If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have Today

Google parent Alphabet has been a market-beating machine for ages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Google parent Alphabet (GOOGL) has been a buy-and-hold bonanza since it first went public more than two decades ago. Even better, analysts say the frenzy over all things AI gives GOOGL stock more room to run.

Investors knew they had something special with Google when it went public via a Dutch auction (don't ask) back in those innocent days of the early 21st century.

The company clearly offered the best internet search product, one that would eventually give it a near-monopoly in that lucrative market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But Google hardly rested on its search laurels. The company rolled out a steady stream of new products – mail, maps and the Chrome operating system, for example – that extended its reach across the world wide web.

In 2006, the same year GOOGL was added to the S&P 500, the company acquired a quirky startup that allowed users to upload videos to the internet.

Critics questioned the wisdom of spending $1.7 billion on what looked to be a fad, but the YouTube deal turned out all right. After all, the business generated $36 billion in ad revenue in 2024, or roughly 10% of Alphabet's entire top line.

Google, now dominant in search and omnipresent on the web, soon set its sights on mobile.

When smartphone sales exploded following Apple's (AAPL) release of the iPhone, Google entered the booming segment by creating the open-source Android mobile operating system.

And those are just a handful of highlights from the early days. By 2015, Google was operating so many diverse projects that it reorganized into a holding company called Alphabet.

Today, Google commands roughly 90% of the market for global search, and its Android operating system is found on approximately 70% of all smartphones.

Future success, however, is predicated on competing with fellow Magnificent 7 stocks Amazon.com (AMZN) and Microsoft (MSFT) in artificial intelligence and cloud-based enterprise services. Note too that analysts feel pretty good about GOOGL's prospects in these endeavors.

But before we get to where Wall Street thinks the communication services stock is going, let's take a look at how it’s performed for the truly faithful over the past couple of decades.

The bottom line on Google stock?

GOOGL stock has been one of the best stocks of all time, according to research by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Over its entire lifetime as a publicly traded company, Alphabet generated more than $1 trillion in lifetime wealth creation, which accounts for a stock's increase in market cap adjusted for cash flows in and out of the business and other factors.

How impressive is that? Only Apple, Microsoft and Exxon Mobil (XOM) created more wealth for shareholders, per Bessembinder's findings.

Heck, GOOGL is one of just four stocks to ever top $4 trillion in market cap.

But then retail investors are probably more interested in what a long-term investment in GOOGL stock looks like on a brokerage statement.

Spoiler alert: Alphabet's outperformance has been nothing less than stupendous.

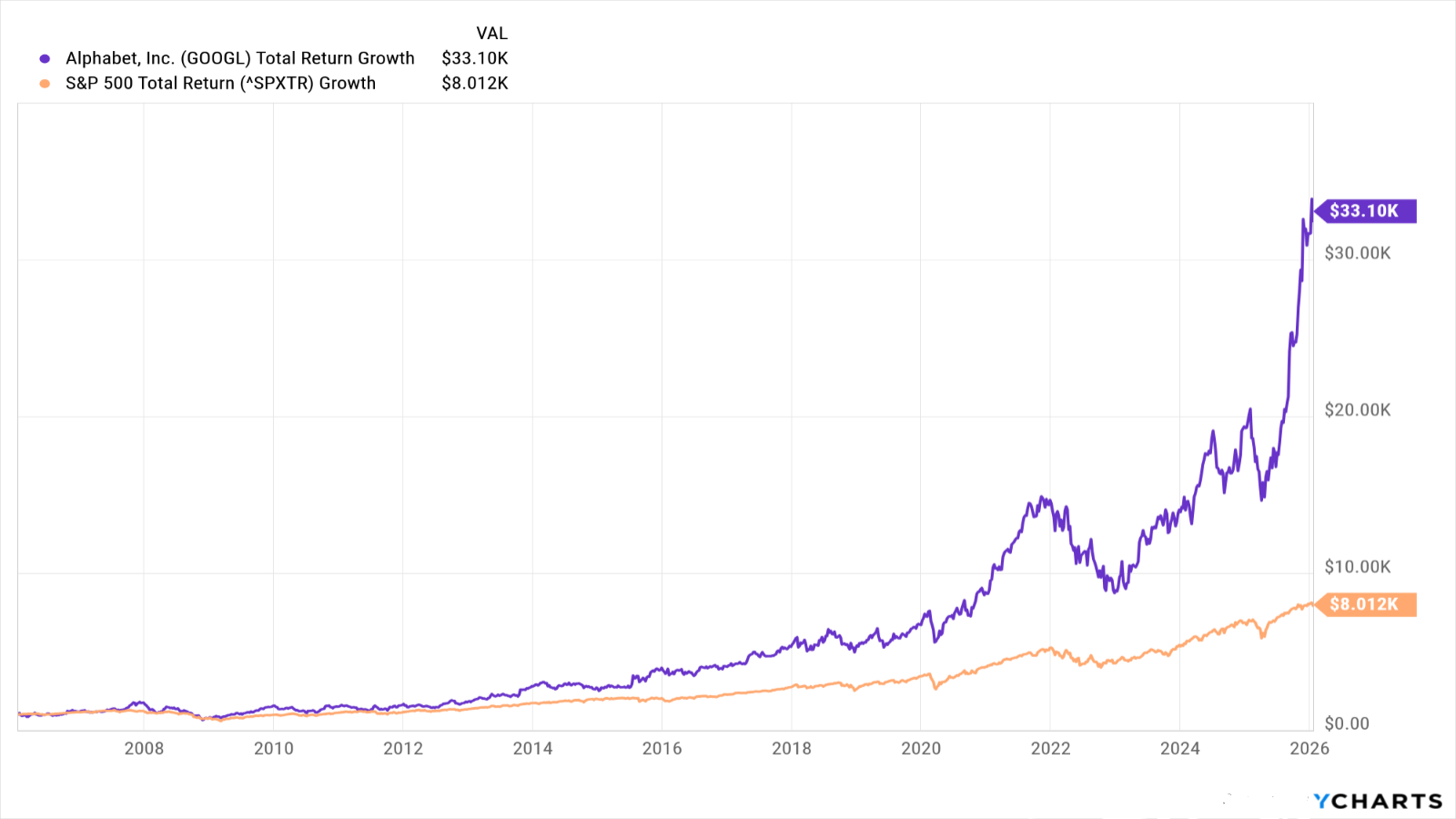

GOOGL stock outperforms the S&P 500 over any pretty much any standardized time period investors care to measure.

Over its entire life as a publicly traded company, GOOGL stock has generated an annualized total return (price change plus dividends) of 25.6%. That more than doubles the broader market's total return of 10.8%.

GOOGL's 20-year performance might be slightly less impressive, but it’s been highly remunerative nonetheless. Over the past two decades, GOOGL stock delivered an annualized total return of 19.1% versus 11% for the S&P 500.

Have a look at the above chart. You'll see that if you put $1,000 into GOOGL stock 20 years ago, it would be worth about $33,000 today. The same amount invested in an S&P 500 index fund would be worth about $8,000.

Happily for GOOGL shareholders, analysts see plenty more upside ahead for the blue chip stock. Of the 67 analysts covering GOOGL stock surveyed by S&P Global Market Intelligence, 46 call it a Strong Buy, 13 say Buy and 8 have it at Hold.

That works out to a rare consensus recommendation of Strong Buy. Indeed, Alphabet routinely ranks among analysts' top S&P 500 stocks.

Speaking for the bulls, Argus Research analyst Joseph Bonner praises the company's success outside of its core search product.

"The rapid growth of Google Cloud and YouTube have begun to diversify the company’s revenue," writes Bonner, who rates GOOGL at Buy. "Alphabet remains at a minimum competitive, if not a leader, in the development of generative AI, perhaps the new computing paradigm."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.