Stock Market Today: Jobs Data Weighs on Stocks, But Nasdaq Hits New High

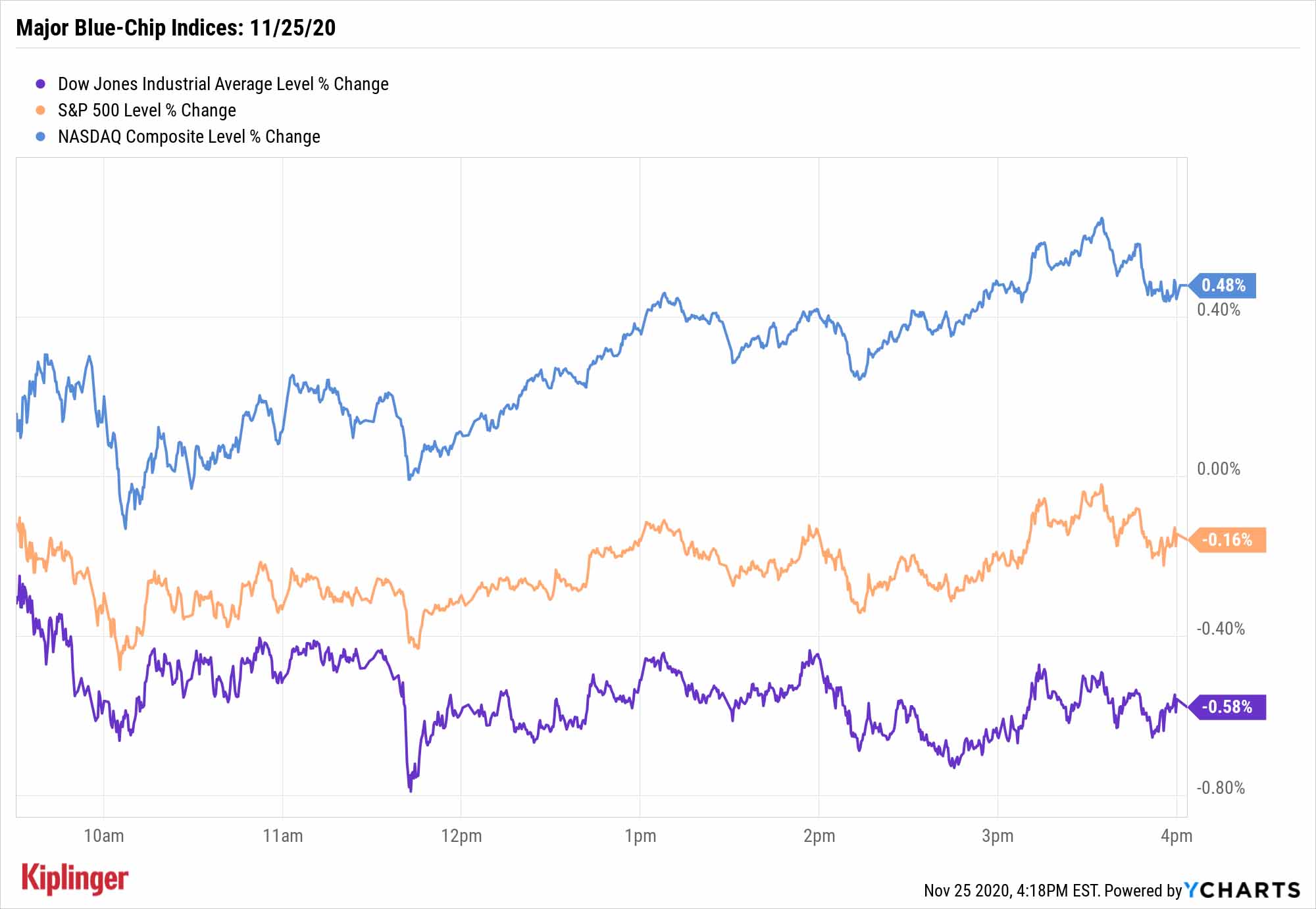

The Nasdaq cleared its September highs Wednesday despite a second straight week of rising unemployment claims that slowed the other major indices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After vaccine euphoria drove several major indices to all-time highs earlier this week, COVID realities led to a more mixed session heading into the Thanksgiving holiday.

The Labor Department released weekly unemployment data a day early, reporting a second consecutive week of rising filings, to 778,000 last week — a number that remains significantly higher than the pre-pandemic record of just under 700,000 in 1982.

Barclays Investment Bank analysts think a particular nuance is worthy of note, however.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We continue to believe declines in claims reflect expiring benefits from the usual state programs, and not necessarily elevated re-hiring," write Barclays' Michael Gapen and Pooja Sriram. "In the post-lockdown period, we have generally drawn signals from continuing claims about the pace of re-hiring and changes in labor market conditions. However, we now believe that a sizable portion of the recent week-to-week decline in continuing claims reflects the expiration of benefits under state programs, which generally last up to 26 weeks."

Meanwhile, the U.S. reported a record number of COVID-related hospitalizations, with 88,080 such cases straining the nation’s healthcare infrastructure and personnel.

The Dow Jones Industrial Average, weighed down by a 5.4% decline in Salesforce.com (CRM) after the Wall Street Journal reported it has been in talks to buy workplace-communications company Slack Technologies (WORK, +37.6%), declined 0.6% to 29,872.

However, gains by the likes of Amazon.com (AMZN, +2.2%) and PayPal (PYPL, +4.1%) helped lead the Nasdaq Composite 0.5% higher to a record-high 12,094.

Other action in the stock market today:

- The S&P 500 closed with a small 0.2% loss to 3,629.

- The Russell 2000 also fell from all-time highs, declining 0.5% to 1,845.

- Gold futures, mired in a nasty slump, managed to eke out a 0.1% improvement to finish at $1,805.50 per ounce.

- U.S. crude oil futures climbed 1.8% to eight-month highs of $45.71 per barrel.

And remember: The stock market will be closed Thursday in observance of Thanksgiving Day.

A Bumpy Road Ahead? If So, Prioritize Shock Absorbers

Today's decline is a reminder that even the forward-looking market will hit some speed bumps along the way to a vaccine and a return to normal. Expect volatility for at least the next few months, and consider stocks offering stability and income.

The Dividend Aristocrats remain the gold standard for steady total returns, given records of dividend growth across several bull and bear markets alike. It’s worth looking at aggressive dividend growers as well, just given what their generosity says about their underlying financials.

And then there are our personal favorites: The Kiplinger Dividend 15. This group of 15 income-oriented picks addresses several types of income needs, whether it’s high yield, dividend growth or just rock-solid payments for those most concerned with stable payouts.

Read on as we catch up on these 15 dividend stocks, which have made it through 2020 with their distributions fully intact.

Kyle Woodley was long AMZN and CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.