20 Stocks Billionaires Are Selling

Billionaires, hedge funds and other high-net-worth investors did plenty of selling in Q1. Here are 20 stocks they unloaded over the most recent three-month period.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A lot of money continues to flow into hedge funds and other billionaire money managers – even as those hedge funds underperform and sprint to shrink their positions.

Consider this: The Goldman Sachs Hedge Industry VIP ETF (GVIP, $73.98) – which tracks the performance of an index composed of roughly 50 U.S.-listed stocks that appear in the top 10 holdings of prominent hedge funds – is in a bear market for 2022, off 23% year-to-date. Actual hedge-fund performance has been more mixed, with the Eurekahedge Hedge Fund Index outperforming the market in January and February but falling behind in March.

Investors, however, are happy to keep throwing money at billionaire investors. According to data provider HFR, hedge funds enjoyed $19.8 billion in net inflows during the first quarter of 2022. That’s the highest amount since Q2 2015.

However, hedge funds largely sat on that money during the first quarter of 2022. According to WhaleWisdom.com, first-quarter Form 13F filings (required quarterly reports of holdings by large institutional investors) showed that investors sold almost three times as many shares as they bought – an indication that investor conviction was heading lower.

Consider this from Bloomberg:

"'A plummeting equity market and the even worse performance of the most popular long positions have led to the worst start of a year on record for hedge fund returns,' [Goldman Sachs] strategists led by Ben Snider wrote in a note on Friday. 'As a result of these struggles, in recent months hedge funds have accelerated the reduction in leverage and rotation away from growth stocks they began several quarters ago,'" Bloomberg reported on May 23.

Studying which stocks asset managers are taking their capital out of is an interesting exercise for many retail investors. That's largely because of the "why." In some cases, these billionaire investors are selling to take profits. In other situations, they could be rotating assets into more appropriate investments based on the current economic environment.

Here are 20 stocks the billionaire set sold off over the past few months. Every quarter, we look at 13F filings from institutional investors to discover not only some of the billionaire set's favorite stock picks – but also which investments they're souring on.

Data is as of June 6. Stake values and portfolio weights are as of March 31. Data is courtesy of S&P Global Market Intelligence, YCharts, WhaleWisdom.com, Forbes and regulatory filings made with the Securities and Exchange Commission, unless otherwise noted.

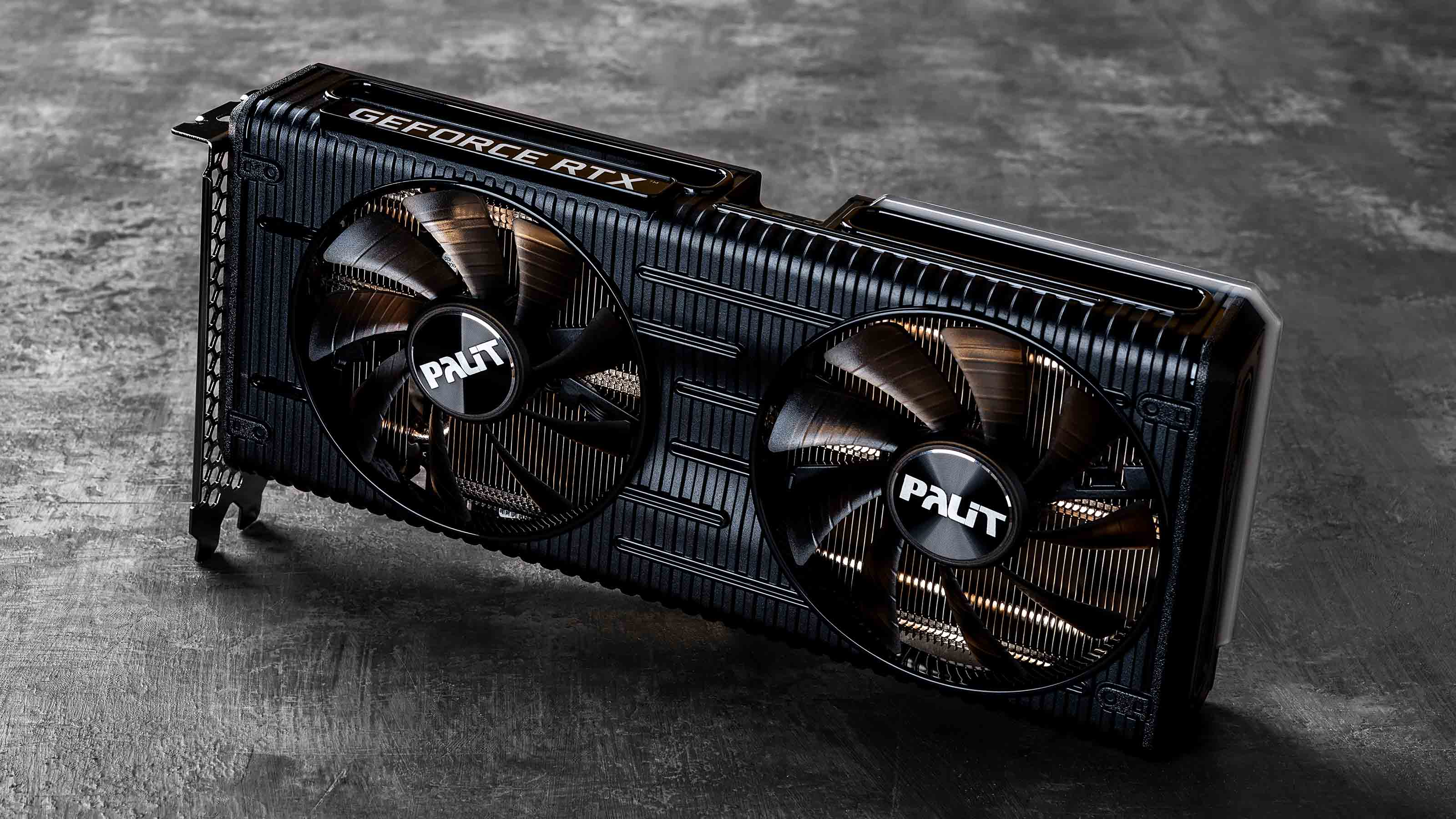

Nvidia

- Market value: $468.1 billion

- Billionaire investor: Jennison Associates

- Shares sold: 7,037,626 (25%)

New York-based hedge fund Jennison Associates sold 25% of its stake in Nvidia (NVDA, $187.86) in the first quarter, reducing its weight from 5.14% to 4.12%. However, Jennison still finished the quarter owning 20.5 million shares of NVDA, which makes it the fifth largest position in its portfolio.

Jennison first acquired Nvidia shares in Q1 2016. According to WhaleWisdom.com, it has paid an average of $40.09 a share over the years. Nvidia shares were priced at $272.86 as of the March 31 close.

Of the big institutional investors holding Nvidia, Jennison was the third-largest seller of the stock in the first quarter, behind only FMR (11.3 million shares sold) and Norges Bank (21.3 million shares sold). Norges Bank manages the Norwegian government's global pension fund.

While Nvidia shares are down 36% year-to-date, they are up roughly 400% over the past five years. As such, it's probable that Jennison sold the semiconductor stock to lock in some of its profits.

Should NVDA's share price continue to fall in 2022, the hedge fund will likely add to its position at some point. Nvidia's too good a company not to be invested for the long haul.

Jackson Financial

- Market value: $3.1 billion

- Billionaire investor: Apollo Global Management

- Shares sold: 2,935,220 (27%)

Apollo Global Management's 13F reported that it had $21.1 billion invested at the end of March in 362 stocks. The investment advisory arm of the alternative asset manager sold out of 96 stocks during the quarter and reduced its position in 98 others. One of those that it pared its stake in was Jackson Financial (JXN, $35.50), a Michigan-based provider of annuities and other retirement products.

Jackson was Apollo's ninth-largest holding at the end of Q1 2022, despite reducing its position by 27% over the three-month period. Apollo first acquired JXN shares in the fourth quarter of 2021, paying an average price of $41.83 per share. JXN stock traded between $35 and $47 throughout the first quarter, so if Apollo made money on its share sale, it didn't make much.

As far as billionaire investors selling JXN shares during the first quarter, Apollo sold the second-largest amount, behind only Sessa Capital, which unloaded 3.9 million shares. While Apollo reduced its weighting in JXN to 1.58% from 1.91% in Q1, Seesa slashed its Jackson weighting to 1.91% from 9.84%.

In September 2021, Jackson Financial was spun out of Prudential Financial (PRU). Shareholders of the parent company received one JXN share for every 40 PRU shares they owned. Prudential retained a 19.7% economic interest. As of Dec. 31, 2021, it still owned 18.4% of the financial firm.

Alcoa

- Market value: $11.8 billion

- Billionaire investor: Theleme Partners

- Shares sold: 1,585,000 (32%)

Of all the hedge funds and investment firms covered in this article, Theleme Partners is by far the most focused. At the end of December, the London-based firm had almost $6 billion invested in just 11 positions. One of those was Alcoa (AA, $64.02).

Interestingly, Theleme had almost half its assets invested in put options – a bet the share price will go down – on the iShares Russell 2000 ETF (IWM), which tracks the performance of 2,000 small-cap U.S. stocks. Its next largest holding was Moderna (MRNA) at almost $1.3 billion. AA was the hedge fund's fourth-largest holding at the end of December, accounting for 4.9% of the portfolio.

By the end of March, Theleme's 13F was down to $3.1 billion. It appears the hedge fund went heavily to cash. The entire iShares put position was sold out in the first quarter.

As for Alcoa, Theleme first initiated a position in the aluminum giant in Q3 2021, paying an average price of $48.94 a share. At the end of March, AA closed at $90.03 (though it's down a third in the two months since). We chalk up Theleme's 32% reduction to profit-taking.

Devon Energy

- Market value: $50.9 billion

- Billionaire investor: Permian Investment Partners

- Shares sold: 1,762,856 (44%)

There's been a lot of profit-taking so far in 2022. Devon Energy (DVN, $77.05) is no exception. In the first quarter, Permian Investment Partners reduced its position in the Oklahoma City oil & gas producer by 44%. Devon's weighting in Permian's $834-million portfolio fell to 15.44% at the end of March from 18.05% at the end of December. Still, it remains the hedge fund's second-largest position, behind utility stock NRG Energy (NRG).

Interestingly, despite the name Permian, the New York-based hedge fund owns just two other energy stocks – Cameco (CCJ) and Golar LNG (GLNG). Permian first initiated a stake in Devon in Q1 2021, paying an average price of $23.18 a share. One year later, the stock is up more than 200%.

That's quite the timing.

Permian's portfolio was made up of 18 positions at the end of March. Its top five holdings accounted for 77.15% of its portfolio. The five holdings were from five different sectors: utilities, energy, industrials, transportation and healthcare.

Devon reported first-quarter earnings on May 2. It beat on both the top and bottom line. In the quarter, the oil and gas company generated a record $1.3 billion in free cash flow – the money left over after a company has paid its expenses, interest on debt, taxes and long-term investments needed to grow its business.

It doesn't appear there's anything to get in the way of more record-setting results for Devon, either, except a possible recession in 2023. In the meantime, Permian will most likely hang on to most of its DVN shares.

Visa

- Market value: $450.6 billion

- Billionaire investor: GQG Partners

- Shares sold: 6,967,149 (61%)

GQG Partners finished the first quarter with $43.1 billion invested in 72 managed 13F securities. This was after the investment advisor reduced its holdings in 17 stocks over the three-month period, including its stake in Visa (V, $212.94). With the sale of almost 7 million shares, Visa's weighting in the Ft. Lauderdale advisory firm's large portfolio was reduced from 6.07% as of Dec. 31, 2021, to 2.22% at the end of March.

The billionaire investment firm first acquired a position in the Dow Jones stock in Q4 2016. It's estimated to have paid an average price of $199.65 per V share. The investment advisor sold 61% of its Visa shares in the first quarter, most likely to preserve profits. It also could be over concerns of a potential economic slowdown.

At the end of April, Piper Sandler analyst Chris Donat downgraded both Visa and Mastercard (MA) to Neutral from Overweight (the equivalents of Hold and Buy, respectively) on concerns that inflation could result in slowing discretionary spending and less cross-border activity in the future, Visa's bread and butter.

"While we think that MA and V have beautiful business models, these models operate in the broader global economy," Donat wrote in a note. He adds that both credit card companies have wide exposure to Europe, which could put pressure on transactions, profits and valuation multiples should the region enter a recession next year.

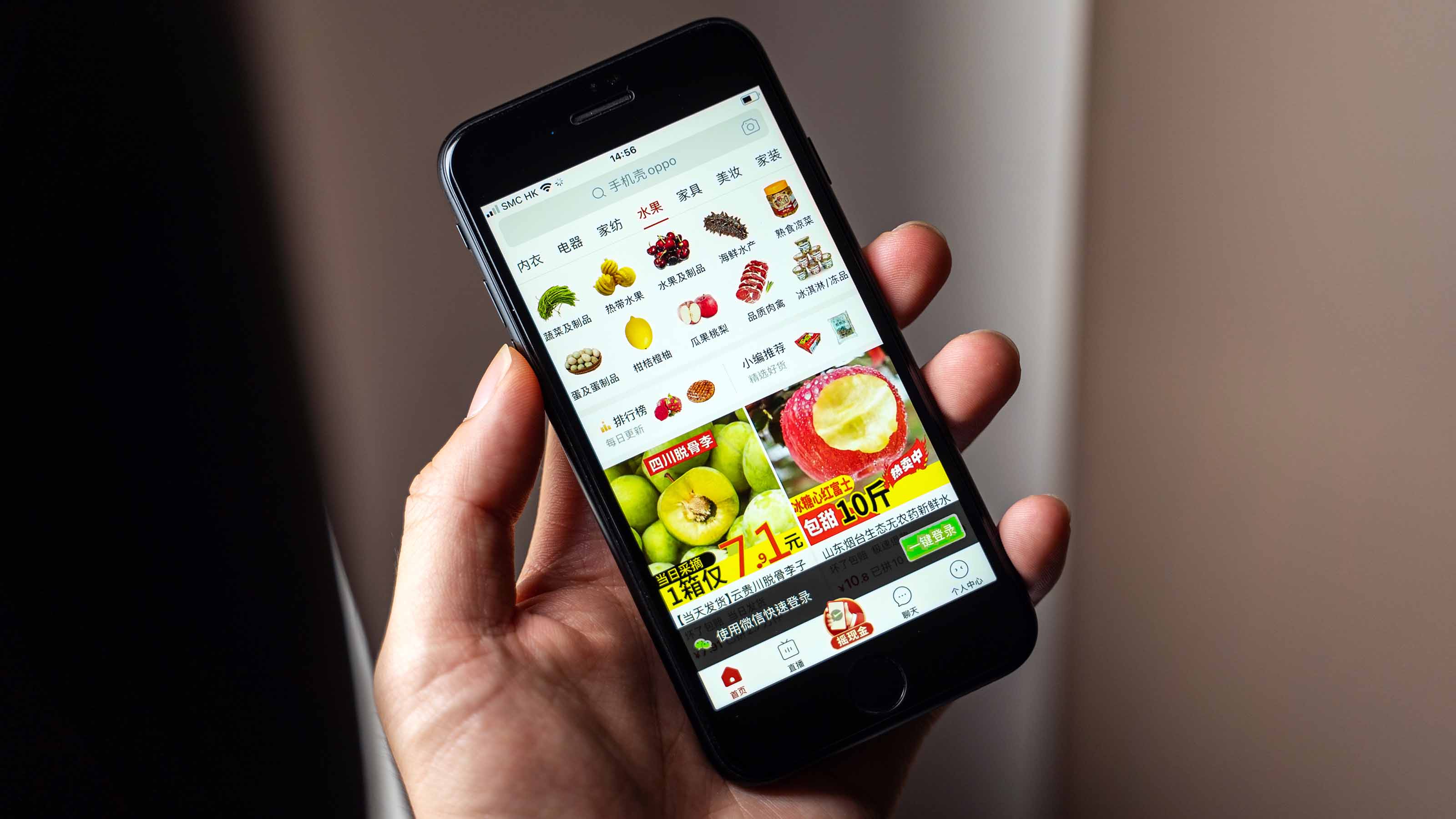

Pinduoduo

- Market value: $68.0 billion

- Billionaire investor: Chase Coleman III (Tiger Global Management)

- Shares sold: 10,012,324 (63%)

Tiger Global Management, the hedge fund run by Chase Coleman III, sold out of 83 stocks in the first quarter and reduced its position in 46 others. In contrast, it bought just two new stocks and added to 21 others.

Among those that Tiger Global Management reduced its position in during the first quarter were a number of Chinese stocks listed on U.S. exchanges. One of those was Shanghai-based e-commerce platform Pinduoduo (PDD, $53.75). The billionaire investor's hedge fund cut its position in PDD by 63%, dropping its weighting from 2.0% at the end of 2021 to 0.87% at the end of March. It finished the first quarter owning 5.8 million shares of PDD.

Investors remain concerned that many of these firms will be delisted due to the Chinese government standing in the way of U.S. regulators for more than a decade. U.S. regulators are required by law to inspect the auditors of Chinese companies in order to be listed on domestic exchanges. In order to avoid a massive delisting of Chinese stocks in the U.S., Beijing will likely need to reach a settlement with Washington at some point in the near future.

Tiger made other large sales of Chinese stocks during the quarter including New Oriental Education & Tech Group (EDU), JD.com (JD) and Alibaba Group (BABA).

Apple

- Market value: $2.4 trillion

- Billionaire investor: Winslow Capital Management

- Shares sold: 4,587,508 (99%)

Winslow Capital Management had $23.1 billion in managed securities in its first-quarter 13F. Apple (AAPL, $146.14) was its largest reduction in terms of the number of shares sold without completely closing out of the position. Interestingly, the Minneapolis-based hedge fund retained 2,386 shares of Apple that were worth $417,000 at the end of March. Perhaps that's to lay the groundwork for building a position in the iPhone maker in the future.

Apple was one of Winslow's largest positions heading into the quarter. However, after unloading nearly 4.6 million shares over the three-month period, AAPL is now the hedge fund's smallest stock holding. Only the iShares S&P 500 Growth ETF (IVW) has less of a weighting in Winslow's portfolio.

Winslow first acquired Apple shares in the third quarter of 2019, paying an average price of $55.99 a share. The sale was likely another case of profit-taking. AAPL shares finished the quarter at $174.61. They've fallen 16% in the second quarter.

The hedge fund also wasn't close to being the largest institutional seller of Apple stock in Q1 2022. That distinction belongs to Norges Bank, which sold 142.1 million AAPL shares to close out of its position entirely. State Street, meanwhile, came in second, selling 19.3 million shares during the quarter. Despite the sale, Apple remains State Street's largest equity position, with a 5.3% weighting.

AAPL was just one of 21 stocks Winslow reduced its stake in during the first quarter, while the hedge fund completely sold out of 16 positions. Its top 10 holdings accounted for 46.0% of its portfolio at the end of March.

Verizon

- Market value: $215.2 billion

- Billionaire investor: Warren Buffett (Berkshire Hathaway)

- Shares sold: 157,444,464 (99%)

Verizon (VZ, $51.24) was easily Warren Buffett's biggest stock sale in the first quarter. Berkshire Hathaway sold 99% of its stake in America's second-largest wireless carrier. Despite unloading all but 1.38 million shares of VZ stock, its current stake is still worth $70.7 million. That's how big the Berkshire Hathaway equity portfolio is.

Berkshire first bought Verizon shares in the last quarter of 2020. It's estimated the holding company paid an average of $58.70 a share, or $9.3 billion, for its stake. VZ was Berkshire's seventh-largest position at the end of December, good enough to get a mention in the company's 2021 shareholder letter. It owned 3.8% of the company at the end of 2021, but that has fallen to a 0.03% ownership stake following the most recent share sale.

Verizon's share price traded in a tight range between $50 and $55 during the first quarter. Even if Buffett got $55 from Q1 2022's big sale, it likely lost money on the stock it sold. How it ultimately does on the remaining 1.3 million VZ shares has yet to be written.

Needless to say, it was not a good bet by Buffett & Co.

Walt Disney

- Market value: $196.4 billion

- Billionaire investor: Ruane Cuniff & Goldfarb

- Shares sold: 2,804,442 (99%)

In the first quarter, Ruane Cuniff & Goldfarb sold out of just one stock and reduced its stakes in 19 others. The one stock it sold out entirely was Primerica (PRI). However, PRI was not a big holding for the investment firm best known for its Sequoia Fund. It owned 1,400 shares of the insurance and wealth management company.

Ruane's biggest sale in the first quarter was its disposition of 99% of its shares in Walt Disney (DIS, $107.83). Ruane first acquired Disney stock in Q2 2020. It paid an average price per share of $114.52. Following an 11.4% swoon in Q1 2022, Disney's share price was $137.16 at the end of March – and it has fallen even farther in the second quarter to now trade below cost.

So, it appears that Ruane sold out at the right time.

Still, at the end of March, Ruane owned 1,988 shares of the entertainment conglomerate. Just as Winslow Capital Management hung on to a little piece of Apple, the New York-based investment firm hung on to a little sliver of the blue-chip stock. One has to wonder why?

Abbott Laboratories

- Market value: $204.1 billion

- Billionaire investor: Steadfast Capital Management

- Shares sold: 1,672,054 (100%)

The New York-based hedge fund finished the first quarter with assets of $5.8 billion and 45 positions. One of them wasn't Abbott Laboratories (ABT, $116.42).

The hedge fund sold its entire position in the first quarter – a massive turnaround from the end of December, when ABT was one of Steadfast’s largest positions at 3.93% of the portfolio.

It was a quick turnaround, too. Steadfast first acquired shares in Abbott during the first quarter of 2021, paying an average price of $118.41 per share. The fund then added to its stake in Q2 – another 761,858 shares, for about 57% growth in the position. But over Q3 and Q4, Steadfast turned tail, unloading 149,705 and 263,979 shares, respectively. It was most certainly profit taking, as the stock hit a 52-week high of $142.60 on Dec. 27, 2021.

Meanwhile, during the first quarter, ABT shares traded between about $114 and $141. It wouldn’t be surprising if Steadfast executed most if not all of its exit during the first quarter.

Cerner

- Market value: $27.9 billion

- Billionaire investor: John Paulson (Paulson & Co.)

- Shares sold: 474,010 (100%)

Cerner (CERN, $94.97) was one of six companies Paulson & Co. – the hedge fund founded by billionaire investor John Paulson – completely exited in the first quarter. Paulson first acquired CERN shares in the fourth quarter of 2021, so the bet was a quick one.

Paulson is estimated to have paid an average price of $92.87 a share for the healthcare technology stock. CERN's price at the end of March was $93.56 and it's barely budged from there.

There's a reason for the lack of movement.

In December, Cerner agreed to be acquired by Oracle (ORCL) for $28.3 billion, or $95 per share, in cash. Paulson might have held on to see if a better offer surfaced. When it was clear that wasn't going to happen, it's likely the hedge fund sold its shares. On June 1, ORCL said it has received all antitrust approvals for the buyout.

Two Sigma Advisers is one of the largest institutions still holding CERN. The hedge fund actually added 592,400 shares during the first quarter, bringing its total position to 4.4 million shares, or 1.1% of its portfolio.

CoStar Group

- Market value: $24.2 billion

- Billionaire investor: Dan Loeb (Third Point)

- Shares sold: 5,687,819 (100%)

Third Point – the hedge fund founded by billionaire investor Dan Loeb – sold out of 26 stocks in the first quarter and reduced its position in 22 others. One of the largest positions it completely sold out of in Q1 was CoStar Group (CSGP, $61.13). At the end of December, the hedge fund's stake was worth $449.5 million, and accounted for 3.1% of its portfolio.

According to WhaleWisdom.com, Third Point first bought the commercial real estate data analytics firm's stock in Q1 2021. The average price paid is a shockingly high $154.30 a share. While that seems improbable, there is an explanation.

On June 28, 2021, CoStar split its stock on a 10-for-1 basis. So, Dan Loeb's 5.69 million shares were 568,782 before the stock split. Third Point's 13F from Q1 2021 confirms that the hedge fund owned 550,000 shares as of March 31, 2021.

At the end of Q2 2021, it owned 5,671,000 shares, which means it picked up an additional 17,100 shares before the 10-for-1 split. It picked up its final 16,819 in Q3 2021 after the split.

The 550,000 shares bought in Q1 2021 were worth $452.0 million at the end of March 2021. That's $82.19 a share post-split.

No matter which way you splice it, it's unlikely Loeb made money on this trade.

General Motors

- Market value: $55.2 billion

- Billionaire investor: David Tepper (Appaloosa Management)

- Shares sold: 2,250,000 (100%)

Of the 12 stocks Appaloosa Management – the hedge fund co-founded by billionaire investor David Tepper – closed out in Q1 2022, General Motors (GM, $37.83) was the second-largest position behind T-Mobile (TMUS). Heading into the quarter, GM accounted for 3.39% of the hedge fund's portfolio.

Appaloosa's purchase of GM appears to be nothing more than poor timing. It acquired its shares in Q4 2021 at an average price of $58.63 a share. GM stock is currently trading more than 35% below that price.

For the sake of Appaloosa's limited partners, hopefully, David Tepper's money managers were able to unload GM by mid-January when shares were still trading in the mid-$50s.

Capital Research Global Investors was another investment firm to sell GM stock in Q1, with the 13.9 million shares sold the most of any institution. However, despite the large share sale, it still owned 81.2 million shares at the end of March, making it the investment management firm's 24th largest position.

While Appaloosa exited its GM position, Berenberg analyst Adrian Yanoshik is big on the Detroit auto manufacturer. On May 10, Yanoshik initiated coverage of GM with a Buy rating and a $55 price target.

"Despite fears, our work suggests that [auto maker] price-mix strength and deep order books can help generate free cash flow, funding transformations of legacy businesses into the electrified arena," Yanoshik wrote in a note to clients, as reported by Barron's.

We'll know who's right in a year from now.

Jack in the Box

- Market value: $1.5 billion

- Billionaire investor: David Einhorn (Greenlight Capital)

- Shares sold: 211,024 (100%)

Out of the 12 stocks David Einhorn's Greenlight Capital closed out in the first quarter, Jack in the Box (JACK, $69.48), a California-based burger chain, was his largest holding at the end of December, with a 1.06% weighting. Einhorn first acquired JACK shares in Q2 2020, paying an estimated $86.89 a share.

Between January and March, Jack in the Box's shares traded between $79 and $97, so it's possible the hedge fund made some money on its bet. Not a huge amount, mind you, but a profit is always better than a loss.

The consumer discretionary stock ended the first quarter at $93.41. Year-to-date, the stock is down 21%, so it appears Einhorn got out in the nick of time.

Last December, Jack in the Box announced that it would acquire Del Taco, the country's second-largest Mexican QSR (quick-service restaurant) chain by the number of locations. JACK paid roughly $585 million, including the assumption of debt, for Del Taco. It closed the deal on March 8.

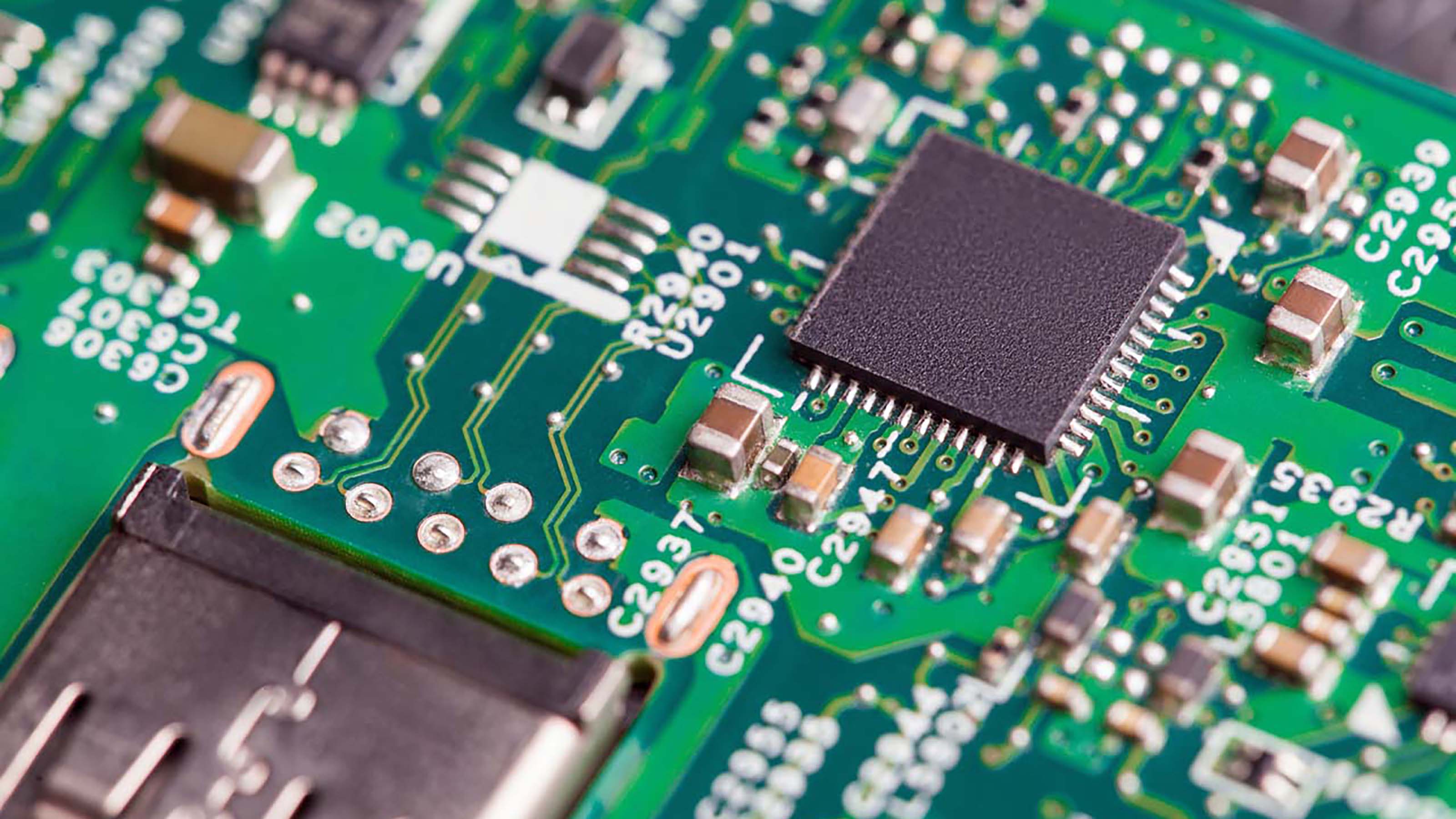

Micron Technology

- Market value: $78.7 billion

- Billionaire investor: Jim Simons (Renaissance Technologies)

- Shares sold: 4,066,036 (100%)

Figuring out which stocks to highlight with Jim Simons' hedge fund is not an easy task.

At the end of the first quarter, Renaissance Technologies had $85.2 billion invested among 4,032 companies. That's an average of $21.1 million per company. While most hedge funds' top 10 holdings account for more than 50% of their 13F portfolios, Renaissance's top 10 represent just 12% of its massive portfolio.

It was a busy first quarter for Simons. Over the three month period, the billionaire investor sold out of 656 stocks, reduced positions in 1,631, bought 828 new stocks and added to 1,564 existing positions.

Of the 656 stocks it exited in the first quarter, Micron Technology (MU, $70.45) was the second-largest position in terms of percentage of the hedge fund's portfolio at the end of December, with a 0.47% weighting, behind only Microsoft at 0.98%. Renaissance first acquired Micron shares in Q4 2018.

The hedge fund became legendary on Wall Street for using machine learning to bet on the markets. In a January 2020 article in Towards Data Science, the author points out that the firm's Medallion Fund achieved an average annual return of 66.1% between 1988 and 2019.

Renaissance Technologies is estimated to have paid an average of $89.87 a share for its position in Micron. On a few occasions in the first quarter, Micron's share price reached above $95. The hedge fund likely used its first-rate machine learning capabilities to get out with a profit in hand.

NortonLifeLock

- Market value: $14.3 billion

- Billionaire investor: Seth Klarman (Baupost Group)

- Shares sold: 5,780,000 (100%)

Baupost Group, the hedge fund founded by billionaire investor Seth Klarman, sold out of just two stocks in the first quarter. One was NortonLifeLock (NLOK, $24.65). The other was Pershing Square Tontine Holdings (PSTH), Bill Ackman's failed special purpose acquisition company (SPAC). Baupost also reduced its positions in 29 stocks during the first three months of 2022.

The hedge fund is said to have first initiated a position in NLOK in Q4 2021, paying an average of $25.98 a share for the cybersecurity software company. NortonLifeLock accounted for 1.48% of Baupost's $10.1 billion in assets listed in its fourth-quarter 13F.

Last August, NortonLifeLock announced that it was buying Czech consumer cybersecurity firm Avast for between $8.1 billion and $8.6 billion in a cash-and-stock transaction. The acquisition is expected to close sometime in the second half of 2022, pending regulatory review.

The combined business is expected to have annual revenue of $3.5 billion. Norton CEO Vincent Pilette will head the merged firm, while Avast CEO Ondrej Vlcek will serve as president. Norton shareholders will own between 74% and 86% of the combined entity.

The tech stock is down 5.1% for the year-to-date.

Occidental Petroleum

- Market value: $65.2 billion

- Billionaire investor: Carl Icahn

- Shares sold: 45,000,346 (100%)

A funny thing happened to Occidental Petroleum (OXY, $69.61) in the first quarter. Two billionaire investors were buying and selling the oil and gas producer's stock. Carl Icahn was the one doing the selling, while Warren Buffett was buying.

In early March, Icahn sold off the last of his 45 million shares of OXY stock, according to The Wall Street Journal. At one time, Icahn owned 10% of Occidental. He took the energy producer to task in 2019 for its $38 billion acquisition of Anadarko Petroleum.

Buffett was instrumental in Occidental's Anadarko purchase.

In the first quarter, Buffett's Berkshire Hathaway bought 136.4 million OXY shares. Berkshire also owns preferred stock on OXY and has warrants to buy an additional 84 million shares that it received for helping Occidental acquire Anadarko.

As for Icahn, investors need not feel sorry for the billionaire. He first acquired shares of the company in the second quarter of 2019. He's estimated to have paid an average price of $21.44 a share, so the 86-year-old easily doubled his money over less than three years.

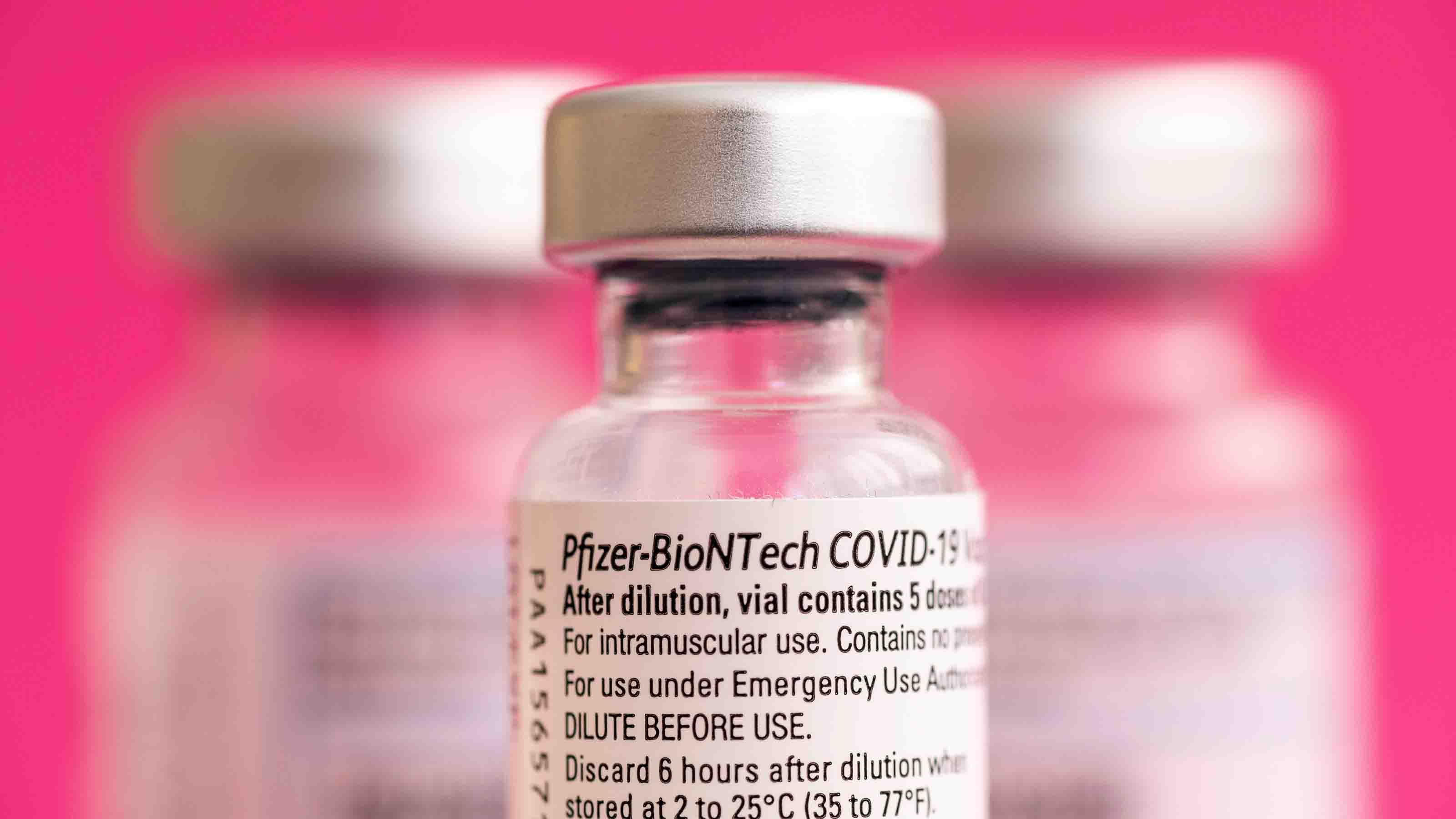

Pfizer

- Market value: $298.8 billion

- Billionaire investor: Philippe Laffont (Coatue Management)

- Shares sold: 10,311,917 (100%)

Coatue Management sold out of 35 stocks in the first quarter, while reducing its stake in another 18 companies. Pfizer (PFE, $53.26) was the most notable position the New York-based hedge fund closed out of. During the first quarter, Pfizer stock traded as high as $58.55 and as low as $45.40.

The hedge fund first acquired shares of PFE in Q4 2021, so the position wasn't held for very long. Coatue is estimated to have paid an average of $59.05 per share during the final three months of 2021, so the fund most likely lost money on its Pfizer position.

Coatue still counts healthcare stock Moderna (MRNA) among its top positions – the 6.9 million shares held makeup 8.7% of its portfolio. This puts it in third place, just behind electric vehicle stocks Tesla (TSLA) and Rivian Automotive (RIVN) that take up the top two spots.

Among other institutions selling 100% of their Pfizer stock during the quarter was Sanders Capital. The Florida-based hedge fund unloaded its 12.2 million PFE shares in Q1. Unlike Coatue, Sanders Capital first acquired Pfizer shares in Q4 2015, paying an average price of $33.24 per share.

While PFE stock is down nearly 10% for the year-to-date, it could have a potential COVID-related catalyst coming down the pike. The Food and Drug Administration recently announced that 5- to 11-year-olds are now able to get a Pfizer/BioNTech (BNTX) booster shot. In addition, Paxlovid, the company's antiviral pill to treat COVID-19, is expected to generate $22 billion in sales in 2022.

T-Mobile US

- Market value: $172.0 billion

- Billionaire investor: David Tepper (Appaloosa Management)

- Shares sold: 1,275,992 (100%)

In the first quarter of 2022, Appaloosa Management closed out 12 positions. America's third-largest wireless carrier, T-Mobile US (TMUS, $137.17), was one of them. And TMUS was the hedge fund's largest position at the end of December – accounting for 3.8% of the $3.9 billion in assets listed on its fourth-quarter 13F – that it closed out in the first quarter.

Appaloosa first acquired TMUS shares in Q4 2017. It paid an average of $99.35 a share. At the end of the first quarter, T-Mobile shares traded at $128.35. For the year-to-date, they're up 18.3% – not too bad considering the S&P 500 is down more than 13% so far in 2022.

T-Mobile stock's return is also better than its two biggest competitors: AT&T (T) and Verizon (VZ) that are up 12.7% and down 1.4% for the year-to-date, respectively. When it comes to wireless, T-Mobile is winning the shareholder return game so far in 2022.

Of the other institutions that sold TMUS in Q1 2022, King Street Capital had the largest weighting for TMUS at the end of December, with its stake accounting for 7.78% of its $1.07 billion in assets. No other company came close to being nearly as consequential a closeout.

For whatever reason, known only to David Tepper and Appaloosa Management, the hedge fund didn't sell TMUS in July 2021 when it hit an all-time high of $150.20. Clearly, the 2022 rebound has given the hedge fund a chance to bow out gracefully.

Willis Towers Watson

- Market value: $23.2 billion

- Billionaire investor: Larry Robbins (Glenview Capital Management)

- Shares sold: 362,996 (100%)

Glenview Capital Management sold out of six stocks in the first quarter and reduced its holdings in 20 others. One of the six it sold in its entirety was Willis Towers Watson (WTW, $208.27). The hedge fund first acquired shares in the insurance brokerage in Q3 2021. It paid an average price per share of $232.46. Prior to the sale, WTW accounted for 1.84% of Glenview's $4.7 billion in managed 13F securities at the end of December.

While Glenview's sale of Willis Towers Watson is notable, the biggest seller in terms of the number of WTW shares sold in the first quarter was Eagle Capital Management. It sold 2.0 million shares over the three-month period, nearly its entire stake. The New York-based investment firm first acquired shares in Q1 2021, paying an average price per share of $228.96.

At the end of April, Willis reported first-quarter earnings that included an 11% year-over-year increase in adjusted net income to $315 million, or $2.66 per share. Analysts, on average, were expecting $2.28 a share. Its revenue during the first quarter was down 3% versus the year prior to $2.2 billion.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.