Why Are Gas Prices So High If the U.S. Is Energy Independent?

Unfortunately, energy independence can’t keep U.S. gas prices down, and it isn’t enough to protect your stock portfolio either. Here’s why, and what worried investors should know.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We’ve all seen the rising cost of oil and its ripple effect through the economy, especially on prices at the pump. You may have also read that the U.S. is energy independent or that we export more oil than we import and that Russian oil only makes up 3% of all U.S. oil imports.

So why are oil and gas prices so high in the U.S.? The national average price for a gallon of regular gasoline was $4.24 as of March 30, up from $2.87 a year ago, according to AAA.

Prices Are Global, Not Local

A fundamental economic concept called the law of one price can help us understand what is going on. In short, this concept explains that even though the U.S. produces more oil than we use domestically, we buy and sell it on the global market. This means that buying pressures and supply shortages in other parts of the world impact the cost here, even if we produce oil here and use it here. In fact, there is money to be made if you can buy oil in the U.S. at a different price. You could buy in the U.S. then sell internationally and profit from the price difference.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

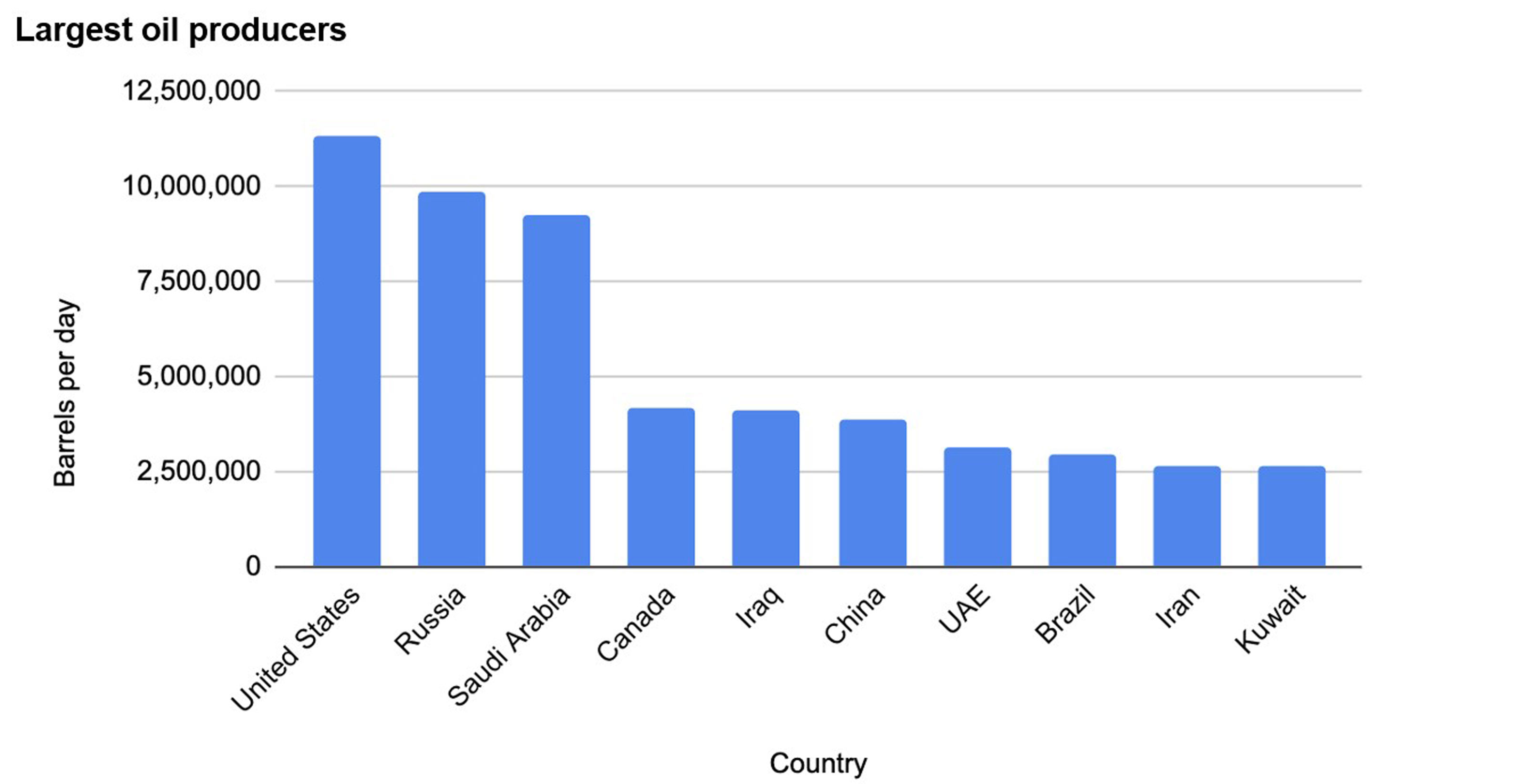

It’s precisely this market force that causes oil — or any other commodity — to trade at one price worldwide. So, even being energy independent, we are still affected by the behavior of the (other) largest oil-producing nations (including Russia, Saudi Arabia, etc.).

Source: U.S. Energy Information Administration

What Does This Mean for Your Portfolio?

Besides the pain at the pump, higher oil prices can erode buying power as input and transportation costs for goods and services rise. Protecting one’s portfolio from inflation can be an imperfect science. Gold, commodities, Treasury inflation-protected securities (TIPS) or even bitcoin all offer some level of peace of mind, but each has its quirks.

While not a direct hedge, investors may also want to consider allocating more dollars to companies involved in renewable energy. Over time, as fuel costs rise, one can expect a greater focus and demand for sustainable energy alternatives.

The implications for sustainable energy go beyond climate impact. Russia’s invasion of Ukraine has cast oil dependence in sharp relief, as oil revenue powers the Kremlin. Less demand for oil can mean less dependence on and funding to Russia, as well as other countries whose practices and policies may not align with investor values.

Natural resources may be randomly distributed around the world, but your investments don't have to be.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Grealish serves as Head of Investments at Altruist, a fintech company on a mission to make great independent financial advice more affordable and accessible. With a career rooted in financial innovation, Adam most recently led Betterment's strategic asset allocation, fund selection, automated portfolio management, and tax strategies. In addition, he served as a vice president at Goldman Sachs, overseeing the structured corporate credit and macro credit trading strategies.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.