New Ways to Invest in Bitcoin

ProShares Bitcoin Strategy and other ETFs offer an easier way to gain bitcoin exposure than buying the actual cryptocurrency.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

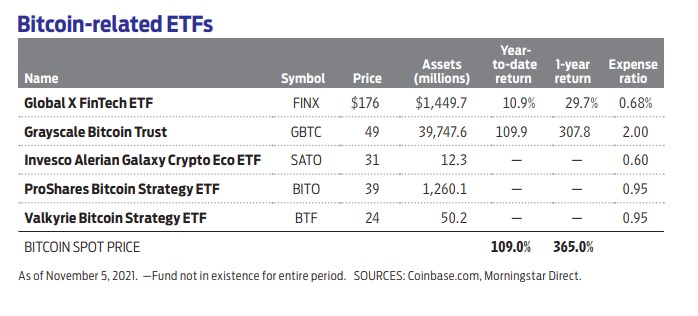

The launch of an exchange-traded fund (ETF) based on bitcoin futures in October was epic. Less than a month after it opened, ProShares Bitcoin Strategy ETF (BITO) had $1.26 billion in assets – one of the biggest ETF debuts ever. A second bitcoin futures fund, Valkyrie Bitcoin Strategy ETF (BTF), opened two days after the ProShares fund.

The bitcoin futures ETFs are actively managed and use similar strategies. The managers buy one-month forward futures contracts – the nearest-dated contract – tied to bitcoin prices. Every month, they close or sell those contracts before they expire and buy new contracts dated for the next month.

You can't actually invest in bitcoin's spot price –the price at which an asset can be bought or sold for immediate delivery – says Simeon Hyman, head of investment strategy at ProShares. "So the futures market is a good place to get bitcoin exposure," he says. Because of the way futures contracts are sold, a certain amount of cash per contract needs to be held in collateral. That's why these ETFs are heavy in Treasuries and cash.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Both ProShares and Valkyrie examined how their respective futures-based strategies would have performed in the past, relative to the spot price of bitcoin, and found a high correlation – a so-called beta of 0.87 to 0.99 – between the two. For context, S&P 500 index funds typically have a beta of 1.0 with the stock benchmark.

But futures investing comes with some unique risks. Because of how these securities are priced, shifts in supply and demand for the underlying asset – in this case, bitcoin – can impact contract prices and the fund's returns.

ETFs also have limits on the amount of any given contract they can own, says Steven McClurg, Valkyrie Funds' chief investment officer. Funds with sizable assets may be forced to purchase longer-dated futures contracts, and that can increase volatility. In early November, for instance, ProShares' BITO held November and December contracts.

Even so, the ETFs offer an easier way to gain bitcoin exposure than buying the actual cryptocurrency. You don't have to open a digital currency exchange account or remember any passwords. But if you plan to invest, devote only a small portion of your portfolio to this kind of futures ETF.

There are other ways to gain exposure to bitcoin and blockchain, the technology behind the digital asset. Invesco Alerian Galaxy Crypto Economy ETF (SATO) focuses on companies that enable the crypto economy, such as Canaan (CAN), a Chinese maker of servers and microprocessors used to create bitcoin. Grayscale Bitcoin Trust (GBTC) has yet another approach: Every share in the trust is backed by bitcoin.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.