Stock Market Today: Stocks Start Another Week With a Vaccine Bump

Equities rallied Monday after data showed high efficacy for an AstraZeneca (AZN) vaccine that could be more easily distributed than its peers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

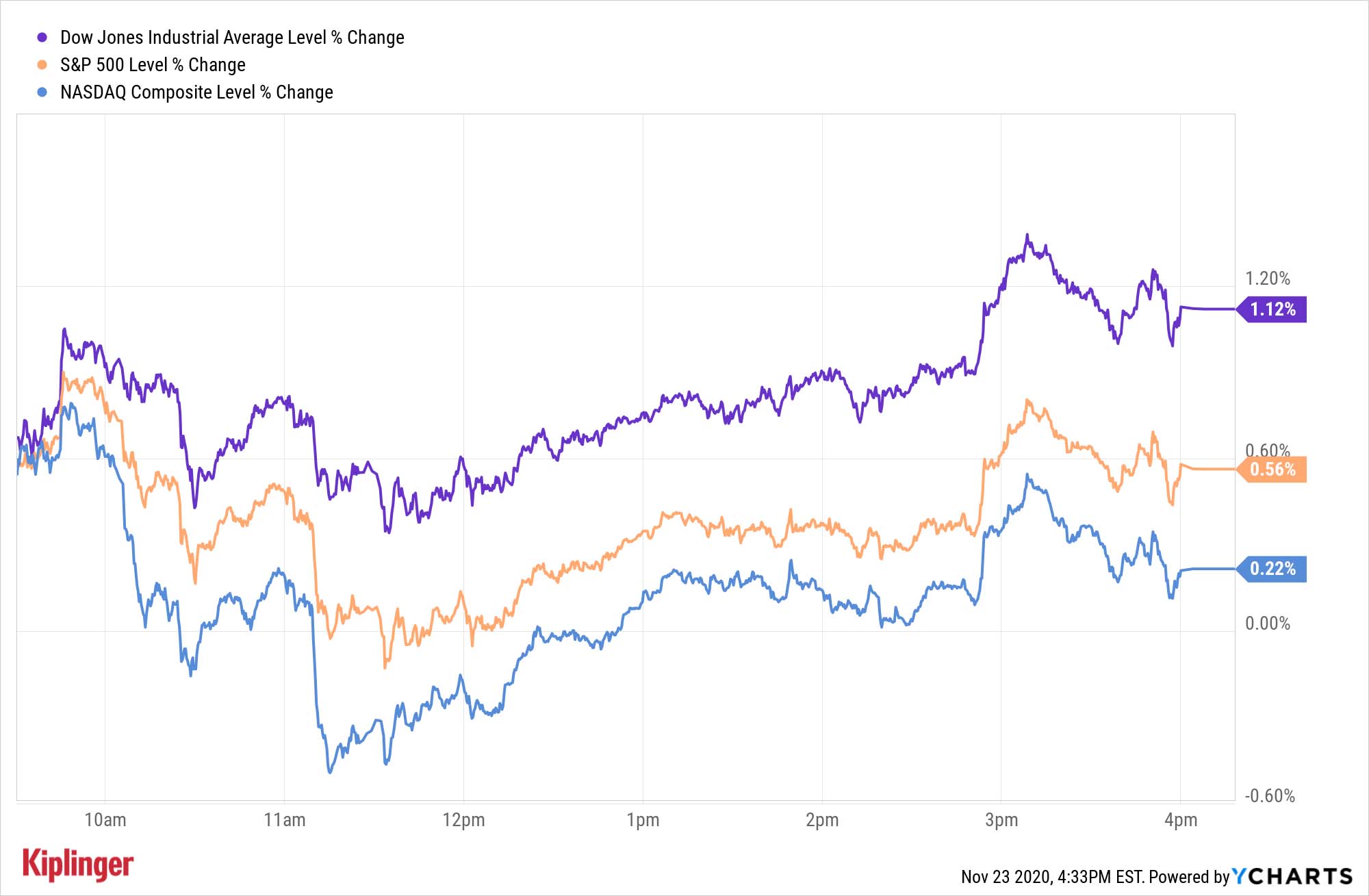

The "rotation" trade returned once more after the market was greeted with COVID vaccine news for a third consecutive Monday.

The heroes today were AstraZeneca (AZN, -1.1%) and the University of Oxford, whose trial vaccine is far easier to store than other vaccines, which could make it easier to distribute across the globe. Trial data revealed an average efficacy of about 70% against COVID – lower than competitors Pfizer (PFE)/BioNTech (BNTX) and Moderna (MRNA), hence AZN's down day – but adjusting dosages could get efficacy up to 90%.

The news prompted a massive spike in cyclical sectors such as financial stocks, up 1.9% as a sector, as well as energy plays such as Exxon Mobil (XOM, +6.6%) and Chevron (CVX, +6.1%) as U.S. crude oil futures climbed 1.5% to $43.06 per barrel. Stocks also enjoyed a bump after learning that President-elect Joe Biden may nominate former Fed chair Janet Yellen as his Treasury Secretary.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average jumped 1.1% to 29,591, while the Nasdaq Composite gained a more subdued 0.2% to 11,880.

Other action in the stock market today:

- The small-cap Russell 2000 closed at another record high, up 1.9% to 1,818.

- The S&P 500 improved by 0.6% to S&P 500.

- Gold futures dropped 1.8% to settle at $1,837 per ounce.

Could 2020 Finish Like It Started?

Wall Street is increasingly warming to the idea that the market could rally into the new year.

"The impending roll-out of multiple highly effective COVID vaccines and the Fed's commitment to backstopping the economy give me confidence that stocks will trade higher into year-end and beyond," says Marc Chaikin, founder of quantitative investment research firm Chaikin Analytics. "I don’t believe that caution is in order and view sideways to downward price action as a buying opportunity.

"The broadening out of the advance to include small cap, value and cyclical stocks, should be accompanied by a robust year-end rally."

If you're looking to leverage value, you can do so either through individual stocks or diversified funds, while these small-cap stocks could make hay as well. The pros also expect further gains for so-called Biden stocks as challenges to his presidential victory thin away.

Another source of gains could come from an unlikely area of the market: consumer staples stocks.

The conventional wisdom goes that staples will be in for a difficult 2021 as vaccines dampen the COVID threat and Americans emerge from their houses. But some staples plays benefit just as much if not more from an outgoing American consumer, and a few others have additional edges on their side as we head into 2021. Read on as we look at some of the best consumer staples stocks for 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.