China Shares Still Hold Promise

The outlook for profit growth is strong, but the shares are cheap.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

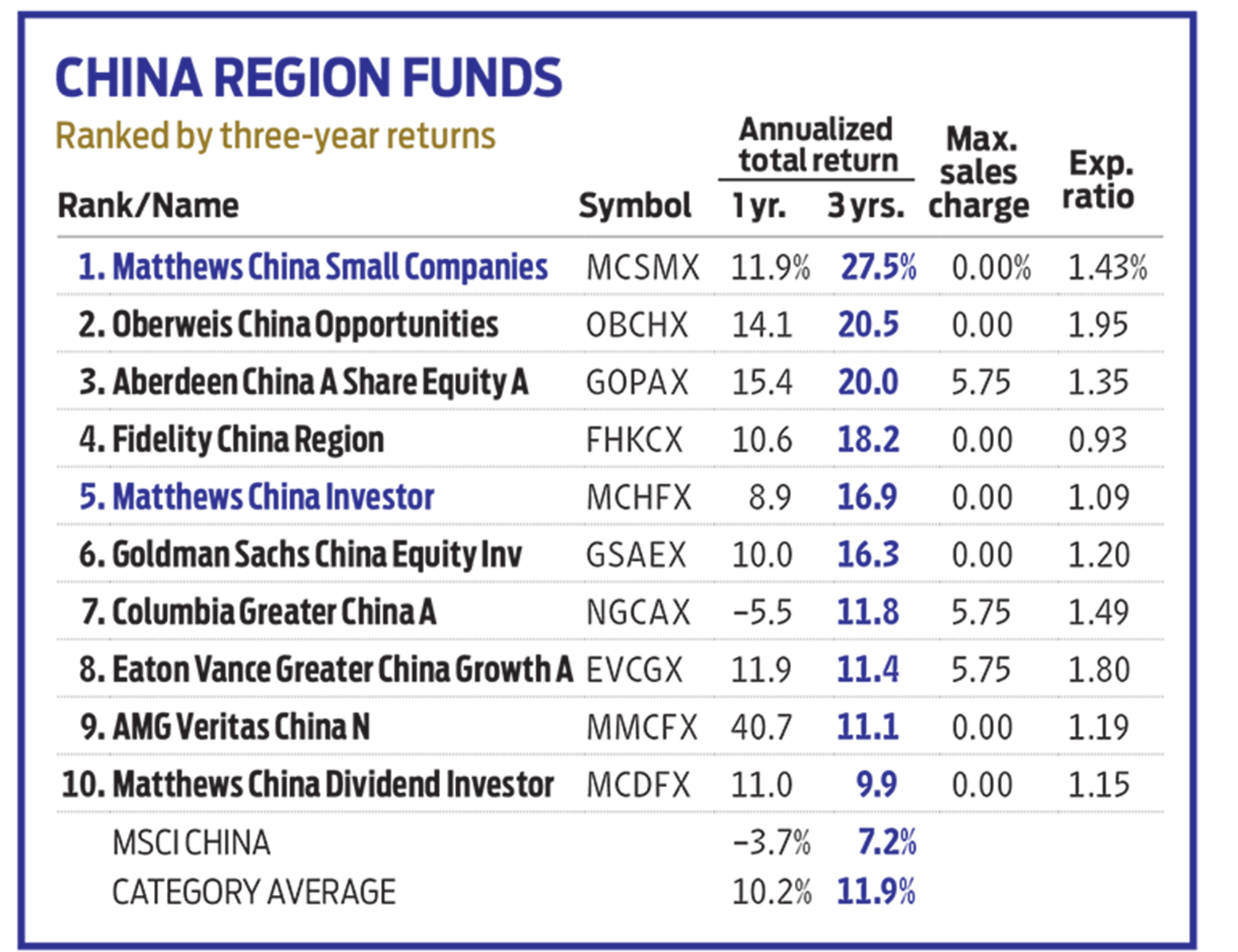

Some Chinese stocks got thumped recently when investors were spooked by actions China's government took to rein in the country's tech and tutoring companies. But the supervisory moves were no surprise to old China hands, says Winnie Chwang, comanager of Matthews China (MCHFX) and Matthews China Small Companies (MCSMX).

"Regulation in China is part and parcel of a macro-reform agenda that's ongoing," she says. "We do not think this is an effort to stifle private business entrepreneurship in China."

Foreign investors dominated the sell-off, which was concentrated in well-known tech stocks such as Alibaba Group Holdings (BABA) and Tencent Holdings (TCEHY). The more domestically focused China A-share market gained a robust 16% over the past 12 months, while the broad China market, as measured by the MSCI China Index, lost 4%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Chwang, who manages both funds with Andrew Mattock, knows all about the A-share market. That's the focus at the Matthews China fund. The managers comb through roughly 2,200 candidates to find growing, high-quality companies of any size trading at reasonable prices. Once they've narrowed the list to about 150, they like to get a 360-degree view of a company before settling on some 35 to 45 stocks.

The bright spot of late is the managers' other fund, Matthews China Small Companies, which has a chart-topping 26% five-year annualized return. The managers follow the same investment process with the Small Companies fund as with the China fund, but they focus on firms with a market value between $1 billion and $5 billion.

Fast-growing technology and healthcare companies dominate the Chinese small-cap market, says Chwang, so close to 30% of the fund's assets are invested in those sectors. "Entrepreneurship is important to China's economic engine," she says. "These small companies contribute 60% to the country's overall gross domestic product growth."

Chwang expects Chinese stocks overall to post earnings growth of 10% to 15% over the next three to five years. And shares are relatively cheap: China stocks trade at 14 times expected earnings for the year ahead; U.S. shares trade at 22 times earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: U.S. Savings Bonds

Bond Basics: U.S. Savings Bondsinvesting U.S. savings bonds are a tax-advantaged way to save for higher education.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.