Johnson & Johnson Spins Off Kenvue in Biggest IPO Haul Since 2021

Johnson & Johnson rips off Band-Aid and spits out Listerine in a bid to boost margins.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Johnson & Johnson (JNJ) spun off its Kenvue (KVUE) consumer brands division on Thursday, raising the most cash from an initial public offering (IPO) in more than a year.

Johnson & Johnson said it sold 172.8 million shares at $22 a pop in Kenvue, giving the company whose brands include Band-Aid, Tylenol and Listerine a valuation of roughly $40 billion.

Johnson & Johnson, a component of the Dow Jones Industrial Average, raised $3.8 billion from the offering. That's the largest haul from an IPO since late 2021, according to Renaissance Capital. The IPO market dried up in 2022 amid a historically bad year for stocks and the hangover from 2021's frenzy of fizzled SPAC offerings.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Indeed, direct listings and IPOs with an initial valuation of at least $50 million numbered just 71 last year, down from nearly 400 in 2021, per Renaissance Capital.

JNJ announced the split of its consumer brands business from its pharmaceutical and medical devices divisions in late 2021. The healthcare giant's aim – as is pretty much always the case with these sorts of breakups – is to liberate faster-growth, higher-margin businesses from the drag of slower-growth, lower-margin businesses.

Johnson & Johnson said it continues to own about 90% of Kenvue after the IPO, with plans to distribute shares to its own shareholders perhaps in the second half of this year.

Johnson & Johnson's aims

As for the proceeds from the KVUE offering, Johnson & Johnson said it will retain $1.1 billion in cash and cash equivalents, with the remainder being used for general purposes.

Kenvue, meanwhile, hits the market with a roughly $40 billion market value. On a pro forma basis, the company recorded annual net income of $1.5 billion on almost $15 billion in revenue.

"Being spun out of Johnson & Johnson, consumer health giant Kenvue is pitching a mature and profitable business with a healthy dividend yield, bolstered by a portfolio of well-known brands like Tylenol and Listerine," notes Renaissance Capital.

JNJ, whose 60-year streak of annual dividend increases makes it one of the best dividend stocks for dependable dividend growth, does get a Buy recommendation from analysts, according to S&P Global Market Intelligence – but with very mixed conviction. That places it pretty far down the list of Wall Street's favorite Dow stocks.

The overhang of litigation stemming from allegations that the talc in its iconic baby powder is carcinogenic has been just one issue for JNJ. And although the Kenvue separation should help the company's margin profile, there's no denying that JNJ became one of the best stocks of the past 30 years as a three-headed business.

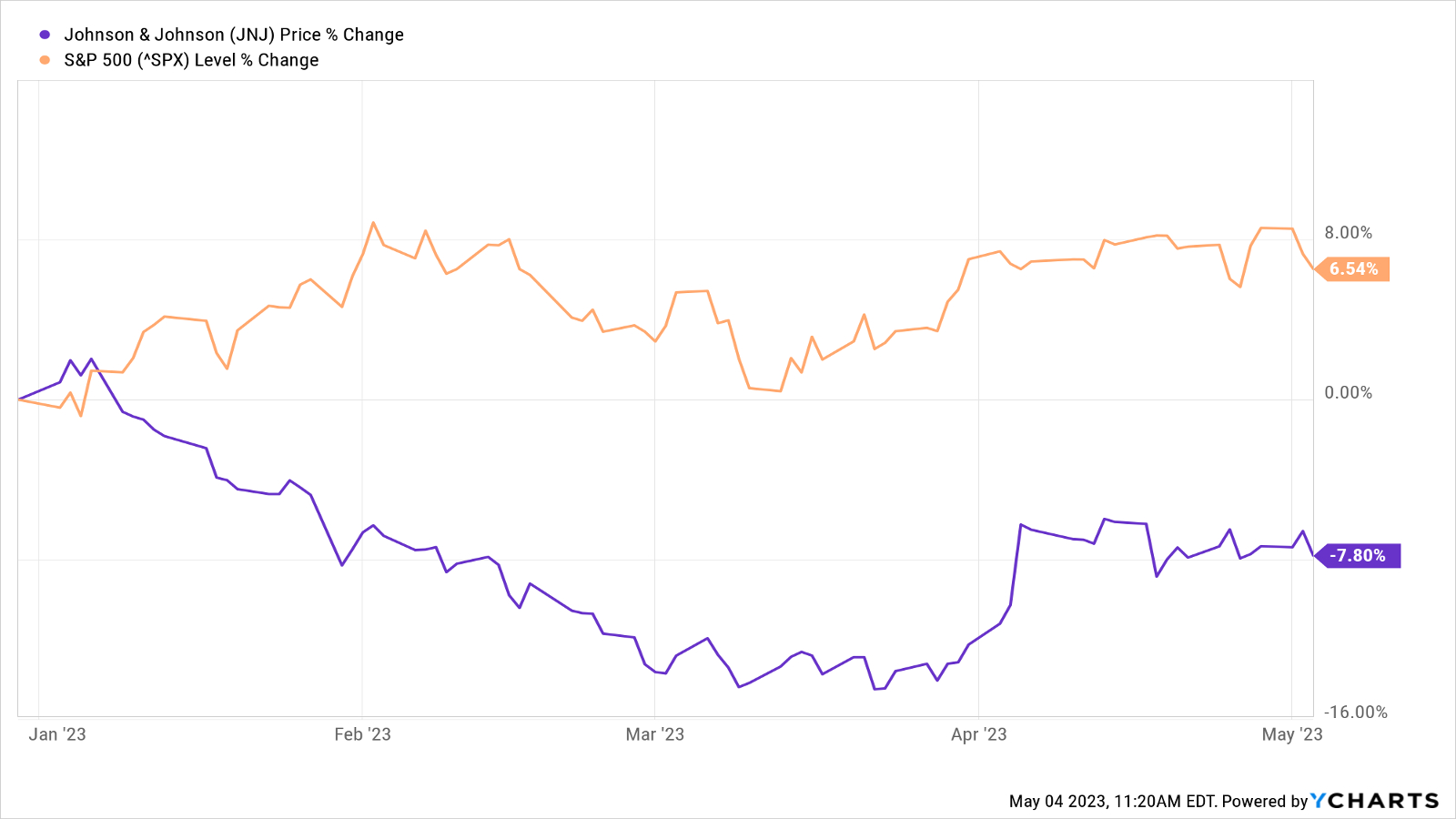

As you can see in the chart below, shares in Johnson & Johnson were off nearly 8% for the year-to-date through May 3, lagging the broader market by about 14 percentage points.

With an average target price of $178.79, analysts give JNJ stock implied upside of about 10% in the next 12 months or so. Add in the dividend yield, and the implied total return comes to roughly 13%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.

-

Risk Is Off Again, Dow Falls 397 Points: Stock Market Today

Risk Is Off Again, Dow Falls 397 Points: Stock Market TodayMarket participants are weighing still-solid earnings against both expectations and an increasingly opaque economic picture.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Stock Market Today: Powell Rumors Spark Volatile Day for Stocks

Stock Market Today: Powell Rumors Spark Volatile Day for StocksStocks sold off sharply intraday after multiple reports suggested President Trump is considering firing Fed Chair Jerome Powell.

-

The Best Health Care Stocks to Buy

The Best Health Care Stocks to BuyThe best health care stocks offer investors a defensive hedge in an uncertain market. Here's how to find them.

-

Stock Market Today: Stocks Are Mixed Before Liberation Day

Stock Market Today: Stocks Are Mixed Before Liberation DayMarkets are getting into the freewheeling rhythm of a second Trump administration.