Get Weekly Dividends With SoFi's New WKLY ETF

The fresh-faced SoFi Weekly Dividend ETF (WKLY) ups the ante on dividend frequency by paying its investors every seven days.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The newly launched SoFi Weekly Dividend ETF (WKLY) hopes to tackle a common complaint among income investors:

Too much time between dividend checks.

We've long discussed the benefits of monthly dividend stocks and funds – a very small subset of dividend payers that pay up much more frequently than the typical quarterly dividend schedule of your average U.S. stock. Chief among them is how monthly payouts better align with the realities (read: bills) of daily life.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But SoFi, with its new WKLY ETF, aims to deliver income at an even more dizzying pace, as it's the first equity ETF to promise weekly dividends – in theory, enough to satisfy even the most micromanaging of budgeters.

A Look at the SoFi Weekly Dividend ETF

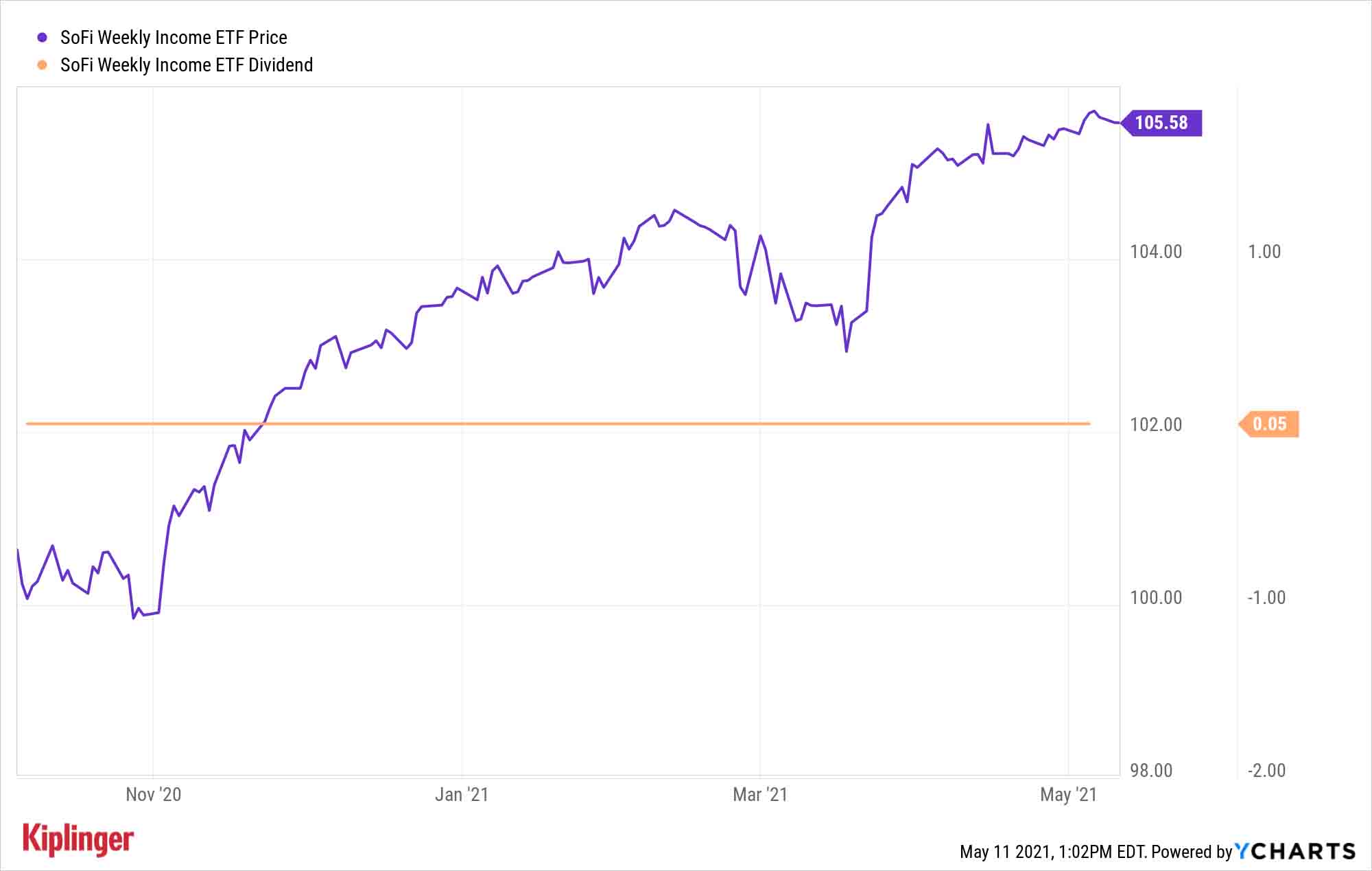

First things first: WKLY isn't the first ETF to pay out weekly distributions. SoFi already cleared that hump in October 2020 with the launch of the SoFi Weekly Income ETF (TGIF) – a fixed-income fund holding both investment-grade and junk bonds.

But it is the first such equity ETF to do so.

The SoFi Weekly Dividend ETF enters the market with a stated goal of high dividend frequency, pledging to pay out income to shareholders each and every Thursday. To do so, its portfolio emphasizes consistency in its dividend payers.

Here's how the sausage gets made:

WKLY will track the SoFi Sustainable Dividend Index, which the company says "is made up of large- and mid-cap companies in both the U.S. and developed international markets that meet a robust set of sustainable dividend filters."

Those filters include:

- Dividend sustainability: Each holding must have paid regular dividends over the prior 12 months, and be forecasted to pay dividends over the next 12 months as well. (SoFi uses a third-party service provider for dividend forecasts.) And those dividends must be at least 90% of the annual dividends paid out both one and five years ago.

- Payout ratio: Companies also must have an earnings payout ratio – the percentage of earnings that are paid out to shareholders as dividends – of between 0% and 100%. Existing holdings can be booted from the index if their payout ratio falls outside of that range for two consecutive "selection days," which occur 10 weekdays before each quarter's rebalancing. (A small note here: While a payout ratio filter cap of 100% prevents inclusion of stocks that are paying out more in dividends than they're earning, it leaves open at least the potential for including companies that are barely managing to afford their payouts.)

- Debt-to-equity ratio: A company's debt-to-equity ratio has to be outside the top 10% of its sector's companies in the "GBS Universe" – a field consisting of the largest 85% of stocks (by market capitalization) in developed markets.

- Dividend yield: A company can only be included if its dividend yield over the past 12 months is more than 1.2 times the weighed average dividend yield of the GBS Universe.

The end result at launch is a portfolio of nearly 300 stocks that's stuffed at the top with multinational blue chips such as JPMorgan Chase (JPM, 4.5% of assets), Nestle (NSRGY, 3.2%) and Procter & Gamble (PG, 3.1%).

While most readers' attention naturally goes to the ETF's weekly dividends, WKLY's geographic bent is worth noting.

"It is a rare global dividend fund, with likely half assets from non U.S. companies," says Todd Rosenbluth, Head of ETF & Mutual Fund Research at CFRA. "Most if not all dividend ETFs focus on either the U.S. or international markets."

That focus on international markets, where you can often find much larger yields than comparable to those offered by U.S. blue chips, allows SoFi to more comfortably target a fund yield of roughly 3% to 4%.

And while WKLY's expense ratio of 0.49% is on the high side for an indexed dividend ETF – that's roughly twice as high as the average 0.24% in fees charged by the 10 largest dividend-focused ETFs – you are, at least at the onset, paying for something that you simply can't get in any other ETF.

Let's Talk About Those Weekly Dividends

Anthony Noto, CEO of SoFi, notes that both WKLY and TGIF are nods to the old investing adage "Pay yourself first."

Since these ETFs will pay you every week, it will certainly feel like you're getting paid first. But the dividend distribution isn't as simple as "company pays SoFi, SoFi immediately hands that over to shareholders."

Just like with TGIF, the SoFi Weekly Dividend ETF aspires to pay out a consistent weekly dividend with little to no variance – TGIF, for instance, has maintained 5-cent weekly payouts since inception – regardless of how much or how little its holdings actually pay out on a week-to-week basis.

To accomplish this, SoFi analyzes its holdings and predicts a certain level of dividend payments it believes it can reasonably pay throughout the year. Should its holdings pay a little more, it can "top up" the final payment of the fiscal year. Or if a holding distributes a special dividend, WKLY might adjust a nearer-term dividend higher to reflect that one-time payout.

And despite sticking to a fixed sum each week, SoFi intends for all distributions to be paid out in cash, not capital gains, in order to avoid less favorable taxation.

Still, buyer beware – or at least, buyer be aware. The prospectus wording technically opens the door to potential variation in the weekly dividend:

"However, although the Fund intends to maintain a consistent weekly income distribution, depending upon the timing of the receipt and payment of dividends from the Fund's underlying holdings, the amount of the Fund's weekly income distribution may fluctuate."

Be that as it may, given the types of stocks that WKLY targets, this ETF is unlikely to ever suffer a sudden massive downshift in payouts.

"This is just a steady stream of income for investors while providing more capital appreciation potential than a bond fund," Rosenbluth says. "The dividend ETF universe is crowded, but this is a novel approach and is likely to appeal to investors that like consistent income."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.