McDonald's (MCD) Stock: Tasty, Empty Calories

For some, ESG challenges such as climate change and animal welfare offset the durability and dividends of MCD shares.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors very well might find riches at the end of the Golden Arches. Indeed, McDonald's (MCD, $244.52) stock is a popular Buy call on Wall Street, and it features prominently in our own Kiplinger Dividend 15 as a stalwart payer.

But from an ESG perspective, McDonald's isn't nearly as clear-cut a winner. While it has made some strides in becoming a more environmentally conscious company, its business model – built on selling more beef burgers than any other restaurant in the world – is locked into an unsustainable product.

Here, we'll explore how MCD stock falls short, and what the blue chip has going for it.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cattle, Carbon and Climate

Enormous, public-facing companies such as McDonald's are attractive targets for environmental activists. And indeed, MCD stock is facing its share of controversies and challenges on the environmental, social and governance (ESG) front.

The company has shown leadership in areas such as sustainable packaging, partnering with the Environmental Defense Fund for over three decades. By 2020, almost 100% of its customer packaging was from deforestation-free sources, and by 2025, all customer packaging will come from recycled, renewable, or certified sources.

However, its reliance on beef puts it on a collision course with the need to reduce its climate-warming emissions.

Cattle in the company's supply chain serve up a double portion of climate impact:

- As cows digest, they emit methane gas, which is 25 times more powerful than carbon dioxide when it comes to trapping heat in the earth's atmosphere.

- And the huge demand for cattle drives deforestation in places such as the Amazon rainforest, where ranchers may illegally burn forestland and claim it as their own farmland.

To its credit, McDonald's has tried to lead the restaurant industry to a more sustainable way of raising cattle, but it is a slow, tough slog, says Bloomberg. Despite pledging to source sustainable beef, a recent investigation by Repórter Brasil cataloged problems in McDonald's Brazilian supply chain. The report alleges that suppliers sourced meat from ranchers that illegally cleared forested land and violated labor and human rights laws.

This news came just weeks after a sobering report that the Amazon rainforest is reaching a tipping point and could quickly transform into grasslands, disturbing global weather patterns.

"There is no way that McDonald's can continue to grow with its current meat-heavy menu while delivering on its promise to reduce emissions," says Kari Hamerschlag, deputy director of the food and agriculture program at Friends of the Earth.

More Meaty Controversy

MCD stock investors should expect a prickly shareholder battle at the annual meeting on May 26. In addition to a shareholder proposal filed by the Humane Society, activist investor Carl Icahn has put forward two board nominees who would support better conditions for pigs in McDonald's supply chain.

While this effort might seem capricious to investors unfamiliar with the issue, the U.S. Supreme Court announced in March that it will hear a case at the center of this fight between animal welfare activists and the pork industry, and 10 states and several countries have adopted similar pig welfare standards. After years of trying to transform these standards together, both McDonald's and the Humane Society have released blow-by-blow accounts of how the partnership soured.

McDonald's promised in 2012 to phase out by 2022 the use of all "gestation crates" – cages that house pregnant sows, unable to turn around, for any period during their four-month pregnancy. The practice became a pork industry norm in the 1970s as a way to curb injury or aggression by sows, but these assumptions were later challenged by animal welfare scientists.

Gestation crates had for years been especially abhorrent to animal welfare groups, and McDonald's commitment was momentous. McDonald's VP of Corporate Social Responsibility at the time, Bob Langert, was central to this effort.

"I toured my first sow facility, astonished as I observed a few thousand sows all lined up in rows, each confined to what seemed like a little prison," he wrote.

Langert found that, though the cost passed on to the consumer was low, the cost of transitioning from gestation crates to more humane housing was considerable, up to $25 million per supplier. Meat companies and lobbyists were dead-set against these changes. For this reason, Langert set a 10-year goal to allow suppliers to make changes gradually as they retired assets, and subsequent studies supported the business case for this transition.

Once McDonald's pioneered this commitment to phase-out gestation crates by 2022, other retailers soon followed, and their pork suppliers started to fall in line with similar commitments. Ten U.S. states banned gestation crates, as did several countries.

Yet despite these promises, many pork producers failed to make progress on the phase-out.

From the Humane Society's perspective, the company made a clear commitment in 2012 to abolish all gestation crates.

"McDonald's believes gestation stalls are not a sustainable production system for the future," Dan Gorsky, senior vice president of McDonald's North America Supply Chain Management, said at the time.

Now that the 10 years is up, the Humane Society is understandably upset that MCD has moved the goalposts, allowing suppliers to keep sows in crates for four to six weeks of every pregnancy.

McDonald's counters that it only purchases 1% of the U.S. pork supply, and that fully gestation-free crate pork is a "niche" market that would require an extra 300 to 400 times the current number of animals to produce the same amount of meat.

This is an uncomfortable position for MCD stock holders. McDonald's appears to be reneging on its original commitment because its suppliers revolted and possibly also because the transition is more expensive and difficult than it estimated.

Mr. Icahn's nominees are unlikely to win board seats at the annual meeting. Proxy voting advisory firms ISS and Glass Lewis recently recommended opposing his proposal, citing a lack of attention to the proposal's cost and impact on shareholder value.

MCD Stock: A Buy (For Conventional Investors)

For investors with pretty strict standards about the environmental impact of their holdings, McDonald's shares still need some work. MCD earns average ratings on ESG management from MSCI and Sustainalytics. MSCI notes that the company has comprehensive climate goals, but critics point to fuzzy math and greenwashing.

But if you're less concerned about ESG criteria, MCD stock does offer safe harbor.

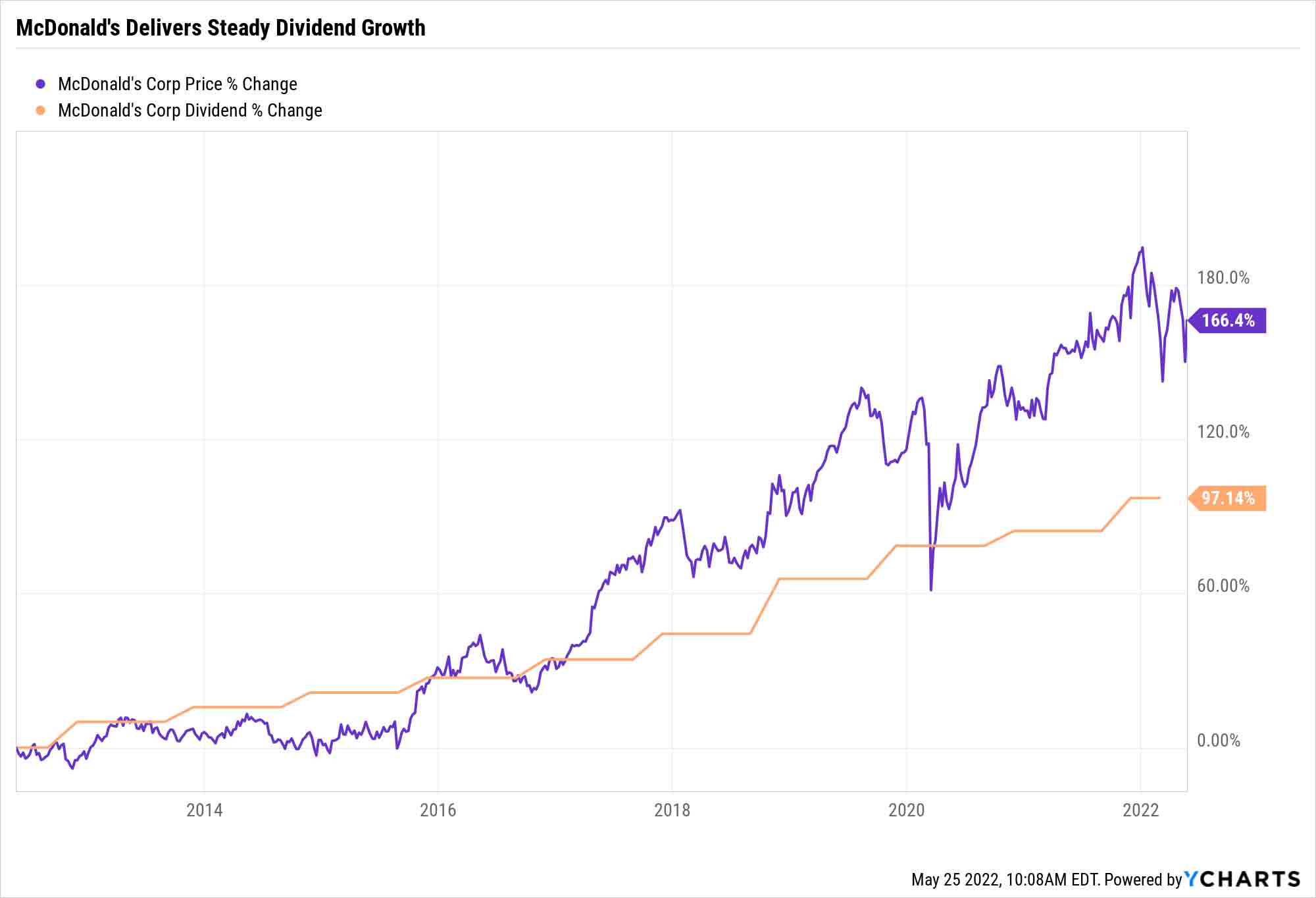

As mentioned above, McDonald's is a member of our Kiplinger Dividend 15, thanks in large part to its status as a Dividend Aristocrat. The dividend on MCD shares has improved annually without interruption for 45 years, at an annual compound rate of 8% over the past half-decade.

McDonald's stock also offers up a 2.4% yield at present, which is better than the S&P 500's 1.6% yield.

Wall Street remains pretty high on the consumer discretionary stock as well. According to S&P Global Market Intelligence, 36 analysts cover the stock – of those, 27 maintain a Strong Buy or Buy rating, while eight say Hold and only one has a Sell recommendation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Dow Climbs 559 Points to Hit a New High: Stock Market Today

Dow Climbs 559 Points to Hit a New High: Stock Market TodayThe rotation out of tech stocks resumed Tuesday, with buying seen in more defensive corners of the market.