Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Rebalancing your portfolio regularly is one of the basic fundamentals of sound long-term investing. The good news for long-term investors is that if you regularly give to charity, there is a tax-efficient way to rebalance your portfolio — the donor-advised fund.

Why rebalance? Over time, higher-risk assets, like stocks, will dominate a portfolio, leading to higher volatility. Without rebalancing, it is too easy for portfolios to drift significantly from the risk-reward balance that is right for your personal financial goals. But if you rebalance too often, you can hurt your long-term returns with higher trading costs and by triggering expensive capital gains taxes.

Some of the best research to date on how to rebalance a multiasset portfolio has come from Vanguard, which looked at a wide variety of approaches and thresholds. Their conclusion? Most investors would be better off by rebalancing their portfolios once per year, with a 1% or 2% threshold for variation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, that research did not take into account the donor-advised fund, one of the most useful and rapidly growing types of tax-advantaged accounts available to investors.

The Problem with Rebalancing and Taxes

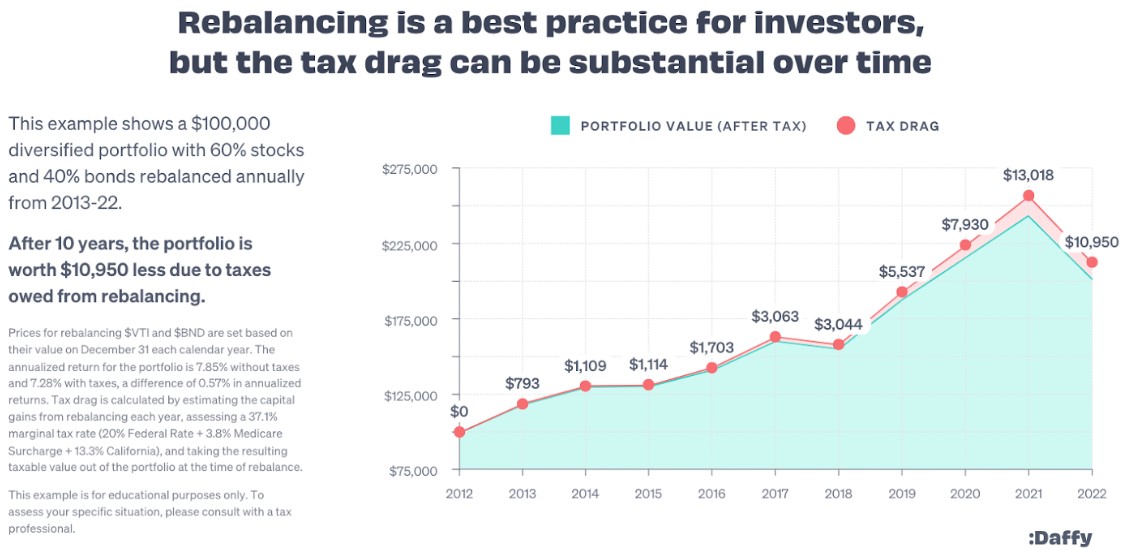

Most people follow a relatively simple process for rebalancing their portfolios, and robo advisors and target-date funds do this automatically for investors. However, one of the fundamental problems with rebalancing is the drag introduced by triggering capital gains taxes.

By definition, rebalancing a portfolio involves selling assets that have outperformed the overall portfolio and buying assets that have underperformed. This makes sense, as the performance year-to-year of various asset classes is unpredictable, and rebalancing forces investors to periodically “buy low and sell high.”

The problem is that selling assets that have outperformed inevitably leads to realizing capital gains, which means capital gains taxes. In a high-tax state like California, that can mean taxes of up to 37.1% on long-term capital gains (20% federal rate + 3.8% Medicare surcharge + 13.3% California rate).

While this issue is not a problem for tax-deferred accounts like 401(k)s or IRAs, it can seriously impact the performance of a taxable brokerage account.

How to Use Charitable Donations to Rebalance

Between 60 million and 70 million households in the United States donate to charity every year. If you are one of those households, there is a better and more tax-efficient way to rebalance your portfolio and support the charities and causes you care deeply about.

In the traditional method, rebalancing a portfolio involves two sets of transactions. First, you sell off the excess amount of the assets that have outperformed the portfolio. Second, you use the cash to purchase shares of the underperforming assets.

But if you regularly give to charity, you can save taxes by changing the first step of this process.

To understand this new method, you need to recognize only two simple insights:

- When you donate stocks, ETFs or mutual funds that have long-term capital gains, you get the full income tax deduction (up to 30% of your AGI) for the market value of the securities.

- There is no “wash sale rule” for donating securities.

As a result of these two facts, you can dramatically increase your tax savings every year when you rebalance by donating appreciated shares instead of selling them, and then using the cash that you would have normally donated to charity to purchase the underperforming assets.

Let’s look at a simple example to illustrate. Imagine an investor who has a $100,000 portfolio made up of 60% stocks and 40% bonds, as represented by Vanguard Total Stock Market Index Fund (VTI) and Vanguard Total Bond Market Index Fund (BND).

This investor has been holding their portfolio for a few years without rebalancing, and in that time period, stocks have outperformed bonds, so the portfolio is now a $120,000 portfolio made up of 70% stocks ($84,000) and 30% bonds ($36,000). To rebalance this portfolio back to the desired 60/40 split, the investor would normally sell $12,000 of VTI and use those funds to purchase $12,000 of BND.

Unfortunately, that would trigger $12,000 of long-term capital gains, which at top rates could mean a $4,452 tax bill for federal and state taxes.

But if this investor normally donates $6,000 per year to charity, they can save half of that tax bill.

Instead of selling $12,000 of VTI, they can donate half of those shares ($6,000) to charity instead. They get the same charitable deduction they would have received for donating cash, and they never trigger those capital gains taxes. Since they did not use the $6,000 in cash they normally donate to charity, they can use that money to buy $6,000 of BND to help rebalance their portfolio, saving up to $2,262 in taxes.

That’s a huge number. $2,262 is a 1.9% drag on a $120,000 portfolio. Think of how many investors work diligently to lower their investment expenses by even 0.5%, and these annual savings could be several times bigger!

This sounds too good to be true, so if you are looking for a catch, there are a couple. First, most charities do not accept securities donations. In fact, out of the over 1.7 million registered charities in the U.S., only a few thousand accept securities. Second, you may want to spread out your charitable donations to organizations over months or even years.

Fortunately, donor-advised funds solve both of these problems. A good donor-advised fund will accept securities donations and let you invest the proceeds of that donation tax-free until you are ready to recommend a grant to a specific charity.

Donor-advised funds used to have high minimum balances and even higher fees, but there are now modern, low-cost options, like Daffy.org, which charge as little as $3 per month.

So rest assured. You no longer have to choose between sound long-term investing and lower taxes. By taking advantage of the ability to donate your appreciated securities, you can now rebalance your portfolio annually and save money on taxes.

Assumptions that were used in the above graphic: Prices for rebalancing VTI and BND are set based on their value on December 31 each calendar year. The annualized return for the portfolio is 7.85% without taxes and 7.28% with taxes, a difference of 0.57% in annualized returns. Tax drag is calculated by estimating the capital gains from rebalancing each year, assessing a 37.1% marginal tax rate (20% federal rate + 3.8% Medicare surcharge + 13.3% California rate), and taking the resulting taxable value out of the portfolio at the time of rebalance. This example is for educational purposes only. To assess your specific situation, please consult with a tax professional.

The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Nash is the co-founder & CEO of Daffy.org, the Donor-Advised Fund for You™, an innovative, fast-growing platform for charitable giving. With no minimum to get started, industry-low fees and ground-breaking technology, Daffy brings the donor-advised fund back to its original goal of helping people be more generous, more often. Adam has served as an executive, angel investor and adviser to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.