Stock Market Today: Stocks Retreat on Stimulus Stalemate

Investors rushed out of tech stocks Wednesday as continued gridlock on COVID stimulus measures weighed on Wall Street confidence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

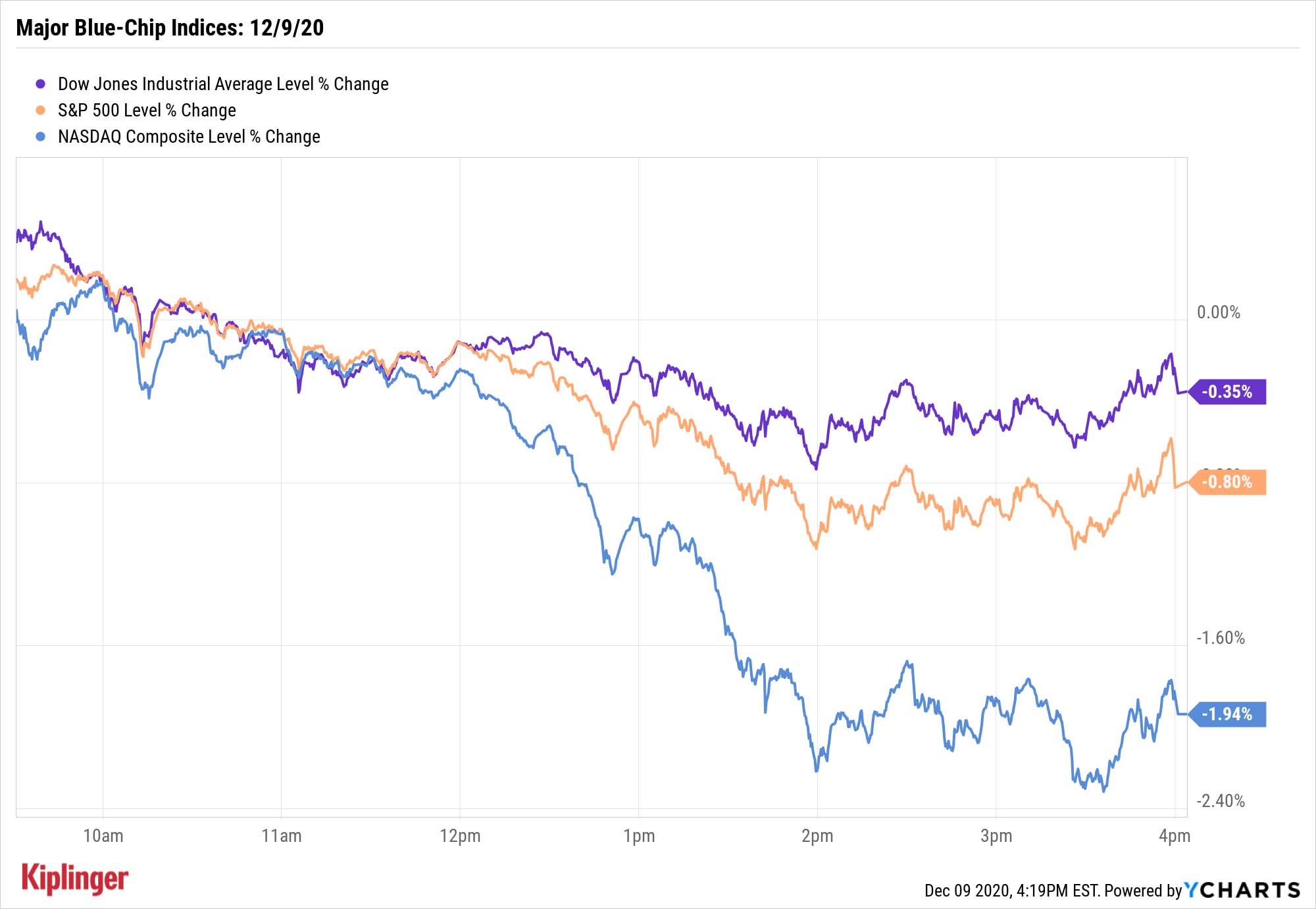

The major indices all retreated on Wednesday, with some of Wall Street's largest corporations bleeding the most.

Washington still can't get its act together on COVID relief: Democratic leaders shot down a $916 billion proposal from the White House, favoring instead a $908 billion bipartisan deal that's still not fully hammered out.

However, the "rotation" away from tech stocks was back on – sellers weren't overly aggressive with the many cyclical names of the Dow Jones Industrial Average, which dipped 0.4% to 30,068, but they sprinted away from mega-cap technology and tech-related firms.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Facebook (FB, -1.9%) helped lead the Nasdaq Composite (-1.9% to 12,338) lower after a group of 48 state attorneys general filed antitrust lawsuits against the social media firm; Apple (AAPL, -2.1%), Amazon.com (AMZN, -2.3%) and Google parent Alphabet (GOOGL, -1.9%) weighed heavily, too.

Where was that money flowing? Well, housing-related stocks Lowe's (LOW, +5.9%) and Home Depot (HD, +1.5%) attracted buyers Wednesday, as did the initial public offering (IPO) of food delivery service DoorDash (DASH), which rocketed 85.8% higher on its first day of trading.

Other action in the stock market today:

- The S&P 500 shed 0.8% to 3,672.

- The small-cap Russell 2000 closed 0.8% off its lows to 1,902.

- Gold futures joined stocks in their decline, falling 1.9% to $1,838.50 per ounce.

- U.S. crude oil futures slid, but by just 0.2% to settle at $45.52 per barrel.

How to Manage This Rotation

Investors should expect more of the same daily churn, analysts say, as Wall Street hangs on every stimulus-related headline. And they also continue to say that value stocks still have the edge.

"November was also a great month for Value with outperformance relative to Growth across all the size segments," write BofA Global Research analysts. "However, multiples actually expanded more in the Growth benchmarks than in the Value benchmarks across sizes. … This is one reason why we remain bullish on Value: the rally barely made a dent in relative valuations."

That continues to bode well for value stocks and value funds alike.

But investors who are fully allocated can't buy much of anything without raising a little cash, so unless you plan a massive contribution soon, you might need to do a little pruning. These 15 dividend-paying stocks continue to look problematic, according to analyst opinions and fundamental data.

Other stocks are coming up against difficult business environments and other obstacles that could hold them back in the year to come. Sell recommendations can always be dicey in a market as resilient as this one, but these five stocks are best sold or avoided as we turn the calendar to 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.