How a Stock Trade Actually Works

While trades are now commission-free to most consumers, a lot of money is still being made on penny-level differences in the process.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

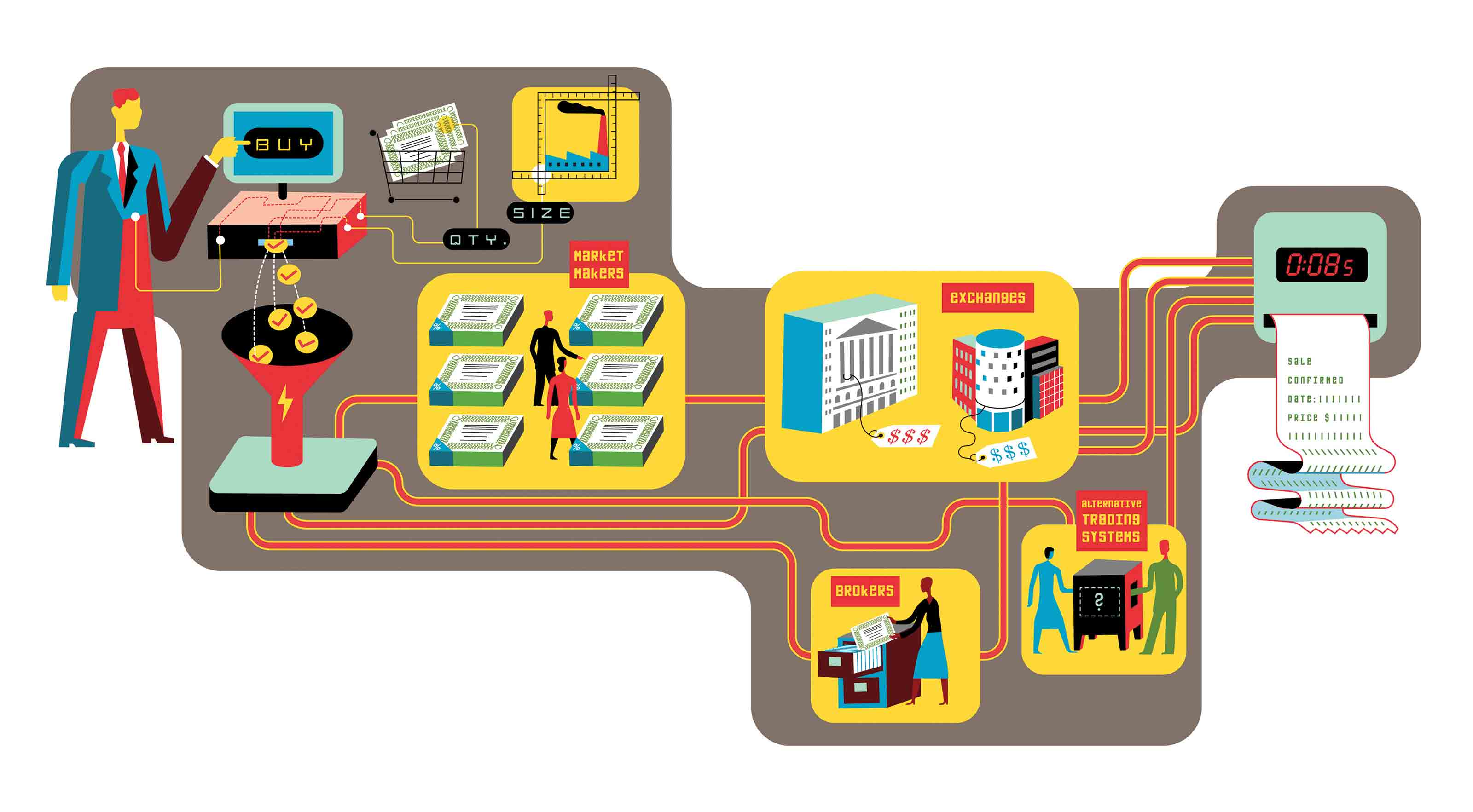

Stock trades are free these days at most online brokers. But where and how your trade is filled can impact your purchase price. And “it all happens in a flash,” says Jeff Chiappetta, vice president of trade and education at Schwab. It takes just 0.08 seconds, on average, at Schwab, from the time you submit your trade to validation of execution. Here’s a step-by-step look at what happens when you place a market-order stock trade.

Step 1: You click “buy”

After you submit a trade but before it is routed to the next step, your brokerage firm will review your trade for certain factors. The size of the company and the size of your trade can influence where and how the order is filled and the price you pay. Fractional orders or oversized orders (say, more than 10,000 shares), for instance, may be filled in multiple transactions. Some firms may scrutinize a trade for whether it could impact the stock’s trading price. An exceptionally large order “could drive the price of a stock up or down,” says Chiappetta, “and we don’t want that.” Some firms also check to see that you have the cash or margin in your account to cover the trade; others may give you leeway to fund the account over the next two business days.

Step 2: Routing

Your broker has a duty to deliver the best possible execution price to you for your trade, which means it must meet or beat the best price available in the market. To do so, it can choose to send your order to one of four venues:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

■ Market makers, including firms such as Citadel and Virtu Financial, “act like car dealers” for buyers and sellers, says James Angel, a professor at Georgetown’s McDonough School of Business. These firms will pay a fraction of a penny for every share that your broker sends their way in a practice called payment for order flow. Although some brokers don’t accept payment for order flow, it’s not necessarily a bad thing: In exchange for the order flow, the market maker also promises to beat the best quoted price you see flashing on your quote page. Say the current market price for XYZ stock is $50. The market maker may fill your order at $49.98 a share. That’s price improvement.

Brokerages must disclose how much they receive in payment for order flow every year. Firms like to tout their price improvement. Fidelity “passed back $650 million in price improvement” in 2019, says Gregg Murphy, senior vice president of Fidelity’s retail brokerage division. This year, the figure may double. Schwab’s Chiappetta says the firm passes back $8 of price improvement for every $1 it receives for payment for order flow. “Net-net, our clients are saving money,” he says.

■ An exchange, such as Nasdaq or the New York Stock Exchange, can fill the order, too. But the exchanges charge your broker roughly 30 cents for every 100 shares traded, says Angel. “Doesn’t sound like a lot, but every penny adds up,” he adds.

■ Some brokers (but not all) may fill the trade from their own inventory. The broker makes money on the “spread”—the difference between the purchase price and the sale price.

■ Alternative trading systems are a last option. Most trades don’t end up here, says Chiappetta, but these systems match buyers with sellers. In some cases, there’s little transparency. “That’s why they’re called dark pools,” says Chiappetta.

Step 3: Confirmation

You’ll get a notification that the order was filled, at what price and what time. If the order was small (fractional, for example) or oversized (for more than 10,000 shares, say), you might see multiple executions, says Murphy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.