Nvidia (NVDA) disclosed its fiscal first-quarter earnings report after the close Wednesday, May 28.

Nvidia earnings have become one of Wall Street's most anticipated events thanks to snowballing demand for all things artificial intelligence (AI).

Management reported expectations-beating year-over-year revenue growth of 69% to $44.1 billion and earnings of 81 cents per share. Analysts were calling for earnings of 73 cents per share on revenue of $43.2 billion.

As a result, NVDA stock is poised for a notable gain in Thursday's session.

The Kiplinger team is reporting live on Nvidia's first-quarter earnings report, bringing you the news and our expert analysis of what the results could mean for you and your portfolio.

Scroll for the latest updates.

What Is AI? Artificial Intelligence 101 | Best AI Stocks to Buy | 10 Major AI Companies You Should Know

What time is Nvidia's earnings release?

Nvidia will release its first-quarter earnings report after the stock market closes on Wednesday, May 28. The results typically come through around 4:20 pm to 4:30 pm Eastern Standard Time.

The release of Nvidia's earnings report will be followed by a conference call, which will begin at 5 pm EST.

- Karee Venema

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021, and oversees a wide range of investing coverage, including content focused on equities, fixed income, mutual funds, ETFs, macroeconomics and more.

What Jensen Huang had to say at Computex 2025

Ahead of next week's big earnings event, Nvidia CEO Jensen Huang delivered the keynote address at Computex 2025, a global computing tech show.

Speaking to a crowd of more than 4,000 people, the executive cheered the Trump administration's recent decision to suspend former President Joe Biden's tiered restrictions on AI chip exports to China.

The AI market in China has extreme growth potential, Huang noted, and could reach $50 billion this year.

Nvidia said in April it expects to incur $5.5 billion in additional costs in its first quarter due to new licensing requirements put in place by the Trump administration.

Other announcements Huang made during Computex included a joint venture between Nvidia, Foxconn Hon Hai Technology Group and the Taiwan government to build an AI factory supercomputer.

Huang also discussed NVLink Fusion, a new architecture that will allow hyperscalers to create semi-custom compute solutions.

"This technology aims to break down traditional data center bottlenecks, enabling a new level of AI scale and more flexible, optimized system designs tailored to specific AI workloads," Nvidia stated in a blog post.

Huang's keynote address at Computex "positioned NVDA as the dominant AI infrastructure player, drawing parallels to electricity and Internet transformations," said CFRA Research analyst Angelo Zino.

- Karee Venema

Nvidia stock gets a pre-earnings price-target cut

UBS Global Research analyst Timothy Arcuri recently cut his price target on Nvidia stock to $175 from $180, representing implied upside of roughly 32% to current levels. He maintains a Buy rating.

Despite the Trump administration's restrictions on exports of the company's H20 chips to China, which will result in $15 billion in lost revenue according to Nvidia, Arcuri still expects a top-line beat.

He also believes the chipmaker will give stronger-than-expected second-quarter revenue guidance.

"This should be enough to satisfy investors because many (about half) expect revenue to be guided down quarter to quarter," Arcuri says.

He adds that he expects growth to reaccelerate in the second half of the year "as GB300 racks start to ship late in the third quarter and NVDA is potentially allowed to resume shipments of data center GPUs to China with a modified Blackwell-based SKU."

Still, Arcuri is targeting below-Street earnings of 76 cents per share for Q1 on a gross margin of roughly 58.5%.

"Aside from this noise, we do expect a confident overall tone on the call, but the company could slightly temper second-half gross margin commentary because it is sticking with the Bianca compute board configuration for GB300 and pushing the higher margin Cordelia boards to Rubin next year," he notes.

- Karee Venema

Wedbush reiterates Outperform on top-rated Nvidia

Nvidia remains one of the highest-rated Dow Jones stocks. Of the 62 analysts covering the name who are tracked by S&P Global Market Intelligence, 42 say it's a Strong Buy, 12 have it at Buy, seven say Hold and one has it at Strong Sell.

This works out to a consensus Strong Buy recommendation.

Wedbush analyst Matt Bryson reiterated his Outperform (Buy) recommendation on Nvidia on May 22.

Bryson says the main question for Nvidia's fiscal first-quarter earnings results and forward guidance is whether the company can boost sales to offset the loss of revenue from H20 restrictions on China.

The analyst believes that demand was running ahead of expectations before the early April announcement on new licensing requirements, and Blackwell shipments have ramped up quicker than expected.

"Net, we remain comfortable with our first-quarter and consensus estimates at $43 billion (particularly with NVDA having consistently embedded some conservatism into forecasts during the last few years of explosive growth)," Bryson writes in a note to clients.

He also notes that Nvidia's guidance could matter less this time around, "as investors become more confident around NVDA's intermediate-term growth outlook following recent announcements around planned AI data center investments."

- Karee Venema

Snowflake earnings signal strong enterprise AI demand

After the close on Wednesday, May 21, cloud-based data platform Snowflake (SNOW) disclosed its fiscal first-quarter results.

For the three months ending April 30, Snowflake reported earnings of 24 cents per share (+71.4% YoY) on revenue of $1.04 billion (+26% YoY).

Analysts expected SNOW to report earnings of 21 cents per share on revenue of $1.01 billion.

The company also said product revenue was up 26% to $996.8 million and its net revenue retention rate was 124%. It now has 606 customers with trailing 12-month product revenue of more than $1 million.

SNOW raised its fiscal second-quarter revenue of $1.035 billion to $1.04 billion on strong enterprise demand for AI products.

"Snowflake delivered strong fiscal Q1 results on broad-based demand and steady consumption trends," says Oppenheimer analyst Ittai Kidron. "In addition, better-than-expected Snowpark and Dynamic Tables activity and strong AI adoption suggest that newer products are resonating with customers."

Kidron has an Outperform (Buy) rating on SNOW and says it's a "top pick," adding that if "macro conditions hold, we see room for upside, especially considering the still-nascent AI opportunity, continued product expansion, and the maturing sales/GTM motion."

- Karee Venema

OpenAI buys Jony Ive's artificial intelligence company

Artificial intelligence bellwether OpenAI announced Wednesday evening that it will buy Jony Ive's AI devices startup, io, in an all-equity deal valued at roughly $6.4 billion.

Ive is most well-known as the former chief design officer at Apple (AAPL) who played a pivotal role in the look of the tech giant's suite of products. And his company is "focused on developing products that inspire, empower and enable," said OpenAI in a statement.

The startup "will now merge with OpenAI to work more intimately with the research, engineering and product teams in San Francisco."

"We've been waiting for the next big thing for 20 years," said OpenAI CEO Sam Altman. "We want to bring people something beyond the legacy products we've been using for so long."

This is OpenAI's biggest purchase to date and follows recent news that the company is buying AI coding company Windsurf for $3 billion.

The goal of the merger is to build AI-capable consumer products, but Tech Radar says a smartphone is unlikely to make the list.

"Instead, most expect the duo to focus on wearables like earbuds and smartwatches that could be enhanced with, for instance, cameras that could see your surroundings and use onboard AI to help you act on and react to them," writes Lance Ulanoff, editor at large for Tech Radar.

- Karee Venema

How did Nvidia do in Q4?

Nvidia's results for its fiscal 2025 fourth quarter were released in late February. The company reported earnings of 89 cents per share on $39.3 billion in revenue, beating analysts' estimates for earnings of 85 cents per share on revenue of $38.1 billion.

NVDA stock closed just above its intraday low at $120.15 on February 27, down 8.5%. It was the blue chip's worst one-day decline since the January 27 DeepSeek sell-off, when NVDA was down 17%.

And it was the worst post-earnings announcement performance since February 17, 2022, when the AI stock shed 7.6%.

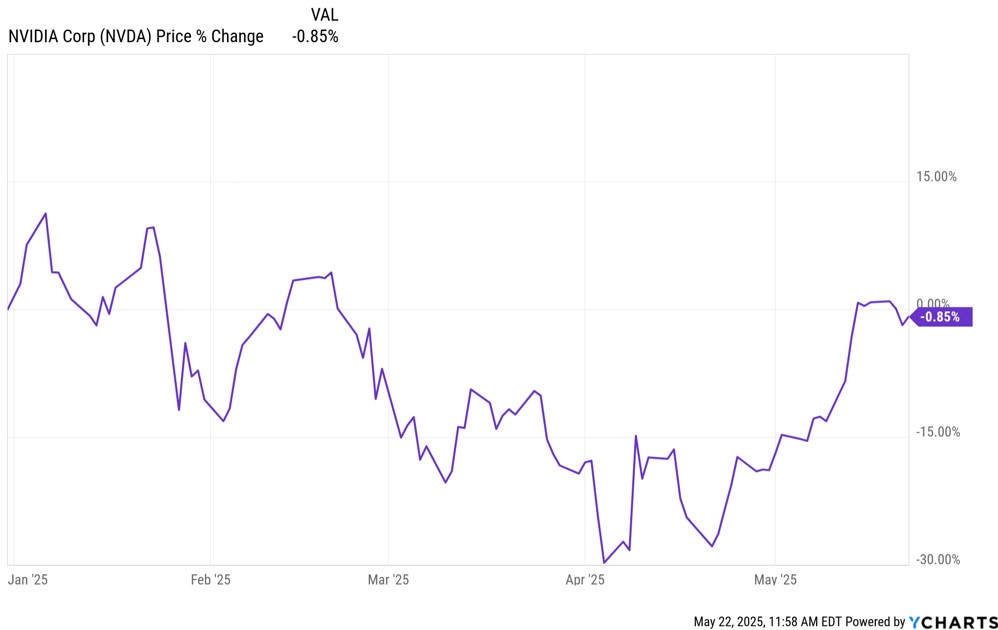

Nvidia continued to slide over the next six or so weeks and was down nearly 30% for the year to date in early April. Shares have staged an impressive rebound, though, and are now nearly flat for the YTD.

Nvidia stock has been a buy-and-hold investor's dream

Nvidia stock has been a solid choice for those seeking out the best long-term investment stocks.

Indeed, shares have averaged an annual total return (price change plus dividends) of 38.3% over the past 20 years, easily outpacing the S&P 500's 10.4% gain.

"The potential of being an undisputed leader in an industry that will indisputably mushroom is one reason Nvidia stock has increased by over 1,000% from the fall of 2022 midway into 2024," writes Kiplinger contributor Louis Navellier.

"Yes, NVDA has always been a grower. From earnings per share of just 1 cent in 2005, the company reported earnings per share of $1.21 for its fiscal year 2023. That represents an average annual growth of 27.1% per year," he adds.

Read more: Nvidia Stock's Been Growing for Years. Just Look At Its 100,000% Return

Nvidia remains a top AI stock, says Oppenheimer

Oppenheimer analyst Rick Schafer reiterated an Outperform rating on Nvidia stock Thursday, adding that it "remains best positioned in AI, in our view, benefiting from full-stack AI hardware/software and unique rack-level approach."

The analyst says that production of Nvidia's "flagship GB200 rack-scale systems appears to have moved past their initial 'growing pains,'" and he believes "Blackwell 200/300 NVL72 equivalent volumes still on track to meet or exceed 40,000 this year."

For Nvidia's fiscal Q1, Schafer expects above-Street earnings of 92 cents per share. He also anticipates data center revenue growth of greater than 8% quarter to quarter and roughly 71% year over year.

NVDA's data center segment accounts for 90% of total revenue.

- Karee Venema

Apple becomes Trump's latest tariff target

Apple is the latest target of President Trump's tariff threats. In a post on Truth Social, Trump wrote that he "long ago informed Tim Cook of Apple that I expect their iPhone's that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else."

Trump added that if this is not the case, "a Tariff of at least 25% must be paid by Apple to the U.S."

Reuters reported in late April that the tech giant is planning to move most of its manufacturing for iPhones sold in the U.S. to India by the end of this year.

A more recent report in The Financial Times indicates Apple is proceeding with its plans to build a $1.5 billion components plant near Chennai, India.

In a May 16 note to clients, Wedbush analyst Daniel Ives wrote that Apple's "aggressive push towards India production has been a very smart strategic move given the uncertain tariff environment facing Apple in China."

He added that he anticipates "more pressure from the Trump Administration on Apple to build iPhone production in the U.S.," but doing so "would result in an iPhone price point that is a non-starter for Cupertino and translate into iPhone prices of ~$3,500."

- Karee Venema

Nvidia is attractively valued given its AI pole position, says Stifel

Stifel analyst Ruben Roy says Nvidia remains "attractively valued" based on its leadership position in the AI industry.

And despite concerns over hyperscaler demand and the sustainability of infrastructure spending as well as worries over the impact of China export restrictions, Roy does not expect its dominance to fade.

The analyst, like many others, anticipates an in-line fiscal Q1 print thanks to demand for the company's H200 GPUs and the ramp-up of its GB200 superchips.

Roy also believes Nvidia's new strategic partnership with Humain – a Saudi Arabian AI company – will boost its top line by an additional $800 million to $1 billion.

Earlier this month, Nvidia announced it will sell more than 18,000 of its AI GPUs – including its GB300 Blackwell chips – to Humain.

- Karee Venema

Huang wants AI to address labor shortages

Just before he departed after the Computex 2025 and GTC Taipei conferences, Nvidia CEO Jensen Huang took time to say Taiwan should "expand its opportunity" with "agentic artificial intelligence" (AI) and robotics to address a domestic labor shortage.

Speaking to reporters at the Mandarin Oriental Hotel on his way to Taipei Sonshan Airport, Huang said 2025 will be a "very exciting" year as AI can now reason.

"It can now think step by step by step and solve problems it has never seen before – it's called agentic AI, AI agents," Huang explained.

The leader of the AI revolution said AI agents will help people plan vacations and streamline workflows.

It will also accelerate robotics development. "The technology has also reached a level where we can have robotics. Here in Taiwan, we have many great ideas, but there are not enough people," Huang said. "Now with AI and robots, Taiwan can expand its opportunity."

The CEO said Blackwell production is expanding in Taiwan. "All of our partners are in full production, and the excitement is so great all over the island.

"We're going to bring AI all over the world."

- David Dittman

I am the former managing editor and chief investment strategist of Utility Forecaster and the former editorial director of Investing Daily, Charles Street Research, and Weiss Ratings. I am also a former stockbroker and have been working in financial media for more than 20 years.

Hedge funds sold out of Nvidia in Q1

Hedge funds were net sellers of Nvidia stock in the first quarter – a time frame that saw the semiconductor stock slide nearly 20%.

According to WhaleWisdom, 59 hedge funds closed out of their NVDA positions completely over the three-month period and 327 reduced their stakes.

This compares to 49 hedge funds that initiated new positions and 337 that increased their stakes.

The net change in hedge fund share ownership amounted to -77.3 million shares.

CoreWeave strength bodes well for Nvidia stock

CoreWeave (CRWV) shares have displayed impressive strength in recent weeks, easing worries after a lackluster IPO.

CRWV started as a crypto mining firm before shifting to cloud computing. Its main business now involves renting AI infrastructure to developers. And its share price has more than doubled since its late-March public offering.

Most recently, the tech stock got a boost after Nvidia revealed it owned 24.2 million shares of CRWV, equating to a 7% stake.

Nvidia also counts itself as one of CoreWeave's many high-profile customers. Meta Platforms (META), OpenAI, IBM (IBM) and Microsoft (MSFT) are also included among its clientele.

CoreWeave "has done an impressive job delivering GPUs and piecing together data center capacity in a constrained power market to capture share on the back of a strong demand backdrop for compute to power AI workloads," wrote Needham analyst Mike Cikos in a May 16 note.

Cikos has a Buy rating on CRWV, saying the company's recent earnings report "demonstrated the massive market opportunity and strong execution."

For the three months ending March 31, CoreWeave reported revenue of $981.6 million – a marked improvement over the $188.7 million from the year-ago period.

Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) rose to $606.1 million from $104.5 million.

The company also unveiled a strategic deal with OpenAI that will add $11.2 billion to its revenue backlog.

- Karee Venema

Can Nvidia hit a new high after earnings?

As of Thursday's closing bell, 96% of the S&P 500 Index had reported "actual results" this earnings season.

According to FactSet, 78% of S&P 500 companies have reported a positive EPS surprise, and 63% have reported a positive revenue surprise. FactSet also found that "few S&P 500 companies have withdrawn EPS guidance for 2025."

All things considered, especially expectations about forward-looking guidance, it's been a good few weeks.

And, yet, the whole season still seems to ride on what a single company will say.

So, is Nvidia still making the AI revolution?

Virtus Investment Partners senior managing director Joe Terranova said this week on CNBC he "wouldn't be surprised to see the stock make a move towards" its "all-time high." That's $153.

Oppenheimer analyst Rick Schafer reiterated an Overweight (or "Buy") rating and a $175 12-month price target on Thursday. The highest target on Wall Street for NVDA stock is $220. And Stifel analyst Ruben Roy underscored his Buy rating and $180 target on Friday.

Roy said investors will focus on hyperscaler demand and sustainability of infrastructure investment, potential incremental impacts related to China export restrictions, and potential margin pressure.

"We do not expect any change to NVDA’s leadership positioning in shaping global AI infrastructure," Roy concludes, "and we continue to view shares as attractively valued within the context of that positioning."

- David Dittman

The stock market is closed on Monday

Investors and speculators will have one fewer day to position for Nvidia earnings this time around, with the U.S., stock market closed on Monday, May 26, in observance of the Memorial Day holiday.

Markets will reopen at 9 am Eastern Standard Time on Tuesday, May 27, for regular trading hours.

Read more: Stock Market Holidays in 2025: NYSE, NASDAQ and Wall Street Holidays

Salesforce joins Nvidia on the earnings stage

Nvidia is just one of several tech companies reporting earnings this week. For instance, Salesforce (CRM) will also disclose its fiscal first-quarter results after Wednesday's close.

Stifel analyst Brian Schwartz has an Outperform (Buy) rating on CRM, saying the company is "one of the healthiest long-term profitable growth stories in our SaaS/applications software universe."

For CRM's fiscal Q1, Schwartz says, "the earnings risk looks more favorable on low expectations."

And while he thinks the material impact from Agentforce – CRM's platform to deploy AI agents – is further out, he expects management to provide strong commentary on the "investable theme."

As a group, analysts are targeting fiscal first-quarter earnings of $2.55 per share (+4.5% YoY) on revenue of $9.7 billion (+6.6% YoY).

Read more: Earnings Calendar and Analysis for This Week

Nvidia stock has been volatile after earnings

Nvidia stock has made some big post-earnings moves in the past two years. Here's a quick rundown of NVDA's single-session returns the day after the chipmaker reported earnings:

- Q4 Fiscal 2025 (reported February 26, 2025): -8.5%

- Q3 Fiscal 2025 (reported November 20, 2024): +0.5%

- Q2 Fiscal 2025 (reported August 28, 2024): -6.4%

- Q1 Fiscal 2025 (reported May 22, 2024): +9.3%

- Q4 Fiscal 2024 (reported February 21, 2024): +16.4%

- Q3 Fiscal 2024 (reported November 21, 2023): +0.8%

- Q2 Fiscal 2024 (reported August 23, 2023): +3.2%

- Q1 Fiscal 2024 (reported May 24, 2023): +24.4%

This time around, options traders are pricing in a potential 7% post-earnings move in either direction, according to Yahoo Finance.

- Karee Venema

Nvidia's growth story is intact, says CFRA

After a turbulent start to the year for Nvidia, which included a rotation out of growthier tech stocks and concerns over AI spending sparked by China's lower-cost DeepSeek model, the clouds appear to be parting, says CFRA Research analyst Angelo Zino.

"Our outlook on NVDA has considerably improved in recent weeks with favorable policy shifts, including more lenient China tariffs and the scrapping of the AI diffusion rule, though uncertainty remains around the 232 semiconductor investigation," Zino writes in a note to clients.

The "232 semiconductor investigation" was initiated by the Trump administration to uncover the impact of pharmaceutical and semiconductor imports on national security.

Zino adds that the new deal with Saudi Arabia's Humain "demonstrates NVDA's strategic importance in U.S. trade negotiations," while Q1 earnings from several mega caps "have also reinforced AI investment visibility, with customers maintaining or increasing their 2025 capex plans."

As a result, Zino thinks "NVDA's content growth story in data centers will extend through at least 2027, supported by its product pipeline" that includes "B300, Rubin, and Rubin Ultra (new architecture with higher GPU server count)."

Zino notes that Nvidia's upcoming earnings report creates a risk for the stock, but he views " any pullbacks as enhanced buying opportunities given the better policy backdrop and customer visibility."

- Karee Venema

Nvidia to launch a cheaper Blackwell AI chip

Nvidia was higher in pre-market trading Tuesday morning, a day after Reuters reported the chipmaker will introduce a scaled-down Blackwell AI chipset in China in response to U.S. export restrictions on the H20 unit.

The new China option will be priced between $6,500 and $8,000 vs $10,000 to $12,000 for H20, according to Reuters.

Nvidia plans to start producing the cheaper chipset, weaker specifications and simpler manufacturing requirements in June.

A spokesperson for Nvidia told Reuters the company is still considering "limited" options.

"Until we settle on a new product design and receive approval from the U.S. government," the spokesperson said, "we are effectively foreclosed from China's $50 billion data center market."

China accounted for approximately 13% of Nvidia's sales during the trailing 12 months. That's down from more than 20% during fiscal 2024.

- David Dittman

Nvidia boasts a red-hot 20-year return

Nvidia's share price has gone through some notable ups and downs over its 26 years as a publicly traded company, but its long-term trend has always been up and to the right.

Indeed, Nvidia has been one of the best stocks to own over that time frame and created more than $309 billion in shareholder value between January 1999 and December 2020, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Looked at another way, over its life as a publicly traded company, Nvidia stock generated an annualized total return of 36.3%. The S&P 500, with dividends reinvested, returned an annualized 10.4% over the same period.

Read more: If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Pros outweigh cons ahead of Nvidia earnings

Investors should be wary of Nvidia's guidance for its fiscal second quarter, says Morgan Stanley analyst Joseph Moore, given that the H20 ban on China creates a 10% headwind to the company's July quarter revenue that has not been factored into consensus estimates.

"There is simply no offset to this. Blackwell demand is very strong … but they are supply-constrained, and lost H20 does not result in more Blackwell supply," Moore notes.

As a result, there is some downside risk heading into tomorrow's print given a stale consensus outlook.

However, the analyst calls Nvidia a "top pick" among semiconductors, saying that near-term issues have been well-telegraphed and "the path to a second-half reacceleration is clear."

Moore's conviction is "driven by the fact that literally everyone we talk to in the space is telling us that they have been surprised by inference demand, and there is a scramble to add GPUs."

He adds that "LLM cloud customers are requesting that in lieu of GB200 availability, that their cloud partners add capacity of Hoppers and B200s."

- Karee Venema

Investors shouldn't worry about AI spending, says Goldman Sachs

One worry that weighed on AI stocks earlier this year was that Big Tech would reduce its spending on AI initiatives – due in part to the release of China's lower-cost DeepSeek AI model, as well as muddied tariff announcements.

But commentary from several mega-cap tech firms following their respective quarterly results should put investors' minds at ease.

"U.S. tech giants are continuing to ramp up their spending on artificial intelligence, despite the uncertainty of tariff policies," says Eric Sheridan, co-business unit leader of the Technology, Media, and Telecommunications Group at Goldman Sachs Research.

During a recent appearance on the Goldman Sachs Exchanges podcast, Sheridan pointed out that there is unlikely to be any major adjustments because the AI spending is "aimed at multi-year themes."

Indeed, in its fiscal Q3 earnings call, Microsoft Chief Financial Officer Amy Hood said that "roughly half" of the company's "cloud and AI-related spend was on long-lived assets that will support monetization over the next 15 years and beyond."

Sheridan adds that "given the sheer number of players investing both offensively and defensively in AI, I think this spend will get protected for a little longer than the macro environment might influence it."

- Karee Venema

NVDA rises in pre-market trading

Nvidia traded up in the pre-market Wednesday morning, rising about 0.6% as of about 15 minutes ahead of the opening bell at the New York Stock Exchange a day after it added 3.2.%

Nvidia will report fiscal 2026 first-quarter earnings after today's closing bell. Management will host a conference call to discuss results and guidance starting around 5 pm ET.

A FactSet-compiled Wall Street consensus forecast includes revenue growth of 66% to $43.3 billion, earnings per share growth of 40% to 73 cents, and fiscal second-quarter guidance of EPS of $1 on revenue of $45.9 billion.

The key factor here is China and the impact of U.S. restrictions on sales of Nvidia's H20 chipset there.

Nvidia has already said it expects to book a $5.5 billion first-quarter charge on inventory and production commitments because of the new restrictions. And CEO Jensen Huang said they'd cost Nvidia about $15 billion in revenue.

According to FactSet, the forecast for Nvidia's fiscal second-quarter revenue has declined by approximately $2 billion from a late-March peak.

Meanwhile, "hyperscalers" in the AI infrastructure space such as Microsoft (MSFT) and Meta Platforms (META) are standing by and even boosting their capex forecasts.

- David Dittman

Why Nvidia's earnings announcement is "pivotal" for the stock market

James Demmert, chief investment officer of Main Street Research, says Nvidia's earnings announcement, due after today's close, is "pivotal" not only for the chipmaker but also for the broader stock market.

A strong print "can rejuvenate investor optimism across the board and help investors to focus on the power of AI and less on headlines out of Washington on tariffs and taxes," Demmert explains.

The CIO thinks the "AI story and evolution is alive and well," but he notes that it has been "clouded by trade fears and U.S. policy."

Demmert adds that "AI has proven to enhance productivity growth for the global economy.

He says investors who want exposure to the expanding space should consider buying Nvidia stock, considering it's trading "at a discount to the company's growth rate."

- Karee Venema

NVDA (and markets) will move

Markets seem on edge ahead of Nvidia's post-closing-bell earnings and guidance event.

Just more than an hour into Nvidia Day, the S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite were all down – by 0.01%, 0.02% and 0.03%, respectively.

Ten of the 11 sectors were in the red – but health care was up 0.02%.

The Cboe Volatility Index (VIX) remains below 20. Treasury yields are higher across maturities, though the 30-year remains below the psychologically significant 5% threshold.

Options pricing suggests NVDA could move as much as 6% in either direction through the end of the week in response to this evening's events.

"That would put Nvidia’s share price at either $143.92, a 4-month high, or $127.09, a little above where it closed after the U.S. and China agreed to lower sky-high tariffs on each other’s imports," writes Investopedia's Colin Laidley.

- David Dittman

3 stocks that could move with Nvidia

There are lots of other stocks in the AI space that could move in tandem with Nvidia after earnings, says Joe Tigay, portfolio manager of the Rational Equity Armor Fund.

"The race for AI leadership is only getting bigger – it's rapidly expanding," he explains.

"This isn't discretionary spending; companies aren't just experimenting for fun. This is a critical investment in their future," Tigay adds, and the "underlying demand for Nvidia chips is urgent and very real."

The portfolio manager notes that "the market has been driven by a tech recovery and boom that has lifted many companies. And with the surge in chip sales, even more names are likely to rise with the tide."

Tigay highlights a handful of stocks that investors should watch outside of Nvidia. They include:

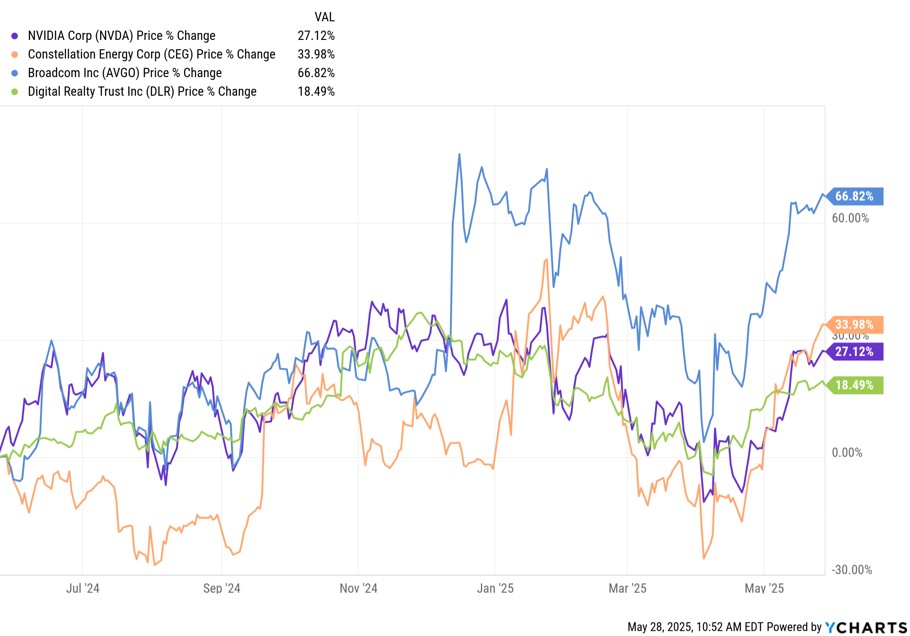

Constellation Energy (CEG) is a utility stock focused on nuclear power that can meet the massive energy demand from AI data centers."Commentary from NVIDIA or general AI buildout trends will directly impact their energy demand outlook," Tigay says.

Broadcom (AVGO) is a chipmaker that supplies its products to hyperscalers such as Alphabet's (GOOGL) Google and Meta Platforms (META). It also provides key networking solutions for data centers."Strong Nvidia results and bullish AI commentary can signal continued robust demand for Broadcom's data center solutions and custom silicon," the portfolio manager explains.

Digital Realty Trust (DLR) is a real estate investment trust (REIT) that owns physical infrastructure that houses AI servers."Increased demand for NVIDIA chips means more colocation and interconnection services, higher power density requirements, and expansion" for DLR, says Tigay.

– Karee Venema

The Nvidia obsession is relatively healthy

Investors, traders and speculators are squarely focused on Nvidia's earnings and guidance today, the climax of a so-far-so-good reporting season.

And that makes a lot of sense given semiconductors are probably the most important group of stocks right now and the leader of the AI revolution is easily the biggest among them.

It's also refreshing that tariffs and trade wars and regulation have been reduced somewhat in the bigger picture, if only for now, and albeit with significant qualifications…

Such as investors, traders, speculators and we will listen closely to what CEO Jensen Huang and his management team have to say about their plans to mitigate the impact of U.S. restrictions on chip sales to China during Nvidia's conference call.

That starts at about 5 pm ET. Be sure to join us.

– David Dittman

Jensen Huang: AI revolutionary/head cheerleader

"The entire stock market is expecting great results and guidance from Nvidia after today's market close," writes Louis Navellier of Navellier & Associates. "Jensen Huang is now the head cheerleader for AI and, eventually, quantum computing."

Navellier notes that D-Wave Quantum (QBTS) won a quantum computing architecture contest sponsored by Nvidia. QBTS is one among four viable ways to invest in quantum computing right now.

"I expect Huang to continue to inspire investors and AI users with upbeat guidance," Navellier foreshadows. "It is up to Huang to paint a positive picture of how he expects AI to continue to unfold and literally envelop more aspects of our lives."

Navellier concludes with one observation, "that younger people are clearly AI-obsessed for superior internet search and advice."

The major equity indexes were rising back toward their respective intraday breakeven lines and NVDA remained in positive territory about three hours ahead of Nvidia's expected 4:20 pm ET earnings release.

We'll cover the conference call live starting at 5 pm.

– David Dittman

NVDA rises

Nvidia stock surged in the last couple of hours of trading ahead of its highly anticipated fiscal 2026 first-quarter earnings release, rising from an intraday low of $134.80 around 11 am ET to an intraday high of $137.25 shortly after 2 pm.

NVDA was at $136.50 as of 3 pm, up 1% vs Tuesday's close of $135.50.

NVDA isvidia stock is trading at a lower-than-average valuation as earnings approach.

According to Dow Jones Market Data, NVDA is trading at 28.4 times forward earnings vs a five-year average of 40.2 times.

"We see the stock as attractive at current levels," writes Main Street Research Chief Investment Officer James Demmert. "Nvidia's stock is trading at about the same price as almost a year ago – but their earnings have almost doubled."

Nvidia's earnings press release is expected to drop at 4:20 pm. The conference call will follow at 5 pm.

– David Dittman

Nvidia CEO Huang: AI is just like electricity and the internet

Nvidia stock sagged in the last hour of Wednesday's trading session and closed down 0.5% after rising as much as 1.3% intraday.

But NVDA got a fresh bounce after management reported expectations-beating year-over-year revenue growth of 69% to $44.1 billion. Wall Street saw 66% growth to $43.3 million.

Earnings of 81 cents per share also topped a FactSet-compiled consensus of 73 cents.

Nvidia incurred a $4.5 billion charge on excess H20 inventory and purchase obligations due to diminished demand resulting from U.S. government restrictions on chip exports to China introduced on April 9.

"Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements," Nvidia said in its press release. "NVIDIA was unable to ship an additional $2.5 billion of H20 revenue in the first quarter."

EPS would have been 91 cents but for the new restrictions and the $4.5 billion charge. Gross margin of 61.0% would have been 71.3%, Nvidia said.

“Our breakthrough Blackwell NVL72 AI supercomputer – a ‘thinking machine’ designed for reasoning – is now in full-scale production across system makers and cloud service providers,” said CEO Jensen Huang.

Huang described global demand for NVIDIA’s AI infrastructure as incredibly strong. Countries around the world are recognizing AI as essential infrastructure – just like electricity and the internet – and NVIDIA stands at the center of this profound transformation.”

Nvidia management guided to fiscal second-quarter revenue of $45.0 billion "plus or minus 2%." The guidance "reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations."

Gross margin is expected to be 72.0%, "plus or minus 50 basis points," with management noting its "work toward achieving gross margins in the mid-70% range late this year."

NVDA was up more than 3% in after-market trading shortly after the release of its numbers.

– David Dittman

Nvidia's business is "firm"

"Our customer commitments are firm," said Executive Vice President and Chief Financial Officer Collette Kress at the top of Nvidia's conference call this evening.

Nvidia exceeded Wall Street expectations for its fiscal first quarter revenue and earnings but fell short on guidance.

Revenue is expected to be $45.0 billion, plus or minus 2%, and reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations.

According to FactSet, Wall Street was looking for fiscal second-quarter revenue guidance of $45.9 billion.

Kress noted that H20 revenue of $4.6 prior to April 9 was offset by $4.5 billion charges related to new export controls. The charge was less than management initially expected, and Nvidia continues to evaluate "limited" options available to it in a fast-growing market.

Nvidia expects a meaningful decrease in second-quarter data-center revenue from China because of new restrictions.

The Blackwell ramp is the fastest in Nvidia's history, highlighted by hyperscaler Microsoft (MSFT) and its deployment, with countries, industries and companies expanding their infrastructure build-outs and the transfer to agentic AI driving demand.

NVDA rose into Kress's summary of Nvidia's on-the-ground operations, peaking at $142.81 a few minutes into the conference call.

Nvidia CEO Huang is anti-export controls

"We've had a busy and productive year," said Nvidia CEO Jensen Huang before he launched a rebuttal to export controls imposed by the U.S. government on April 9 that effectively cut off the world's second-largest economy from U.S semiconductor makers.

"The platform that wins China," Huang explained, "is in position to win globally." The export ban ended Nvidia's Hopper data center business in China. But, as Huang emphasized, China's AI efforts will move on – with the U.S. or without the U.S.

"The question is not whether China will have AI," he said. "It's whether it will run on American platforms."

The Trump administration's export ban "only strengthens China and weakens the U.S." because it has "spurred China's ambition and scale" and "assumptions about China's capabilities" have been proven wrong.

The U.S. will always be Nvidia's largest market, Huang clarified, but the AI race "is about which stack the world will run on. And U.S. global infrastructure leadership is at stake."

Nvidia will report fiscal 2026 second-quarter results on August 27.

Nvidia, Sweden and "sovereign AI"

Nvidia CEO Jensen Huang reserved most of his prepared remarks to talk about export controls and their impact on U.S. AI infrastructure leadership.

At the conclusion of his statement, though, he teased "sovereign AI" and Nvidia's new relationship with Sweden.

"Sovereign AI" is about nations such as Sweden establishing their own capability to build and develop artificial intelligence with its own infrastructure, data and workforce.

NVIDIA is helping a consortium of Swedish companies build the country's largest enterprise AI supercomputer with Grace Blackwell GB300 systems.

And it recently struck a deal with Saudi Arabia. India and the United Arab Emirates are also clients.

Still the beginning of a big AI buildout

"We're at the beginning of all of this buildout," said CEO Jensen Huang in another of his extended responses to analysts' questions during Nvidia's fiscal 2026 first-quarter conference call.

"Intelligence is surely one of those things," like electricity and information, "it's essential infrastructure."

As the leader of the AI revolution conceives it, "every country will have it, that I'm certain of" and "every industry will use, that I'm certain of."

Huang noted as well that "what's unique" about AI "is that it needs factories.

"We need factories to produce this intelligence. And the intelligence is getting more sophisticated."

– David Dittman

"The age of AI is here"

CEO Jensen Huang cited four factors that continue to support Nvidia's growth trajectory despite restrictions on its business in China.

The first is the step-up in function to reasoning AI, which allowed the technology to "bust through" and drive exponential growth.

The second is the rescission of a U.S. anti-diffusion law.

"President Trump wants America to win," Huang noted. "He realizes we're not the only country in the race and that we have to get the American stack out into the world."

The third factor is the emergence of enterprise AI and the proliferation of agents. "Agents work," Huang said. "Agents are really quite successful, vs generative AI. Agents can understand ambiguity and implicit instruction and can problem solve."

The fourth "pillar of support" is industrial AI. "The implication of the world reordering, with regions on-shoring manufacturing and building plants everywhere, is that every factory will have an AI factory associated with it."

"The age of AI is here," Huang said in his closing remarks, "and Nvidia is ready."

– David Dittman

All systems go after Nvidia earnings, Jefferies says

Jefferies analyst Blayne Curtis says Nvidia's earnings report answered several overhangs for investors, namely that its built-up inventory is clearing out.

"The biggest issue for the stock was the disconnect between Blackwell sales and GB200 shipments but that is now in the rearview as NVDA noted multiple hyperscalers ramping 1,000 NVL72s per week," Curtis wrote in post-earnings note.

The analyst adds that sovereign AI is gaining traction "on the back of significant commitments from both UAE and Saudi Arabia," while networking revenue "also looks better with Spectrum-X adding two new customers (Google and Meta) and NVLink exceeding $1 billion revenue in April quarter."

Putting this all together, the second half appears to "be shaping up nicely for Nvidia," Curtis notes, "with likely beat/raises from here, while the setup for the rest of AI names becomes more challenging."

Curtis has a Buy rating on Nvidia and a $185 price target, representing implied upside of 37% to its May 28 close.

- Karee Venema

Nvidia is one of the best Dow Jones stocks on Thursday

Nvidia stock is up more than 4% in mid-morning trading on Thursday, making it one of the best Dow Jones stocks so far today.

And Morgan Stanley analyst Joseph Moore thinks the chip stock has more room to run.

Moore raised his price target on NVDA to $170 from $160 after earnings, representing implied upside of 21% to current levels.

"Nvidia is putting digestion fears fully to rest, showing acceleration of the business other than the China headwinds around growth drivers that seem durable," the analyst writes in a note to clients, adding that "Everything should get better from here."

Moore notes that Nvidia is "outgrowing expectations despite supply constraints, and outgrowing competition by a larger magnitude."

The analyst has an Overweight (Buy) rating on Nvidia and an Attractive view on the broader semiconductor industry.

- Karee Venema

Nvidia closes higher after earnings

Earnings and guidance together support Nvidia CEO Jensen Huang's big vision, and NVDA stock was up as much as 6.4% the day after its latest quarterly update and closed with a gain of 3.3%.

"NVDA executed well despite the loss of H20 representing a greater headwind than we (or investors) had anticipated," writes Wedbush analyst Matt Bryson.

Bryson notes that gross margins and revenue are "expected to trend positively" during the second quarter of the calendar year, "despite the China headwind" and cites "seemingly more certain demand growth" through calendar year 2026, driven by an increase in sovereign AI projects.

"We see no reason to shift our constructive opinion on NVDA," the analyst concludes. Bryson reiterates his Outperform (or "Buy") rating and his $175 12-month price target.

Thanks for joining us.

We'll be back in late August to cover Nvidia's fiscal 2026 second-quarter earnings and conference call.

- David Dittman