Stock Market Today: Market's Spark Fades, But Fireworks Abound

Tuesday was a lackluster day for the broader market, but Tesla (TSLA), Palantir Technologies (PLTR) and Warren Buffett provided plenty of excitement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

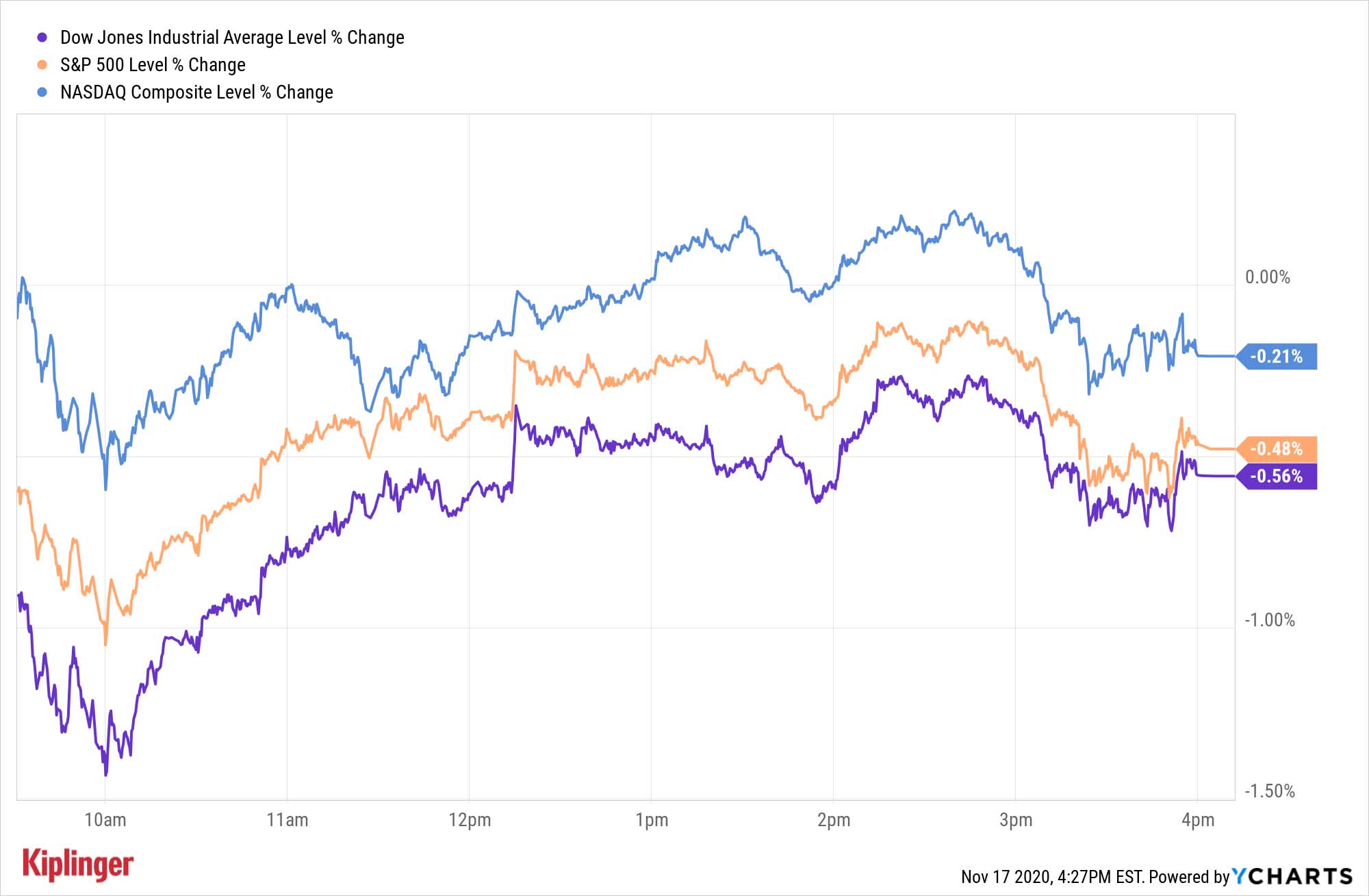

The major indices followed Monday's raucous rally with a tamer, flatter Tuesday. The Dow Jones Industrial Average declined 0.6% off its record high to 29,783, while the Nasdaq Composite slipped by a thin 0.2% to 11,899.

But the relative calm belied a number of exciting developments over the past 24 hours.

One of the market's most anticipated initial public offerings (IPOs) is one step closer to happening, as vacation rental marketplace Airbnb filed its S-1 – an important precursor to an eventual offering.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And Tesla (TSLA, +8.2%) shot higher following Monday night's announcement that it would join the S&P 500 Index.

Wedbush analyst Daniel Ives called the development "a major feather in the cap for the Tesla bulls after much agonizing around not getting into the S&P 500 in early September." It's a complicated move, too – funds benchmarked to the index will have to make billions of dollars' worth of trades to get the requisite amount of Tesla exposure.

Other action in the stock market today:

- The S&P 500 lost 0.5% to 3,609.

- The Russell 2000 continued to press into record territory, gaining 0.3% to 1,791.

- U.S. crude oil futures improved 0.3% to settle at $41.49 per barrel.

- Gold futures slid 0.1% to $1,885.10 per ounce.

What Has Warren Buffett Been Up To?

Markets also absorbed Monday afternoon's flurry of filings from hedge funds and other "smart money" investors.

For instance, data-tracking firm Palantir Technologies (PLTR, +12.1%) rocketed after the latest 13F filing from Steve Cohen's Point72 Asset Management LP hedge fund revealed that it had snapped up 29.9 million shares during the third quarter.

However, George Soros said Tuesday he would keep selling Soros Fund Management's investment in PLTR, which he said was made "at a time when the negative social consequences of big data were less understood."

But the biggest "get" from Monday's 13F dump was the latest treasure trove from Warren Buffett.

The Oracle of Omaha's Berkshire Hathaway (BRK.B) holding company filed its 13F for the quarter ended Sept. 30, 2020 and revealed yet another busy quarter. While Buffett continued to whittle away at a number of positions, as he did in Q1 and Q2, he appeared much more optimistic, buying up 10 stocks – including six new positions.

Investors can scour the entire Berkshire Hathaway equity portfolio for a precise look into how Buffett and his lieutenants were positioned heading into 2020's final stanza. However, if you just want to catch up on what Uncle Warren has been up to lately, we've wrapped up Warren Buffett's recent buys and sells here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.