The Social-Tracking BUZZ ETF: What It Is, What It Isn't

The VanEck Vectors Social Sentiment ETF (BUZZ) taps into social media's growing voice and David Portnoy's popularity. But the exposure it provides isn't quite what you might think.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Asset manager VanEck is tapping into the wisdom of the crowd for its latest product offering: the VanEck Vectors Social Sentiment ETF (BUZZ).

And they've brought one of the loudest of loudspeakers in to let you know about it.

The BUZZ ETF, which is set to launch March 4, tracks an index comprised of stocks benefiting from positive sentiment expressed through social media, news, blogs and other "alternative datasets."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It's a fitting launch given that the past year has seen a groundswell in daytrading, especially among young people who are taking their stock-picking cues from Reddit forums such as r/WallStreetBets and other social media platforms.

And as if to drive the point home, the BUZZ ETF's launch was announced on Twitter by Dave Portnoy. The, ahem, vocal CEO of Penn National's (PENN) Barstool Sports began day trading heavily during the COVID lockdowns of 2020, inspiring many of his followers to do the same. (Portnoy also is a partner and part-owner of Buzz Holdings, the firm behind BUZZ's underlying index.)

But early hype – and early detractions – about what this fund could be don't quite hit the mark. Read on as we discuss what the BUZZ ETF really is ... and what it isn't.

What the BUZZ ETF Is

It's a sentiment tracker.

VanEck says its VanEck Vectors Social Sentiment ETF is a collection of larger stocks – names with market values of at least $5 billion – that "exhibit the highest degree of positive investor sentiment and bullish perception" based on content that one could typically find online. Twitter posts. News articles. Blogs.

The BUZZ ETF tracks the BUZZ NextGen AI US Sentiment Leaders Index, which uses natural language processing technology to ingest and determine the positive, negative or neutral value of millions of inputs.

"It's all about training the models to understand written text the same way people in the investment world understand that text," says Jamie Wise, founder and CEO of Buzz Holdings. "People speak very differently about stocks than they do, say, product reviews on Amazon."

After ranking stocks by factors such as degrees of sentiment and breadth of discussion, the system's algorithms pluck the 75 top-scoring names for inclusion in the index.

The BUZZ index repeats the process as part of a monthly rebalancing, with a small "buffer" provision included. If a stock was ranked at 71 to 75 in the prior month, and following rebalancing it would be ranked at 76 to 80, the index keeps said stock to minimize turnover (and thus trading costs).

What It Isn't

The BUZZ ETF is not a way to recreate the r/WallStreetBets phenomenon.

We explain the GameStop/WallStreetBets phenomenon in more detail here, but for the uninitiated, a very quick explanation:

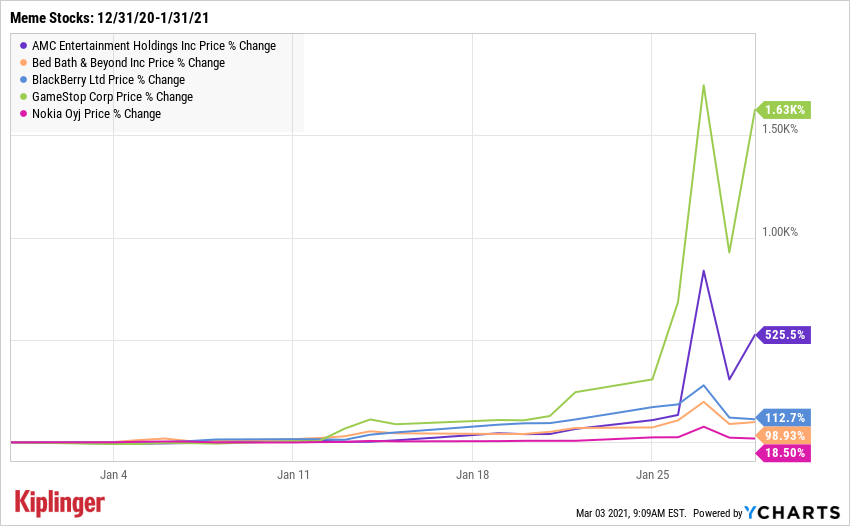

Back in January, a Reddit community identified a number of stocks that Wall Street was overwhelmingly betting against. These stocks were perfect targets for a so-called short squeeze, in which a burst of buying impels people making bearish bets against the stock to unwind their trades – by purchasing more shares, thus driving the stock even higher. The greatest stock of focus, GameStop (GME), was squeezed as much as 2,463% higher at its peak ... before crashing back down to earth, that is.

That brings us back to the BUZZ ETF.

Again, this new VanEck fund's index is only exploring a universe of stocks with market caps of $5 billion or more. Share prices of companies like that are much more difficult to move with retail cash alone given their sheer market size.

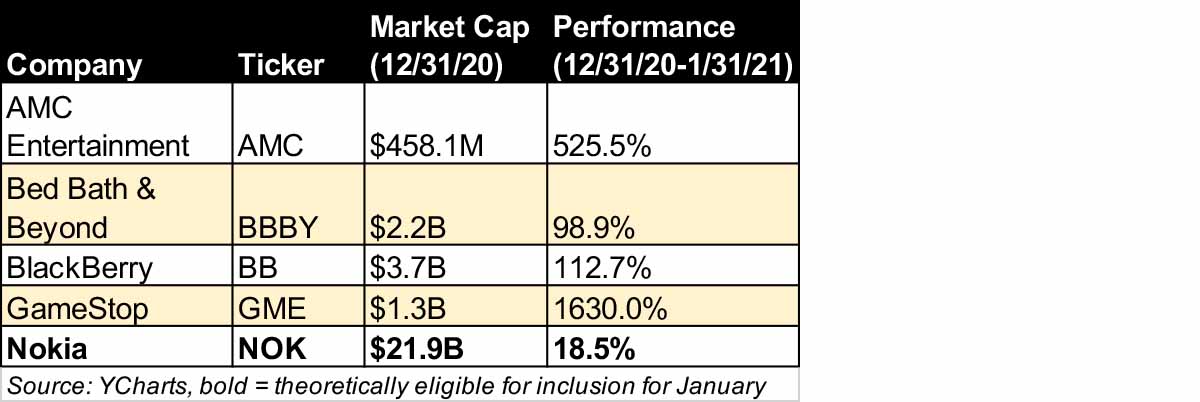

In fact, many of the stocks targeted in the WallStreetsBets craze wouldn't have had large enough market values to merit inclusion in the BUZZ ETF until after their seismic run-ups.

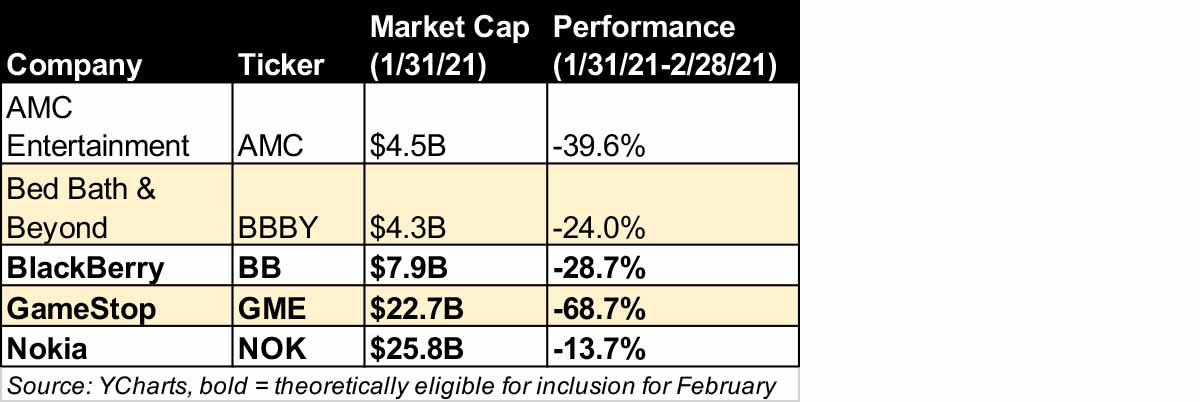

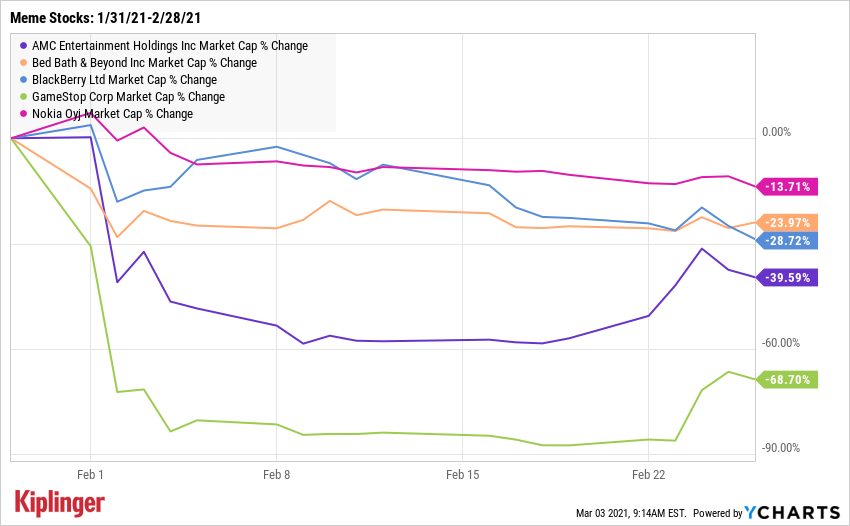

On the flip side, three of those stocks that were jolted above the $5 billion market cap threshold would've been theoretically eligible to enter the fund in February ... much to investors' detriment.

VanEck's ETF isn't tracking sentiment across just a day or two, however. Instead, it's looking for positive sentiment sustained across at least a month. So it's possible that none of these stocks would have qualified anyway given the speed of their ebbs and flows into the social consciousness.

All of this is ultimately moot, however. Because the BUZZ ETF harnesses broader social sentiment, not just investment-specific posts.

"This is just a way to tap into that sentiment, but it's not only coming from WallStreetBets," says Todd Rosenbluth, CFRA's Head of ETF & Mutual Fund Research. "This will also take into account when a company does a cool advertisement and there's positive sentiment, and the company is trending on social media platforms because of that.

"There's noninvestment angles, and in fact, I think the original thought process was to invest in companies that were trending outside of the investment world, on the assumption that there would be investment benefits when the company was trending."

Wise also points out that despite being borne of high positive sentiment, the BUZZ ETF isn't just a list of hot growth names.

"There are growth stories that they expect to do well," he says, "but there's also value sentiment, where stocks have fallen too far, and all the traditional reasons why people would be positive about a stock."

Top 10 holdings include not only larger growth names such as Facebook (FB) and Amazon.com (AMZN) and newer growth plays such as DraftKings (DKNG), but previously trod-upon stocks such as Ford (F) and American Airlines (AAL).

Interestingly, the high minimum market cap requirement and diversification across dozens of stocks could make this a much calmer fund than what "to the moon!" types and WSB detractors alike might expect.

What the BUZZ ETF Is

This ETF is a second chance.

VanEck is actually trying its hand at some light necromancy with the VanEck Vectors Social Sentiment ETF. The BUZZ NextGen AI US Sentiment Leaders Index, which currently dictates BUZZ's holdings, used to power the Sprott Buzz Social Media Insights ETF, which hit markets in 2016 with the ticker BUZ.

"The index itself went live back in December 2015, and the research that led to the index started a year before that," Wise says. "We were longtime believers of potential insights from the collective conviction of the online community."

The market wasn't a believer, though, at least not at first. Sprott's fund closed after just three years.

But that doesn't necessarily mean BUZ was a bad product.

"The ETF graveyard is littered with strategies that sound like they should work, and they failed to gather assets," says Rosenbluth, who thinks "this time will be different" because companies and stocks are being impacted by social sentiment more than they would have even just a few years ago.

"I think this time around, investors are going to be more likely to consider such a strategy because there's a growing number of investors that found their way toward ETFs through social media platforms," he says, adding, "I think it could be one of the most successful products to come live in 2021."

What It Isn't

The BUZZ ETF certainly isn't like most ETFs in that it's launching with some controversy.

The first bit has to do with Portnoy's involvement.

Portnoy is not directly connected to VanEck, something the fund provider made clear in an emailed statement to Sportico: "He represents the Index and has no affiliation with VanEck. He does not provide investment advice on behalf of VanEck. There is no affiliation with VanEck and Barstool Sports."

However, as mentioned before, he is a partner in index provider Buzz Holdings, along with Wise and Michael Kimel; the latter is a co-founder of Ontario-based Chase Hospitality Group. And the very nature of BUZZ's selection methodology connects Portnoy to the BUZZ ETF in a highly unusual way.

"Portnoy is a part owner in Buzz Holdings, he's a director, so he has a financial stake in the index provider," says Lara Crigger, Editor In Chief, Director of Content at ETF Action. "But he's also part of the social media ecosystem on which the index is taking input. So if he posts about PENN or GME or whatever, he's contributing to that social media mention, he conceivably could be directly influencing the rankings of which his index is based."

Wise minimized Portnoy's potential role in the rankings, explaining that "Dave Portnoy's view about Apple is not weighted any higher than your view about Apple."

That said, Portnoy's reach – he has 2.3 million Twitter followers as of this writing – still theoretically gives his messaging far more influence to shape the social conversation, and thus the rankings, than your average Joe.

"If he talks up a stock, that's likely going to affect the rankings," Crigger says.

Crigger also points out a few oddities in Portnoy's Twitter announcement – a video with Portnoy's alter-ego "Davey Day Trader" hyping BUZZ's imminent launch. Among them is that every time Portnoy mouths the word "index" in the video, another person's voice is dubbed over his, saying "ETF."

"Since shares of an ETF are registered securities, any direct or indirect reference to the fund can be construed as selling or soliciting investments in securities which requires an individual to be licensed as a registered representative of a broker-dealer," says Sean Wilke, Partner and Head of Strategic Growth at Greyline, a regulatory and business consulting firm. But he adds, "There are very limited carve-outs from those registration requirements if, for instance, those communications are purely incidental to a more substantive role with the fund, such as portfolio manager."

Crigger says she's been covering ETFs for 15 years, and in that time most of the people she's spoken with wouldn't even link to an article about their ETF – or a podcast on which they appeared – if they had said "ETF."

"He's thumbing his nose at the regulations," she says. "Index providers can talk about their index, but you can't talk about your ETF. He never says, with his own voice, the three letters 'ETF.' He is moving his mouth as they're being said, and the audio can be heard on the video. But he is technically not the one saying the word 'ETF.'"

This kind of behavior, at the very least, could be a turnoff to institutional money. That's no small loss, especially considering that hedge funds and other high-net-worth investors have for years understood and tried to tap into the value of consumer and social sentiment.

Portnoy's high-energy mischief has an undeniable pull on younger generations, however. That might be pivotal in attracting more retail funds than the BUZZ ETF otherwise might have achieved – albeit at the potential cost of PR and regulatory headaches.

Kyle Woodley was long AMZN and DKNG as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.