Stock Market Today: Growth Takes a Backseat to Value Yet Again

A violent rotation from tech and other growth stocks, and into value names, continued Tuesday as a COVID drug received an emergency-use green light.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A rotation away from growth and into value continued apace Tuesday amid more news on the COVID front.

Less than 24 hours after Pfizer (PFE, -1.3%) and BioNTech (BNTX, +7.6%) released promising trial data for their vaccine candidate, the U.S. Food and Drug Administration approved Eli Lilly's (LLY, +3.0%) antibody treatment on an emergency-use basis.

"Yesterday after market close, LLY announced that its monoclonal antibody treatment (LY-CoV555) received FDA Emergency Use Authorization (EUA) based on positive findings from the BLAZE-1 Phase 2 studies to treat patients with mild to moderate Covid-19 cases after immediate diagnosis," writes CFRA analyst Sel Hardy (Buy). "As daily new Covid-19 infections and hospitalizations reach unprecedented highs, we think the EUA opens a considerable market opportunity for LLY," adding that AmerisourceBergen (ABC, +3.7%) will be in charge of U.S. delivery.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That continued a trend of investors moving money from heavily bought growth stocks to battered cyclical plays.

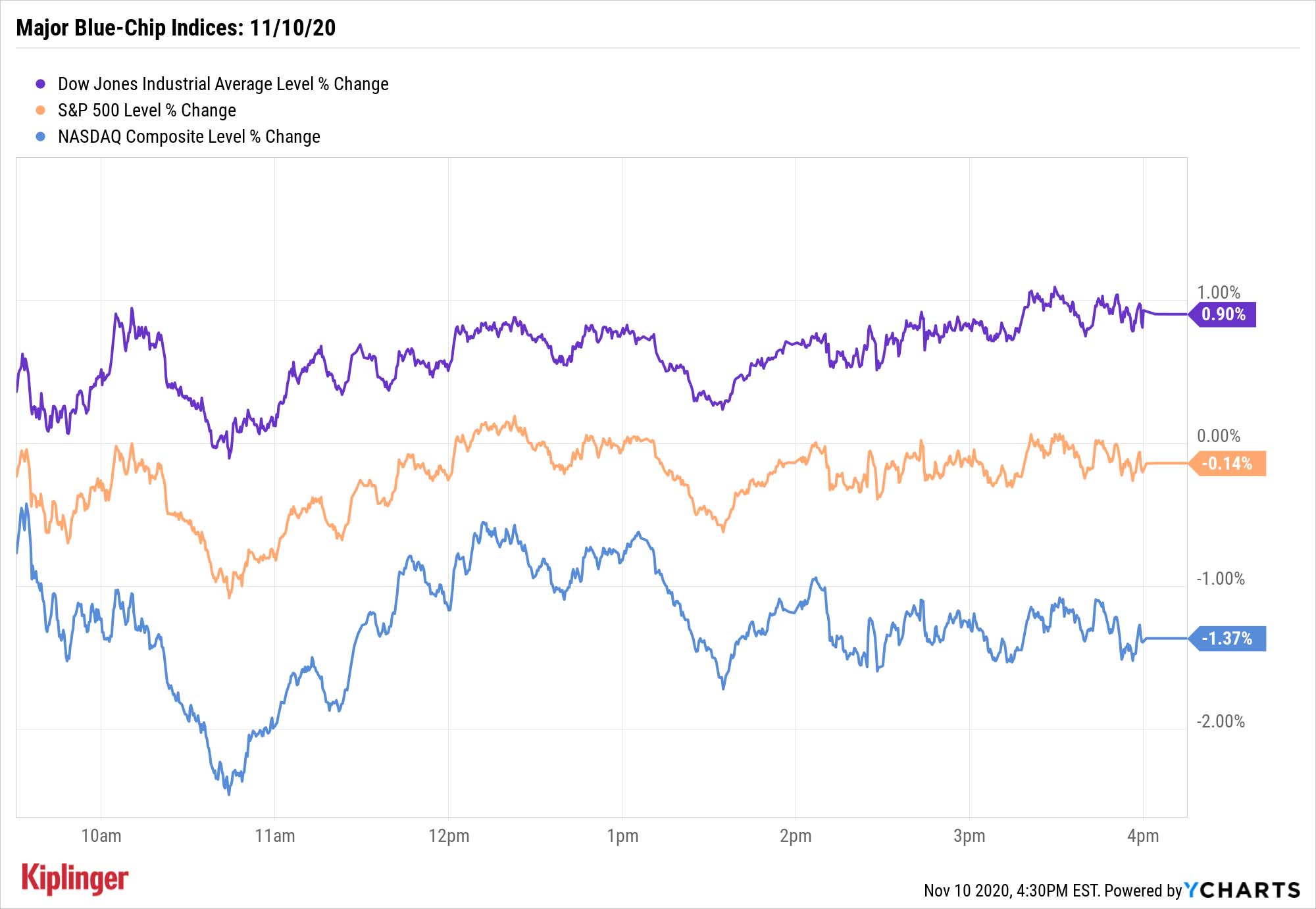

The Dow Jones Industrial Average climbed 0.9% on Tuesday, to another new high of 29,420, led by the likes of Walgreens (WBA, +6.5%) and Boeing (BA, +5.2%), the latter rising amid reports that the government regulators are nearly finished with their review of proposed changes to the troubled 737-MAX aircraft. But the Nasdaq Composite suffered another big drop, losing 1.4% to 11,553.

Other action in the stock market today:

- The S&P 500 slipped by 0.1% to 3,545.

- Small caps had a day, as the Russell 2000 gained 1.9% to a fresh high of 1,737.

- Gold futures improved by 1.2%, settling at $1,876.40 per ounce.

- U.S. crude oil futures also settled higher, improving 2.9% to $43.61 per barrel.

Several Trends Could Be Here to Stay, However

A team of UBS strategists believe the rotation has more room to run: "After Monday's (and last week's) strong moves, we find that … US Growth stocks are pricing in the most hope of normalization, while European and US Value stocks are pricing in the least, and therefore should have more upside potential," they write.

But don't expect the coming months and 2021 to completely flip the script.

We could also see a continuation of several trends that blossomed over the past few months. For instance, the earnings calendar included a big win from D.R. Horton (DHI, +9.1), which reported a quarterly profit beat and raised its dividend, putting more fuel behind 2020's rally in housing-market stocks. A second-half resurgence in initial public offerings (IPOs) should remain strong, thanks to several big-name offerings expected to go live by the end of this year and throughout 2021.

And we could see continued outperformance by one of the market's most ignored sectors: materials stocks.

While metals miners and chemical producers don't tell scintillating stories, they've got what counts: an improving macroeconomic picture, often low valuations and, in some cases, decent dividend programs. While they've also been outperforming for several months now, the "great rotation" should still benefit many of these value-priced materials stocks.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today"The stock market is not the economy," they say, but both things are up. Yet one survey says people are still feeling down in the middle of this complex season.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

Stocks Struggle Ahead of November Jobs Report: Stock Market Today

Stocks Struggle Ahead of November Jobs Report: Stock Market TodayOracle and Broadcom continued to fall, while market participants looked ahead to Tuesday's jobs report.