Looking For Attractive Uncorrelated Returns in a Highly Uncertain Market? Consider Merger Arbitrage

This successful hedge fund strategy is finally being offered to individual investors.

The 60/40 “Balanced” portfolio, consisting of both stocks and bonds, has long been revered as a trusted guidepost for the moderate investor. Nevertheless, in 2022, this established methodology had one of its worst years on record as both sides of the portfolio came under pressure.

So, what is an investor to do? During a market with lots of uncertainty, the few asset allocations that perform relatively well are the ones that exhibit low correlation to the overall markets. At SAM, this investment strategy has become our bread and butter.

Over the last several decades, one of these successful investment blueprints that SAM has employed has been merger arbitrage. Sophisticated institutional clients often seek this idiosyncratic solution from multi-strategy hedge funds. Fortunately for our individual clients, we’ve managed to implement this strategy at SAM with considerable success since our inception over seven years ago.

Merger Arbitrage: What Is It?

When a corporate acquisition is announced, perhaps the most important facet to understand is that a legal obligation is assumed by the acquirer to purchase the target. Because of the typically strong contractual language that governs this legal obligation, a very large percentage of announced U.S. public mergers have successfully closed. In fact, global consulting company McKinsey & Co estimates that in any given year, only 10% of all large mergers and acquisitions are cancelled (1).

Consequently, the stock of the acquired company usually jumps up and closes the day at a price very close to the acquisition price, but oftentimes a bit lower. The difference between the acquisition price and the market price is called the deal spread.

The spread occurs because there is a varying degree of perception that the deal may be in jeopardy. There could be antitrust concerns if two corporate entities in the same space are merging, or perhaps financing concerns if the acquirer may not be able to raise the required capital to complete the deal.

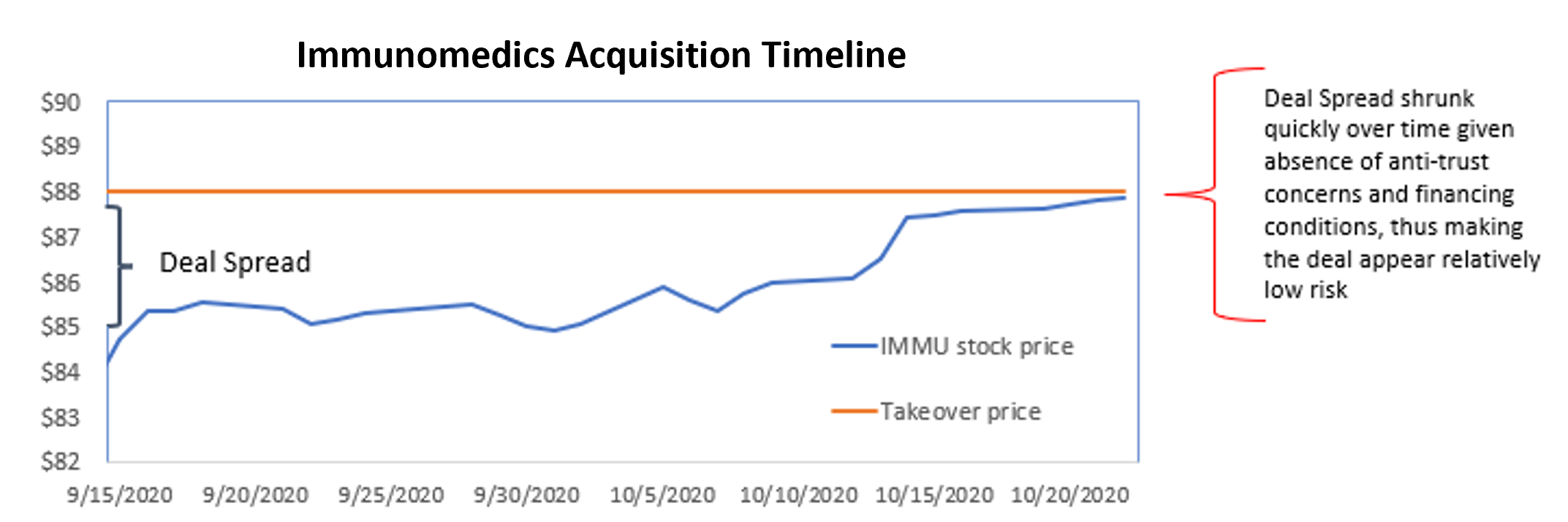

For example, in mid-September 2020, Gilead Sciences (GILD) announced the acquisition of cancer-focused biotech Immunomedics (IMMU) for $88 per-share in all-cash consideration, which represented a 108% premium over IMMU’s prior closing price.

When the deal was announced, IMMU quickly rose from $42 to $84.50 per-share, still below the $88 deal price. The $3.50 spread created a compelling merger arbitrage buying opportunity. On October 23rd, only 6 weeks after the deal announcement, the deal closed without incident. Investors who purchased the stock when the deal was announced would have earned 4% over the subsequent 40 days, or an annualized 36% return.

Ultimately, investors who purchase the stock of a company that is being acquired are attempting to capture the deal spread of a corporate transaction with a historically high success rate of completion.

Regulatory Scrutiny

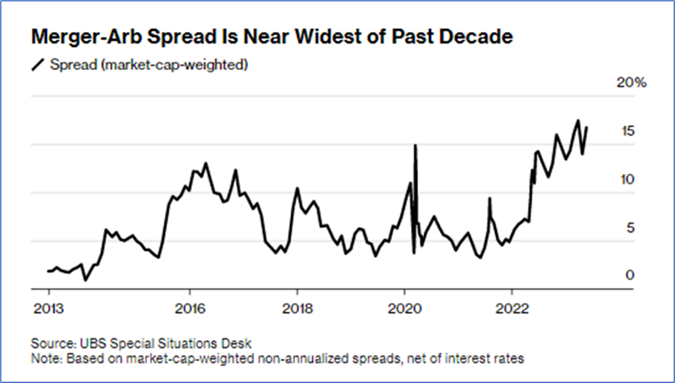

Over the last decade, antitrust enforcement in the M&A space hasn’t been much of an issue, enabling traditional hedge fund merger arbitrage investors to deploy a straightforward trading approach – like only having to consider acquirer financing risks or risk of an adverse shareholder vote. As a result, generating 5-10% annualized returns, with very little beta, was very appealing in an era when borrowing costs were near-zero.

But generating these kinds of numbers has become much harder with Biden administration regulators roughly doubling their efforts to block mergers. And the antitrust risk is evident in the widening deal spreads, which are around the widest in the past decade as you can see here in the graph below.

Of course, the riskier backdrop potentially creates more opportunity for profits as well. In other words, because of the regulatory fear, a lot of deal spreads are trading unjustifiably wide – which is creating significant opportunity for seasoned professionals who have been investing in this space for quite some time.

So, What Is The Takeaway?

Many of these merger arbitrage investments possess specific nuances that separately influence the deal spread, which therefore requires a manager with a deep and broad investment acumen.

At SAM, we’ve amassed the skill-set necessary to successfully navigate this strategy. Time and again, we’ve demonstrated that we can profit from capitalizing on this deal spread by painstakingly analyzing the specific dynamics of each corporate acquisition.

At the end of the day, merger arbitrage lays the foundation for substantial uncorrelated returns, which is an extremely compelling proposition – especially in a market environment where overall uncertainty is rapidly climbing.

To read more about how SAM and Mario are investing in the merger arbitrage strategy, please download this whitepaper.

(1) Source: Done Deal? 08/05/2019

Stansberry Asset Management ("SAM") is a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. Such registration does not imply any level of skill or training. This presentation has been prepared by SAM and is for informational purposes only. Under no circumstances should this report or any information herein be construed as investment advice, or as an offer to sell or the solicitation of an offer to buy any securities or other financial instruments.

The statements and views expressed herein may not express current views or positions. In addition, the views expressed may be historic or forward-looking in nature, may reflect significant assumptions and subjective judgments, and are subject to change without notice. SAM does not undertake to revise or update this information in any way. In some circumstances, this report may employ data derived from third-party sources. No representation is made as to the accuracy of such information and the use of such information in no way implies an endorsement of the source of such information or its validity.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Future returns are not guaranteed and a loss of principal may occur. Past performance is not an indication of future results.

This content was provided by Stansberry Asset Management. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.