Stock Market Today: Flicker of Stimulus Hope Lifts Stocks

Reports that Sen. Mitch McConnell is willing to negotiate with Democrats on COVID stimulus helped stocks climb back into the black Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks started Thursday the same way they ended Wednesday – weakly – but got a little pep in their step after Senate Minority Leader Chuck Schumer said that his Republican counterpart, Mitch McConnell, has agreed to resume stimulus negotiations.

The market was spooked early by initial jobless claims, which actually increased by 31,000 to 742,000 during the week ended Nov. 14.

"The rise went against our and consensus expectations for a decline in claims and paints a picture of some loss in labor market momentum in mid-November," say Barclays Investment Bank's Michael Gapen and Jonathan Millar. But the pair adds, "Despite the increase in this week's initial claims data, the four-week moving average in initial claims fell to 742k, down from 756k in the prior week."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, America's coronavirus death toll surpassed 250,000, and 1 million new cases have been reported in the past week alone, prompting the Centers for Disease Control and Prevention to recommend against traveling for the Thanksgiving holiday.

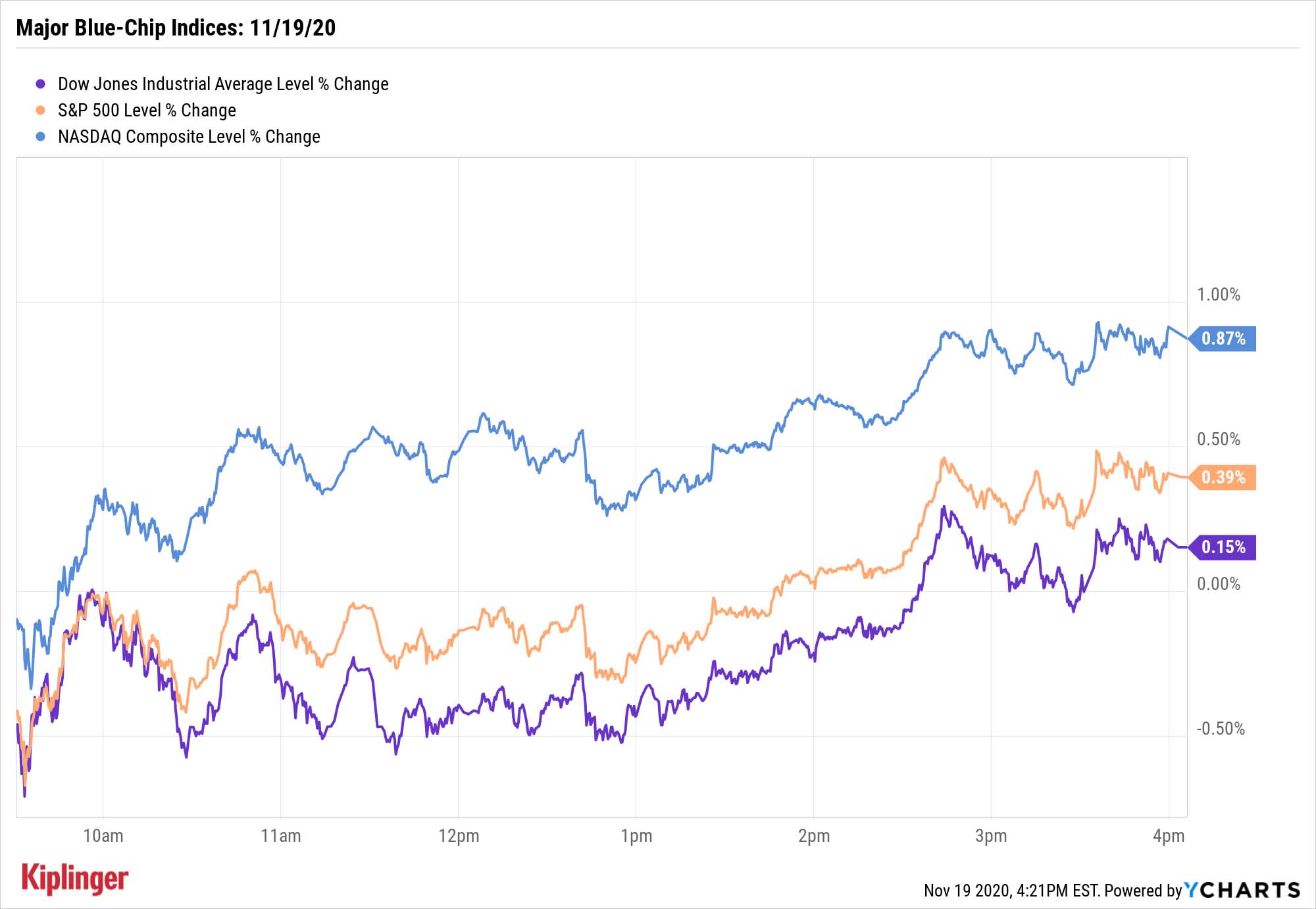

That held back some of the value and cyclical areas of the market that had been advancing of late, and instead, tech led the day. The Nasdaq Composite closed 0.9% higher to 11,904, helped by gains from the likes of Fiserv (FISV, +4.7%) and Advanced Micro Devices (AMD, +3.6%).

Other action in the stock market today:

- The Dow Jones Industrial Average gained 0.2% to 29,483.

- The S&P 500 improved by 0.4% to 3,581.

- The small-cap Russell 2000 finished 0.8% higher, to 1,784.

- U.S. oil futures fell 0.3%, settling at $44.20 per barrel.

- Gold futures dropped 0.9% to $1,856.80 per ounce.

Healthcare: Center Stage in 2021?

One thing seems certain as 2020 begins to wind down: COVID likely will be one of the major market factors of 2021, too. Even if a vaccine were approved for full use tomorrow, it would still take months for distribution to begin, and far longer to inoculate much of the U.S., let alone the rest of the world.

So it's likely, then, that the healthcare sector will remain in focus for investors.

Healthcare is widely praised as a "go-anywhere" sector given the sheer necessity of its products and services – it can hold up when the bears bear down, and join in when the bulls start to charge. And investors have a wide array of ways to participate in healthcare's gains that can suit just about any appetite.

Diversified healthcare mutual funds can defray risk across dozens or hundreds of stocks. But if you don't mind risk, you can swing for the fences with potent biotech stocks.

Fortunately, 2021 appears to have room for healthcare stocks of every stripe. Read on as we dig into some of the sector's most attractive opportunities as you begin to adjust your own portfolios for the year ahead.

Kyle Woodley was long AMD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.