Sports Memorabilia Appear to Have Arrived as Investing Class

The world's most prestigious auction house recently had a Sports Week in which it auctioned off sports collectibles.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

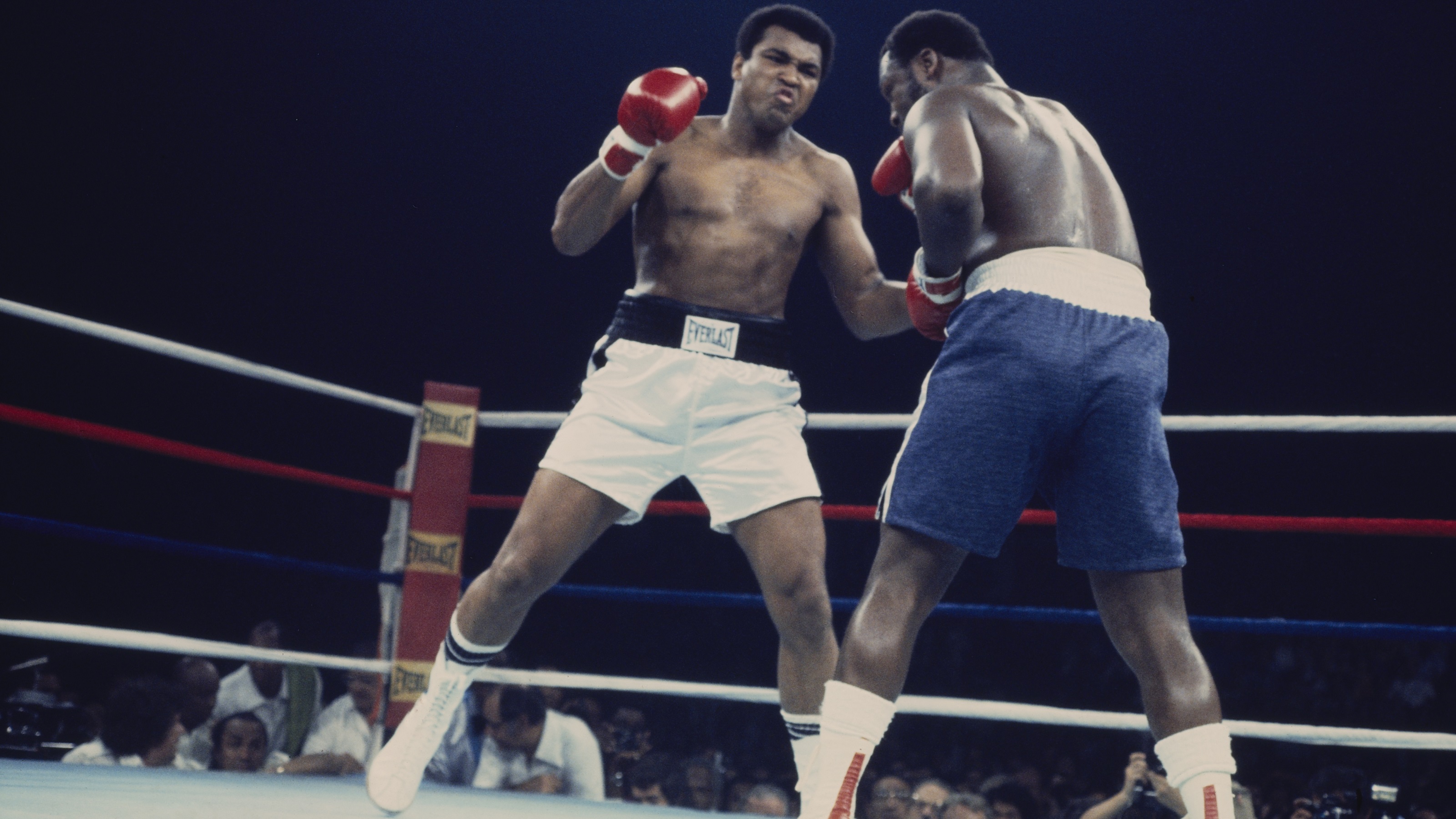

Sotheby’s, the legendary auction house, wrapped up Sports Week in April, its first dedicated foray into sports memorabilia. The piece de resistance of the auction: a signed pair of boxing trunks that Muhammed Ali wore during his “Thrilla in Manila” bout against Joe Frazier.

The fact that Sotheby’s, an auction house whose past sales include a $157.2 million Modigliani and a $139.4 million Picasso, has stepped into the ring with sports memorabilia is a clear declaration: Sports collectibles have made it to the big leagues in investing.

While sports memorabilia has, for the last several decades, generated some major sales and notable headlines, it has largely been viewed as the interest and concern of only a passionate few.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We know that sports fanatics might be willing to spend hundreds of thousands of dollars on a baseball card or Ali’s sweaty white trunks, but would — should? — anyone else be willing to invest?

The answer from Sotheby’s is clear: Yes. (And for major dollar amounts, too.)

While Sotheby’s has traded in some historic sports memorabilia before — its $10 million auction of Michael Jordan’s famed Last Dance game-worn jersey set a record in 2022 — Sports Week is an escalation of that trend.

A growing market

Since the pandemic, demand for sports collectibles has reached new heights, and valuation in the market is expected to have a CAGR of 21.8% over the next decade. Collectors who have held on to memorabilia are now seeing massive returns.

For example, a pair of Jordan’s sneakers worn in his “flu game” during the 1997 NBA finals first went up for auction in 2013, where they sold for a record $104,765 — the most ever paid for a pair of game-worn shoes. But when they came up again in 2023, the shoes sold for $1.38 million. By then, even that was not a record.

It appears we’re witnessing the emergence of a new blue-chip investment class. For the discerning investor, sports memorabilia may be part of a new investment strategy.

Part of it is straightforward logic: The return on sports memorabilia has outpaced the S&P 500 in recent years. If you’re an investor and would like to allocate a portion of your investment money, even a few thousand dollars, investing in a baseball card or other collectibles could be part of a sound allocation strategy.

In recent years, I’ve talked to more than one high-net-worth individual who has chosen to move into sports memorabilia; they’ve never owned a single collectible before, but now have acquired several multimillion-dollar trading cards.

For them, it’s not their passion. It’s an investment opportunity that has shown incredible returns.

Jumping into the collectibles pool

As these wealthy individuals have seen the success that more humble, passion-based collectors have had with certain items, they’ve jumped into the pool, driving up demand and fueling some of these sky-high valuations.

This isn’t a bubble. Sotheby’s wouldn’t be engaging in sports memorabilia at this scale if there wasn’t significant, deep-pocketed demand from its customer base. And the market has been growing for decades.

Back in 1991, hockey great Wayne Gretzky and a business partner bought a premier T206 Honus Wagner card. The near-mint-condition card was sold to Gretzky for just over $450,000. At the time, many people — myself included — thought Gretzky was crazy for spending that much money on a baseball card.

But when it sold again in 2007 — even after an FBI investigation over fraud concerns about the card’s condition — it went for a cool $2.8 million.

Sports collectibles are appreciating like fine art in the modern market. Collectors who purchase and hold on to their piece for multiple years can expect a steady return.

Who you collect is critical

Also like art, who you buy matters.

There’s a difference between purchasing a Van Gogh and some up-and-coming artist — maybe they make it big, maybe they don’t. Similarly, with sports collectibles, items owned by GOATs (greatest of all time) are going to be premium investments. Memorabilia linked to Jordan, Babe Ruth and Ali all have proven demand, even compared to other legends like LeBron James or George Foreman. It’s not that a Larry Bird-worn jersey won’t appreciate, but it’s less likely to fetch the multiple-million-dollar hype that a Jordan jersey will. And Ruth’s jersey, hitting the auction block in August, is expected to fetch $30 million.

Obviously, none of this implies that sports collectibles are some sort of infallible asset class, or without a material degree of risk.

Like all collectibles, sports memorabilia is not going to be a liquid asset. In order to maximize investment, cashing out will require multiple months and working with an auction house. The value of the asset is also subject to the whims of the broader macroeconomic environment, meaning that in times of downturn, demand can evaporate.

There’s another unique risk, too, with sports collectibles: Because the market is growing so dramatically, valuations for certain items can at times be wildly off, making insuring the item more complicated. A pair of Ali ring-worn trunks purchased 10 years ago for $400,000 may actually be worth $4 million at auction today, but if no similar Ali trunks have changed hands in a decade, it’s impossible to say for certain.

As major auction houses turn their attention to sports memorabilia, the moment for collectors appears to have arrived. For the right investors, it may be a new blue-chip opportunity.

Related Content

- Provenance Plays a Vital Role in Car Collecting

- Collectibles Prove to Be a Solid Asset Class for Investors

- Collectible Vintage Photos Emerge as Investable Asset Class

- How to Help Your Kids Profit From Their Collectibles

- You Can Now Invest in Hot Private Tech Companies: Should You?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Ruggie, ChFC®, CFP®, founded Destiny Family Office, a Destiny Wealth Partners firm, to help clients manage the increasing complexities inherent in their business and personal lives. He has identified three key areas where his firm can make a significant difference: presenting a compelling sphere of investments, including alternative, direct and co-investment opportunities; creating a special emphasis on high-end collectors whose collections signify significant alternative investments; and strengthening the firm’s private trust capabilities. Ruggie has become one of the most respected financial advisers in the industry, receiving national recognition and rankings including: 7x Forbes Best-in-State Wealth Advisors (including 2024; #1 N Florida), InvestmentNews Awards RIA Team of the Year (2024), Forbes Top 250 RIA Firms (2023), Forbes Finance Council since 2016, 12x Barron’s Top 1200 Financial Advisors (including 2024), InvestmentNews Top 75 Fastest-Growing Fee-Only RIAs (2023), 12x Financial Advisor Magazine America’s Top RIAs (including 2024), 3x Family Wealth Report Awards Finalist (2024), USA Today Best Financial Advisory Firms (2023).

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.