Stock Market Today: Bulls Reclaim Ground on Cheerful GDP, Jobless Data

A record rebound in third-quarter GDP, as well as better-than-expected jobless claims, propelled stocks on Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Whether stocks would recover Thursday was in doubt in early trading as investors struggled to embrace bright tidings from recent economic data. But the loud rebound in third-quarter GDP and better-than-expected unemployment claims eventually roused some bulls.

On the latter front, the Labor Department reported that last week's jobless filings fell from 791,000 in the week prior to 751,000, comfortably below the Bloomberg consensus estimate of 770,000.

On the former, Q3 GDP predictably made its sharpest recovery since World War II (after all, it followed Q2, which suffered the sharpest drop since then). The 33.1% sequential expansion topped the consensus forecast for 32% growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, that performance comes with quite a few asterisks and other forward-looking considerations. Some expert observations about Thursday's GDP data:

- Pooja Sriram, vice president, U.S. economist, at Barclays Investment Bank: "The outsized magnitude of increases across categories was to a large extent mechanical, in part due to the low base in the second quarter and in part due to solid activity momentum in May/June, which carries a respectable weight in the Q3 GDP calculations. The imposition of stay-at-home orders caused activity to plunge in the second quarter, and their removal led to a substantial improvement thereafter."

- Ryan Detrick, chief market strategist for LPL Financial: "GDP rebounded stronger than expected in the third quarter, but the big question on everyone's mind is whether the economy can remain on firm ground in the fourth quarter and into 2021. Barring a new round of fiscal stimulus, it's likely that growth will taper off in the fourth quarter, but we still don't expect a double-dip recession."

- Ludovic Subran, chief economist for Allianz: "This strong rebound should be short-lived as Q4 macroeconomic conditions will be much less favorable to growth. It will probably be towards the end of 2021 before we return to previous levels of GDP, and if the next surge of COVID causes even more shutdowns, it will be longer than that. … Today's data clearly showed the impact of the CARES Act and the boost it gave to personal income. But that boost is now long gone, and it seems like a new stimulus package will not deliver cash to consumers anytime soon."

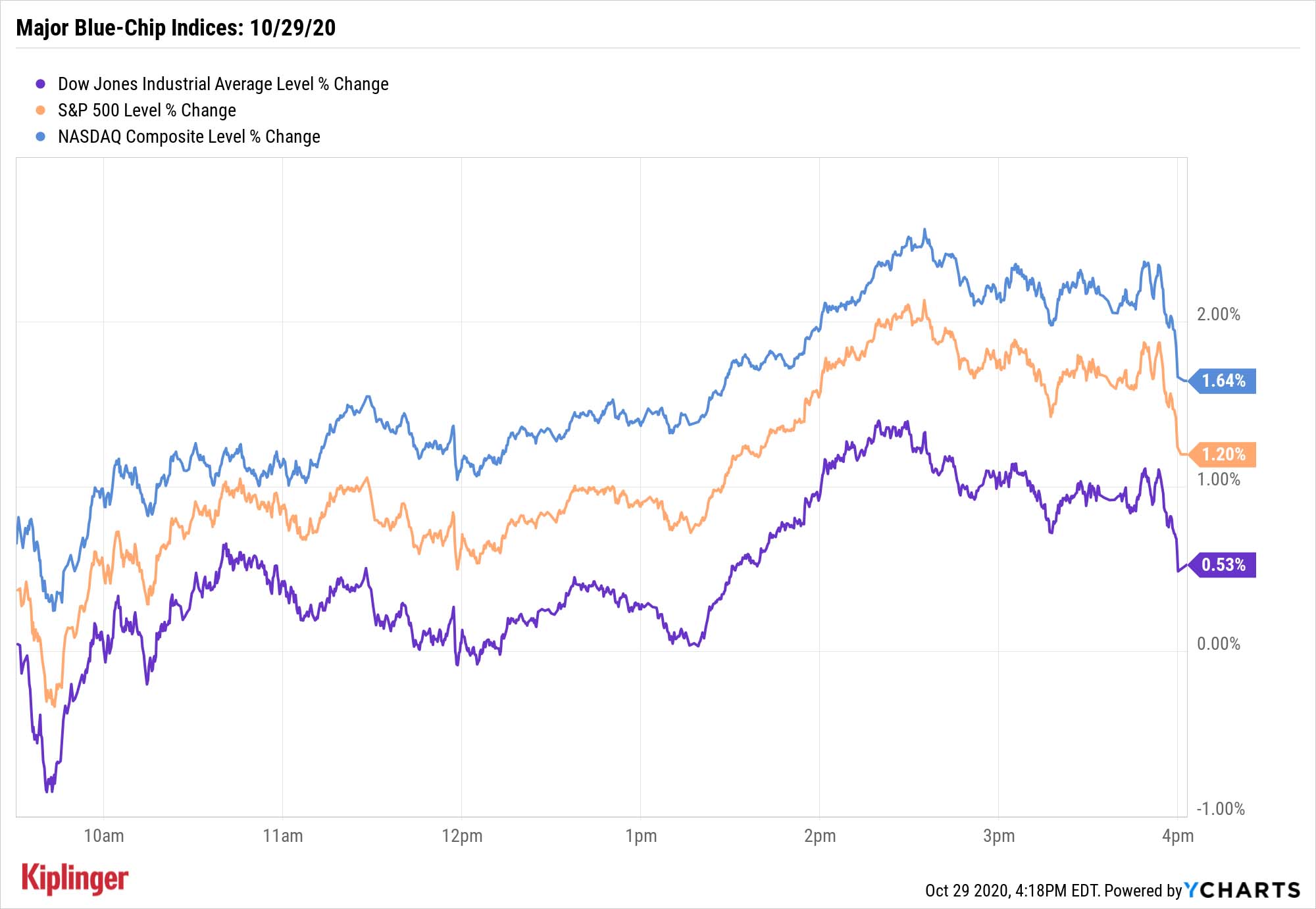

Nonetheless, the Dow Jones Industrial Average clawed back a little of what it lost Wednesday, climbing 0.5% to 26,659, while the Nasdaq Composite finished with a more emphatic 1.6% gain to 11,185.

Other action in the stock market today:

- The S&P 500 improved by 1.2% to 3,310.

- The small-cap Russell 2000 closed up 1.3% to 1,563.

- Netflix (NFLX, +3.7%) shot higher in the late afternoon following its announcement that it would raise its U.S. prices. Standard plans will go from $13 per month to $14, while premium plans are being hiked from $16 per month to $18.

- Several mega-cap stocks, including Apple (AAPL, +3.7%) and Amazon.com (AMZN, +1.5%), report earnings this evening. Here's what analysts are expecting.

How to Steady the Boat Ahead of Election Day

Today's swing favored investors, but some might be tiring of the market's recent turbulence. A respite might be a ways off.

"The two main investor concerns over recent months have been what would happen if there is a contested election and/or a second wave of COVID-19 spread," says Canaccord Genuity equity strategist Tony Dwyer. "The markets should remain volatile and unpredictable as these two fears are upon us and playing out in real time over coming days."

Sure, some see this as a chance to make high-potential swing bets on the outcome of the presidential election – whether the winner be Donald Trump or Joe Biden – but some investors would prefer to avoid any choppiness they can.

Generally speaking, low-volatility stocks should be able to help smooth out your portfolio's performance over time. However, a few steady stocks stand out for their ability to shrug off either election outcome for short-term stability. Read on as we highlight five quality stock picks that are well-positioned to withstand any Election Day-specific market shocks.

Kyle Woodley was long AAPL and AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.