18 of the Market's Most Heavily Shorted Stocks

Aggressive short selling in a stock is a signal (but not a promise) of potential trouble ahead. Here are 18 of the most heavily shorted stocks right now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Short selling gets a bad rap. Short sellers are sometimes seen as vultures, gleefully making money during the darkest times for some companies. And when times get tough, they are often smeared as manipulators of the market.

However, short selling has a long history, and academic research proves these tactics are an important part of price discovery for markets.

So what is short selling? Put simply, it's borrowing shares of a stock or ETF so you can sell them first, then hoping it declines so you can buy shares back at a lower price in the future, thus generating a profit. And rather than moralizing over the nature of it, wise investors should view short selling as one more data point to explore in their research, and view heavily shorted stocks as particularly interesting.

By comparing the raw number of shares sold short with the overall number of shares a company has available to trade, investors can get a quick take on what percentage of the current interest in the stock is coming from bearish investors vs. bullish ones.

It's worth pointing out that like any measure, short interest in a stock is not a foolproof sign it will stumble. There is ample evidence that bearish investors can be wrong. And unlike buy-and-hold investors who can just sit on a paper loss and hope conditions change, short-selling bears who booked the sale first must buy shares back for steep losses and cover their risky trade whether they like it or not. This can lead to a phenomenon known as a "short squeeze," in which buying begets more buying as more short sellers are forced to bail out of their positions.

Here are 18 of the most heavily shorted stocks on Wall Street right now. For each of these companies, total short interest by negative investors represents at least a third of the "float," or shares available for regular trading on public markets. But in many cases, it's far more.

Data is as of July 30. Short interest data provided by S&P Capital IQ. Companies listed in reverse order of percentage of tradable shares held short.

Opko Health

- Industry: Diagnostics and research

- Market value: $4.0 billion

- Percentage of tradable shares held short: 36%

Diagnostics and pharmaceutical firm Opko Health (OPK, $5.91), one of the largest stocks on this list by any measure, also boasts one of the highest raw totals of short interest: nearly 137 million shares are promised to bearish investors betting on the downside. That represents nearly 4 in 10 shares in the "float," or shares available for trading – lower on a percentage basis than other stocks on this list, but a significant tally nevertheless.

Opko has ramped up steadily in 2020 after starting the year at under $2 a share, to its price at nearly $6 per share, as Wall Street fell in love with the short-term potential of its clinical laboratory and testing services amid the coronavirus pandemic. Much of this surge has been priced in and the realities of OPKO's capacity have been revealed, so there are clearly those who are now expecting the stock to take a tumble from its current perch near two-year highs.

OPK shares have shaken out a few short sellers, however. Opko's percentage of tradable shares held short was around 50% recently, but the stock's more recent success has knocked that number down to 36%.

Macy's

- Industry: Specialty retail

- Market value: $1.9 billion

- Percentage of tradable shares held short: 46%

One of the most popular names among short-sellers in the last few years has been embattled department store Macy's (M, $6.22).

A host of trends have worked against this once-iconic brand in recent years. That includes a general move towards more spending online and a specific company-wide plan to cut back in recent years on both physical locations and capital spending to keep the remaining Macy's stores looking fresh.

That would be a bad enough situation, but the COVID-19 pandemic in 2020 has created even bigger headaches for retail. Aside from the practical concerns about in-store shopping and weaker consumer confidence, the reality is that women's apparel, accessories and cosmetics make up more than 60% of sales – and with remote work causing many professionals to spend less time in expensive shoes and more time in yoga pants, things are looking nasty for Macy's stock.

Although shares have already cratered from highs of more than $23 a share last summer to the $6 range at present, UBS recently downgraded the stock to Sell with a meager $3 price target that will surely energize the bears.

Madrigal Pharmaceuticals

- Industry: Biotechnology

- Market value: $1.7 billion

- Percentage of tradable shares held short: 49%

At first blush, Madrigal Pharmaceuticals (MDGL, $106.95) doesn't look quite as bad as many of the rather disappointing companies on this list. Like many clinical-stage biopharmaceutical companies, MDGL does run at a steep loss as it focuses on the development and commercialization drugs for various cardiovascular and liver conditions. But again, that's not altogether uncommon, and the raw short interest of less than 3 million shares at present doesn't seem particularly noteworthy.

The challenge, however, is that MDGL stock isn't very common. There are only about 15.4 million total shares outstanding for this company, and about two-thirds of that is tied up via insiders and institutions that aren't actively trading. As a result, Madrigal is a good example of a stock with a small "float" of available shares – and when even a modest amount of negative traders target the stock via short-selling, they can have significant influence on pricing.

But shares have jumped more than 17% in 2020; people short selling Madrigal have been on the wrong side of the trade so far. Thus, MDGL is among the most heavily shorted stocks demonstrating that significant bearish interest isn't necessarily a death sentence for a company.

Gogo

- Industry: Telecom services

- Market value: $286.5 million

- Percentage of tradable shares held short: 49%

It likely has been a while since you've flown, given the current public health crisis. But you might recognize Gogo (GOGO, $3.42) as a major provider of in-flight internet connectivity and entertainment services.

Of course, that business model explains rather simply why so many investors are pessimistic about this stock in 2020: Fewer fliers mean fewer potential customers.

That would be bad enough, but as a fairly small and specialized firm, there isn't much of a cushion for a stock like GOGO. It doesn't have other business lines or deep pockets to rely on, and that means it is highly susceptible to the near-term trends in the aviation industry.

There's no dire talk of bankruptcy just yet, and analysts are expecting a rebound in revenue next year as trends normalize. But the rest of 2020 looks rather bleak, and short-sellers see Gogo – already off 47% year-to-date – as a logical target.

Seritage Growth Properties

- Industry: Retail real estate

- Market value: $548.7 million

- Percentage of tradable shares held short: 53%

Though Seritage Growth Properties (SRG, $9.82) has "growth" in its name, that may be a bit misleading, as the real estate investment trust (REIT) was fundamentally formed after the bankruptcy of Sears Holdings (SHLDQ) prompted the spinoff and sale of its real estate holdings.

Seritage had its hands full to begin with. The portfolio of properties included aging Sears and Kmart locations that were in dire need of a face lift – an expensive undertaking that ultimately led the REIT to suspend its dividend altogether in 2019.

The challenge has been compounded in 2020, of course, as the pandemic has created challenges in the overall capital improvements plan as well as the efforts to fill those spaces. While the structure of SRG was tailor-made for its distressed state and its management knew what they were getting into, the reality is that shares have crashed from $40 earlier this year to under $10 as short sellers have sharpened their knives.

And given the high level of short interest at present, it seems unlikely the selling pressure will abate in the near future.

Benefytt Technologies

- Industry: Health care plans

- Market value: $440.2 million

- Percentage of tradable shares held short: 54%

Benefytt Technologies (BFYT, $30.88) is a health insurance technology company that operates online health insurance marketplaces for consumers as well as insurance policy administration platforms to benefit providers. The specifics of its business, however, are less important than a simple fact:

Benefytt, which agreed to be bought for $31 per share by Chicago-based private equity firm Madison Dearborn Partners, faces several stockholder-rights investigations of the buyout.

At present, shares are trading at or around that price. However, since news of the acquisition broke on July 13, there have been periods where shares lurched dramatically lower based on sentiment that the deal might not actually go through. Based on short interest in BFYT stock, there is a substantial part of the investment community that seems to expect things to hit a snag – and if they do, we can expect Benefytt shares to suffer as this floor of $31 is removed.

Tanger Factory Outlet Centers

- Industry: Specialty retail

- Market value: $615.0 million

- Percentage of tradable shares held short: 54%

Associated by many with beach-town shopping binges or back-to-school closet stuffing, it's no surprise that Tanger Factory Outlet Centers (SKT, $6.58) has seen rather bleak performance in 2020. Outlet malls often are a destination for shoppers, and the lack of travel compounded with fading consumer confidence has dealt this retail space operator a difficult hand. In fact, SKT has lost more than half its value in 2020.

To be clear, Tanger doesn't own or operate the shops – it's another REIT, one that merely owns the properties these merchants rent in. However, with e-commerce pressures generally causing many stores to shrink their brick-and-mortar footprint, the timing of the pandemic couldn't have been worse.

This REIT does have plenty of diversity in its operations, with 14.3 million square feet leased to more than 2,800 stores under more than 500 brand names. However, the trend in Tanger's financials is decidedly down – and based on more than 48 million shares held short by bearish investors, Wall Street seems to expect SKT stock to do the same.

Ligand Pharmaceuticals

- Industry: Biotechnology

- Market value: $2.0 billion

- Percentage of tradable shares held short: 57%

While many short sellers target money-losing drugmakers that they think might not ultimately bring successful-enough products to market, some have also targeted more mature players in the sector, including Ligand Pharmaceuticals (LGND, $126.72).

Ligand boasts more than $100 million in annual revenues, and analysts predict double-digit sales growth this year. More importantly, it has been profitable (and increasingly so) for the past three years. Nonetheless, LGND stock hasn't quite been the same since early 2019, when prominent short-selling firm Citron Research targeted this firm.

Citron's reasoning focused on a bearish assessment of Ligand's "Big 6" drugs, a massive part of its product pipeline that could make or break the future of the company. LGND shares are now up 20% year-to-date, well back in the positive after slumping during the February and March market declines. But judging by the roughly 9 million shares held short – more than half of the available shares on the market – plenty of investors still have their doubts.

Precigen

- Industry: Biotechnology

- Market value: $757.6 million

- Percentage of tradable shares held short: 59%

Biotechnology stock Precigen (PGEN, $4.40) is a highly volatile firm that researches gene and cell therapies for various illnesses, including several cancers. It's a great example of both the promise and risk posed by this kind of business – shares went from about $6.50 at the start of the year to a low of about $2 in spring, but have snapped back to the $4.50 range at present.

Investors are gambling on this development-stage company connecting with some of its nascent treatments. And depending on the headlines or clinical trial results of the moment, that's what moves share prices.

In June, preclinical trial data on an ovarian cancer treatment, PRGN-3005 UltraCAR-T, looked encouraging and PGEN stock soared as a result. But as the stock continues to bleed cash and investors are eager for more material signs of progress, some on Wall Street have begun to take the other side of the trade. Well more than half of Precigen's float is owned by investors with doubts about the drugmaker's short-term performance.

Macerich

- Industry: Retail real estate

- Market value: $1.2 billion

- Percentage of tradable shares held short: 59%

Many retailers have made their way onto this list of heavily shorted stocks because of e-commerce pressures and consumer spending challenges amid the coronavirus pandemic. Well, real estate operators such as Macerich (MAC, $8.16) are hurting, too, for many of the same reasons.

Macerich is an operator of regional malls throughout the United States, with 51 million square feet of real estate across 47 shopping centers. And it's easy to understand how social distancing and online sales trends are putting the hurt on its tenants (and thus rent payments) to Macerich.

The financial structure of REITs is slightly different than that of conventional publicly traded stocks; these entities must pass on 90% of taxable income directly to shareholders. However, a few statistics of note include the fact that Macerich's top line is predicted to decline both this year and next year, reinforcing a multiyear slump. Revenue is predicted to drop to $865 million or so for fiscal 2021, compared with a tally of almost $1.3 billion in fiscal 2015.

When you combine short-term pressures with this long-term trend, it's easy to understand why some investors are bearish on MAC stock.

Bed Bath & Beyond

- Industry: Specialty retail

- Market value: $1.4 billion

- Percentage of tradable shares held short: 59%

Specialty retailer Bed Bath & Beyond (BBBY, $10.96) is one of many big-box stores that have struggled mightily in the age of Amazon.com (AMZN).

Bed Bath was once the go-to source for wedding registries and families looking to dress up their first home. But a preponderance of e-commerce alternatives and more fashionable nameplates have emerged in the last decade or so to put the squeeze on this once-dominant housewares store.

As a result, revenues peaked for BBBY back in fiscal 2017 at more than $12.3 billion but have been pretty much been in free-fall ever since. Analysts are estimating just $9.5 billion in sales for 2020.

The pandemic has taken its toll, yes. But recent consumer spending trends have only exacerbated the multi-year crisis for this specialty retailer. And with operations expected to run in the red both this year and next, investors are expecting it to be very difficult for management to change course in the near future as they hold some 71 million shares short.

Accelerate Diagnostics

- Industry: Diagnostics and research

- Market value: $828.0 million

- Percentage of tradable shares held short: 61%

Accelerate Diagnostics (AXDX, $14.98) is a specialized medical technology company that is aimed at combating antibiotic resistance and hospital-acquired infections.

While Accelerate's business is generally important considering that "superbugs" like MRSA create costly disruptions in healthcare facilities, the response to coronavirus – including limited social contact, a focus on hygiene and limited hospital visitation – has created a dynamic that makes these concerns much less urgent than a year ago.

That is not to say that Accelerate has no long-term potential. But Accelerate is running deeply in the red, and it has been for years. While revenue is rising rapidly, the harsh reality is that even the most optimistic of estimates are only for about $50 million or so in sales next fiscal year. That gives AXDX a current valuation of about 17 times forward sales even if all goes well.

Clearly some investors think this is a risky state of affairs, given Accelerate's spot on this list of highly shorted stocks. Those short sellers assuredly doubt the stock can justify its current share price in the near-term.

National Beverage

- Industry: Non-alcoholic beverages

- Market value: $3.2 billion

- Percentage of tradable shares held short: 67%

One of the standout stocks of 2020, National Beverage (FIZZ, $69.62) has defied gravity and overcome a rather rocky stock market environment to log year-to-date returns of more than 36%. Its flagship product, La Croix sparkling water, is a popular soft drink for people looking for a low-calorie option to soda but something more interesting than tap water.

The trend of more consumers buying groceries instead of eating out amid the pandemic has certainly translated into positive short-term momentum for shares. However, while La Croix may have been one of the leaders in the sparkling water trend, it now faces competition on all sides, including Coca-Cola (KO), which launched Aha-branded flavored sparkling waters in late 2019.

If revenues plateau as a result, it's reasonable to wonder whether share prices are destined to correct course. Based on the roughly 6 million shares held short at present, that's a bet that bears are increasingly willing to take.

AMAG Pharmaceuticals

- Industry: Biotechnology

- Market value: $338.3 million

- Percentage of tradable shares held short: 72%

AMAG Pharmaceuticals (AMAG, $9.87), a small drugmaker focused on a variety of therapeutics. It has periodically enjoyed a cult following among investors thanks in part to its development of "female Viagra" products that enhance the sex drive of women. Back in 2015, shares briefly traded for a sky-high valuation of more than $60 a share, but they now reside around the $10 mark.

Interestingly, that's a big improvement from back in March, when AMAG traded around $5 a share. That has come amid some big changes. For one, former CEO William Heiden announced earlier in the year that he would step down, and he was eventually replaced by Scott Myers. The company also has divested Intrarosa, a steroid that treats pain during intercourse that's associated with menopause, and it's looking for a buyer of its "female Viagra" product Vyleesi.

However, investors seem to be worried that perhaps the snap-back has been too much and too fast. Time will tell whether the sleeker AMAG will be more successful. But in the here and now, plenty of bears are skeptical that the stock will deliver.

World Acceptance

- Industry: Financial services

- Market value: $565.2 million

- Percentage of tradable shares held short: 80%

World Acceptance (WRLD, $76.20) is a consumer finance business that specializes in small, short-term loans and strategic services. These installment loans tend to target less credit-worthy Americans with low credit scores and no collateral, with very high in interest rates to offset the risk.

Sadly, this class of consumers has been hardest-hit by coronavirus-related layoffs. For instance, Pew Research reported in April that half of all layoffs during the peak of the crisis were shouldered by lower-income Americans. As a result, World Acceptance's products are dangerously at risk, at least in the short-term, though the delay in passing a second stimulus measure might make them all the more necessary.

Unlike some of the other stocks on this list, WRLD is a very solvent operation that is still plotting a profitable year with modest revenue growth according to current estimates. But as a situational play, the bears have latched on to World Acceptance and expect it to give back some of its more recent gains.

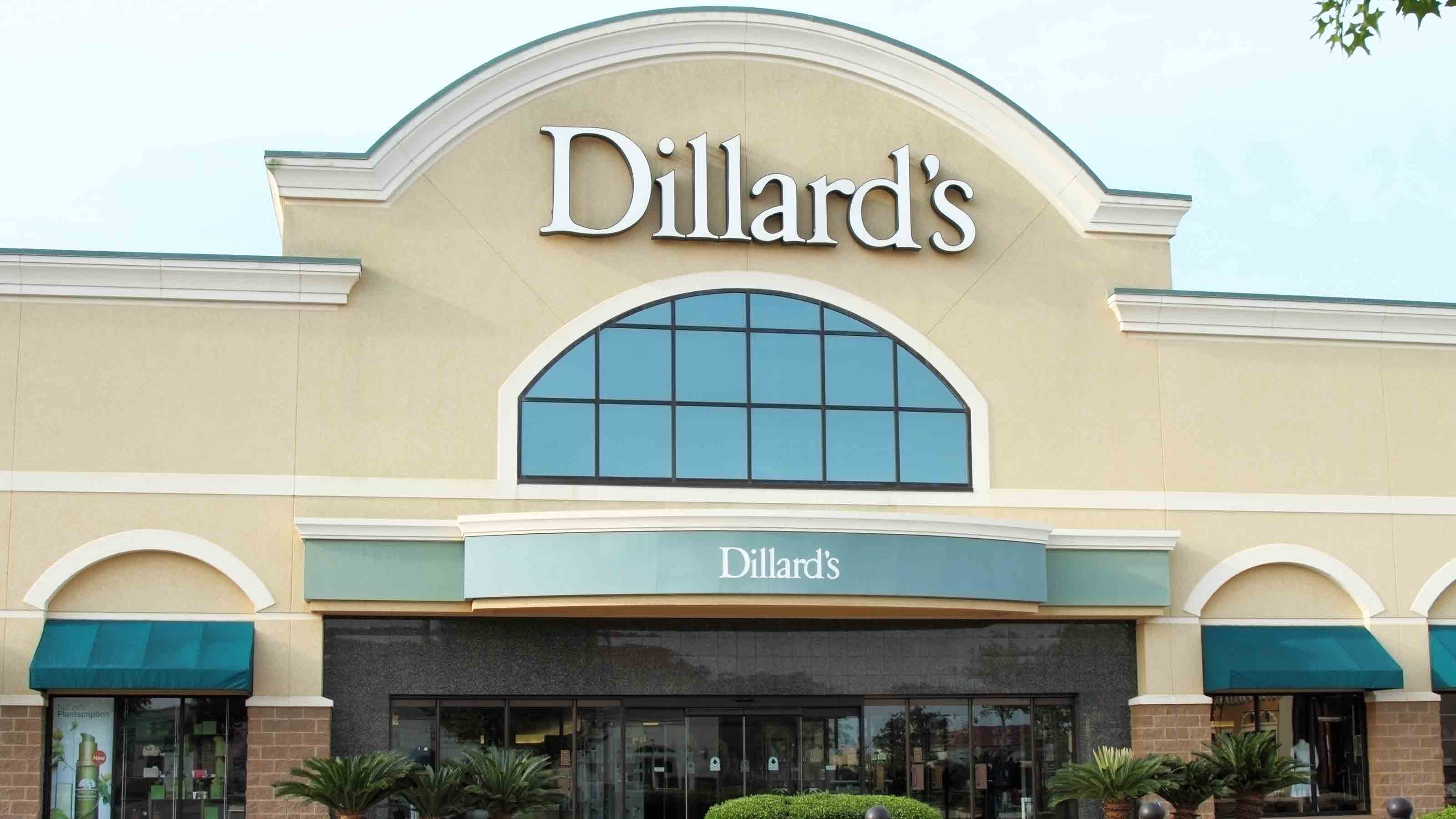

Dillard's

- Industry: Specialty retail

- Market value: $556.8 million

- Percentage of tradable shares held short: 85%

Department store chain Dillard's (DDS, $23.97) has been arguably out of step with the current trends in the industry, and as a result, it remains one of the most shorted names on Wall Street.

With only about 260 stores, Dillard's doesn't have the scale of larger rivals; however, these locations are spread from Florida to California to Montana to Virginia. On top of the challenges in managing distribution across a lot of empty space, Dillard's also has a comparatively anemic e-commerce business to fill in the blanks. The result is that total short interest in this stock isn't far off from the number of tradable shares in the market.

This situation created a bleak enough outlook. But the coronavirus pandemic has only exacerbated trends as consumers have pulled back in many areas and reallocated spending to online options in others. Analysts now expect the company to swing from a $3.56-per-share profit last year to a $10.26 loss in 2020. And with long-term debts that are currently more than the total market value of the stock, there are serious concerns about whether DDS has the time or capital to restructure operations, even if management wanted to change course.

Wave Life Sciences

- Industry: Biotechnology

- Market value: $318.0 million

- Percentage of tradable shares held short: 111%

Singapore-based Wave Life Sciences (WVE, $8.90) is smaller than many of the names on this list, with about 300 total employees and less than 5 million total shares available for trading on U.S. markets. However, this tiny biotechnology company has big interest among the bears – so much so that short interest currently has surpassed the number of tradable shares.

While it's true that even modest progress on potential drugs could result in a big pop for this relatively small health care stock, the stakes are incredibly high. Wave Life continues to burn cash with no material revenue to speak of and deep losses as it invests in research.

Based on recent trends, it seems investors are losing patience. The stock has suffered a huge drop from highs around $37 in late 2019 to less than $10 a share at present after learning late last year that its Huntington's disease treatment underperformed a competitor's drugs, and short sellers seem to expect that trend to continue in earnest for the foreseeable future.

GameStop

- Industry: Specialty retail

- Market value: $265.5 million

- Percentage of tradable shares held short: 113%

With short interest of 53.5 million shares and a float of only about 47 million total shares, GameStop (GME, $4.10) has the ignominious title of the most heavily shorted name on Wall Street.

There are a host of reasons for this, but a short list includes the fact that GME remains largely a brick-and-mortar retailer in a digital age and that its primary product of video games is increasingly delivered directly to consumers via downloadable software rather than physical discs or cartridges.

With deeply unprofitable operations predicted for this fiscal year and a tiny 2-cent-per-share earnings projection for 2021 that's well below 2019's 22-cent profit, it seems unlikely that the retailer's fortunes will change anytime soon. Activist investors have recently signed on to the board, but many investors still worry that they are either too late to change things, or that the activists are simply looking to harvest what's left as the stock circles the drain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Stocks Are Up and Down on Fed Day: Stock Market Today

Stocks Are Up and Down on Fed Day: Stock Market TodayIn another sign of changing times, JPMorgan has partnered with Coinbase to enable cryptocurrency purchases with credit cards.

-

Stocks Rise After Trump-Powell Fed Tour: Stock Market Today

Stocks Rise After Trump-Powell Fed Tour: Stock Market TodayNvidia hit a new all-time high intraday, but another renowned semiconductor name and some less iconic stocks were bigger movers Friday.

-

Dow Bleeds Red Due to Big Blue: Stock Market Today

Dow Bleeds Red Due to Big Blue: Stock Market TodaySix of the official GICS sectors were in the green, led by communications services, technology and energy stocks.

-

Stock Market Today: Auto Tariffs Send Stocks Lower

Stock Market Today: Auto Tariffs Send Stocks LowerThe main indexes snapped their win streaks after the White House confirmed President Trump will talk about auto tariffs after the close.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Stock Market Today: Stocks Stagger After CPI but Rebound to Post Gains

Stock Market Today: Stocks Stagger After CPI but Rebound to Post GainsA mixed CPI report had traders recalibrating their rate-cut bets.

-

GameStop Sinks on Revenue Drop, Stock Offering: What to Know

GameStop Sinks on Revenue Drop, Stock Offering: What to KnowGameStop stock is plunging Wednesday after the video-game retailer said sales declined in Q2 and that it's selling shares to raise cash.

-

GameStop Stock Adds To Losses After Roaring Kitty Livestream

GameStop Stock Adds To Losses After Roaring Kitty LivestreamGameStop shares were already lower Friday after an early earnings release and news of another stock offering, but fell further after Roaring Kitty's livestream.