Stock Market Today: The Only Clear Winner Right Now? Stocks.

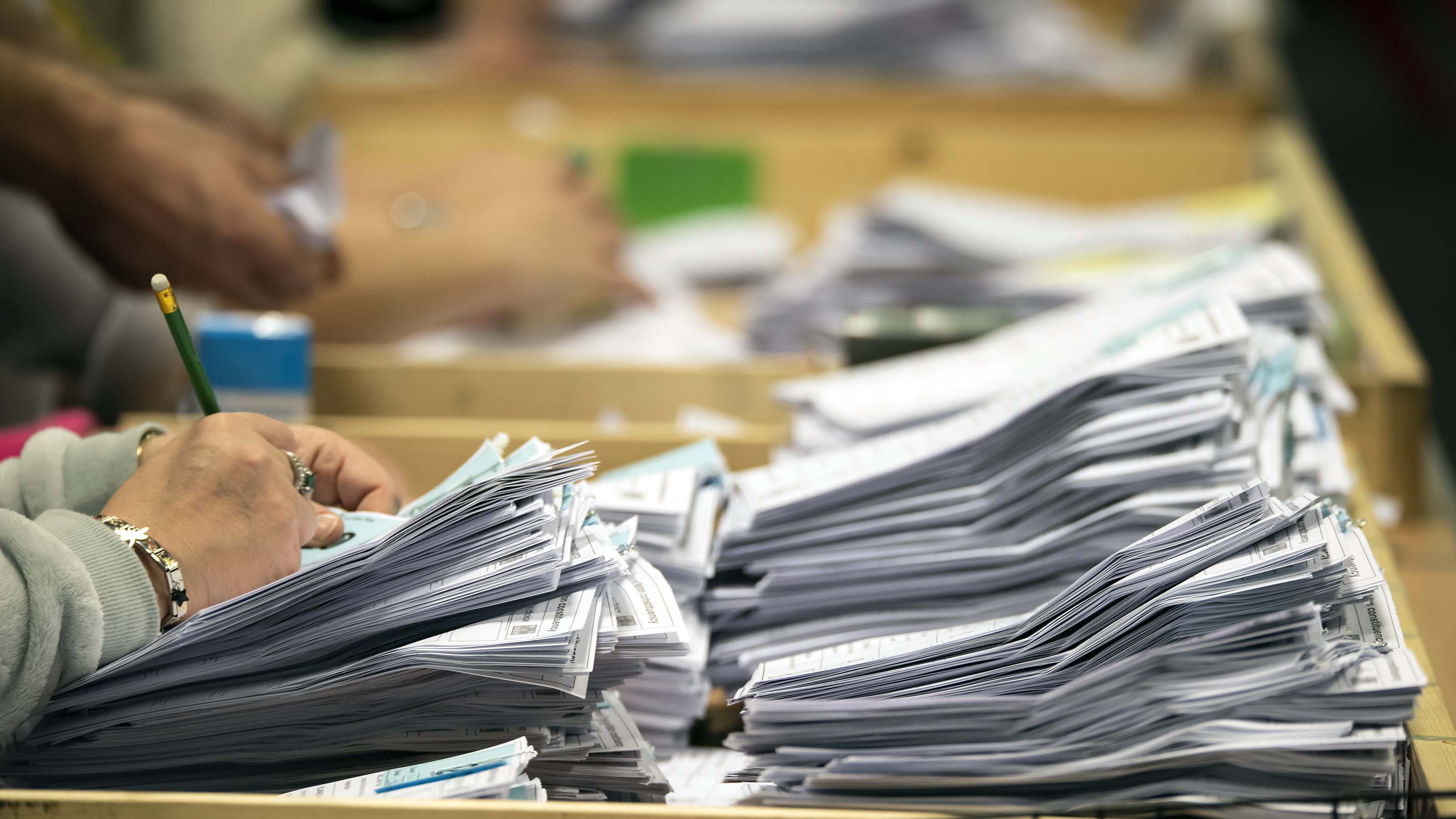

U.S. markets surged Wednesday amid a still-to-be-decided election that was pointing in Joe Biden's favor, but with no 'blue wave.'

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Political chaos? You'd never have guessed it by the stock market's response Wednesday to the presidential election, which indeed has still not been decided. Investors who slept in after a long night of election-watching woke up with considerably more money in their portfolios than they went to sleep with.

The Dow Jones Industrial Average gained 1.3% to 27,847, though late profit-taking cut the Dow's haul by more than half. The S&P 500 enjoyed one of its best post-election gains ever, jumping 2.2% to 3,443.

And the Nasdaq Composite was the most resilient of the blue-chip indices, hanging on for a 3.9% improvement to 11,590 thanks to the likes of Amazon.com (AMZN, +6.3%), Facebook (FB, +8.3%) and Google parent Alphabet (GOOGL, +6.1%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"One of the big takeaways so far from Tuesday night is that the Senate likely will stay Republican, meaning we may have a divided Congress," says Ryan Detrick, chief market strategist for LPL Financial. "The chances of higher taxes and more regulation likely took a hit under this scenario. This could be a nice tailwind for stocks, as the S&P 500 historically has done quite well under a divided Congress, up more than 17% on average.

"Additionally, in years with a divided Congress, stocks have been higher the past 10 times, with 2020 potentially being the 11th in a row.

Other action in the stock market today:

- The Russell 2000 was virtually flat, gaining less than one point to 1,615.

- U.S. crude oil futures jumped 4.1% to $39.18 per barrel.

- Gold futures were off 0.7% to $1,896.20 per ounce.

Who Wins, Who Loses?

But Wednesday wasn't an across-the-board rally -- there were big winners and big losers.

Bank stocks, as measured by the SPDR S&P Bank ETF (KBE), dropped 5.4% today as interest rates plunged, while energy (+0.1%) crawled and materials (-1.7%) struggled on fears of a diminished federal stimulus package from a divided government.

However, healthcare stocks such as UnitedHealth Group (UNH, +10.3%) and Merck (MRK, +4.8%) soared in response to Joe Biden's slim lead, given the potential for less uncertainty around health care policy.

And, as mentioned earlier, technology and tech-esque stocks had a field day today. But why?

"With no blue wave, we are likely to see the Senate remain very closely divided, which will constrain the policy options of whoever wins the presidency," says Brad McMillan, chief investment officer for Commonwealth Financial Network. "That probably rules out any substantial activity on taxes, as well as limiting any actions to control the major tech firms."

The race is, of course, not over -- certainly not as of this writing -- so the winds could change yet again. And if there's no holding back tech, you should probably be investing in it. Investors preferring a diversified, lower-risk approach might want to consider these 15 technology ETFs, which allow you to invest in the sector more broadly, or across narrower industries and even "themes."

Or, if you can handle more risk, you can shoot for more robust returns via these seven small-cap technology companies that Wall Street is wild about right now.

Kyle Woodley was long AMZN and FB as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.