These Energy ‘Middlemen’ Are an Income Lover’s Dream

Midstream energy companies, which connect producers and end users, service the industry itself, rather than being tied to commodity prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investing in the energy sector has been quite a roller coaster. Energy was the worst performing S&P 500 sector in 2018. And 2019. And 2020.

But then it flipped. Energy was the top performing sector in both 2021 and 2022.

But in 2023, it’s back to its old ways — competing for last place with utilities.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Energy returns are chronically trapped in the cycle of boom and bust because they’re tied to volatile oil and natural gas prices. So, what’s an investor to do who wants to invest in energy but also seeks steady and reliable income?

DON’T focus upstream. Energy exploration and production (E&P) companies engage at the beginning of the supply chain. They identify energy deposits, drill wells and recover raw materials from the ground. This segment of the industry is most directly tied to oil and gas prices, so their stocks typically experience the biggest swings.

DON’T focus downstream. Crude oil and natural gas refineries take raw products and turn them into products like gasoline and heating oil. These businesses face a different source of volatility: the price difference between raw energy (their input) and refined products (their output) can be wild and unpredictable.

DO focus midstream. All those hydrocarbons pouring out of the ground must get to the refiners somehow. That’s done by midstream companies. Their business involves transporting crude oil, natural gas and refined products across a vast network of pipelines, rails, barges and tankers — connecting producers to end users. They service the industry itself, rather than being tied to commodity prices.

Midstream companies are the “middlemen” of the energy business. They connect producers and end users. Owning a pipeline can resemble owning a toll bridge. Once a pipeline is built, the heavy lifting is done. You can then sit back and collect fees from those wanting to use the infrastructure you’ve put in place.

So why isn’t everyone “in” on the midstream companies? Well, some investors got burned during the U.S. shale boom of the last decade. During the rush to build out infrastructure, midstream companies prioritized growth over profitability. They took on projects with poor return prospects and paid for it in 2015. They’ve been out of favor with investors ever since.

It has largely gone unnoticed, but midstream companies are in much better shape today. They are steadily paying down the debt they took on to build infrastructure during the shale boom. The large, capital-intensive projects are largely complete, and now they’re prioritizing profits and shareholder returns.

What kind of returns do I mean? Many of the leading midstream companies like Enterprise Products (EPD), Kinder Morgan (KMI) and ONEOK (OKE) are paying dividends north of 6%. Compared to the S&P 500’s trailing 12-month yield of 1.58%, midstream companies are looking generous.

These pipelines have more going for them than nice dividends. They are well insulated from competition. Getting government approval for a new pipeline isn’t a slam dunk these days. That hinders growth. But it also keeps capital spending and potential new players in check.

That’s great for now, but how long will we really be using this infrastructure? Won’t it become obsolete as we transition to cleaner, greener energy sources?

Perhaps someday. But even forecasts that are incredibly optimistic about the clean energy transition still typically show demand for fossil fuels rising in the years ahead. Even more important, oil and especially natural gas are projected to be critical components of the global energy mix for decades to come.

If you’re thinking there must be a catch … you’re right. Many midstream companies are structured as master limited partnerships (MLPs). That means they issue K-1s, which can be a major headache when it comes to tax preparation.

If you’re interested in midstream companies but prefer to avoid the dreaded K-1, you have a few choices. There are some great midstream companies structured as C-corps. Or you can turn your attention to closed-end funds that specialize in energy MLPs. Instead of buying individual MLP stocks and dealing with the hassle of K-1s, you can own those same stocks through a closed-end fund and receive the simple and more familiar 1099 for your tax reporting.

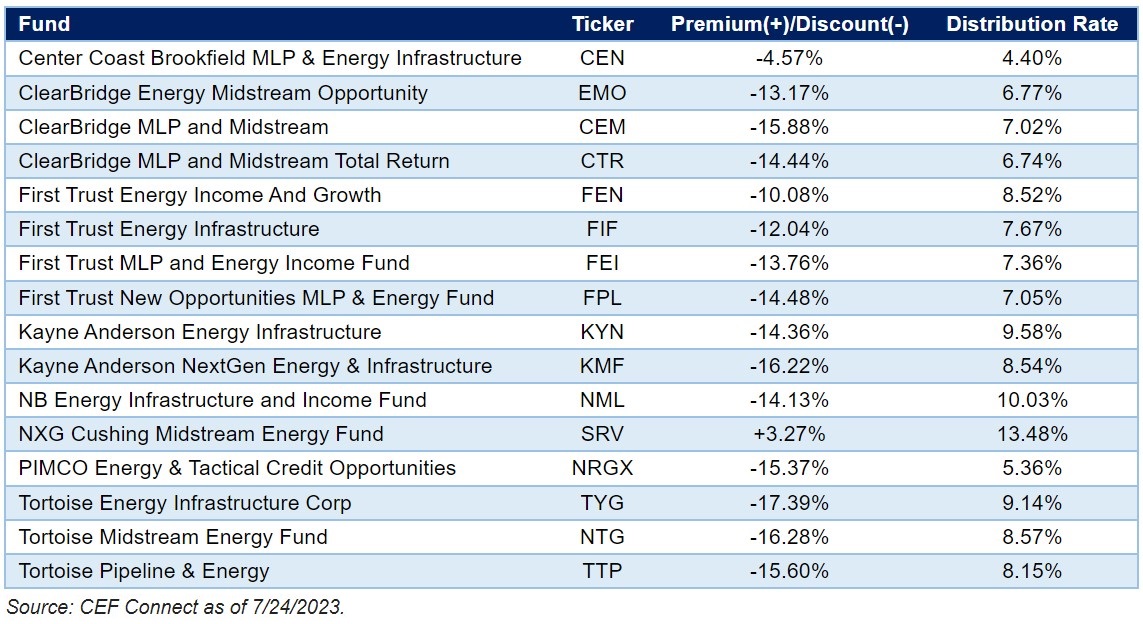

You have plenty of choices — there are 16 midstream-focused closed-end funds listed today.

Those distribution rates should be juicy enough to get your attention, even in today’s interest rate environment where U.S. Treasury bonds actually yield something.

But what about the premium/discount? This feature is unique to closed-end funds. When you buy or sell a mutual fund, you do so at a price on par with the net asset value (NAV) of the fund.

Closed-end funds are different. Unlike mutual funds, closed-end funds don’t continually issue and redeem shares. You trade them with other investors. And they rarely trade at par. Sometimes they trade at a premium to the underlying asset value of the fund. Often, they trade at a discount.

All but one of the closed-end funds above trade at a discount today. That’s typically what happens when a fund specializes in part of the market that has fallen out of favor with investors. If you buy a fund at a 15% discount, you are essentially buying $1 of assets for 85 cents.

To recap: Midstream companies are resilient businesses not at the mercy of volatile commodity prices. They are reducing their debt, paying great dividends, and they’re insulated from competition. And if you own them through a closed-end fund, you avoid the K-1 hassle and get to buy these great assets on sale.

It’s an income lover’s dream. But no need to pinch yourself.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.