Stock Market Today: The New Bull Market Starts With a Limp

Apple (AAPL) briefly touches $2 trillion in market value and Target (TGT) pops, but the new bull market slipped in Wednesday trade.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A day after nudging its way out of bear-market territory, the broader market took a half-step back.

On the single-company front, there were plenty of positive highlights, thanks to corporate earnings and other developments. Target (TGT, +12.7%) popped to all-time highs after it reported online revenues that nearly triple and a 10.9% year-over-year jump in same-store sales. Lowe's (LOW) reported a fantastic quarter in its own right: revenues climbed 30% and profits ballooned by roughly 69%, though the stock only gained 0.3%.

Apple (AAPL, +0.1%), meanwhile, became the first $2 trillion company (by market value) during intraday trading, though it finished with a value of $1.979 trillion. The company's stock is set to split 4-for-1 later this month.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, stocks were shaken a bit in the afternoon after the Federal Open Market Committee released its minutes. FOMC officials "agreed that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and was posing considerable risks to the economic outlook over the medium term."

"The discussions regarding the economic outlook highlighted the considerable uncertainty when judging the path of the recovery, which reflected the Committee's addition to the July post-meeting statement: 'The path of the economy will depend significantly on the course of the virus,'" writes Bob Miller, BlackRock's Head of Americas Fundamental Fixed Income. "To us, this strongly suggests that both monetary and fiscal policy support will continue to be required for the recovery to remain on track."

The S&P 500 declined 0.4% to 3,374 a day after confirming a new bull market. The Dow Jones Industrial Average declined by 0.3% to 27,692, and the Nasdaq Composite lost 0.6% to 11,146. The small-cap Russell 2000 managed a 0.2% gain to 1,572.

A Sign of What's to Come? Maybe Not.

We pointed out yesterday that stocks sometimes take breathers after reaching bull-market territory. But some data points to the potential for better prices in both the long and short term, when the market has gone a while since reaching record territory.

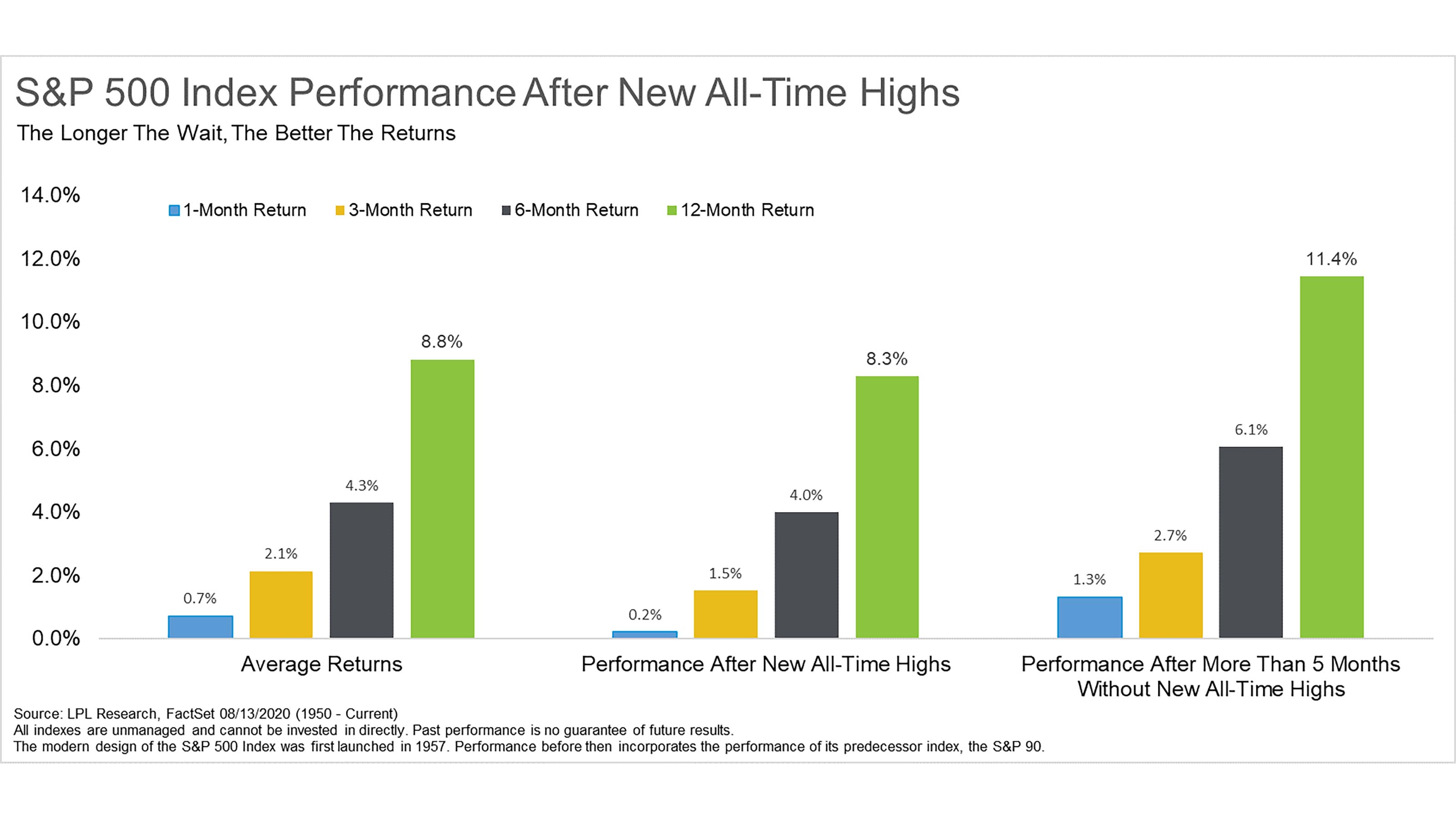

"As shown in the LPL Chart of the Day, returns after a long time without new highs actually get better," writes Ryan Detrick, Chief Investment Strategist for LPL Financial.

"One, three, six, and 12 months after the first new high in more than five months show stronger performance than average or after any new highs," he writes. "Yet another reason to think that this bull market from a long-term point of view could have some more tricks up its sleeve."

However, with so many question marks in the air – When will we get a vaccine? Will trade with China hold up? Who will be in the White House next year? – many investors might be reluctant to make bold stock bets. But they can still participate in any upside while avoiding single-stock ruptures by investing in some of Wall Street's best passive and active funds.

Low-cost provider Vanguard boasts more than a dozen funds that are ready-made for this kind of new bull market, while Fidelity offers some 15 tactical tools to squeeze more out of the next run higher.

Just remember to keep an eye on costs. Every dollar you pay in fees is a dollar that's not being compounded over time, so investors will do best with funds with no sales charges and lower-than-average annual expenses.

Enter the Kiplinger 25. This list of 25 low-fee funds includes products from across the provider universe, and tackles a number of stock and bond strategies. Here's the latest look at our favorite mutual funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.