Disney Stock Still Up on Iger's Return. Will It Last?

Bob Iger's return as CEO pushed Disney stock up 10% on the news. But the leader's second go could be rocky.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's been several days since Disney (DIS, $96.21) shocked the media and entertainment industry, not to mention the entire investment community, with news that former CEO Bob Iger was rejoining the company, ending Bob Chapek's two-year run in the top job. Disney stock opened Monday trading up 10% on the news.

It has since lost some of those gains, but the company's share price remains up on the week, reversing weakness following its latest earnings report.

The ouster of Chapek, while shocking, really shouldn't have come as a surprise to anyone.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Jim Cramer, CNBC's "Mad Money" host, suggested Chapek should be fired on November 9.

"Disney, they have ESPN. If we were on ESPN, we would say he's got to be fired. That's pretty cut and dry," Cramer said on CNBC's business news program "Squawk Box"' Wednesday morning. "The losses here are just mind-boggling. When you're going over the quarter, it's stunning."

Cramer highlighted the company's $1.5 billion loss from Disney+ as a big reason Chapek was no longer fit to lead the House that Walt Built.

And while Disney's stock may be up this week, what doesn't make sense is why the Disney board felt compelled to bring back Iger to clean up a mess he made.

While virtually anyone with extensive media and entertainment experience would fit the bill, the board chose to bring back a 71-year-old man to fix what might not be fixable.

Disney shareholders appear to be happy about the move – as do many investment professionals including Cramer – but as the saying goes, be careful what you wish for.

Iger's chances of success aren't a shoo-in. Here's why.

Disney Stock Needs Disney+ Profitability

As Chapek pointed out in Disney's fiscal Q4 2022 earnings, the Disney+ platform added 12.1 million subscribers over the three-month period ended Oct. 1. However, that includes Disney+ Hotstar, a bundled service that includes Hulu and ESPN+. So if you exclude this part of its business, the Disney+ increase over the third quarter was 9.3 million, or 9.9% higher quarter-over-quarter.

If it continues to grow Disney+ subscribers by 10% a quarter, it will take seven quarters to reach 200 million subscribers worldwide. Netflix (NFLX), which has been streaming video since 2007, grew its global subscriber base in Q3 2022 by 4.5%, to 223 million.

Netflix took 19 years to get to 200 million subscribers. If Disney keeps up 10% quarterly growth, it will have achieved this feat in 4.5 years, less than one-quarter of the time it took Netflix.

Now, granted, the video streaming landscape has become much more competitive since Reed Hastings made the call to go to streaming nearly two decades ago.

And that makes Disney+'s profitability even more elusive than ever.

As mentioned earlier, Disney+ and the rest of its direct-to-consumer business lost $1.5 billion in the fourth quarter. It lost a little more than $4 billion for the entire fiscal year, with Disney+ accounting for a lion's share.

If Iger's not careful, those losses could double in no time, knocking its goal of profitability goal in fiscal 2024 out the window.

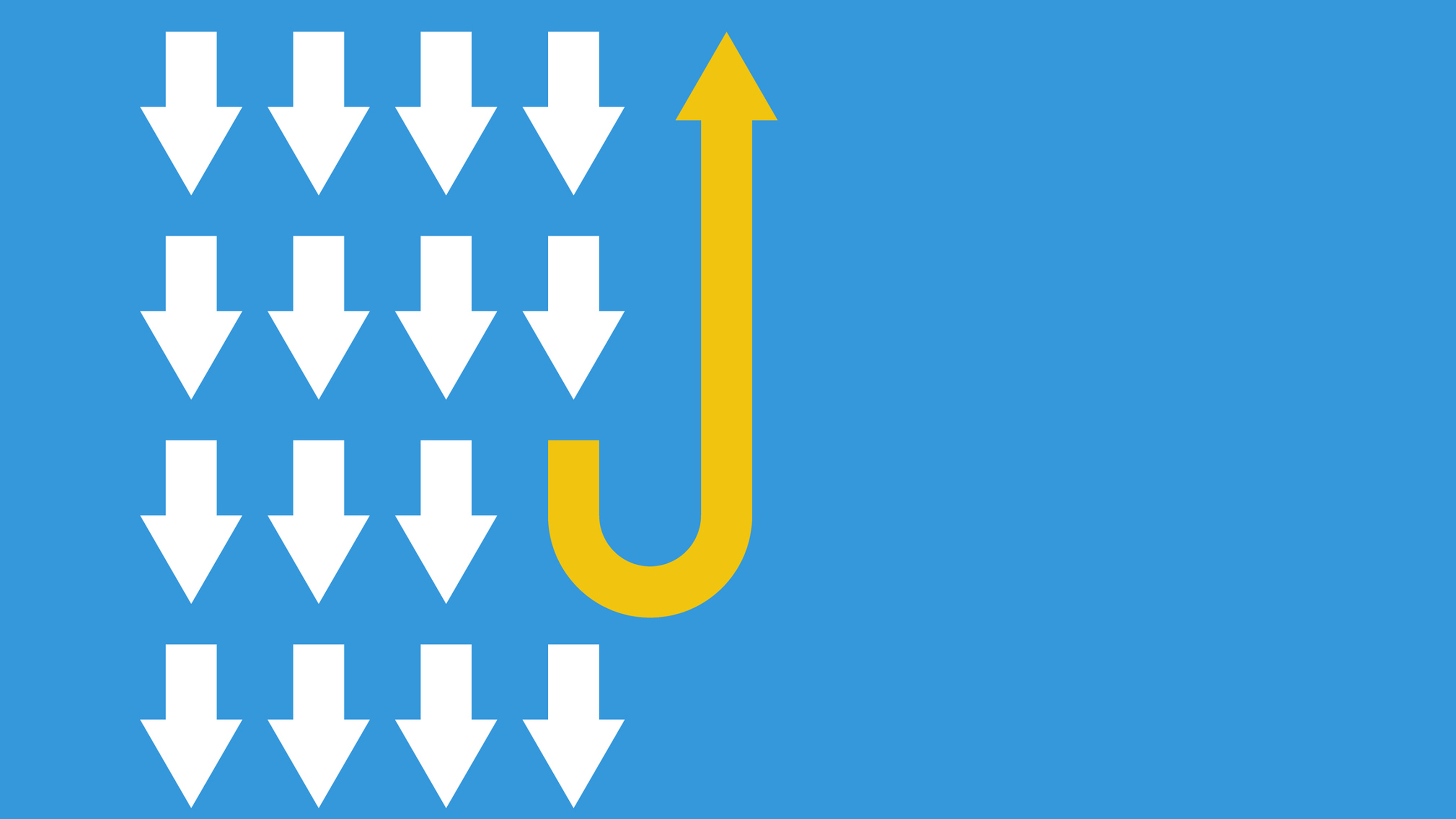

Iger's Got 2 Years to Right the Ship

As the press release stated, Iger will serve as Disney CEO for two years. He's got 24 months to right the ship and find a successor.

If you recall, Chapek was officially named CEO on Feb. 25, 2020. At the time, Chapek was chairman of Disney Parks, Experiences and Products business.

Bob Iger stated about Chapek's appointment in the press release at the time:

"His success over the past 27 years reflects his visionary leadership and the strong business growth and stellar results he has consistently achieved in his roles at Parks, Consumer Products and the Studio."

Iger had plenty of time to select a successor. He botched it. Now he's got just 24 months to get it right. What could go wrong?

One interesting possibility is for Disney to acquire Candle Media. It was launched in 2021 by former Disney executives Kevin Mayer and Tom Staggs with $2 billion in backing from Blackstone. Candle's been on an acquisition binge ever since.

Mayer and Staggs could co-run Disney like Michael Eisner and Frank Wells did in the 1980s.

There are plenty of things that need attention at Disney but none is more important than fine-tuning the company's streaming strategy. First, it needs to widen the content it puts on Disney+. If it doesn't, it's hard to see it reaching its goals for subscribers or profitability.

Iger gets all the credit for launching Disney+ in 2019. Now it's up to him to make it more profitable. That's no sure thing.

They say you can't put the genie back in the bottle. But, unfortunately, Disney's attempting to do just that. Shareholders shouldn't rejoice this move. It could easily backfire.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

Stock Market Today: Stocks Rise Despite Stagflation Risk

Stock Market Today: Stocks Rise Despite Stagflation RiskThe business of business continues apace on continuing hope for reduced trade-related uncertainty.

-

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye On

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye OnA turnaround stock is a struggling company with a strong makeover plan that can pay off for intrepid investors.

-

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending Concerns

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending ConcernsMarkets seesawed amid worries over massive costs for artificial intelligence and mixed economic news.

-

Is Disney Stock Still a Buy After Earnings?

Is Disney Stock Still a Buy After Earnings?Walt Disney stock is down Wednesday after the entertainment and media company beat fiscal 2025 first-quarter expectations. Here's what you need to know.

-

Stock Market Today: Tech Stocks Soar Ahead of CES 2025

Stock Market Today: Tech Stocks Soar Ahead of CES 2025This week's annual technology event will give updates on AI, EVs and self-driving cars.