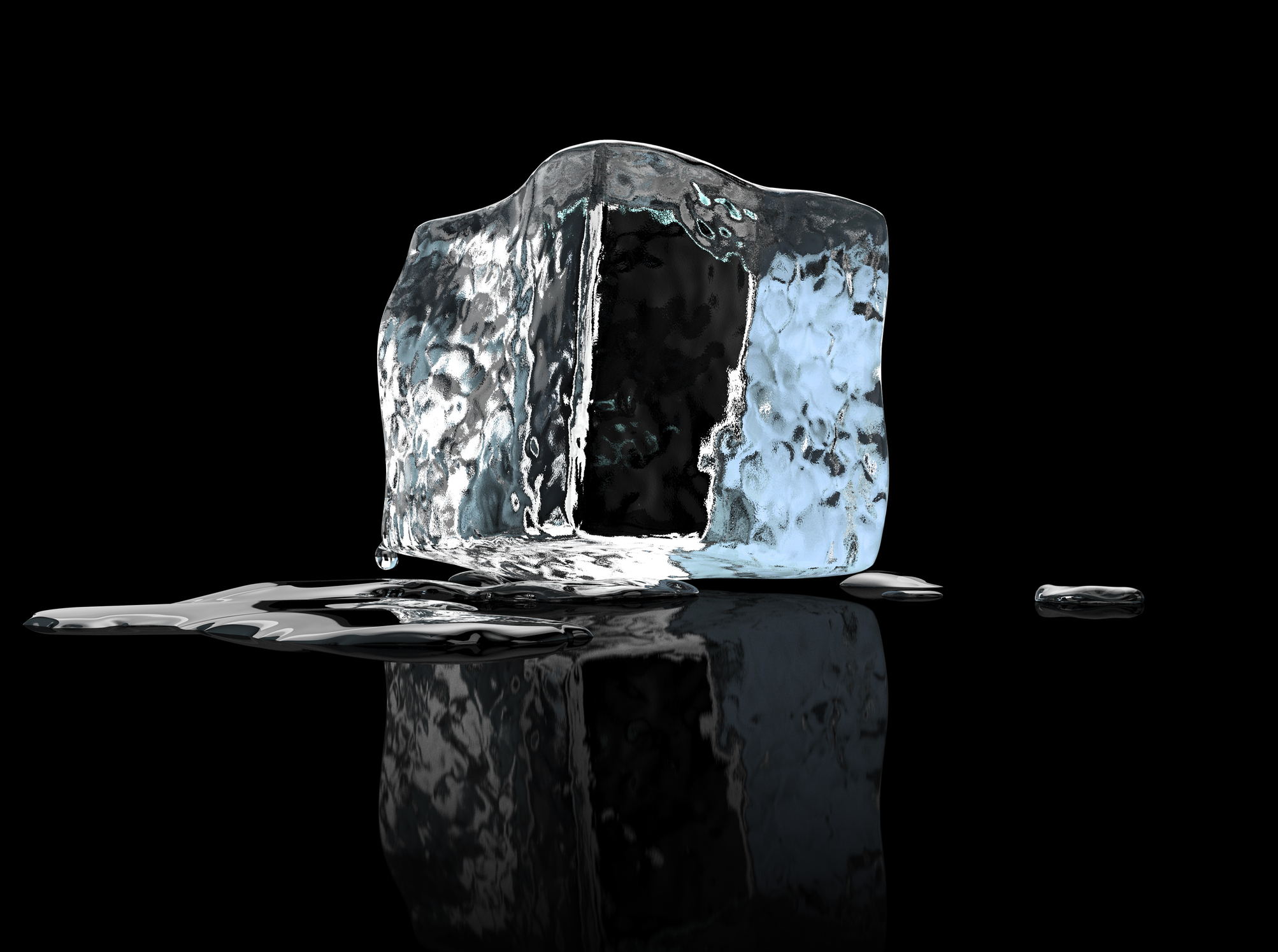

Why Has the IPO Market Gone Cold?

Hopes were high that 2025 would see strong IPO activity, but the market has recently cooled. Here's why.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Heading into 2025, the outlook for initial public offerings (IPOs) seemed to be turning a corner. But those expectations proved overly hopeful – at least for now.

Several highly anticipated upcoming IPOs have hit the brakes. StubHub, a ticketing marketplace, has shelved its plans, while Klarna – a buy-now-pay-later platform – continues to delay its long-anticipated debut. Both were widely believed to be ready to launch their IPOs in April.

Chime, a well-known fintech player, and Hinge Health, a digital health startup, have also opted to wait to go public.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If this feels familiar, that's because it is. IPO volumes have been underwhelming for the better part of the past three years.

In 2022, just 71 companies went public, raising a mere $7.7 billion, according to Renaissance Capital, which is a provider of pre-IPO research and IPO-focused ETFs.

Activity picked up in 2023 with 150 deals totaling $29.6 billion. But that still paled in comparison to the IPO boom of 2021, which saw 397 offerings raise a staggering $142.4 billion. Even in 2020, amid pandemic uncertainty, there were 221 initial public offerings for $78.2 billion.

In 2025, only 70 offerings have raised $9.9 billion. That's barely on pace with last year.

So what's happening? And when might the IPO market get back on track?

Volatility, valuation concerns keep IPOs on ice

The U.S. IPO market remains mired in uncertainty. Much of the recent chill stems from renewed global trade tensions – specifically, President Donald Trump's "Liberation Day" tariffs that were announced on April 2, which sparked retaliatory moves and reignited fears of a broader trade war.

This uncertainty, coupled with a sell-off in tech stocks and increasing market volatility, has made pricing new offerings a major challenge.

"There was a pretty clear shift in IPO sentiment after the tariff announcements, which introduced a lot of uncertainty into the market," says Avery Marquez, director of investment strategies at Renaissance Capital.

"Volatility can be a strong headwind for new issuance, even when investor sentiment and risk appetite are robust. But this came while the trading environment was already somewhat weak in the wake of the mid-Q1 sell-off," Marquez adds.

Beyond tariffs, macroeconomic pressures – including inflation, higher interest rates and geopolitical instability – have spooked investors.

Given the cloudy outlook, major public companies such as Ford Motors (F), General Motors (GM), United Airlines (UAL), Mattel (MAT) and UPS (UPS) have scaled back or withdrawn their financial guidance.

It's no wonder, then, that executives at IPO-bound firms are also treading carefully.

Meanwhile, some of the most promising startups, especially in AI, are opting to stay private longer. OpenAI's $40 billion raise at a $300 billion valuation is just one example of a company flush with cash that sees little reason to brave the public markets at the moment.

"Today's founders have a far wider array of financing options available to them," said David Spreng, chairman, founder and CEO of Runway Growth Capital.

Expansion in the private credit and venture debt markets allows private companies with solid fundamentals to get the capital they need, Spreng adds. "Rather than rush toward an IPO, many late- and growth-stage businesses are choosing to stay private longer, using minimally dilutive debt to extend their runway, strengthen their businesses and preserve ownership."

Are there signs of a thaw?

Still, there are glimmers of optimism that activity in the IPO market is starting to pick back up.

The Renaissance IPO ETF (IPO) share price has recovered to levels not seen since early February, reflecting a modest revival in investor interest.

The Cboe Volatility Index (VIX), a measure of "fear" in the stock market, has also eased off recent highs, suggesting a slight calming of investors' nerves.

And new deals are happening, albeit selectively. Two insurance firms, American Integrity (AII) and Aspen Insurance (AHL) went public in early May and collectively raised more than $500 million.

And while the CoreWeave IPO – a provider of infrastructure for AI developers – underwhelmed at first, the stock has since climbed above its IPO price, a positive sign for others waiting in the wings.

Market watchers believe that when IPO activity resumes in earnest, it will center on well-established, cash-flow-positive businesses in resilient sectors – think defense and artificial intelligence (AI).

Ultimately, the IPO market tends to rebound faster than expected once conditions improve. The key will be less about chasing the next unicorn and more about rewarding strong fundamentals. Until then, companies and investors alike are playing a cautious, wait-and-see game.

Related content

- The 25 Biggest U.S. IPOs of All Time

- What Wall Street's CEOs Are Saying About Trump's Tariffs

- I Have $20,000 to Invest. What Should I Do?

- How to Survive Market Mayhem

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?