Shield Your Portfolio From Inflation

Use our picks to hedge against rising prices that can eat into your investment returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors fear inflation in the same way Superman dreads a pile of kryptonite. Just as the mysterious substance weakened the Man of Steel, a persistent rise in prices can diminish the strength of an investment portfolio. Inflation eats into returns and reduces the buying power of assets in investment accounts, such as 401(k)s. “Inflation has a scary connotation,” says Axel Merk, president and chief investment officer of Merk Investments.

Rising prices are especially scary for retirees with larger holdings of lower-return assets, such as cash and bonds. If inflation rises 3% every year, for example, a retiree who has enough saved today to spend $50,000 a year would need just over $67,000 a year by 2031 and more than $90,000 per year by 2041 to fund the same lifestyle, according to an analysis by Kendall Capital.

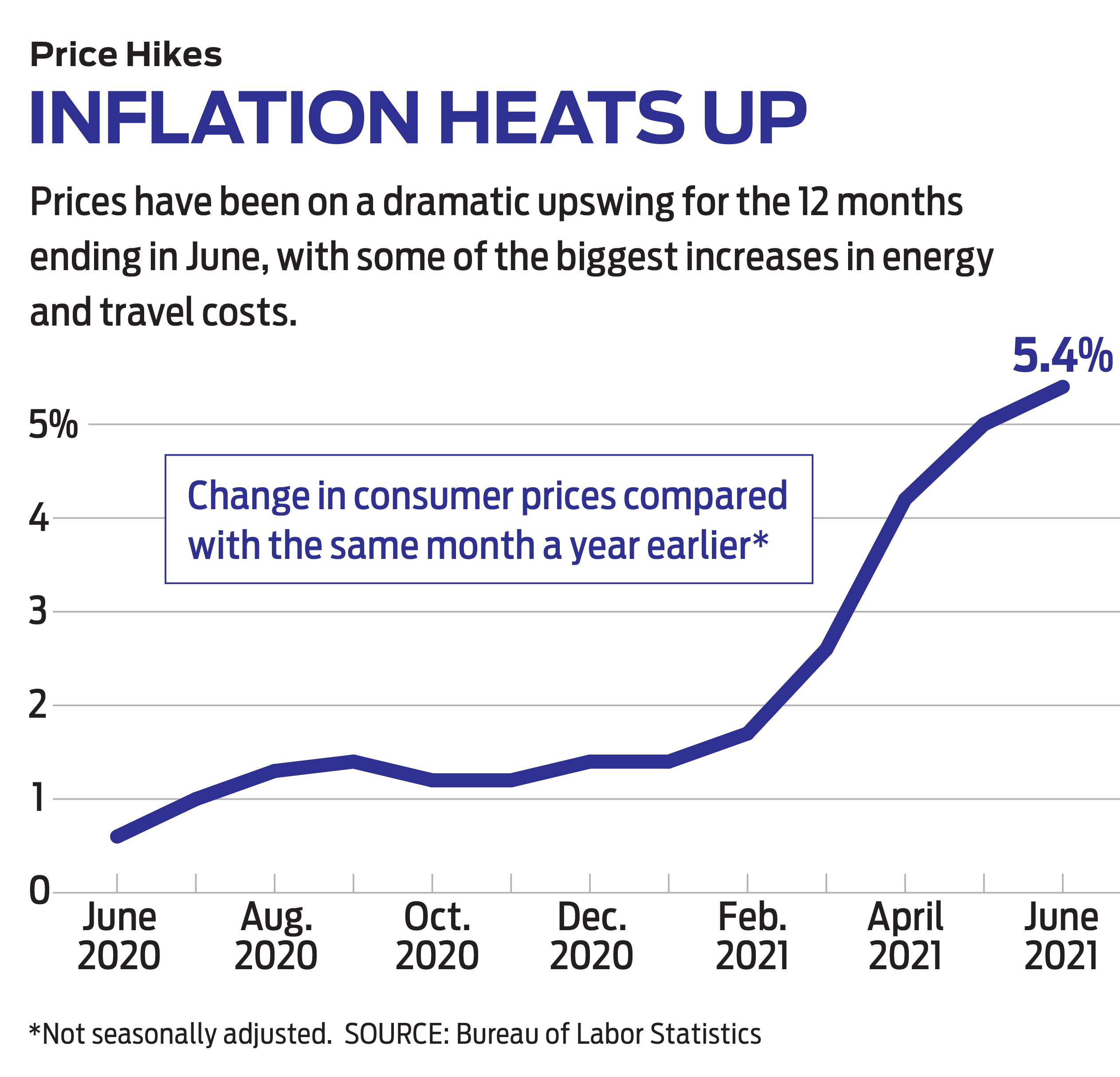

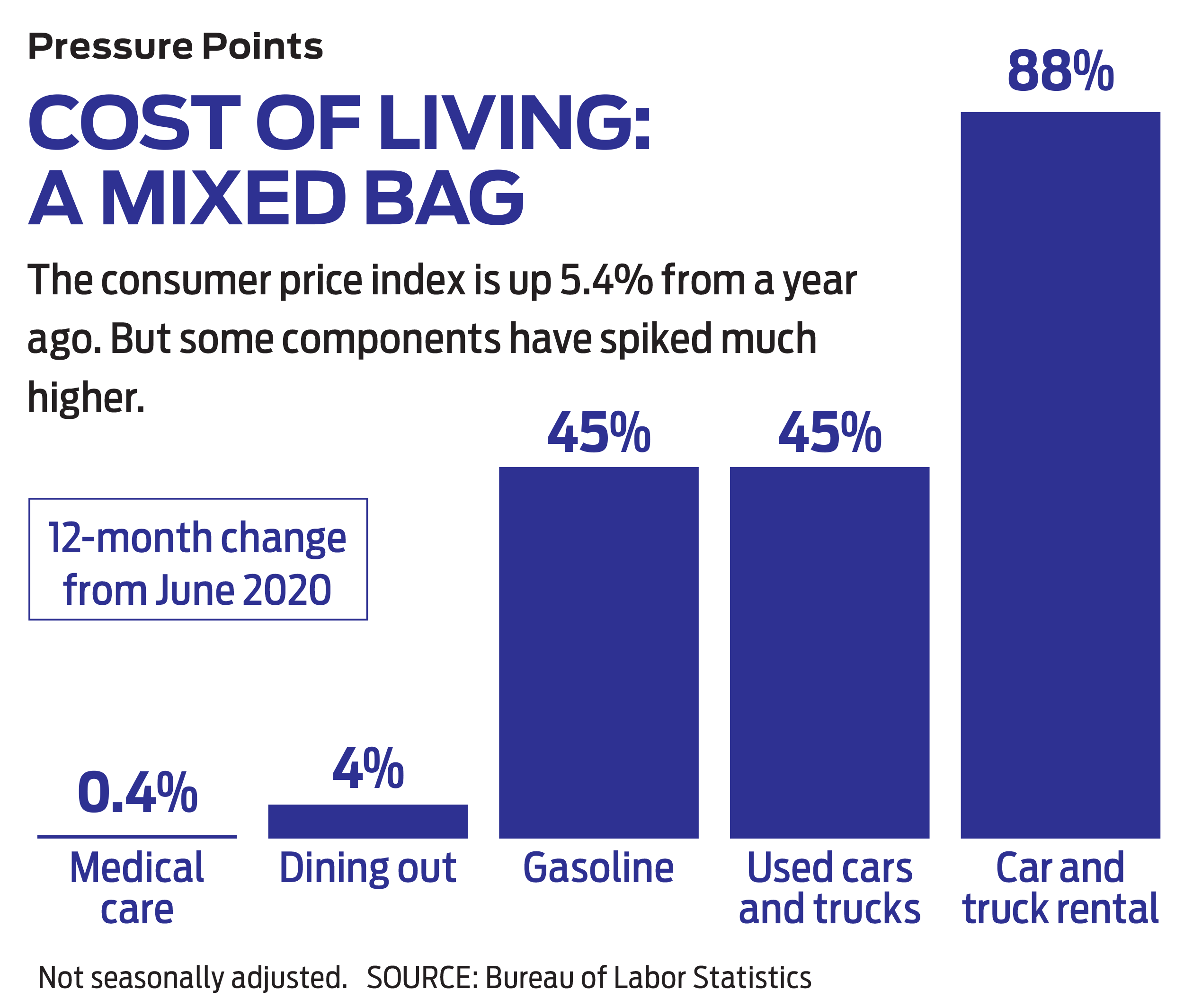

Wall Street is certainly scared of inflation, at least in the short run. The reopening of the economy has created a boom as pandemic headwinds subside, with price hikes driven by supply-chain bottlenecks and product shortages at a time when pent-up consumer demand has been fueled by government stimulus checks. Following a 40-year period during which inflation was mostly in hibernation, the nation is living through the biggest spike in prices in more than a decade for stuff such as gas, groceries and used cars.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In June, the consumer price index, the government’s main measure of inflation, saw a year-over-year increase of 5.4%, the largest rise since 2008. The prices that suppliers charge businesses (so-called producer prices) also rose in June at the fastest annual pace since 2010, and employers are boosting worker pay amid a tight labor market. Fund managers now say inflation is the biggest market risk, a Bank of America Securities survey found.

The $64,000 question (which was worth $60,726 a year ago, according to the government’s inflation calculator): Is higher inflation temporary, or is it here to stay? Federal Reserve chief Jerome Powell insists that the forces driving prices higher will wane and projects that inflation will fall back to around 2% in 2022. Powell downplays a repeat of 1970s-style inflation, when the CPI topped 13%, saying, “It’s very, very unlikely.” Most investment pros agree. Still, Kiplinger expects inflation to reach 5.5% by December, compared with December of 2020, and to average 4.3% for 2021 overall.

It’s worth noting that the stock market’s average annual gain of 10% has outpaced inflation over the long run. But don’t let your guard down. Historically, inflation spikes (such as the current episode), during which the CPI suffers one-month increases of 0.5% or more for at least three months in a row, have been a headwind for stocks, according to Bespoke Investment Group. In five of the previous seven such spikes since 1973, the S&P 500 index declined, suffering a median drop of 7.8%.

And don’t dismiss a common secondary effect of inflation: rising interest rates. Upward price pressures eventually prompt the Fed to increase borrowing costs and dial back bond-buying programs to cool a too-hot economy, a policy shift that can weigh on asset prices and spark volatility. In June, the Fed indicated that rate hikes could come next year, sooner than the 2024 start date it forecast in March.

The best inflation strategy is to hope for the best but plan for the worst. Judging from past inflationary periods, the investments below should provide a hedge against a persistent period of rising prices. (Prices are as of July 9.)

Classic inflation plays

Fight higher inflation directly by buying Treasury inflation-protected securities. The appeal of TIPS is that in inflationary periods, they “pay out more in interest and increase in value,” says Morningstar portfolio strategist Amy Arnott. The principal value (the initial price you pay for the bond) adjusts higher when inflation, measured by the CPI, increases. The interest you receive also rises because it’s based on the adjusted principal. You can purchase TIPS directly from Uncle Sam at www.treasurydirect.gov or invest in Schwab U.S. TIPS ETF (symbol SCHP, $63), a low-cost way (the expense ratio is 0.05%) to own a broad basket of TIPS.

Gold has a reputation for retaining its value when the dollar declines or loses purchasing power. Although the precious metal gets kudos as an inflation hedge, its performance during inflationary times is mixed. Gold tends to perform best during bouts of extreme inflation, such as in the 1970s when oil prices soared. It fares less well during more muted inflationary periods.

“Gold seems to outperform when chaos reigns supreme,” says Thomas Tzitzouris, managing director at Strategas, an independent research firm. And gold’s performance turns “poor … almost instantaneously at first sight of tighter [Fed] policy,” Tzitzouris warns. Still, earmarking a small portion of your portfolio to gold makes sense as an insurance policy in case the inflation dragon reappears and the Fed waits too long to tame it.

To get exposure to gold bullion itself, consider iShares Gold Trust (IAU, $34), which tracks the daily price movement of the yellow metal. Or you might invest in gold-mining stocks, says Merk. When the price of gold is rising, he says, the profits of gold miners increase because the cost of getting the gold out of the ground remains fixed. Mining company Newmont (NEM, $64) is a pro-inflation stock recommended by BofA.

Bitcoin has been growing in popularity as an inflation hedge, held out as an alternative to gold. But it’s best for investors who have a speculative bent and are able to stomach massive volatility, and it should be limited to the smallest of slices of your portfolio. Most brokerages don’t allow clients to buy bitcoin directly, but you can gain exposure through Coinbase, a crypto exchange, on the Robinhood trading app or via products such as Grayscale Bitcoin Trust (GBTC, 28).

Property prices and rents charged by landlords typically go up during inflationary periods, making real estate a popular investment if you want to outrun inflation. Over the past 30 years, an index of U.S. real estate investment trusts posted bigger gains than the S&P 500 in five of the six years when inflation was 3% or higher, according to data from fund company Neuberger Berman. Consider Vanguard Real Estate ETF (VNQ, $105). It owns publicly traded REITs including Crown Castle, which leases communications infrastructure such as cell towers, and Equinix, which specializes in data centers.

Dan Milan, managing partner at Cornerstone Financial Services, is bullish on Simon Property Group (SPG, $130). Simon’s upscale malls, he says, have held up better and can command higher rents than lower-end malls. Investment firm Stifel is bullish on self-storage REITs, such as CubeSmart (CUBE, $49) and Extra Space Storage (EXR, $173).

Stocks and commodities

Stock sectors that tend to do well when the economy is booming—and inflation is often rising—include energy (think big oil companies); industrials (heavy machinery, building products and aerospace firms); and materials, or companies that provide commodity-related materials to businesses (such as suppliers of chemicals, steel and other metals).

To gain exposure to a broad range of raw material producers, consider Materials Select Sector SPDR (XLB, $83). Top holdings include chemical company Dow and paint maker Sherwin-Williams. Michael Cuggino, president and portfolio manager of Permanent Portfolio, recommends copper producer Freeport-McMoRan (FCX, $37). Goldman Sachs analysts cite paint producer PPG Industries (PPG, $171) and Scotts Miracle-Gro (SMG, $183), which sells lawn, garden and pest control products, as firms with pricing power and a history of turning a large slice of revenues into profits.

Top holdings in the Energy Select Sector SPDR ETF (XLE, $53) include oil giant ExxonMobil, oilfield services provider Schlumberger and energy exploration firm Pioneer Natural Resources. A good option for industrial companies is Fidelity MSCI Industrials Index ETF (FIDU, $55), which owns heavy machine manufacturers such as Caterpillar and John Deere.

To take advantage of rising demand and prices for commodities such as oil and gas, gold, corn, soybeans, sugar, wheat, and copper, consider Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC, $20). It’s the biggest, most liquid fund of this kind, has a reasonable expense ratio of 0.59%, skips the troublesome K-1 form at tax time and is outpacing 96% of its peers so far this year.

The ideal companies to own in any sector are ones that can pass along higher costs to customers because of strong demand for their products, says Milan, at Cornerstone. That “helps companies protect their profits,” he says. Stocks that Goldman Sachs analysts say check those boxes include Advance Auto Parts (AAP, $213), whose sales of auto parts to do-it-yourselfers and professional mechanics will benefit from commuters returning to work and Americans hitting the nation’s roads to travel again; Etsy (ETSY, $195), which Goldman Sachs says turns 74% of its total revenues into profit (the highest gross margin of the consumer discretionary stocks listed in Goldman’s “high pricing power” screen) from its e-commerce site that sells unique handmade and vintage items; and Procter & Gamble (PG, $137), which owns brands such as Pampers and Tampax and has already announced coming price hikes for some products to offset rising commodity costs.

Indirect beneficiaries

Inflation can be insidious for bond investors, whose fixed interest payments increasingly lose purchasing power and whose bond prices often decline as interest rates rise in response to inflation. Investing in business bank loans that have interest rates that reset higher when market rates rise is a good strategy for avoiding that dynamic.

Unlike fixed-rate loans, which always pay the same coupon (or income), floating-rate debt allows the bond holder to earn more when rates rise. These loans are typically made to firms with less-than-pristine credit, which means the risk of default is higher. A couple of choices to consider are Invesco Senior Loan ETF (BKLN, $22), a member of the Kiplinger ETF 20 (see more on the ETF 20), and T. Rowe Price Floating Rate (PRFRX).

During periods of rising inflation since 2000, small-company stocks have outperformed large-cap shares, according to the Wells Fargo Investment Institute. Small companies tend to shine when the economy is growing rapidly, as it is now. Plus, they currently have better profit-growth prospects and trade at cheaper valuations relative to large-cap shares, according to investment bank UBS. Consider Kip ETF 20 member iShares Core S&P Small-Cap ETF (IJR, $112).

To better capitalize on the growth that stocks provide, Milan touts companies that regularly boost the size of their dividends. The bigger the increase over time, the greater the chance of outpacing inflation, he says. He likes home improvement retailer Home Depot (HD, $322), which recently hiked its dividend by 10%. It’s a member of the Kiplinger Dividend 15 list of our favorite dividend stocks. Milan also favors snack and soda giant PepsiCo (PEP, $149), which currently yields 3.5%.

Finally, given that inflation is a bigger issue in the U.S. than abroad, make sure you’re diversified overseas. Gina Martin Adams, chief equity strategist at Bloomberg Intelligence, is bullish on emerging-markets stocks, particularly in commodity-producing nations such as Brazil and Russia. “Commodity-sensitive emerging markets are a good place to hide,” she says. Baron Emerging Markets (BEXFX) has exposure to both Brazil and Russia; it’s a member of the Kiplinger 25, the list of our favorite actively managed, no-load mutual funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate Cuts

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate CutsThe November jobs report came in higher than expected, although it still shows plenty of signs of weakness in the labor market.

-

December Fed Meeting: Updates and Commentary

December Fed Meeting: Updates and CommentaryThe December Fed meeting is one of the last key economic events of 2025, with Wall Street closely watching what Chair Powell & Co. will do about interest rates.