Stock Market Today: Tesla, Tech Stay on Track, But Dow Dips

A light news day on the stimulus front put more attention on present COVID issues, weighing on the "rotation" trade and benefiting the tech-heavy Nasdaq.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With little news on the stimulus front to lift investors' spirits, the "rotation trade" away from tech and toward more value-priced, cyclical equities took a breather Monday.

Wall Street's attention was on America's still-worsening coronavirus outbreak, with the country nearing 200,000 new cases daily, and "the blip from Thanksgiving isn't even here yet," says Dr. Anthony Fauci, the nation's top infectious-diseases official.

Meanwhile, slowing momentum on another COVID rescue plan has some analysts worried that relief will be too late and/or too little.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Even with further stimulus, the potential for some volatility exists if the stimulus package proves insufficient to prevent a series of bankruptcies and financial system strain," says Tracie McMillion, head of Global Asset Allocation Strategy for the Wells Fargo Investment Institute.

"In the very near term, we expect volatility to remain elevated as markets await the Georgia election runoff and remain hopeful for more definitive signs of a viable and much-needed stimulus package out of Washington," chimes in Frank Panayotou, managing director, UBS Private Wealth Management.

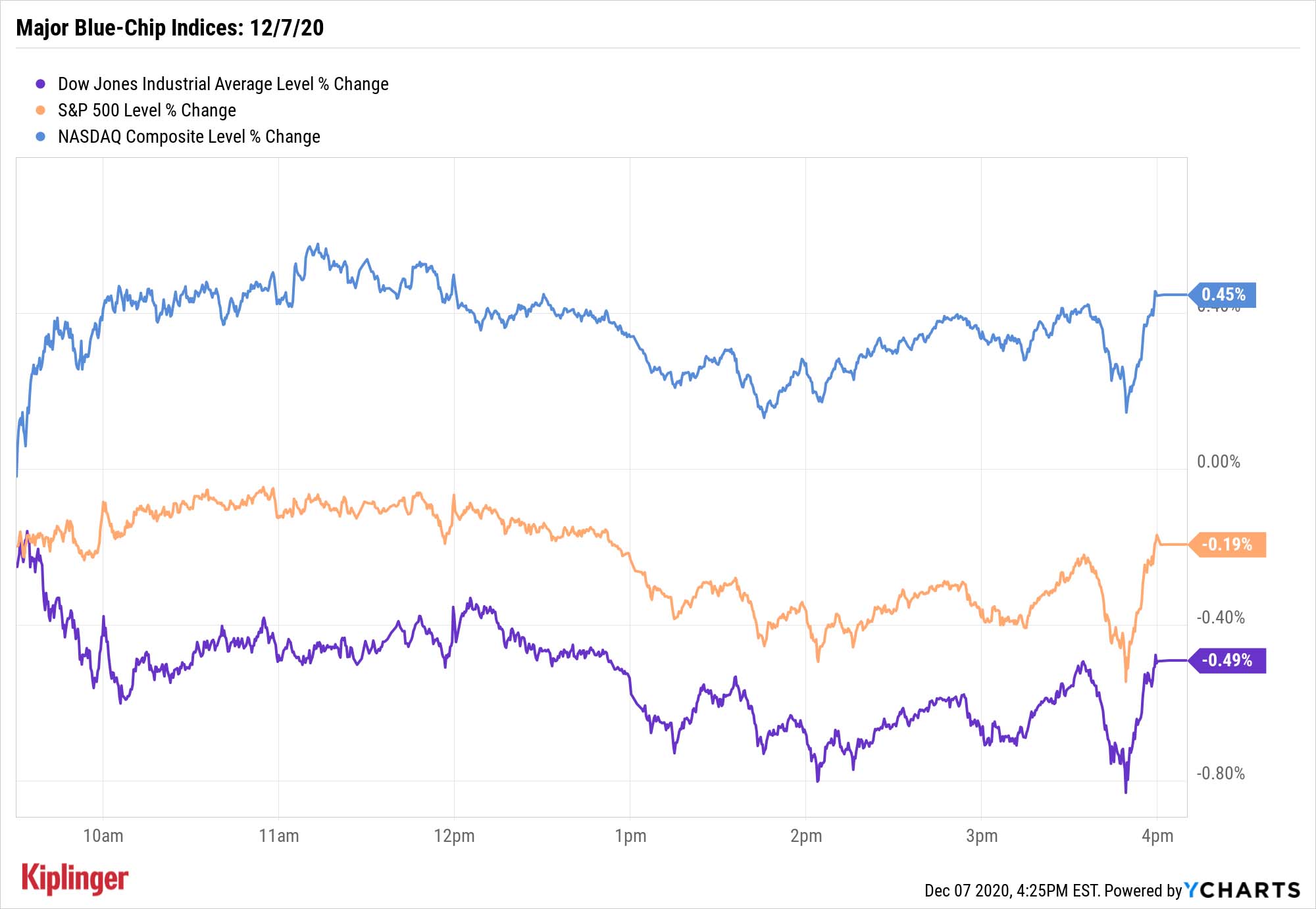

The Dow Jones Industrial Average declined 0.5% today off all-time highs to 30,069. Meanwhile, the tech-heavy Nasdaq Composite gained 0.5% to a record 12,519, helped by Tesla (TSLA, +7.1%), which grew to $608 billion in market value ahead of its inclusion in the S&P 500, where it would be the sixth-largest company at its current worth. Netflix (NFLX, +3.5%) and Facebook (FB, +2.1%) were among the other major contributors.

Other action in the stock market today:

- The S&P 500 lost 0.2% to 3,691.

- The small-cap Russell 2000 dipped marginally to 1,891.

- Gold futures were up 1.4% Monday, settling at $1,866 per ounce.

- U.S. crude oil futures declined by 1.1% to finish at $45.76 per barrel.

What Do Your 2021 Income Plans Look Like?

Bond investors will be pleased to hear that Kiplinger senior editor Jeff Kosnett sees a strong year ahead for bonds.

"Since 2021 stands to be quieter than 2020, with no election, banks and real estate steadying, and progress on the pandemic, there's no urgency I can see to withdraw your 2020 profits from the market," he says.

Investors can take advantage of that kind of environment via these bond funds for a wide variety of income needs.

An economic revival, meanwhile, could benefit real estate investment trusts (REITs), making higher-yielding REITs like these 11 picks a 1-2 punch of price upside and cash payouts.

But no matter what kinds of income investments you consider, ask yourself this: How often are you getting paid?

While most bonds pay semiannually and most stocks pay quarterly, some stocks and funds pay investors each and every month. That kind of dividend regularity can really simplify planning for expenses in retirement, making these picks favorites among people who plan to live on their portfolio income. Read on as we explore 11 of the best monthly dividend payers for the year ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.