Kiplinger ESG 20: Our Favorite ESG Stock and Fund Picks for Investors

Doing good and making money are no contradiction with these ESG stock and fund picks that ride the trend of socially conscious investing.

David Milstead

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It has been a tough year for investors who include environmental, social and corporate governance (ESG) factors when assembling their portfolios, as well as our picks of companies and funds that are ESG leaders.

The 15 stocks in the Kiplinger ESG 20 returned an average of 4.3% over the past 12 months, compared with 15.9% for the S&P 500. Just six of our stock picks outpaced the index. Of our favorite ESG funds, only one outperformed its respective peer group, and we're making several changes.

When we looked at the landscape a year ago, the climate for ESG investing was turning hostile. A number of companies, faced with pressure on social media, retreated from policies designed to promote diversity, equity and inclusion.

Large investors began to pull out of groups formed to advocate that companies adhere to tough climate goals. Despite that, our picks did well compared with the broader market in the 12 months that ended August 31, 2024.

The election of President Donald Trump accelerated the attacks on ESG. From November 5 through August 31 of 2025, our ESG stock picks averaged a 3.7% return, while the S&P 500 rose 14.3%. There's no doubt ESG investing is in the crosshairs.

The Trump administration's Department of Justice asserts that DEI policies amount to illegal discrimination, for example. And Trump has repeatedly expressed disdain for renewable energy, particularly wind power.

Many investors are following Trump's lead, pulling $12.2 billion from U.S. sustainable-investing funds in the first half of 2025, according to investment research firm Morningstar.

Should investors stay the course or flee?

Is it time to walk away from these stocks and the whole concept of ESG investing? That may be hasty.

"One hundred percent, this is a short-term panic" because of the priorities of the Trump administration, says Nell Minow, a corporate governance pioneer and founder of a research firm called The Corporate Library.

ESG-focused investing, also known as socially conscious or sustainable investing, has been a strategy for some investors for decades, and it will likely remain so for a core group seeking to invest in line with their values.

Importantly, we believe our ESG picks represent good business prospects as well. Indeed, some experts believe the current backlash presents an opportune moment for investors with a longer-term view.

"When people are beginning to question the validity of ESG, if you really understand these issues you can start to find some good investment opportunities because people are mispricing or misunderstanding the moment," says Ed Farrington, the North American president of ESG-oriented investment firm Impax Asset Management.

It's worth noting that although U.S. investors continued to flee ESG, the story is different outside the country. Morningstar says European investors poured $8.6 billion of net new money into ESG funds in the second quarter, offsetting the U.S. decline and making the global number positive.

Kiplinger's favorite ESG stocks and funds

With this in mind, here is the Kiplinger ESG 20, a list of our favorite stocks and funds with an environmental, social or governance focus and healthy financial prospects.

Each of our picks for the best stocks to buy has a strong record on at least one ESG pillar. We reviewed ESG ratings from Morningstar Sustainalytics, Institutional Shareholder Services and LSEG Data & Analytics, among others.

But no company can be all things to all people; a firm we've highlighted for its strong governance focus, for example, may not also be an environmental star. As such, we have broken down our stock picks into three separate categories:

Environmental stewards: These companies offer products, services or technologies that provide solutions to problems such as greenhouse gas emissions, air and water pollution, or resource scarcity.

Social standouts: More companies are explicitly abandoning diversity policies and programs and scrubbing their corporate reports of any mention of DEI. But we'll note that diversity is only one of the criteria for this category, which also encompasses a company's broader treatment of its employees, customers, suppliers and community.

Governance leaders: These companies are committed to diverse and independent boards, strong ethics policies, responsible executive pay that is tied to performance, and combatting corruption.

Meanwhile, our five favorite ESG funds are all focused on sustainability, but each has a unique approach. These funds might focus on an ESG category, seek a measurable impact on a specific challenge, integrate ESG criteria into a broader strategy or engage with firms to improve ESG practices.

For details on how our picks have performed and why we think they are standouts, read on. All returns and data are as of August 31, unless otherwise noted.

The Kiplinger ESG 20 at a glance

Company | Symbol |

|---|---|

First Solar | FSLR |

Levi Strauss | LEVI |

Microsoft | MSFT |

Prologis | PLD |

Xylem | XYL |

Costco Wholesale | COST |

Novo Nordisk | NVO |

Salesforce | CRM |

Trane Technologies | TT |

W.W. Grainger | GWW |

Accenture | ACN |

Applied Materials | AMAT |

CBRE Group | CBRE |

Hilton Worldwide Holdings | HLT |

Nvidia | NVDA |

Funds | Row 15 - Cell 1 |

iShares Environmental Infrastructure & Industrials ETF | EFRA |

iShares ESG Aware 60/40 Balanced Allocation ETF | EAOR |

Fidelity Sustainable Core Plus Bond ETF | FSBD |

FlexShares STOXX Global ESG Select ETF | ESGG |

Putnam Sustainable Future ETF | PFUT |

Environmental steward: First Solar

First Solar (FSLR) finds itself a direct target of the Trump administration's attack on renewable energy, and spooked investors have sent the shares down 14.2% over the past year.

The outlook for the largest U.S. producer of solar panels is better than you may think: The One Big Beautiful Bill Act preserved a tax credit that benefits First Solar bigly.

And the government's desire to push Chinese companies out of the market is a plus. Twenty-nine of 35 analysts who cover the stock rate it a Buy, according to S&P Global Market Intelligence.

Environmental steward: Levi Strauss

Shares in Levi Strauss (LEVI), an apparel company best known for its denim wear and given high marks for its greenhouse-gas emission reductions and water management, gained 18.8% over the past year.

The company exceeded expectations for revenue, profits and profit margins in its most recent quarter and is generating healthy cash flow with very little debt.

Analyst Jay Sole of investment firm UBS, who likes the consumer discretionary stock, says the company is transforming into a global retailer with a "lifestyle brand" that appeals to both men and women.

Environmental steward: Microsoft

Microsoft (MSFT) was the top performer in the environmental steward category, gaining 22.3%. Thanks to cloud computing and artificial intelligence, the maker of the fusty Windows software is getting bigger, faster, in its fiftieth year.

Year-over-year revenue growth at its Azure cloud business, home to many of its AI services, hit 39% in the quarter that ended June 30, compared with a 31% growth rate two quarters prior.

The promise of AI suggests Microsoft may defy the law of large numbers and keep posting impressive sales and profit gains, analysts say.

Brian Schwartz, of investment firm Oppenheimer, says Microsoft is his firm's top large-cap stock idea for AI and cloud investing. Of course, the computing power required for AI is an energy hog. Microsoft retains its place on our list by maintaining its goals to be carbon negative and water positive — replenishing more water than it consumes — by 2030.

Environmental steward: Prologis

Prologis (PLD) is a real estate investment trust (REIT) with more than 1.3 billion square feet of warehouse space worldwide. It continues to be an environmental leader with emissions lower than its industry average and a commitment to renewable energy.

But the shares have fallen 7.9% over the past 12 months as investors worry that a downturn in consumer spending could clip Prologis's rental income. That's short-term thinking, considering Prologis's size, quality markets, and healthy balance sheet.

"Despite its blue-chip REIT status, the company does not trade at a meaningful premium to peers, and we think it should," says analyst Jonathan Petersen, of investment firm Jefferies.

Environmental steward: Xylem

Global freshwater scarcity means high demand for the kind of water-filtration equipment that Xylem (XYL) produces, and the industrial stock is a popular pick for funds that focus on sustainability.

Xylem returned 4.1% over the past year as investors worried about tariffs driving up the costs of the parts and raw materials the company uses to make its systems.

Now, though, Xylem is passing along those costs. Profit margins are growing as the firm emphasizes profitable markets and product lines, says analyst Jonathan Sakraida, of research firm CFRA, one reason for his Strong Buy rating on the stock.

Social standout: Costco Wholesale

Costco Wholesale (COST) joined the ESG 20 in May, not long after it pushed back on DEI opponents and reaffirmed its support of the policies. Costco is also known for compensating employees fairly and treating suppliers well.

Shares are up a modest 6.3% over the past year, as fears about a potential slowdown in consumer spending have prompted a retreat from the stock's February highs. The stock still isn't cheap, trading at 49 times estimated earnings for the year ahead, but we're not checking out of Costco.

Morgan Stanley analyst Simeon Gutman says Costco's customer traffic, sales gains and membership growth are "best in class," and he sees the company steadily increasing its earnings and profit margins.

Social standout: Novo Nordisk

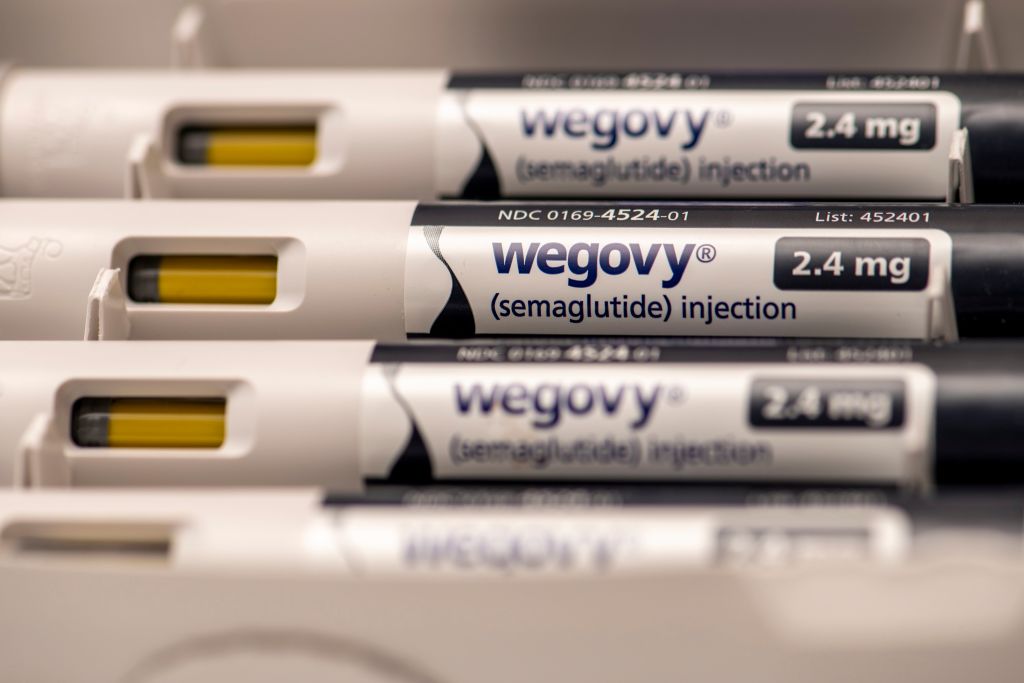

Novo Nordisk (NVO), the maker of the Ozempic and Wegovy drugs, is in our penalty box. The shares are down a disastrous 58.2% from a year ago.

Novo disclosed disappointing results in a late-stage trial for one of its newer weight-loss drugs in December and cut its sales outlook in July. Many investors believe competitor Eli Lilly (LLY), maker of Zepbound, will pull ahead of Novo with its new pill, which will be easier to use than the current injectables.

Others think there's room enough for two in a weight-loss market that could top $200 billion in the next decade — and that investor negativity has made Novo a good value.

With shares trading at about 15 times earnings for the year ahead — a third of the multiple it carried in the summer of 2024 — we'd like to give Novo some time to succeed.

Social standout: Salesforce

Salesforce (CRM) is the leader in customer relationship management software, with the most comprehensive set of CRM products and a client retention rate above 90%.

Among its social strengths are strong policies to ensure its suppliers pay attention to human rights and treat their workers fairly. The stock is up just 2.0% for the past 12 months, reflecting a transition as the company pivots from focusing on sales growth to focusing on profitability. Profit margins are catching up to (but still behind) the average for software companies in its peer group.

The challenges for Salesforce are reflected in its discounted valuation, says Jefferies analyst Brent Thill, who rates the shares a Buy. We're watching closely to see how quickly the firm can close the gaps with peers.

Social standout: Trane Technologies

Investors' desire for all things AI has swept up Trane Technologies (TT), which has seen its shares rise 15.9% over the past year — on par with the S&P 500.

Trane makes heating, ventilation and air conditioning systems, and AI needs AC (otherwise the computers in the data centers will overheat).

The stock may be a bit overheated, however, given recent weakness in Trane's residential business. A drop in the shares in late July may not have been quite enough to create a compelling opportunity for new buyers, as the stock still trades at 30 times estimated earnings.

But analyst Andrew Kaplowitz, of investment bank Citi, says he believes Trane deserves its premium valuation because of its innovative products and strong execution. We'll be watching upcoming results closely.

Social standout: W.W. Grainger

Industrial supplier W.W. Grainger (GWW), ranked as a "best place to work" by several organizations, is up just 3.8% over the past year. (In November 2024, we warned that a 39% gain in the previous year made it unlikely that the shares would outperform the broader market the following year.)

The lackluster return includes a double-digit drop in August, when Grainger lowered its profit expectations for the remainder of the year due to the cost of tariffs on its imported products.

That's a blip for a company that has consistently shown excellent profitability, and Baird analyst David Manthey believes Grainger will continue a long-term track record of successfully passing along cost increases to its customers.

Governance leader: Accenture

Novo Nordisk might be in the penalty box, but Accenture (ACN) is in the DOGEhouse.

Shares in the global consultant, which gets high marks for its anti-corruption and anti-bribery policies, fell 22.2% over the past year on worries about cuts to government contracting inspired by the Department of Government Efficiency.

Indeed, Accenture reported that while its sales increased 8% in the quarter that ended May 31 from the same quarter a year ago, its bookings — or new contracts on which it hasn't yet done the work and earned the revenue — fell 6%.

David Grossman, an analyst at investment firm Stifel who likes the shares, says the report wasn't as bad as it looked and that Accenture is both well positioned for AI and "consistently the best-managed business in the sector."

The current fears allow you to pick up shares in this top consulting firm at a discount.

Governance leader: Applied Materials

Applied Materials (AMAT) shares fell 17.6% over the past year, illustrating that AI hype hasn't lifted all boats.

The company is one of the world's largest makers of equipment for the semiconductor industry. It stands to benefit from growth in AI, but the company is also more exposed to tariffs than its peers, and a disappointing earnings report in August was a setback.

The company issued weak guidance to Wall Street analysts about earnings prospects in the short term, but that "doesn't change our view of Applied's position to capitalize on AI investment longer-term," says Morningstar analyst William Kerwin.

We think the company, praised for excellent compensation disclosure and a strong code of business ethics, can weather the storm.

Governance leader: CBRE Group

Real estate services company CBRE Group (CBRE) makes our list because key board committees are fully independent, and governance monitors give the company plaudits for transparency in how it discloses pay matters.

CBRE delivered a one-year return of 40.8%, among the best of all real estate companies in the S&P 500.

Don't bet against it, say most of the analysts who follow the stock. Even though CBRE hit new 52-week highs in August after strong earnings and a buoyant outlook, analyst Stephen Sheldon, of investment firm William Blair, says CBRE's outlook for 2025 earnings is conservative.

Governance leader: Hilton Worldwide Holdings

Hilton Worldwide Holdings (HLT) boasts a highly independent board and is a guardian of shareholder rights. The stock gained 26.0% over the past year, but there may be no room at the inn for similar gains over the next 12 months, especially if the economy falters and travel trends worsen.

That said, Hilton is the biggest hotel chain in the world and, says analyst Chad Beynon, of investment firm Macquarie, "the most stable and resilient operator" in case of a recession.

Investors have bid up the price of Hilton shares in a flight to quality, but given a muted outlook for travel, investors may be able to pick up this stock at cheaper prices in the months ahead.

Governance leader: Nvidia

Nvidia (NVDA) has been one of the best stocks of the century — logging a 126,100% return over nearly 25 years. A one-year gain of 45.9% is nearly as impressive, given the colossus it has become.

Nvidia's chips are tops for the complex computing that artificial intelligence requires. As companies such as Microsoft and Facebook plow billions into computing's future, much of that money goes straight to Nvidia, which we consider a governance leader due to its independent board and laudable compensation practices.

Reaction to Nvidia's most recent quarterly results were mixed, but traders eventually concluded that the AI boom will remain intact.

ESG fund: iShares Environmental Infrastructure & Industrials ETF

Impax Global Environmental Markets (PGRNX) is out to make way for the iShares Environmental Infrastructure & Industrials ETF (EFRA).

The exchange-traded fund tracks a global index of utility, industrial and basic materials companies that support energy efficiency and emissions mitigation; reduce air, water or land pollution; or minimize land-use and local environmental impact.

Top holdings include Xylem, sustainable paper and packaging business Smurfit Westrock (SW), and Core & Main (CNM), which provides essential products for community infrastructure, including pipes, valves and pumps for wastewater and storm drainage. The fund's 12-month return is 8.1%.

ESG fund: iShares ESG Aware 60/40 Balanced Allocation ETF

The iShares ESG Aware 60/40 Balanced Allocation ETF (EAOR) replaces the Green Century Balanced Fund (GCBLX).

The iShares global moderate-allocation fund hews to sustainable screens — such as no weapons makers or firms embroiled in human-rights or labor issues — and focuses on stocks and bonds with strong ESG traits.

It is a fund of funds: Just over 60% of assets sit in four ESG stock funds that invest in U.S. and foreign shares; the rest is in iShares ESG Aware U.S. Aggregate Bond. The fund's 12-month, 10.2% return beat 59% of its peers.

ESG fund: Fidelity Sustainable Core Plus Bond ETF

The Fidelity Sustainable Core Plus Bond ETF (FSBD) replaces the Brown Advisory Sustainable Bond Fund (BASBX). The Fidelity ETF, yielding 4.4%, is run by bond-picking veterans we know well, including Ford O'Neil and Celso Munoz, who also have a hand in Fidelity Strategic Income (FADMX), a member of the Kiplinger 25, our favorite no-load mutual funds.

The managers invest in bonds with positive ESG traits. Though 80% of the fund is invested in high-quality securities, up to 20% can be high-yield debt. That side bet, currently just under 12% of assets, helped in recent months, as did an overweight position in government mortgage-backed securities.

Over the past year, the fund's 3.0% gain has kept pace with the Bloomberg U.S. Aggregate Bond index.

ESG fund: FlexShares STOXX Global ESG Select Index ETF

The FlexShares STOXX Global ESG Select ETF (ESGG) has been a Kip ESG 20 member from the start.

The ETF focuses on large-company stocks in the U.S. and foreign countries that comply with the United Nations principles of behavior governing human rights, labor, the environment and anti-corruption. Top holdings include Nvidia, Apple (AAPL) and Amazon.com (AMZN).

No surprise, then, that the fund has done well over the past 12 months, with a 15.7% return. That beat 71% of its peers in the global large-stock blend category.

ESG Fund: Putnam Sustainable Future ETF

Actively managed Putnam Sustainable Future ETF (PFUT) focuses on companies that provide solutions to the world's social, environmental and economic-development problems.

The fund's growth-tilted portfolio has been volatile. From its December 2024 peak through April 8, the fund fell more than 27%, as trade worries rocked U.S. stocks. It has rallied 30% since, but the bumpy ride has left the fund with a 12-month return of 3.6%.

Top holdings include Hilton Worldwide, infrastructure firm Vertiv Holdings (VRT) and power company Vistra (VST).

We expect volatility with a fund like this, and we'll wait out this soft patch for now. But we're watching closely.

Learn more about PFUT at the Putnam Investments provider site.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

- David MilsteadSenior Associate Editor, Kiplinger Personal Finance

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.