How Will Stocks React to the 2020 Presidential Debates?

Nervous about how the market will handle the 2020 presidential debates? If history is any guide, the market won't care what happens either way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors worried about how Tuesday night's presidential debate between President Donald Trump and former Vice President Joe Biden will affect the stock market can rest easy.

If history is any guide, the market won't care what happens either way.

Presidential Debates Leave Few Bread Crumbs to Follow

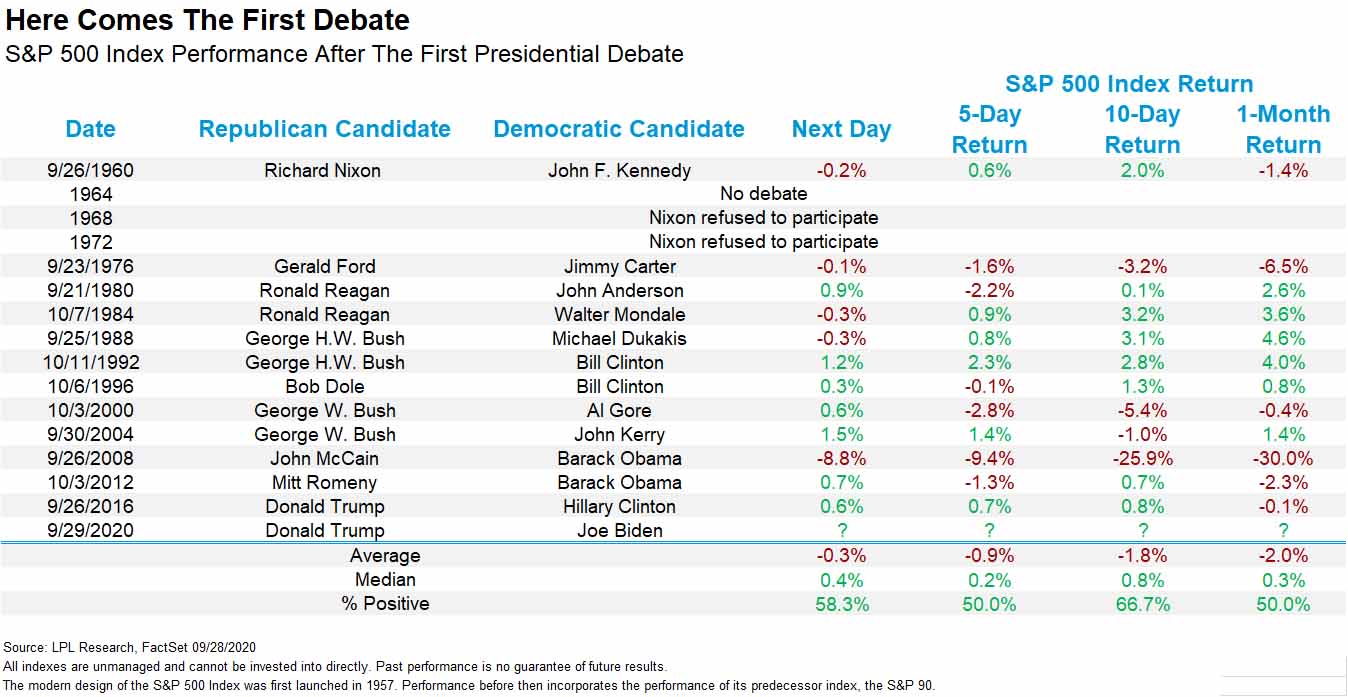

As LPL Financial – registered investment advisor and broker-dealer – notes, the data from past debates going as far back as 1960 don't offer a clue as to how stocks react to the first debate, to say nothing of indicating which party might win.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Could stocks give a clue who will win the election based on how they do after the debate?" writes LPL Financial Chief Market Strategist Ryan Detrick. "Unfortunately, it doesn't appear to give any hints, as returns and winners are all over the place.

"Still, 2020 is unlike any year we've ever seen before, so we could be one Howard Dean gaffe or Ronald Reagan zinger away from a major sway in this election."

To get a sense of how pointless it is to look to the presidential debate for trading insights, check out LPL's "Chart of the Day" and consider just a few of the numbers:

- The odds of the market rising or falling in the session ahead are aren't far off from 50-50.

- There have been 12 first presidential debates since 1960. On average, the S&P 500 retreats 0.3% the next day. The median performance, however, is a gain of 0.4% for the broad market index. Neither of those outcomes are material.

- The days and weeks after the debate don't tell us anything useful either. Five days out, the market is higher 50% of the time. As for a month after the debate, again, stocks are positive 50% of the time.

- On average, stocks lose 0.9%, 1.8% and 2% in the five days, 10 days and one month following the debate, respectively. However, the median return is positive for all of these time frames, albeit at only fractions of a percent. Again, these returns are essentially immaterial.

- The data are skewed by the 2008 market meltdown.

The bottom line: Don't bother buying or selling stocks based on anything that happens in tonight's debate.

No, it's not a sucker's bet, but it is indeed a nothing bet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

What the Rich Know About Investing That You Don't

What the Rich Know About Investing That You Don'tPeople like Warren Buffett become people like Warren Buffett by following basic rules and being disciplined. Here's how to accumulate real wealth.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

How to Invest for Fall Rate Cuts by the Fed

How to Invest for Fall Rate Cuts by the FedThe probability the Fed cuts interest rates by 25 basis points in October is now greater than 90%.

-

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?Warren Buffett and Berkshire Hathaway own a lot of Kraft Heinz stock, so what happens when they decide to sell KHC?

-

How the Stock Market Performed in the First 6 Months of Trump's Second Term

How the Stock Market Performed in the First 6 Months of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Fed Leaves Rates Unchanged: What the Experts Are Saying

Fed Leaves Rates Unchanged: What the Experts Are SayingFederal Reserve As widely expected, the Federal Open Market Committee took a 'wait-and-see' approach toward borrowing costs.