10 Bond Portfolio Picks Before the Fed Cuts Rates

How to boost your bond portfolio and take advantage of this perfect storm.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The U.S. bond market is about to enjoy the proverbial best of both worlds. Bond yields, an approximation for annualized bond returns, are high — the Bloomberg U.S. Aggregate Bond index yields 4.6%; U.S. high-quality corporate debt, 5.1%. And interest rates are poised to move lower, which means bond prices will ratchet up. (Interest rates and bond prices move in opposite directions.)

Together, that’s a double leg up for bond market total returns. “I think this is one of the best times to put money to work in the bond market in 20 to 25 years,” says Thomas Urano, a managing partner at Sage Advisory.

So now is a good time to revisit your core bond portfolio. You can always start with a broad bond index fund, such as iShares Core U.S. Aggregate Bond (AGG, yield 4.5%), an exchange-traded fund that tracks the benchmark considered to be a barometer of the bond market. But “each investor has their own goals and risk tolerance,” says Invesco’s Jason Bloom. “Our view is that investors can do better — much better — than just owning the Agg.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In fact, most active bond fund managers outpace the U.S. Aggregate Bond index over the long haul on average, according to fund-tracker Morningstar. Our favorite active core bond funds, Baird Aggregate Bond (BAGIX, yield 4.2%), Dodge & Cox Income (DODIX, 4.7%) — a member of the Kiplinger 25, our favorite no-load mutual funds — and Fidelity Total Bond (FBND, 5.2%), have each outpaced the Agg over the past one, three and five years. That’s why we prefer starting with an actively managed core bond fund — let an expert do the heavy lifting.

But it may pay to complement your core holding with tactical tilts of exposure to certain bond sectors to enhance performance. We’ll walk you through some simple ways to optimize your portfolio for current market conditions by leaning into bond sectors that are attractive now.

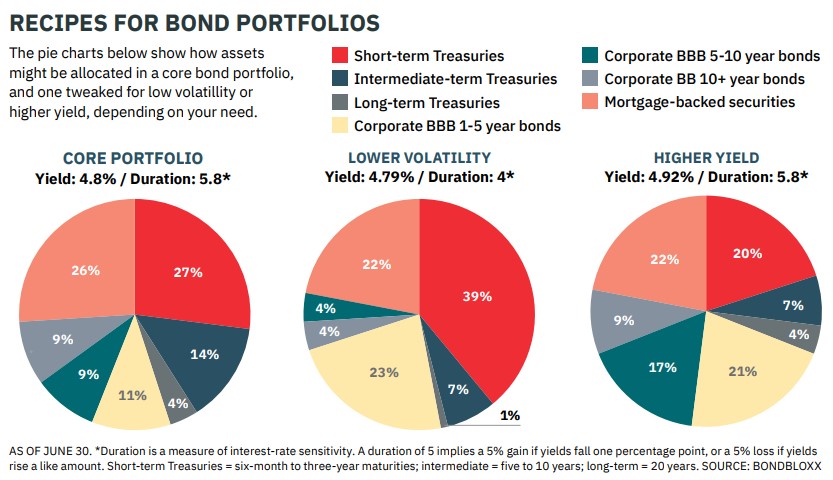

Of course, if you own shares in an active intermediate core bond fund, your manager may be making some of these moves already, so consider any shifts in terms of your overall portfolio. We’ve also included model portfolios, built by Elya Schwartzman at fund firm BondBloxx, as an example of how the pros might enhance yield or lower your portfolio’s sensitivity to interest rate shifts. (Yields and other data are through July 31, unless otherwise noted.)

Mix up the ingredients

To beat the Agg, you’ll want the flexibility to beef up some sectors in your portfolio and de-emphasize others, depending on the market environment. The main ingredients in an investment-grade bond portfolio are Treasuries, corporate debt and mortgage-backed securities, with a dash of government-linked IOUs and asset-backed securities (such as bundled credit card and auto loans).

Start with Treasuries. For now, it makes sense to emphasize Treasuries with maturities between one and 10 years. Although price declines from interest rates moving higher are largely in the rearview mirror, many bond experts still favor short- to medium-term government bonds, which are less sensitive than long-term debt to interest rate swings.

But the yield curve remains inverted, which means shorter-term notes yield more than their long-term counterparts. And when rates start to fall, bond analysts expect yields to dip more on the short end. “We favor short-term because we like the high current yield and safety,” says BondBloxx’s JoAnne Bianco. “And intermediate-term bonds can still capture potential price returns when the Federal Reserve reduces interest rates.”

Funds worth exploring include the SPDR Portfolio Short Term Treasury ETF (SPTS), which currently yields 4.6% and has a duration (a measure of interest-rate sensitivity) of 1.8 years. That implies if rates fall by one percentage point, the fund’s net asset value will rise by 1.8%. Or consider the Schwab Intermediate-Term U.S. Treasury ETF (SCHR), which yields 4.3% and has a duration of five years.

Reach for yield within high-quality corporate debt. “Adding to your exposure to triple-B corporates is a good way to enhance long-term returns,” says Bianco. Corporate bonds rated triple-B are still investment grade, but offer better yields than higher-quality corporate debt and have better long-term returns, too. The trade-off is higher volatility. Over the past decade, triple-B corporate debt was 10% more volatile than the broad corporate-debt market.

If you can stomach the added volatility, consider the iShares BBB Rated Corporate Bond ETF (LQDB), which yields 5.3%. The fund has returned 7.1% over the past 12 months.

Pad the quality of your bond portfolio with a bigger dose of mortgage-backed and asset-backed securities, which offer compelling yields. Mortgage bonds may get a boost when rates fall and the home-loan refinance machine picks up again, says Sage Advisory’s Urano. The Vanguard Mortgage-Backed ETF (VMBS) charges just 0.04% in expenses, yields 3.8% and boasts an average triple-A credit rating. The fund has returned 5.1% over the past year.

Many bond experts like asset-backed securities these days, especially credit card and auto IOUs. “They’re high-quality, triple-A-rated bond investments, and the maturity range is less than three years,” says Urano. Few funds focus exclusively on such securities, but we like the look of the Virtus Newfleet ABS/MBS ETF (VABS). The active ETF is small ($9 million in assets), but it invests in high-quality, short-term asset-backed and mortgage securities. Over the past year, its 8.3% return topped 92% of all short-term bond funds. It yields 5.0%.

Venture beyond the Agg

One trick that winning intermediate-term core bond fund managers often use is to dip into the junk-bond market, which isn’t represented in the Agg. These low-quality corporate securities come with a higher risk of default and are more volatile. But over the past decade, they have returned 4.6% annualized, beating the 2.6% gain in investment- grade debt.

“Many people shy away from high-yield debt because they are risk-averse in their bond portfolio,” says Bloom. But “historically, over the economic cycle — recovery, expansion, slowdown and recession — high yield is the only sector that has outperformed in every phase.”

Stem the risk in junk bonds by keeping your stake small — say, 3% of your bond portfolio — and focusing on double-B-rated debt, the highest-quality tier of high-yield bonds. The iShares BB Rated Corporate Debt ETF (HYBB) holds only double-B-rated debt, yields 6.2% and has returned 10.0% over the past 12 months. The broad high-yield benchmark has done better, with an 11.0% return, but with higher volatility.

Note: This item first appeared in Kiplinger Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Model portfolios for bond investors

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.