UBS: Sell Kohl's, Macy's, Buy "Go It Alone" Brands

COVID-19 has done more damage to department stores like KSS and M than the market realizes, forcing brands to set themselves apart.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

UBS on Tuesday issued downgrades for retail stocks Macy’s (M, $6.80) and Kohl’s (KSS, $22.33), but in so doing also laid out the new operating blueprint for fashion brands.

"To deliver steady long-term growth, we believe brands can no longer rely on Malls or Dept. Stores to drive traffic," a UBS analyst team led by Jay Sole writes. "Brands have to generate their own audiences and become destinations."

"Premium" brands should be able to operate in a virtuous cycle that help them at the top of the retail food chain:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- A strong value proposition earns high gross margins.

- High gross margins help a company build a successful direct-to-consumer operation.

- A strong DTC business lets brands better control inventory and their own brand image.

- Customer loyalty follows, driving strong returns.

- The company can then reinvest those returns to keep the cycle moving.

UBS pinpoints eight Buy-rated stocks it thinks can pull off what it calls a "Go It Alone" model:

- Nike (NKE, $98.36), $127.00 PT

- Levi's (LEVI, $12.15), $23.00 PT

- Skechers (SKX, $29.60), $32.00 PT

- American Eagle (AEO, $10.35), $14.50 PT

- PVH (PVH, $49.02), $107.00 PT

- Capri Holdings (CPRI, $16.31), $26.00 PT

- Canada Goose (GOOS, $22.63), $30.00 PT

- Deckers Outdoor (DECK, $201.30), $250.00 PT

Indeed, Nike on Wednesday made several changes to its senior leadership team to "support the company's Consumer Direct Acceleration (CDA)" as the athletic apparel company continues its shift to a more direct-sales-focused strategy.

UBS also initiated a few stocks at Neutral, saying "we lack lack conviction these companies will be able to 'Go It Alone' in the future."

- Crocs (CROX, $35.83), $40.00 PT

- Gildan Activewear (GIL, $16.81), $16.00 PT

- Steve Madden (SHOO, $22.34), $23.00 PT

- Kontoor Brands (KTB, $17.42), $20.00 PT

As for Macy's and Kohl's, the thesis is no surprise. While Wall Street's outlook on department stores wasn't high in the first place entering 2020, the COVID-19 pandemic has swiftly eroded their businesses and accelerated online buying trends. It has also slammed their stocks: KSS is off 56% year-to-date; M stock has lost a flat 60%.

Importantly, UBS says that they're not factoring in the same comeback in retail that much of the market seems to be.

"Our conversations with investors suggest many are already bearish on Department Stores," Sole's team writes. "However, most think FY21 will be a rebound year as the pandemic ends. While we agree the pandemic ending will help, we don't think it will get Department Store earnings close to FY19 levels.

UBS's analysts see Macy's stock declining to $3.00 per share (~56%) over the next 12 months or so, and Kohl's stock falling to $14.00 (~37%).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

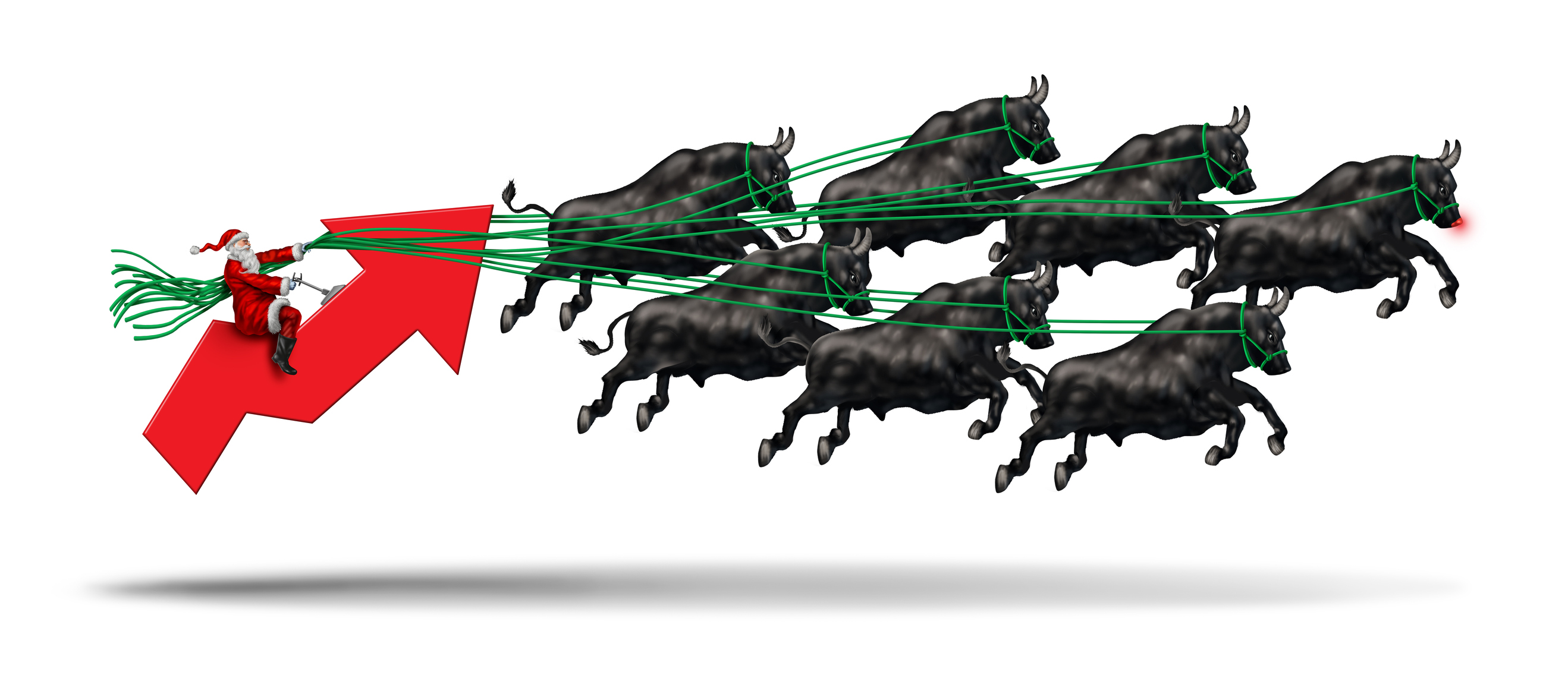

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.