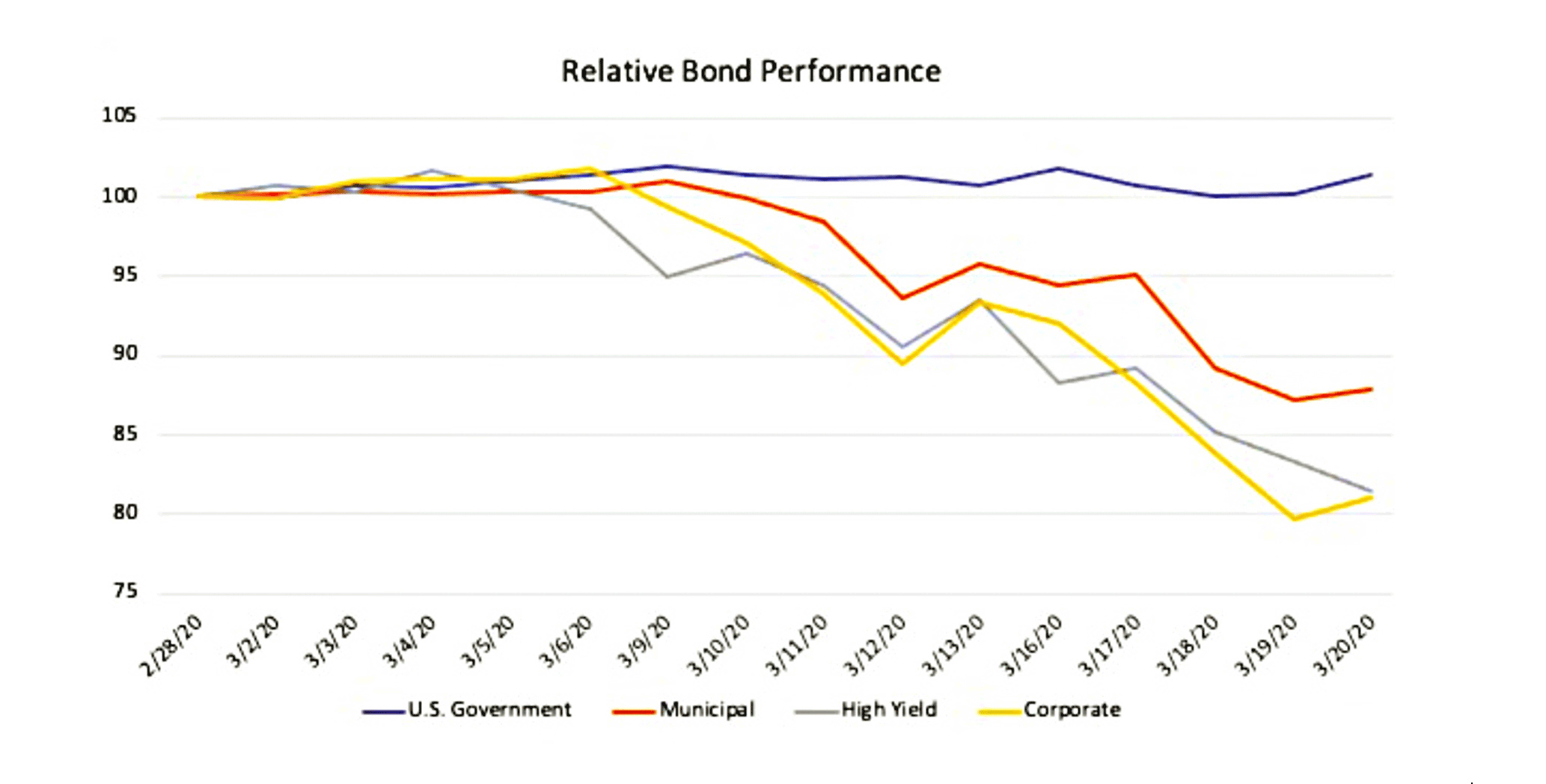

To paraphrase Warren Buffett, we have to run the conservative side of the portfolio so that every check clears under any circumstance. Thus, you might want to consider only owning government bonds (both U.S. and international) in the bond section of your portfolio. What about corporate bonds or high-yield bonds or municipal bonds? The value of a bond is directly tied to its safety. In times of stress, safety — or lack thereof — is revealed. The chart below shows the performance of different types of bonds during the most recent time of stress, March 2020.

During just this three-week period, when people were most worried about the value of their investments, municipal bonds lost 13%, high-yield bonds lost 19%, and corporate bonds lost 20%. Granted, they have recovered most of their losses since then. This time around. The next scare … who knows? I recommend sticking with government bonds of various varieties.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Randy Kurtz, RIA, CFP®, is a nationally recognized expert on risk. Challenging the financial industry's status quo for over a decade, Kurtz feels the standard Wall Street portfolio comes with far more risk than clients realize. He created a method of investing that aims to lower excess risk taken in client portfolios, without reducing expected return. His goal is to transform the industry by turning the client-adviser relationship from a return-centered conversation to a risk-centered one.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.