Kiplinger’s Mutual Fund Rankings, 2021

In a volatile year, the best portfolios had plenty of opportunity to shine.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most of us were all too happy to see an end to 2020, as the pandemic cast a shadow over everything. But from a stock investor’s perspective, the year was spectacular, and mutual funds had ample chances to prove their mettle. Despite swift bear market declines in bourses across the globe during February and March, by year’s end, most broad stock indexes closed at levels higher than at the start of 2020.

It was a year of firsts many times over. Investors suffered the first bear market in U.S. stocks in more than a decade and the deepest recession since the Great Depression, but both were gone in record time. And then began one of the best stock market reversals ever. From its bottom in March, the S&P 500 climbed 70%. The index’s 2020 return: A generous 18%. (Returns here are through December 31.)

Kiplinger's 25 Favorite No-Load Mutual Funds

A late-year rally following announcements of effective vaccines to fight the deadly pandemic was driven by a market rotation that turned longtime laggards into leaders. Large companies led the S&P 500 for most of the spring and summer, as they have for much of the past decade. But by fall, small- and midsize-company shares began to power forward. It was enough to propel the 12-month return in the Russell 2000 small-company index to 20%, which beat the S&P 500. The S&P MidCap 400 index climbed 14% in 2020, a decent year given its 42% decline during the March bear market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Information technology, for the second year in a row, was the best-performing sector in the S&P 500 index, with a 44% gain. Energy, down 34% over the past 12 months, and financials, which slipped 2%, were the benchmark’s worst-performing sectors. But the two sectors stormed back at the end of 2020, another sign that investors are beginning to favor more economically sensitive industries in anticipation of an end to the coronavirus pandemic.

Much of the lift in stock prices came after extraordinary fiscal and monetary stimulus from central banks all over the world. That was a boon to foreign shares, too. The MSCI EAFE index, which tracks foreign stocks in developed countries, gained 8% in 2020. Stocks in emerging nations fared much better. The MSCI Emerging Markets index gained better than 18%, largely on the back of giant-size gains in Asian countries. Shares in South Korea climbed nearly 45%, and the Taiwan market gained 41%. China rose, too—by 30% in 2020. At year-end, those three countries combined represented 65% of the emerging-markets index.

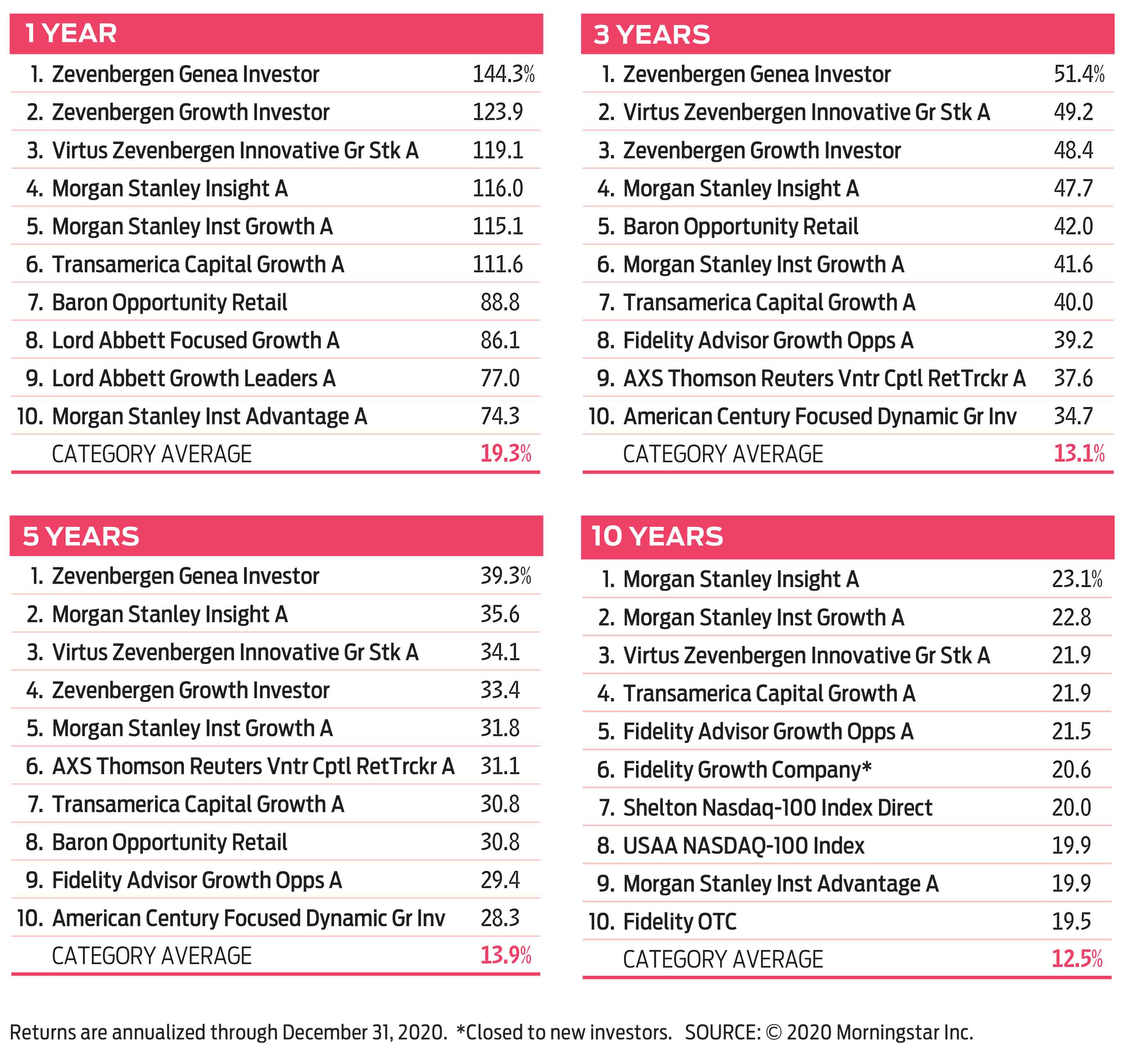

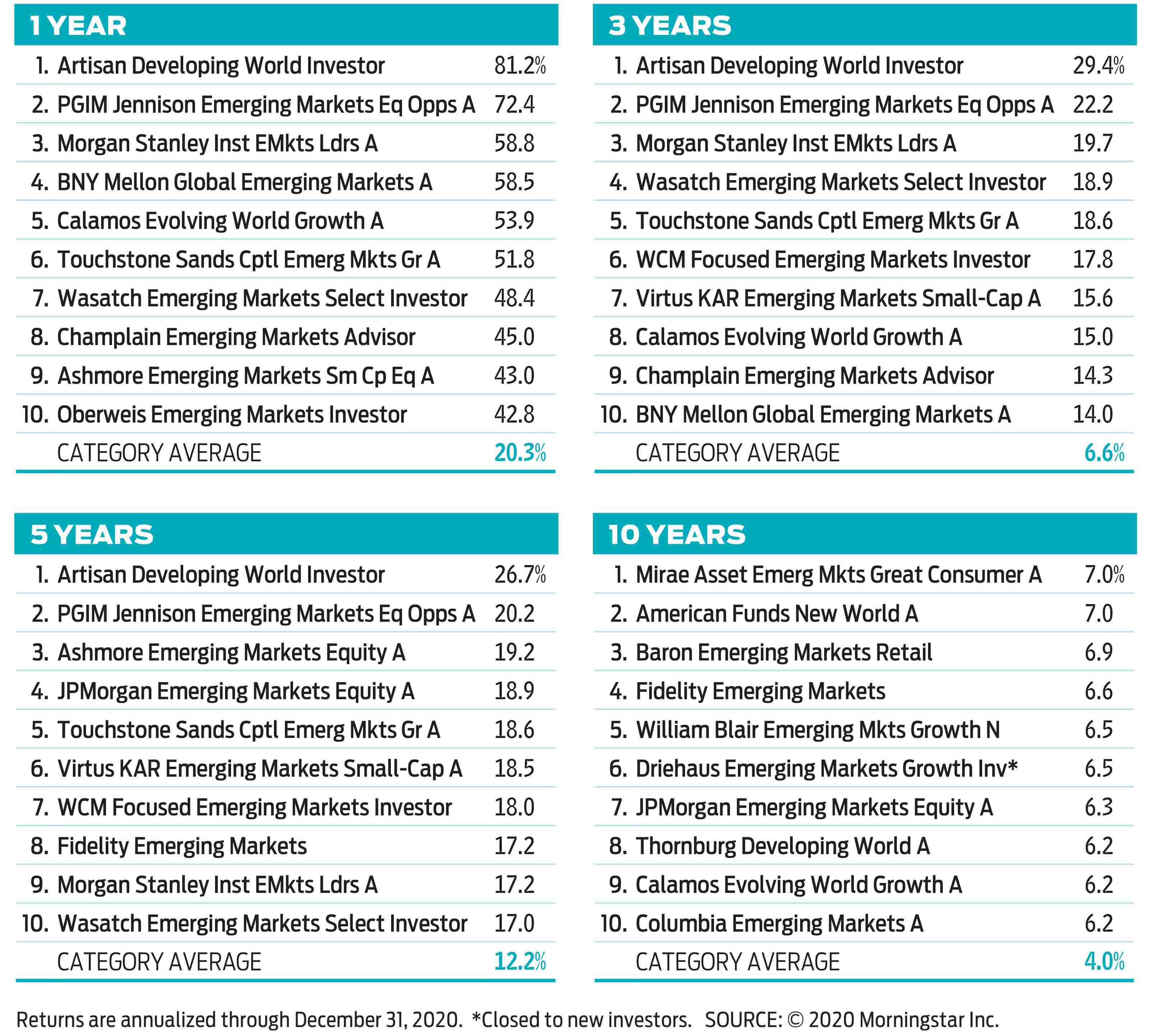

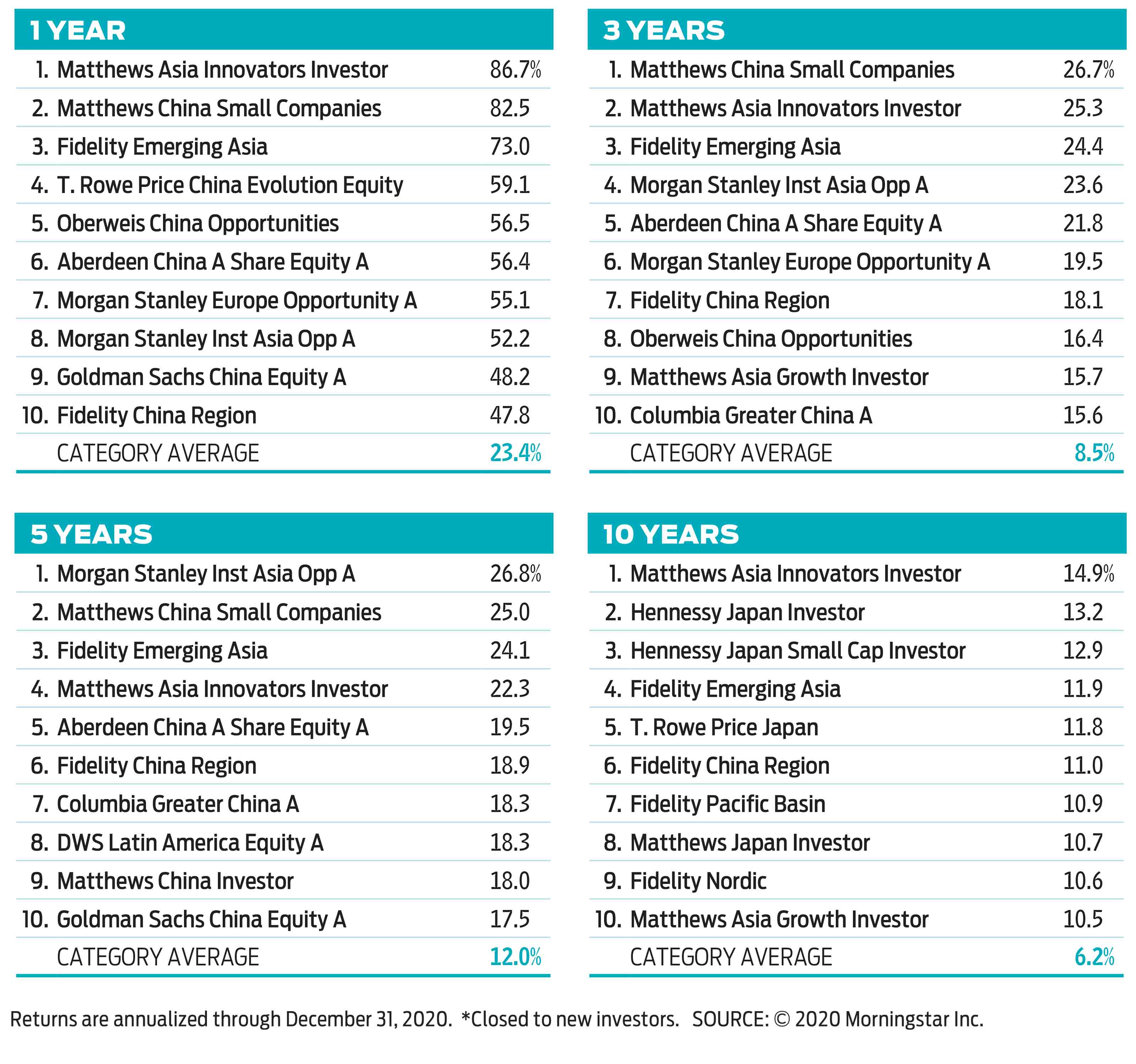

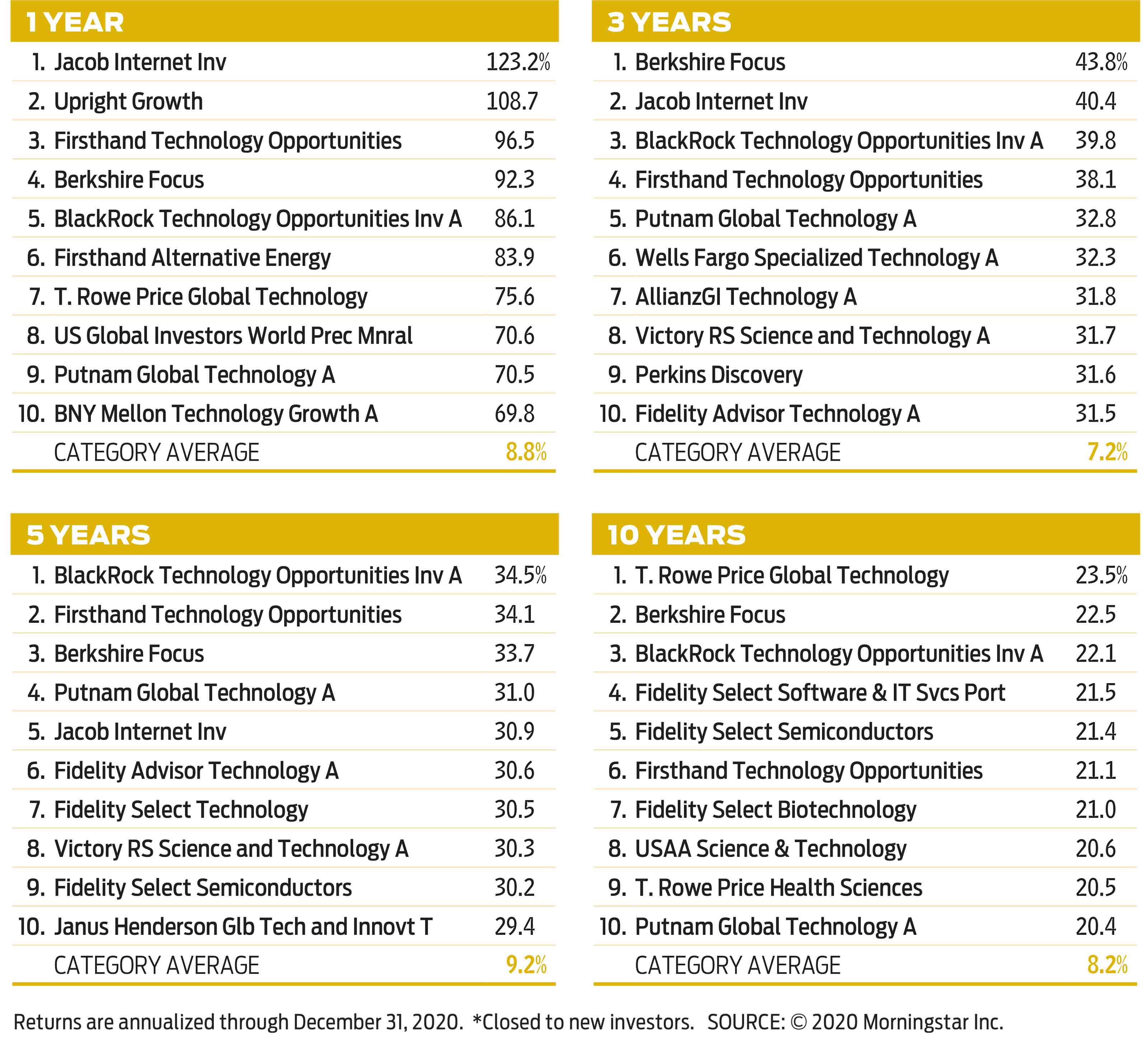

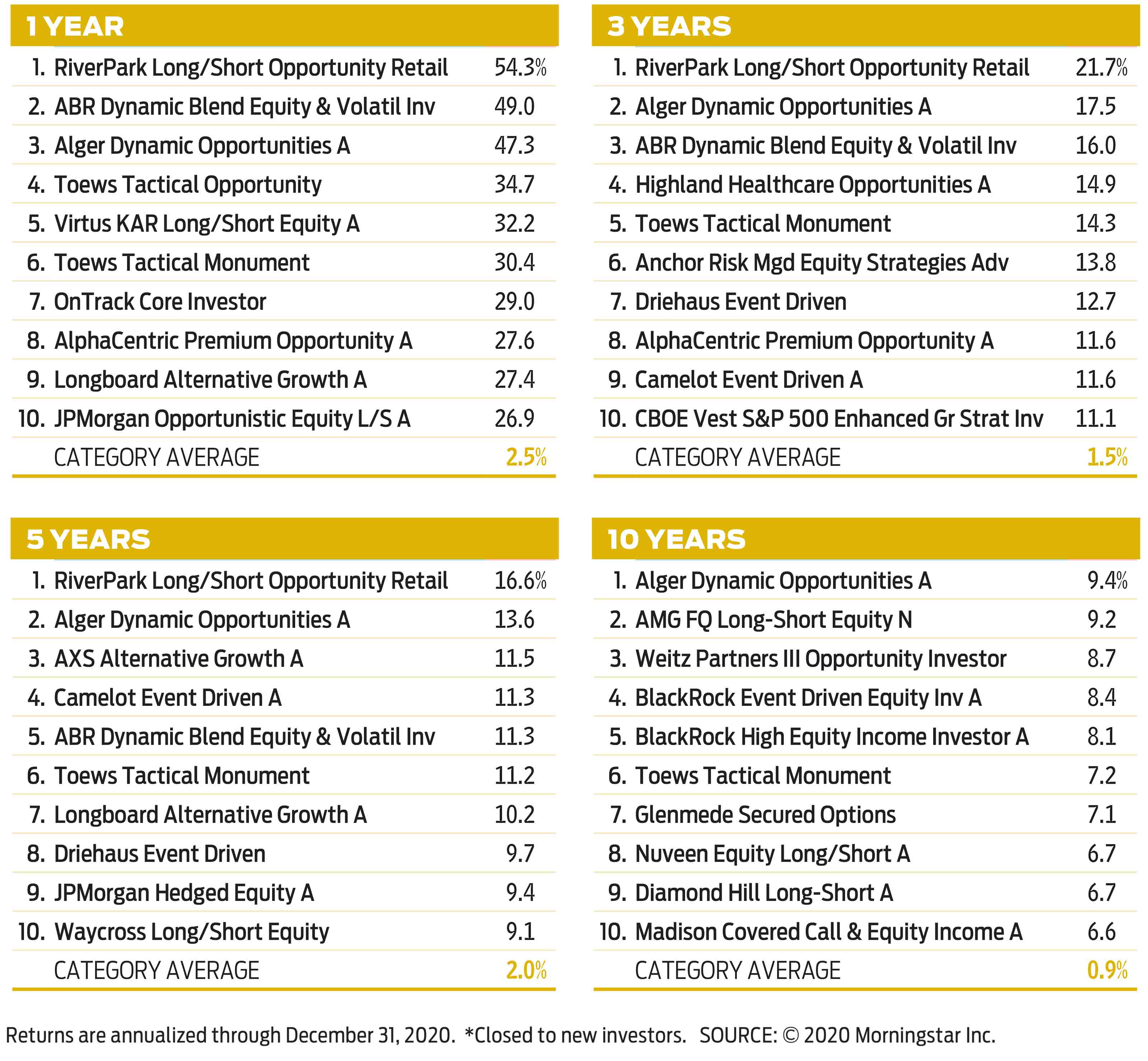

Here are the top-performing stock mutual funds in 11 categories. The list includes only funds with minimum-investment requirements of $10,000 or less, and it excludes leveraged funds, which seek to boost returns with borrowed money, and inverse index funds, which move in the opposite direction of the market. A number of funds in the tables charge a front-end sales fee if you buy them directly from the fund company, but in many cases, you can purchase shares with no sales charge or transaction fee at several discount brokers. The information used to compile these lists comes from financial data firm Morningstar, which determines the categories into which the funds are sorted.

Large-company stock funds

Tech gooses returns.

Large-company funds with big stakes in tech stocks—particularly those benefiting from pandemic-accelerated trends such as the digital transformation of business and cloud computing—were in the sweet spot last year. Baron Opportunity’s focus on disruptive companies, including Amazon.com, Facebook and Zoom, delivered big returns as these fast-growing stocks enabled businesses and people to carry on during the COVID-19 crisis. American Century Focus Dynamic Growth owns 30 to 45 U.S. stocks, zeroing in on rapid-growth firms such as Tesla, Salesforce.com and Square. Zevenbergen Genea, a solid winner over the past one-, three- and five-year periods, targets ground-breaking businesses that it believes can disrupt, grow and evolve for many years. Recent holdings include e-commerce site Shopify and chipmaker Nvidia.

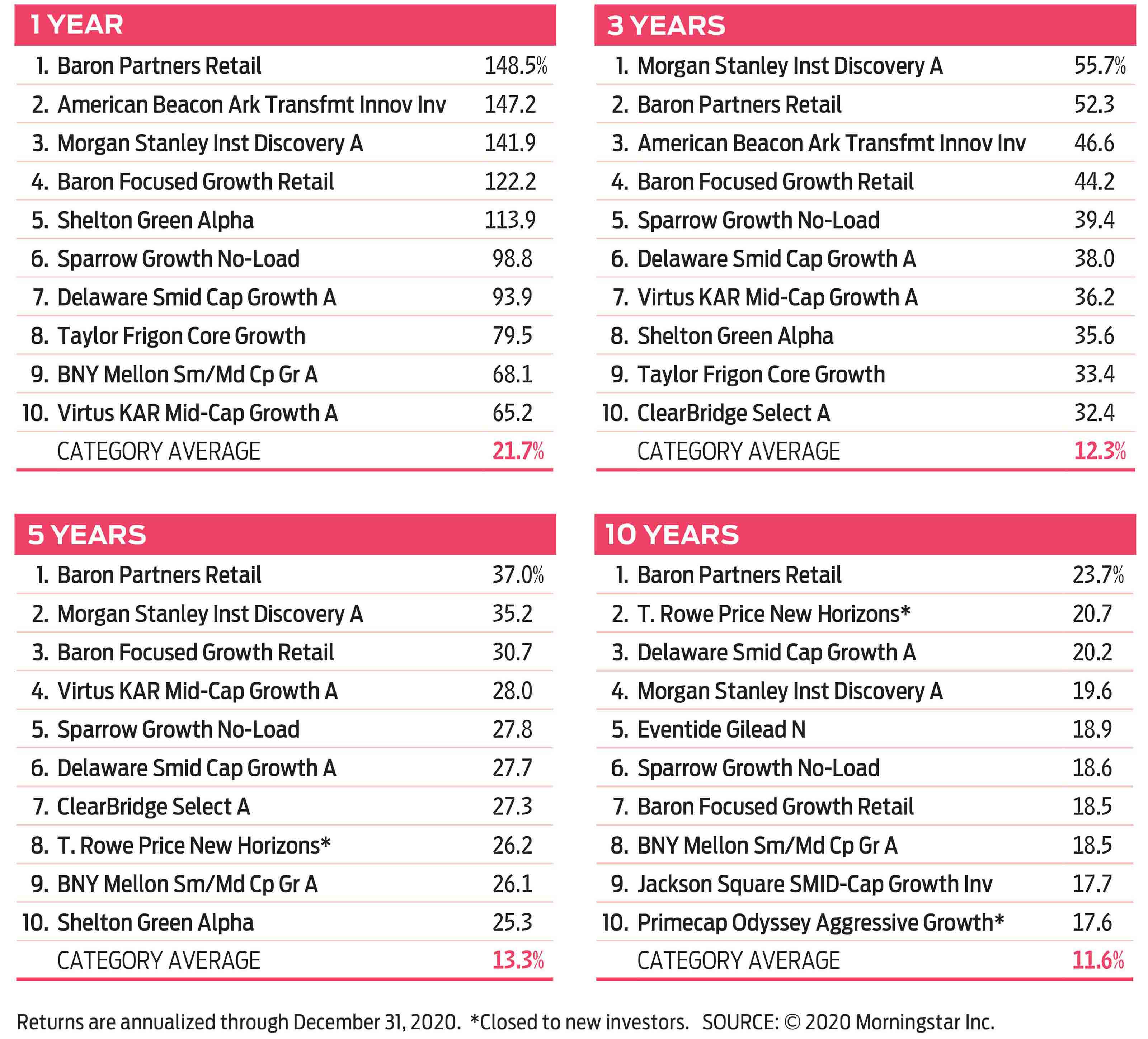

Midsize-company stock funds

A second year of solid gains.

Mid-cap shares delivered respectable gains, even though their benchmark index couldn’t keep pace with big-cap stocks. American Beacon Ark Transformational Innovation loads up on companies with products that are changing the way the world works. Ark Investment Management manager Cathie Wood looks for the next big thing in cutting-edge tech, including DNA sequencing, robotics and artificial intelligence. Holdings include virtual health provider Teladoc Health and workplace communications platform Slack. Sparrow Growth No-Load ranks high over all four periods. Recent holdings include stocks such as Netflix and DocuSign that have above-average prospects for long-term growth. Shelton Green Alpha invests in growth companies that are addressing environmental risk.

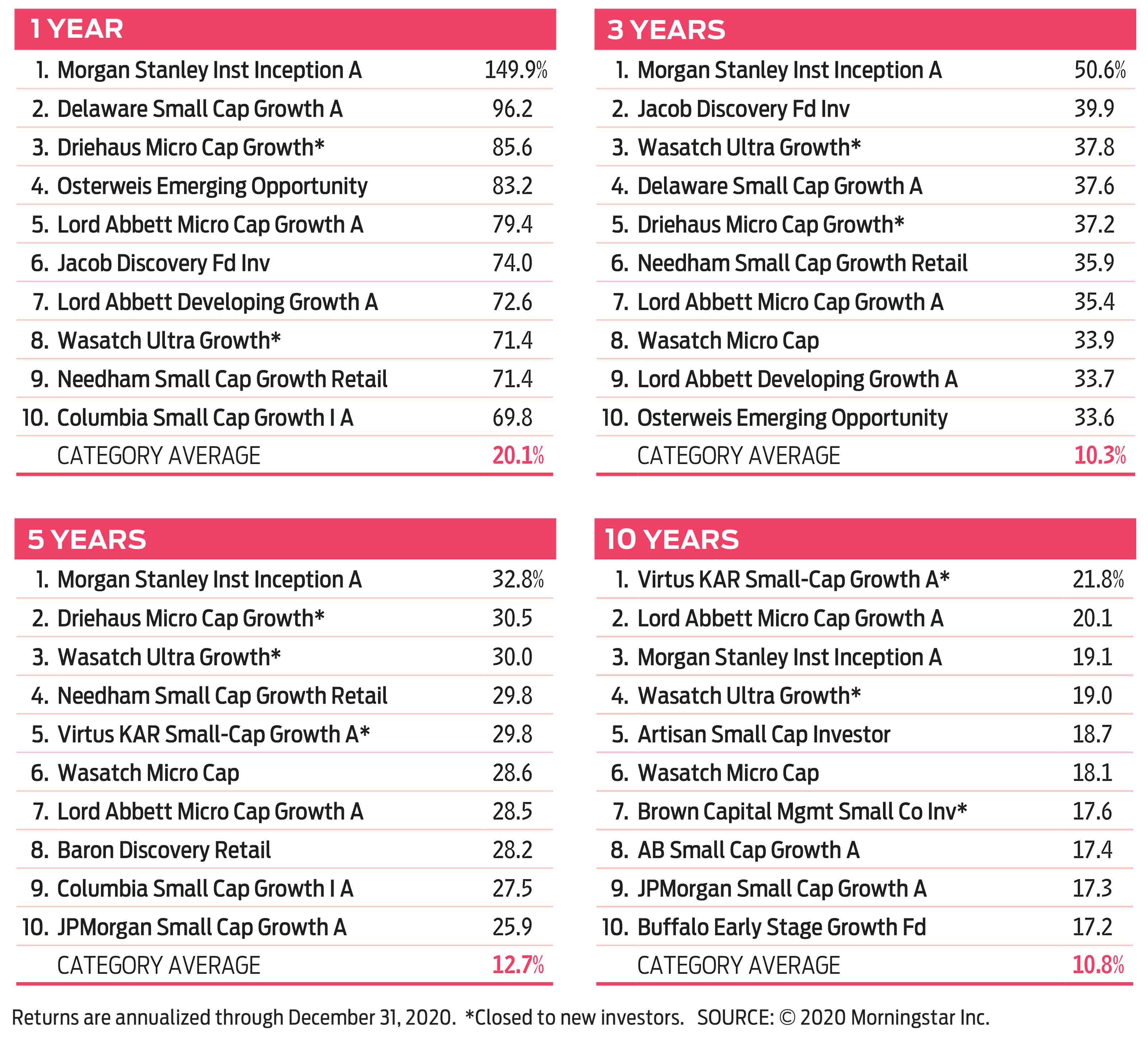

Small-company stock funds

Small caps take the lead.

Stocks in the Russell 2000 small-company index rose 20% in 2020, topping the S&P 500, a benchmark of mostly large firms, for the first time since 2016. Investors appear to be betting that small-cap stocks will be key beneficiaries of an ongoing economic recovery. James Callinan, manager of Osterweis Emerging Opportunity, seeks companies he believes will experience rapid sales and earnings growth—before they are widely discovered. Needham Small Cap Growth, under the helm of Chris Retzler since 2008, looks for small, briskly growing companies that are selling at reasonable prices. The fund has been a mutual fund winner over the past one, three and five years. Baron Discovery continues to deliver by focusing on the long term and buying growth companies with a sustainable competitive advantage.

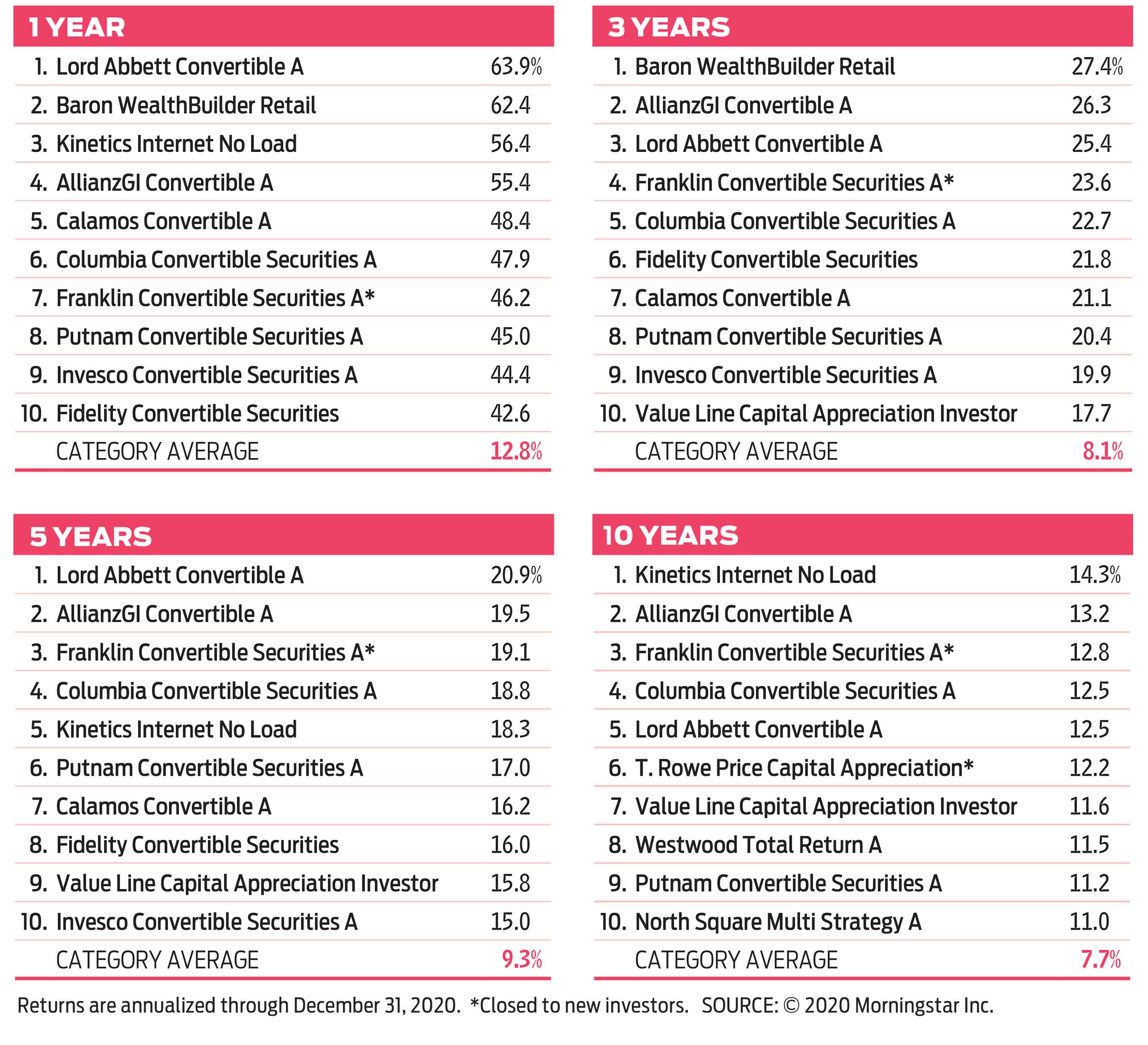

Hybrid funds

Convertibles rule.

Hybrid funds hold a mix of assets, and the group comprises allocation funds and target-date funds—portfolios that typically hold a mix of stocks and bonds. The group also includes funds that invest in convertible securities, which are hybrids in and of themselves—they are bonds or preferred stock that can be converted into common stock. Convertibles tend to be less volatile than the broad market but can post stock-like returns. Fidelity Convertible Securities consistently ranks well, but note that the current manager started in 2016 and is only responsible for the fund’s one- and three-year rankings. A big cash stake in early 2020 helped the fund during the bear market. Allocation fund Value Line Capital Appreciation holds 82% of assets in stocks, 13% in bonds and 5% in cash. It uses the firm’s “timeliness” rankings to find attractive plays.

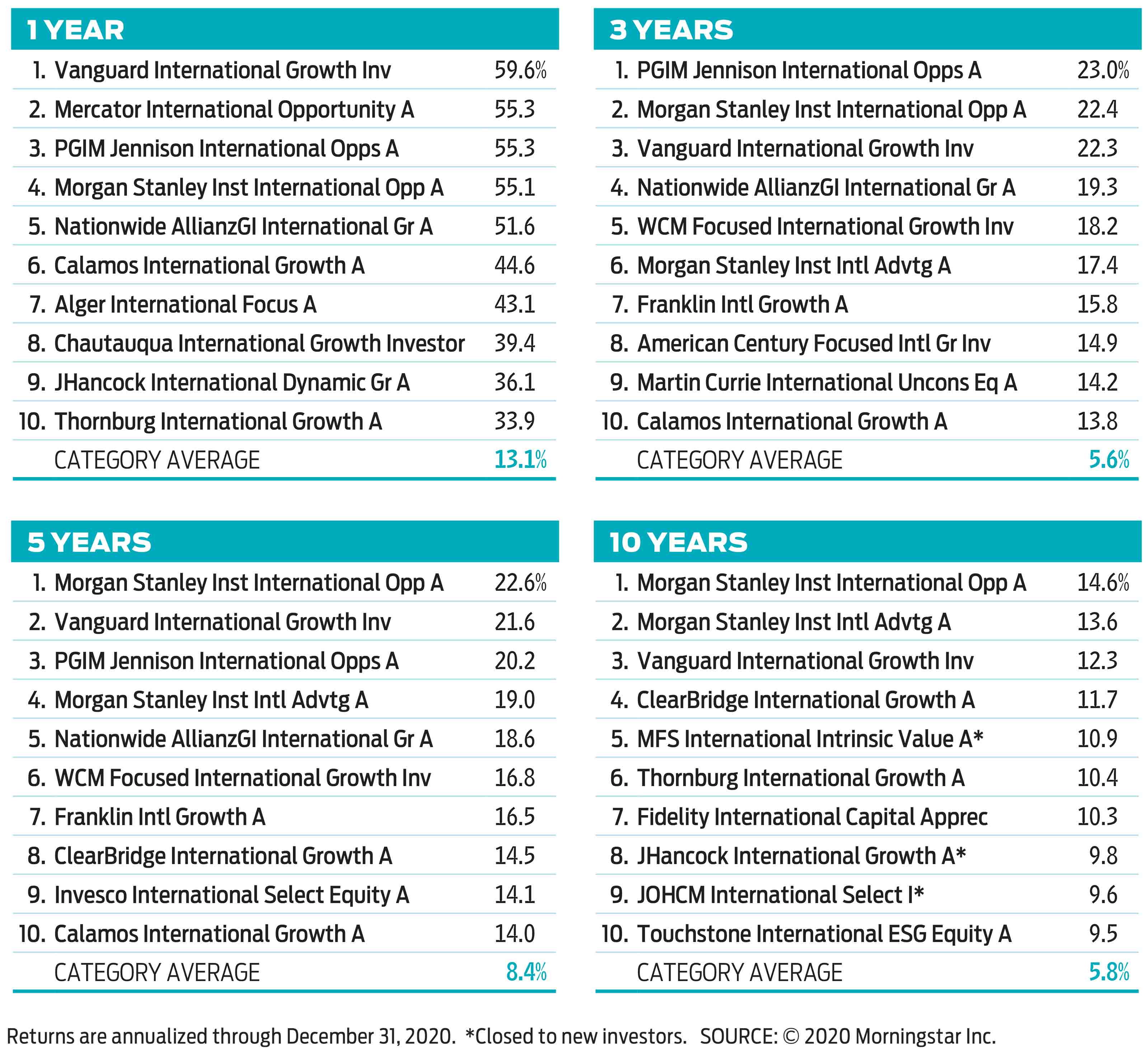

Large-company foreign stock funds

A late-year rally boosts returns.

Many funds in this category charge a load, but not Vanguard International Growth, which ranks among the top 10 performers over all four time periods. Two firms run the fund with slightly different approaches: Baillie Gifford, which manages 60% of the assets, will pay up for stocks with explosive growth; Schroders favors firms that are growing fast but are underappreciated. The fund’s 25% stake in emerging-markets stocks—greater than the category’s average 10%—has boosted returns more recently. WCM Focused International Growth is also a no-load fund, but it charges a relatively high annual fee of 1.26%. Even so, the fund has outpaced its peers in eight of the past nine calendar years. Five managers focus on high-quality firms with demonstrated long-term revenue and earnings growth and a high probability for superior future growth.

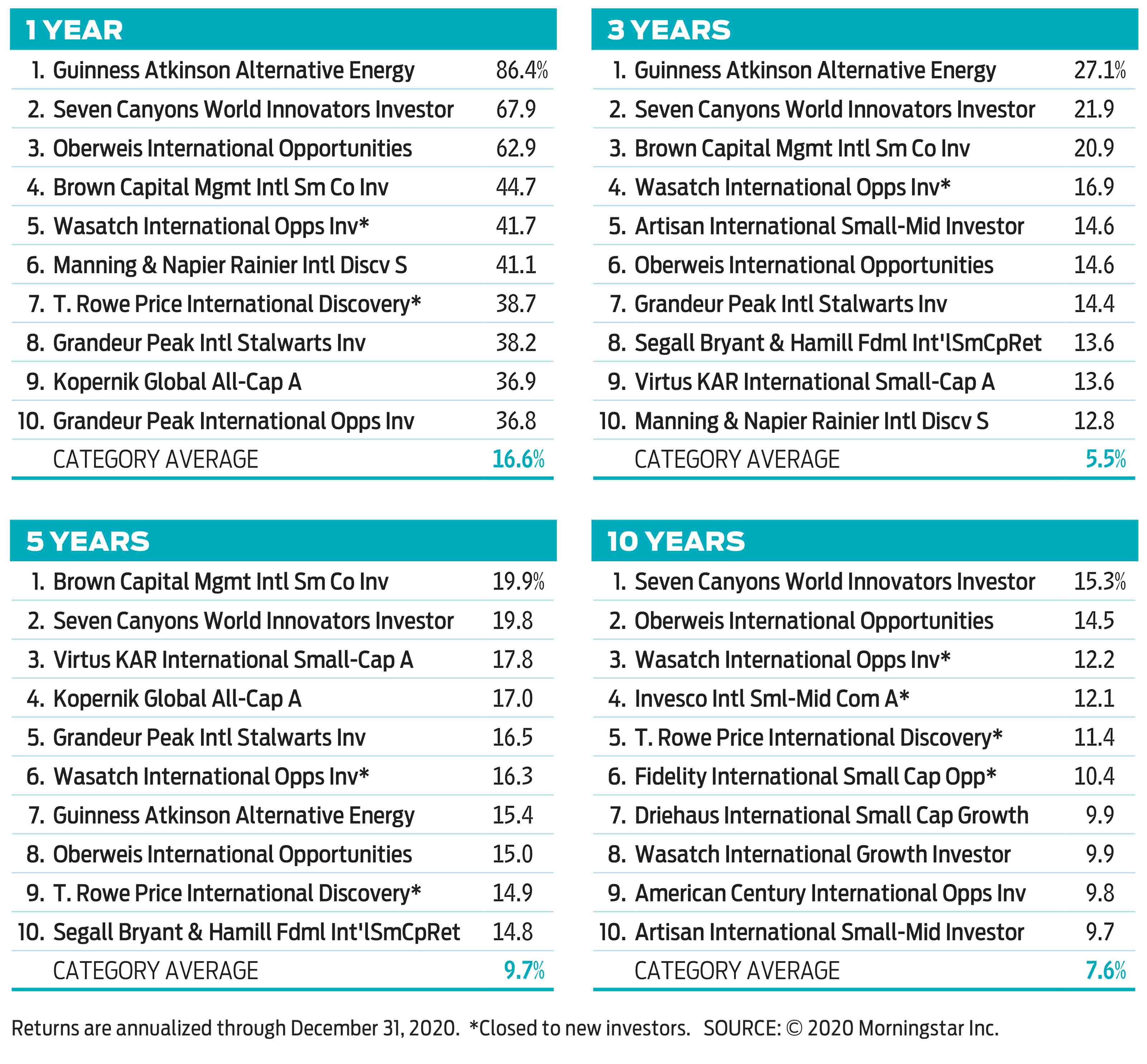

Small- and midsize-company foreign stock funds

At long last, recovery mode.

Shares in small foreign companies had a banner year, but funds that focused on fast-growing firms stood out. The four managers at Brown Capital Management International Small Company favor small, high-quality growth companies, such as Kinaxis, a Canadian supply-chain management, sales and operations software company with a $3.8 billion market value. Artisan International Small-Mid manager Rezo Kanovich is relatively new at the fund, but he previously ran a similar fund at Oppenheimer Funds. Since he started in October 2018, Artisan has outranked 89% of the funds in the category. Or consider Grandeur Peak International Stalwarts. Stocks in the fund have an average market value of $6.4 billion; the U.K., China and Japan are its biggest country exposures.

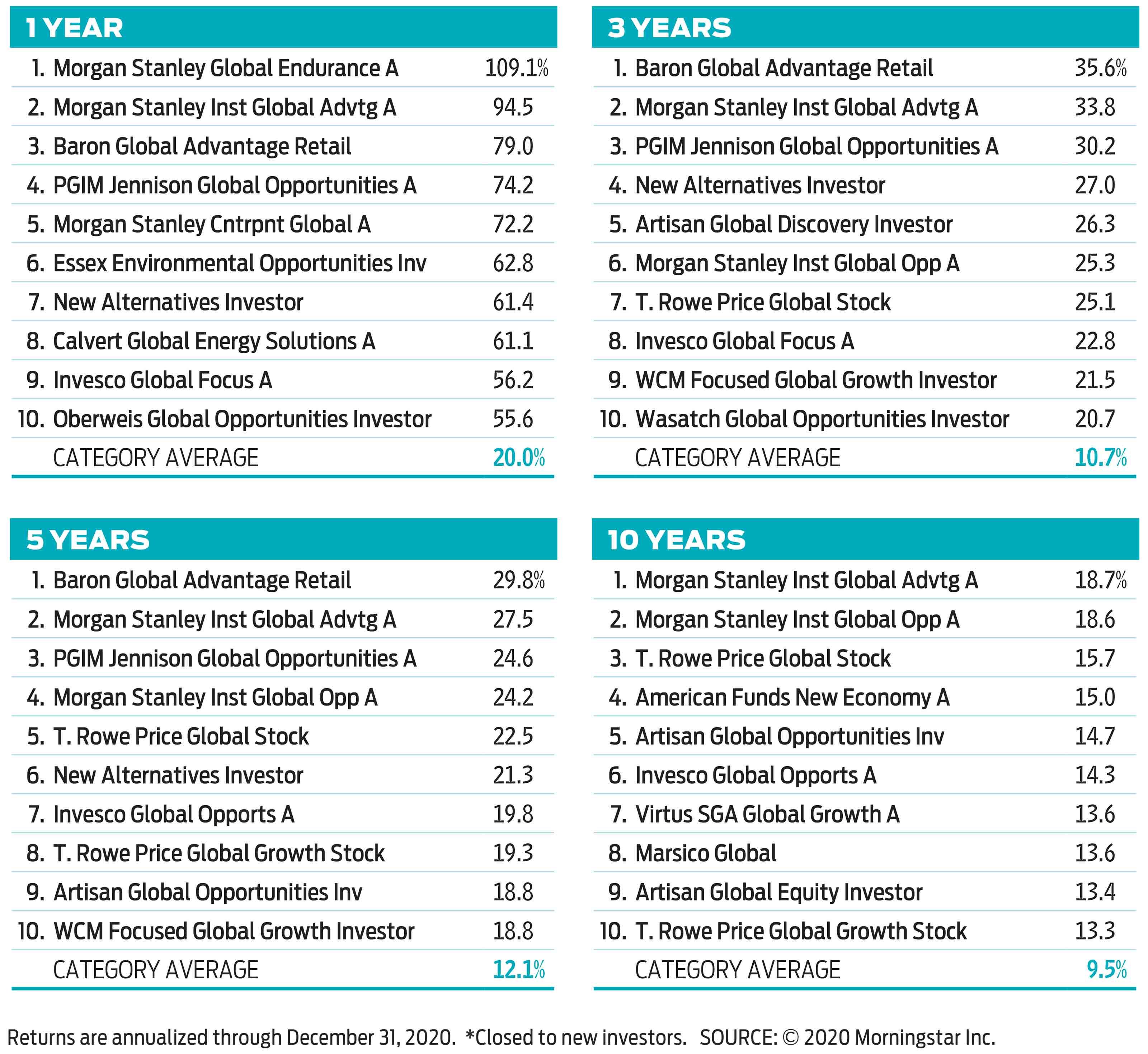

Global stock funds

A tilt toward U.S. growth pays off.

Given all the world’s markets to invest in, global stock funds have done well of late. But the funds that focused on fast-growing companies and held a good chunk of U.S. shares relative to foreign stocks have been the best performers over the past 12 months. Consistent winner Baron Global Advantage targets growing companies with durable competitive advantages. T. Rowe Price Global Stock manager David Eiswert isn’t responsible for the fund’s 10-year record, but he has deftly steered the fund to the top tier of the three- and five-year rankings. Finally, New Alternatives is a socially responsible fund that focuses on small to midsize renewable-energy producers. Almost 60% of the fund is invested in non-U.S. shares. And though 70% of the portfolio is devoted to utilities, the fund also holds stock in other sectors, including industrials and real estate.

Diversified emerging-markets funds

The comeback continues.

After lagging the U.S. in recent years, emerging-markets stocks kept pace with the S&P 500 in 2020 and returned more than 18%. Funds with hefty slugs in Asian countries performed best, as those markets rallied strongly. Morgan Stanley Institutional Emerging Markets Leaders, which you can buy for no fee at several discount brokers, holds nearly 60% of its assets in emerging Asian countries. The fund integrates environmental, social and governance measures into its stock picking. Wasatch Emerging Markets Select has beaten its peers in five of the past eight calendar years. A trim portfolio of 41 stocks favors high-quality growth companies. Baron Emerging Markets, a Kiplinger 25 fund, invests in growth companies of all sizes in emerging economies. China, India and Brazil are its biggest country exposures.

Regional and single-country funds

And the winner, again, is China.

Despite a two-month shutdown in early 2020, China’s stock market finished the year with a 30% gain. Funds that focus on stocks, especially smaller firms, in that country fared best in 2020. The 53 stocks in Matthews China Small Companies have an average $4 billion market value. Top holdings include Joyoung, a Chinese maker of small kitchen appliances, and Hong Kong–based shipping company SITC International Holdings. New fund T. Rowe Price China Evolution Equity invests in small and midsize companies and is off to a spectacular start. For a broader Asian fund, consider Matthews Asia Innovators, which invests in companies based across the region with cutting-edge products or technology. Though China stocks make up 57% of the fund, South Korea, India and Singapore are also among its biggest country exposures.

Sector funds

Partying like it’s 1999.

The year 2020 felt like the tech boom of the late 1990s. The tech-heavy Nasdaq Composite index didn’t eclipse the 86% price gain posted in 1999, but its 44% advance in 2020 was its best year since 2009. Investors flocked to companies that make it easy to work from home, sell products online, protect businesses from cyberattacks and stay entertained without going out. Firsthand Technology Opportunities manager Kevin Landis, who has run the fund since its 1999 launch, buys young tech firms with big growth potential, such as streaming-content providers, web-security players and cloud-computing-software firms. T. Rowe Price Global Technology seeks companies benefiting from rapid advances in technology that offer huge long-term growth prospects. Longtime tech investor Ryan Jacob’s Jacob Internet Fund has performed well over the past five years.

Alternative funds

The long and short of returns.

Alternative funds, a category that encompasses an array of strategies, promise to move differently than the stock market. Some can deliver outsize returns. Lately, long-short funds—which buy stocks the managers like and sell short stocks they don’t—have dominated the charts. Consistent winner Toews Tactical Monument is a long-short fund that invests in stocks, bonds and derivatives to deliver a return similar to large-company stocks with less volatility. RiverPark Long/Short Opportunity manager Mitch Rubin invests part of the fund in firms with above-average growth prospects (Amazon.com) and sells short stocks in declining industries (Western Union). Driehaus Event Driven (not a long-short fund) buys stock of small and midsize companies trading at a discount because of a corporate special situation, such as a merger, spin-off or restructuring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.