7 Megatrend Stock ETFs With Massive Potential

Disruptive technologies such as fintech and genomics are among several investing megatrends that could send whole industries higher. These seven stock ETFs can plug you into those trends.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In 2022, the U.S. equities market got off to its worst start to a year since the dark days of the financial crisis, with many areas of the market, including stocks and stock exchange-traded funds (ETFs), selling off. As a result, many investors are rethinking how to position their portfolio for the months ahead.

However, the most profitable investing strategies often don't involve reacting in real-time to short-term disruptions. Sometimes simply getting in on the ground floor of a long-term trend, and then buying and holding for years or even decades can drive tremendous returns – and save you the heartburn of refreshing quotes and seeing red on a daily basis, too.

"Investors today have more ways than ever to own the future," says Jeff Spiegel, U.S. Head of BlackRock Megatrend, International and Sector ETFs at BlackRock. Spiegel identifies three "megatrends" that he sees accelerating in 2022 and beyond: digital transformation, automation technologies and healthcare.

Investors looking to play these themes may want to do so with both index and stock ETFs that allow for broad access to the megatrends, Spiegel adds.

Here, we look at seven megatrend stock ETFs with massive potential for growth. These funds, like several of Kiplinger's best ETFs for 2022, offer fairly diversified exposure to companies that are participating in a durable, long-term opportunity. And over the long haul, tactical exposure to these trends could result in outperformance for your portfolio as these disruptors come into their own and the traditional players fall away.

If you're interested in looking beyond the day-to-day turmoil on Wall Street right now, consider one of these long-term megatrend stock ETFs.

Data is as of Feb. 2. Dividend yields represent the trailing 12-month yield, which is a standard measure for equity funds.

ETFMG Prime Mobile Payments ETF

- Megatrend: Mobile payments

- Assets under management: $$1.0 billion

- Dividend yield: 0.00%

- Expenses: 0.75%, or $75 annually for every $10,000 invested

A few decades ago, there were still plenty of folks who believed that cash was king and that digital payments were simply a nice option for businesses to offer. These days, many of us don't carry paper money around at all – and furthermore, fewer and fewer transactions are made by even swiping a physical credit card.

Consider that a research report from market research firm Mordor Intelligence pegs the mobile payments market at nearly $1.5 trillion in 2020, and predicts an annual growth rate of almost 25% through 2026. The fees on individual transactions may be small, but it doesn't take a giant share of that market or more than a few fractions of a cent per payment to really add up.

This is the megatrend that the ETFMG Prime Mobile Payments ETF (IPAY, $53.86) is designed to cash in on, with a focus on companies that facilitate cashless digital transactions and mobile-friendly payment apps. This index fund weights stocks according to a modified market-capitalization methodology; larger companies account for more assets, but there are limitations – for instance, no stock is weighted at more than 6% at each rebalancing.

Interestingly enough, however, the portfolio is not full of tiny tech stocks you've never heard of; old credit card giants American Express (AXP), Mastercard (MA) and Visa (V) actually top the list of holdings with about 23% of assets at present. That said, they are closely followed by longtime electronics payment mainstay PayPal Holdings (PYPL) and online banking service provider Fiserv (FISV) to round things out.

Admittedly, this is a smaller shop as far as stock ETFs go and is a niche fund that only has about $1 billion in assets at present. And after a huge run in the early days of the pandemic, IPAY has rolled back about 25% from its 2021 highs.

Still, long-term investors could cash in if the cashless revolution and rise in digital payments continues as expected in the years ahead.

ARK Fintech Innovation ETF

- Megatrend: Fintech

- Assets under management: $2.2 billion

- Dividend yield: 0.3%

- Expenses: 0.75%

A slightly different flavor of fund is the ARK Fintech Innovation ETF (ARKF, $31.35), which focuses on all kinds of revolutionary innovations in the financial sector. This includes mobile payments, but also other hot topics like the use of blockchain in traditional recordkeeping as well as innovations in capital markets and decentralized finance trends that are designed to cut out the middleman.

A reasonably established fund with $1.5 billion in assets, ARKF seeks to invest at least 80% of its assets in fintech stocks. Top holdings at present include Block (SQ), the mobile payments giant formerly known as Square, recently IPO'd cryptocurrency exchange Coinbase Global (COIN) and e-commerce facilitator Shopify (SHOP).

ARKF is an actively managed fund, without constraints other than a general mandate to chase companies involved with "the introduction of a technologically enabled new product or service that potentially changes the way the financial sector works." This means holdings can be big or small.

And roughly 28% of the fund is made up of international offerings, like the Latin American e-commerce play Mercadolibre (MELI), so investors do get some geographic diversification.

The portfolio is quite focused at less than 40 stocks at present. And when it comes to stock ETFs, it has been a brutal run for this one, with a decline of about 40% in the last year after a pandemic-era surge ran out of gas. That was largely because everyone piled into e-commerce and digital payments stocks because of the social-distancing tailwinds, and then recently moved out again on the feeling that the trade was getting a bit long in the tooth.

But long-term investors might want to look beyond this volatility, as fintech stocks continue to reshape the global economy and challenge legacy players.

Global X Telemedicine & Digital Health ETF

- Megatrend: Telehealth

- Assets under management: $230.7 million

- Dividend yield: 0.03%

- Expenses: 0.68%

Another pandemic-era play that could be worth a look for those with a longer time horizon is Global X Telemedicine & Digital Health ETF (EDOC, $14.65). As the name implies, this tactical fund is looking to profit from long-term disruptions to the traditional business of healthcare thanks to high-tech trends. These include artificial intelligence (AI) in diagnosis, connected devices and robotic surgery tools in hospitals, digital patient records and remote physician consultations using video chats.

According to market research firm Grand View Research, the global telehealth market will hit nearly $790 billion by 2028, with annual growth rates of more than 36% each year between now and then. This is the kind of megatrend this stock ETF is looking to cash in on.

The Global X Telemedicine & Digital Health ETF tracks the Solactive Telemedicine & Digital Health Index, a benchmark composed of companies positioned to benefit from additional advances in telemedicine and digital health; specifically, those that derive half of their operating income, revenues or assets from this field. This includes companies involved in telemedicine, healthcare analytics, connected healthcare devices and administrative digitization.

EDOC's top holdings include healthcare software and recordkeeping company Cerner (CERN) and AI leader Nuance (NUAN). However, it also includes a few more traditional players like Laboratory Corp of America (LH) – or "LabCorp," as most folks know it – because of ways the firm is digitizing lab procedures and allowing for remote and digital diagnosis using test results.

EDOC has mirrored the same as some of the prior pandemic-related stock ETFs, as investors enjoyed big gains in 2020 and early 2021, but have since taken some of their winnings off the table.

However, long-term investors interested in the digitization of healthcare may want to give this stock ETF a look.

ARK Genomic Revolution ETF

- Megatrend: Genomics

- Assets under management: $5.0 billion

- Dividend yield: 0.00%

- Expenses: 0.75%

If you're interested in playing a more treatment-focused side of healthcare innovation than simply the digital infrastructure of the industry, the ARK Genomic Revolution ETF (ARKG, $49.09) is one of the best stock ETFs to consider.

Another actively managed ETF from asset manager ARK, this fund invests roughly 80% of its assets in companies that are working on technological and scientific advancements in genomics. The fund's holdings span a variety of sectors, including healthcare, information technology, materials, energy and consumer discretionary.

The roughly $5 billion fund holds about 50 stocks at present. Among its top holdings are DNA screening test specialist Exact Sciences (EXAS) and midsized RNA-targeted therapies specialist Ionis Pharmaceuticals (IONS). There are a few larger picks on the list too, including $60-billion Vertex Pharmaceuticals (VRTX). But ARKG is mostly focused on small up-and-coming names in the space rather than the giants you might find in other biotech or pharma funds.

In the long run, this seems a very powerful megatrend to invest in given the need for niche gene therapies for chronic conditions, the big profit margins on "orphan drugs" that don't have alternatives on the market and the general upwards march of healthcare spending.

But the volatility we've seen recently has also weighed on ARKG, particularly after the rush into healthcare stocks across 2020 and early 2021 abated. Still, the stock ETF is very established and doesn't seem to be going anywhere if you have the patience and desire to ride this long-term megatrend.

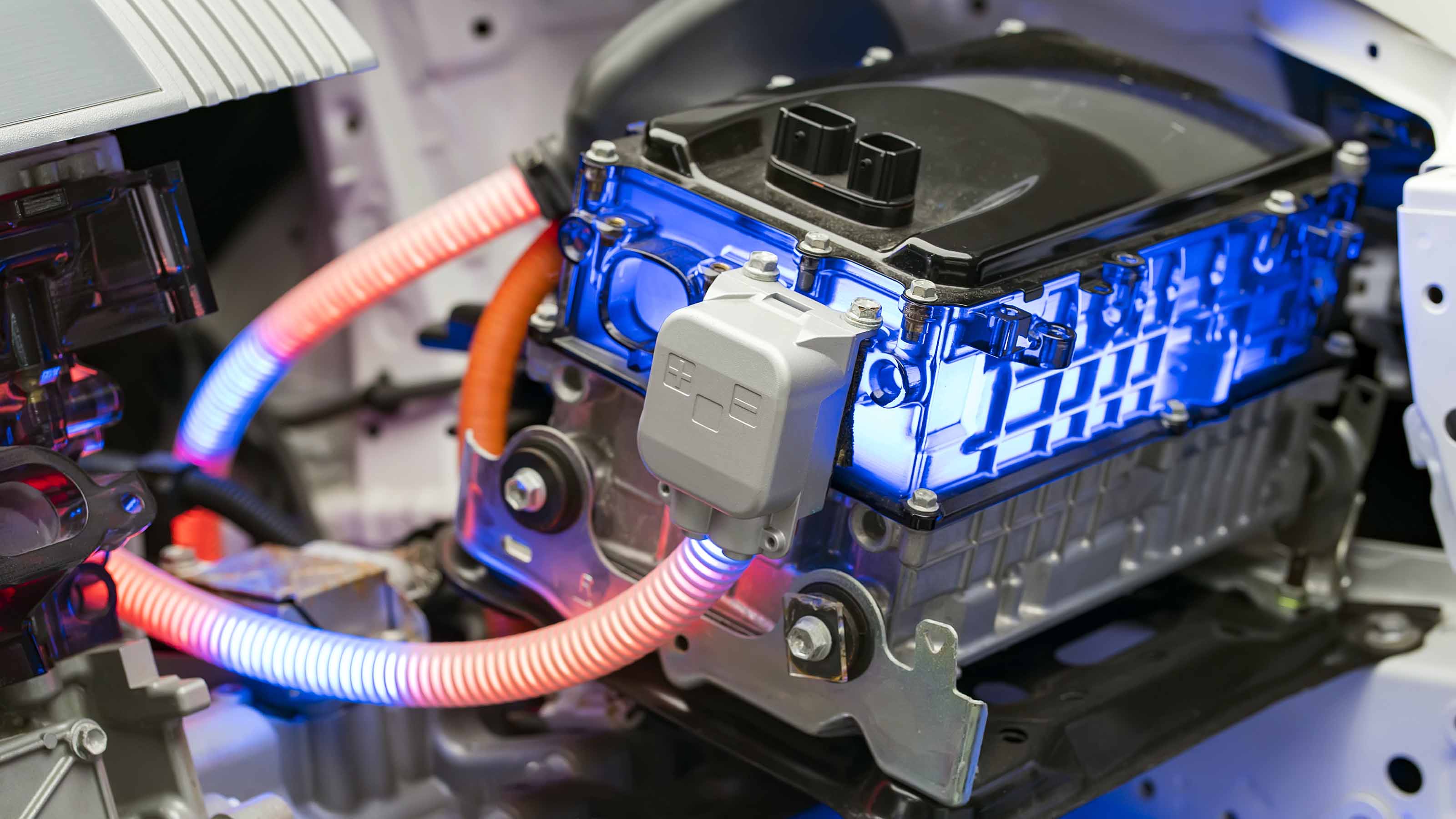

Global X Lithium & Battery Technology ETF

- Megatrend: Electric vehicles

- Assets under management: $5.0 billion

- Dividend yield: 0.2%

- Expenses: 0.75%

Looking beyond healthcare, another area that is being "disrupted" based on slow and steady changes thanks to technology is the auto and transportation market. Due primarily to concerns over climate change, an electric vehicle (EV) revolution has resulted in more than 2 million plug-in cars and trucks on U.S. roadways as of last year, according to a report from the Environment America Research & Policy Center and Frontier Group, two sustainable research firms.

Thanks to this megatrend, we've seen a lot of interest in related stocks in the EV space including Elon Musk's Tesla (TSLA) and China upstart NIO (NIO). But volatility can sometimes be intense when picking individual names, as it's hard to tell exactly which stocks will wind up winners and which ones will eventually fall away.

A more diversified bet is the Global X Lithium & Battery Technology ETF (LIT, $79.01). LIT tracks the Solactive Global Lithium Index, offering investors exposure to plug-in manufacturers, as well as companies involved in EV technology and the lithium batteries that are so important to this industry.

About 40 total stocks make up the fund – and interestingly enough, Tesla ranks third among top holdings with its 5.5% weighting. Other top holdings include under-the-radar plays like North Carolina-based lithium and chemicals firm Albemarle (ALB) at an 11% weighting, Japanese tech firm TDK Corp. (TTDKY) at 6.4% and China-listed EV firm Contemporary Amperex at 5.4%.

LIT was among the top-performing stock ETFs on Wall Street over the last year or two, with an amazing 24-month return of 170%. There are concerns that a "risk-off" environment to start 2022 could create short-term volatility for growth-oriented investments like those involved with EVs; however, the long-term opportunity remains significant.

Emerging Markets Internet & Ecommerce ETF

- Megatrend: Global internet and e-commerce

- Assets under management: $1.0 billion

- Dividend yield: 0.2%

- Expenses: 0.86%

While internet shopping and e-commerce are now a more than 20-year-old trend in the U.S., it's important to remember that America is almost always ahead of the curve when it comes to consumer trends. In contrast, many of the digital opportunities of emerging markets are really just getting started as nations build out their telecom infrastructure and as consumers get savvy to the power of technology.

That's where the Emerging Markets Internet & Ecommerce ETF (EMQQ, $40.04) offers long-term upside. Unlike a plethora of stock ETFs out there that have the usual suspects of Western e-commerce like Amazon.com (AMZN), EMQQ is focused on digital retailers in emerging markets across Asia and Latin America.

To be included in the fund, companies must derive their profits from internet or e-commerce activities, including search engines, online retail, social networking, online video, e-payments, online gaming and online travel.

Don't think that means this stock fund is a small and quirky play, however, with a bunch of no-name stocks. EMQQ has about $1 billion in total assets at present and includes plenty of established names that trade on U.S. exchanges, as well as the smaller local upstarts you can't easily buy into on your own.

Specifically, the top stocks at present are the Asian powerhouses Tencent Holdings (TCEHY) and Alibaba Group (BABA), but farther down the list you'll find Japan's Nexon (NEXOY), which is largely involved in gaming and e-sports, and Brazilian "micro-merchant" platform PagSeguro Digital (PAGS).

To be clear, the Emerging Markets Internet & Ecommerce ETF carries a fair amount of risk as it has the twin factors of high-growth tech companies investing heavily in the future as well as an emerging markets footprint. Right now, about half of total assets are invested in China, with the runners-up being India, Korea and Brazil.

Regions like this inherently have more uncertainty than the U.S., and that is clearly evidenced by recent volatility with EMQQ going from a pandemic-era low around $30 to a high of $80 last year and then back to around $40 at present.

However, this short-term volatility shouldn't overshadow the long-term potential of emerging markets e-commerce for investors who have patience.

iShares ESG Aware MSCI USA ETF

- Megatrend: ESG

- Assets under management: $25.7 billion

- Dividend yield: 1.1%

- Expenses: 0.15%

The last big-picture stock fund that could be worth a look by investors with a long-term time horizon is the iShares ESG Aware MSCI USA ETF (ESGU, $102.79). Not only is ESGU is the largest ESG-focused ETF on Wall Street, currently boasting about $26 billion in assets under management, but its also one of the best ETFs to buy for 2022.

The acronym ESG, if you don't already know, stands for environmental, social and governance issues. The letters are used as a catch-all for "socially responsible" management of a company. These include firms with an eye on emissions and the environmental impact of operations, social justice issues – including gender and racial diversity in both leadership and rank-and-file employees – and corporate governance concerns that ensure there isn't just one or two people at the top who pull all the strings.

ESG criteria are increasingly important for many investors, particularly in the age of climate change and in the wake of the Black Lives Matter movement. And as younger and more socially-conscious investors continue to grow their nest eggs, we can expect this to only continue.

ESGU is the best way to capitalize on this trend as the most established fund in the space. But it's not just a gimmick – in addition to being the largest and most liquid option among ESG ETFs, the fund is efficient, with a low expense ratio of just 0.15%, or $15 per year on $10,000 invested.

The iShares ESG Aware MSCI USA ETF tracks the MSCI USA Extended ESG Focus Index. Each industry is measured on key ESG issues that can lead to unexpected costs for companies in the medium- to long-term, which the index provider uses to calculate each firm's risk exposure to the issues and the tools they have in place to manage the risk. Companies are then rated and ranked compared to industry peers.

The fund is diversified with about 320 mid- and large-cap U.S. stocks in its portfolio based on those ESG ratings as measured by MSCI. Top holdings currently include mega-cap stocks Apple (AAPL) and Microsoft (MSFT) at 6.9% and 5.7% weightings, respectively.

For long-term investors who care about these social trends – or simply want to cash in on this broader megatrend – ESGU is one of the best stock ETFs to consider.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, Guardrails and the 4% Rule Do Not Work

For the 2% Club, Guardrails and the 4% Rule Do Not WorkFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Now Is the Time to Start Designing Your 2027 Retirement

Now Is the Time to Start Designing Your 2027 RetirementThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.