5 Hard Truths Investors Must Hear: Lessons from Josh Brown's New Book

Investors are more empowered than ever, but there are plenty of pitfalls to trip them up. Here, we look at a few Brown identifies in his new book.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The call is coming from inside the house.

No, this isn't a twist from a horror movie – it's a warning for your portfolio. Years ago, investors had to fend off cold calls from brokers pushing penny stocks, the kind of boiler room tactics made famous by fictional and real characters like Gordon Gekko and Jordan Belfort.

Today, scammy brokers are mostly relics of the past, outpaced by investor access to better information and technology. Yet while investors are more empowered, they still face a potential deceiver closer to home: themselves. The silver lining? This hard truth – that we are often our own worst enemy in our portfolios – drives investors to seek better ways to understand how the system really works.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

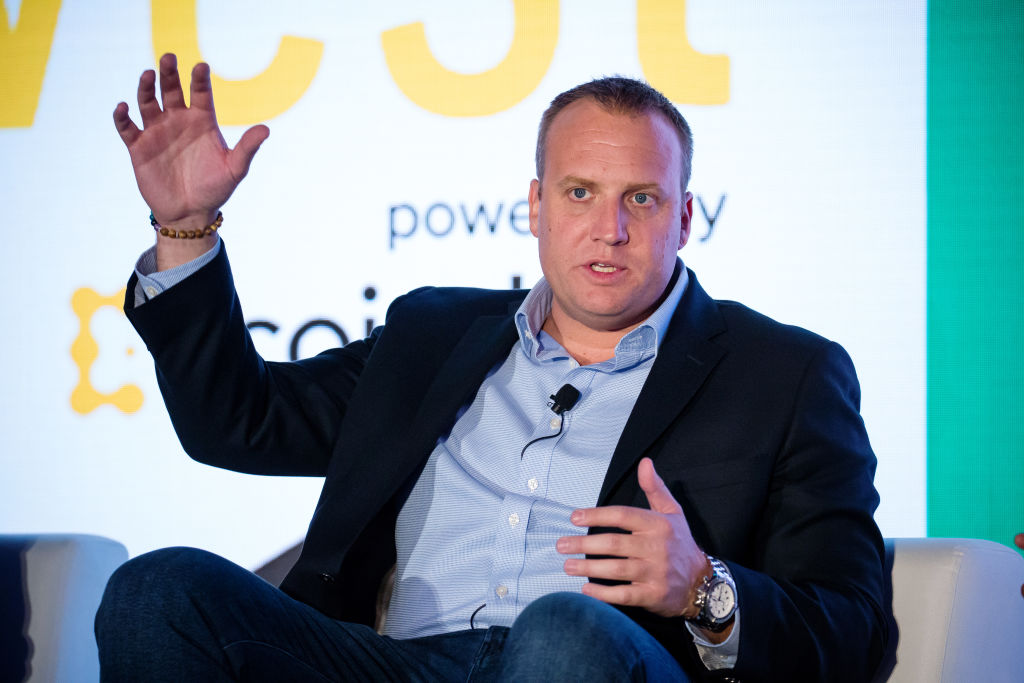

One of the clearest voices on exposing Wall Street's bad actors and empowering regular investors is Josh Brown, CEO of Ritholtz Wealth Management and a regular CNBC contributor.

Brown made his name with The Reformed Broker, a blog that's been read by millions and is known for its brutal honesty and unapologetic style. Although the blog is retired, Brown's new book, You Weren't Supposed to See That, compiles his greatest hits with fresh commentary.

It's a guide to understanding the forces that drive markets and the behavioral pitfalls that can trip up investors, while offering practical advice on cutting through the noise (or, in Brownian speak, the "bull****").

With the release of his book, I had the opportunity to speak with Brown about what investors need to know today. Here are five hard truths that investors must hear, courtesy of Brown's book and my conversation with him.

There are few excuses for being an uneducated investor

A lot has changed since Brown launched his blog 15 years ago. He pointed to one major trend: Investors are getting smarter. Not only has technology made it easier to manage finances, but access to quality information has exploded.

"Investors are getting their information from the internet," Brown said, "and while they find nonsense, they also find wisdom, and they're learning."

Data supports this. Globally, young people are investing more than ever. And nearly 70% of Americans feel confident in their investing strategy, according to a Charles Schwab survey.

Brown has seen it with his clients: "When we have market-wide sell-offs, I have clients calling to put more money to work. That didn't happen 15 years ago."

No one knows what's gonna happen – especially the "experts"

Wider access to information does have a downside: the spread of misinformation. Investors now face the challenge of separating fact from fiction, including "fake" financial news.

As someone on TV almost daily, Brown knows the influence media has on people, writing: "If the TV is on, remember everyone you see on there is doing their best but making guesses. No one can know what's going to happen next for certain."

His advice isn't to distrust experts but to understand their motives. Quoting Charlie Munger – Warren Buffett's right-hand man – he said, "Incentives are everything."

As for Brown's strategy to vet the media, he says to ask: "What does this person want to achieve by participating in financial media?" and "How will they benefit from what they're saying?".

"Investors have more to fear from other investors than from the market"

It's natural to fear the market, but Brown believes this fear is often misplaced.

He says one of the hardest truths for investors to accept is that "they have more to fear from other investors than from the markets."

The real danger is people selling unrealistic promises. These can include promising stock market gains without the downside or guaranteeing returns or access to the next Facebook. "If you look hard enough, you will find the son of a b**** who's gonna sell it to you," Brown warns.

No risk, no reward

From a cold-calling broker to a media personality and CEO of a firm managing billions, Brown's career is proof that taking risks pays off. And he believes this is essential for success in investing: "Taking risk ultimately is rewarded."

"There's no universe where you can eliminate all investment risk and still earn a positive return," he says.

While risk is inherent, it can be managed. Brown cautions in the book against too much caution, though: "There is such a thing as too little risk. You can 'protect' a portfolio so much that you turn it into a bank savings account. That's not investing. That's fooling yourself."

Time goes faster than you think

Perhaps the greatest risk we all take is believing there's always more time.

One of the most affecting chapters in Brown's book, "Scarcity," explores the shortage of our most important asset: time. Brown writes about playing soccer with his son, who's growing up fast, even as work pulls him away.

Any parent knows that kids don't stay kids forever and that time passes quickly. "It's one of those clichés that turns out to be even more true – before you know it, they're going to grow up," he said.

The same is true of investing. The earlier you start, the better. A CNBC survey found 40% of American workers are behind on retirement savings, and "not starting earlier" is their biggest regret.

If you've been putting off saving, the time to act is shorter than you think. As Brown puts it, "Time is scarce. There isn't enough of it by half."

For those considering how to align their financial lives with the lives they want to lead, Brown's new book is time well spent.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.