Should You Use a 25x4 Portfolio Allocation?

The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After a disastrous market in 2022, many strategists claimed that the 60/40 portfolio, which holds 60% of assets in stocks and 40% in bonds, was dead. In its place, some strategists suggested investors consider the 25/25/25/25 portfolio, or 25x4 portfolio, which calls for dividing your assets evenly into stocks, bonds, commodities and cash.

"We believe the 25/25/25/25 portfolio will outperform the 60/40 portfolio in the 2020s," says Michael Hartnett, a chief investment strategist at BofA Global Research.

The simplest reason is that interest rates and inflation are higher than in decades past. The 60/40 portfolio worked best when inflation and interest rates were low or falling, says Hartnett. But this decade he expects higher inflation and interest rates, with added volatility, creating market conditions that are well suited for cash and commodities to outperform bonds and stocks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

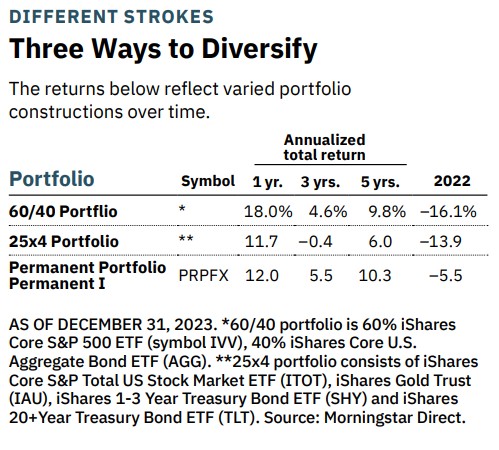

So far, though, that hasn't played out. Although the 25x4 portfolio did marginally better than a 60/40 portfolio in 2022, over longer periods, it has lagged. A 60/40 portfolio has gained 4.6% annualized over the past three years; a 25x4 portfolio has lost 0.4% on average per year.

Think twice before switching to the 25x4 portfolio

In short, don't count the 60/40 portfolio out yet. "Over the years, the 60/40 portfolio has held up for investors, and it's actually provided wonderful returns with low risk levels," says Jan Holman, director of adviser education at Thornburg Investment Management.

This isn't the first go-around for the 25x4 portfolio. It got its start decades ago by way of Harry Browne, the late investment adviser and two-time Libertarian Party presidential candidate (in 1996 and 2000). In Browne's so-called Permanent Portfolio strategy, investors held 25% in cash, 25% in gold, 25% in long-term bonds and 25% in stocks, rebalancing annually. The idea was that the four asset classes would help minimize risk no matter the market or economic condition.

Browne helped develop a no-load mutual fund tied to the 25x4 strategy called the Permanent Portfolio Permanent (PRPFX), which launched in 1982. But it's not a straight-up version of his approach. Instead, the fund is more "dynamic," says fund manager Michael Cuggino.

It targets an allocation of 30% stocks, 25% precious metals (20% in gold and 5% in silver) and 45% in bonds and cash (10% of which is denominated in Swiss Francs). The stock side of the portfolio includes a mix of real estate and natural-resources stocks, such as Prologis (PLD) and Exxon Mobil (XOM), as well as aggressive growth stocks, such as Nvidia (NVDA) and Meta Platforms (META). "The fund's goal is to outpace inflation," says Cuggino, a fund manager since 2003.

The fund's annualized 5.7% return over the past decade has indeed beaten the 2% average inflation rate over the period. And it has been far less volatile over that time than its peers (moderate allocation funds), which typically hold about 60% of assets in stocks. But 63% of its peers did better, generating an average 6.1% annualized 10-year return.

That's evidence that it's important to think through any allocation strategy carefully before you implement it. "Asset allocation should always be decided on an individual basis and in the context of a comprehensive financial plan, not based on a gimmick," says Gordon Achtermann, a certified financial planner in Fairfax, Virginia. As an alternative, consider a low-cost target-date fund. "You won't beat the market," he says, "but you won't get badly hurt, either."

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Yes, Artificial Intelligence Stocks Are Booming

Yes, Artificial Intelligence Stocks Are BoomingIt's fair to ask about the latest tech boom, "Is it really different this time?"

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.