Stock Market Today: Nasdaq Hits Fresh Highs Ahead of Key Washington Meeting

Stocks jumped ahead Tuesday ahead of a pivotal meeting of Congressional and White House leaders, who will try to hash out COVID stimulus and a spending bill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

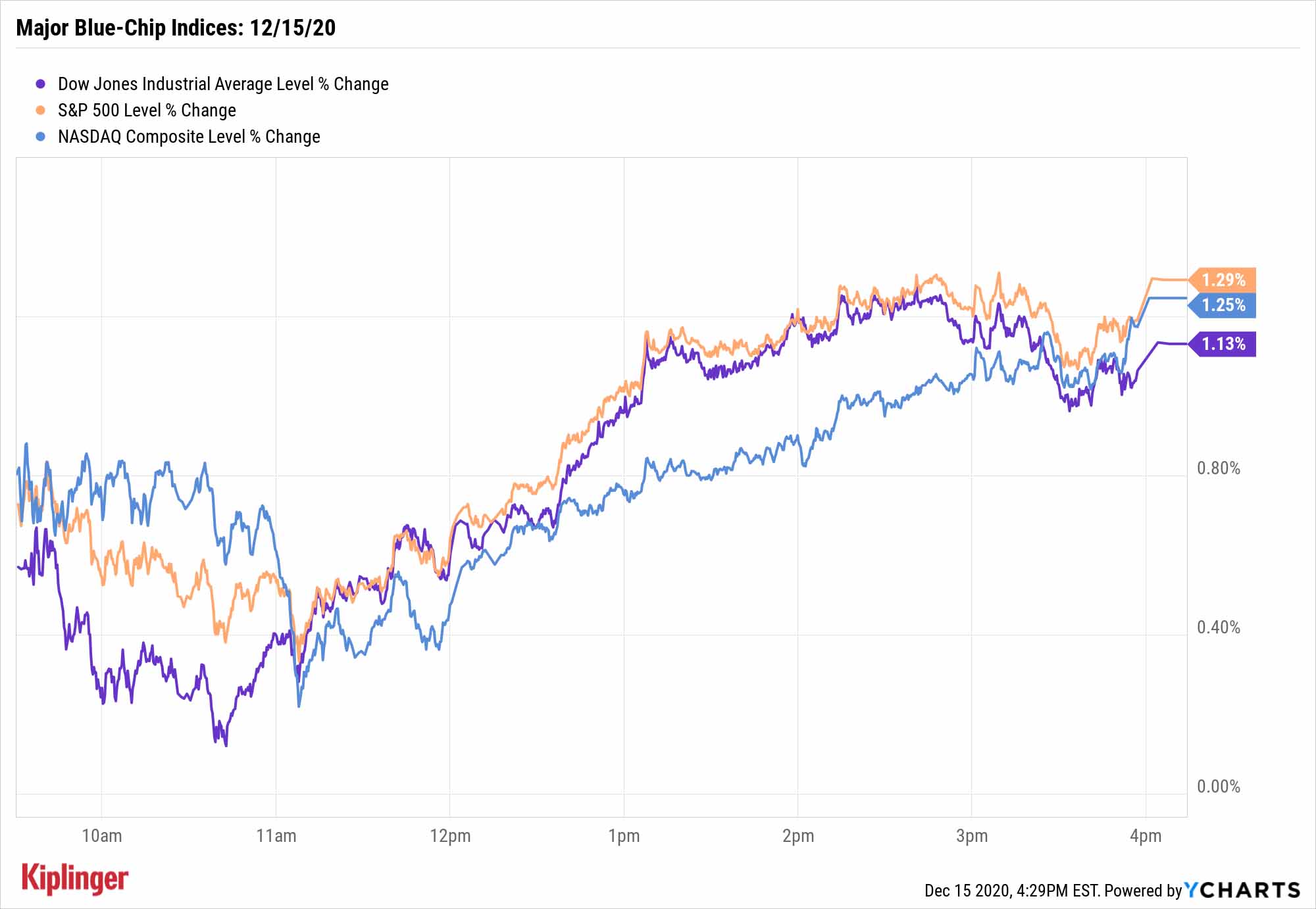

The market's churn around all-time highs continued Tuesday with a solid day of gains as a potential make-or-break moment in COVID stimulus neared.

House Speaker Nancy Pelosi invited Senate Minority Leader Chuck Schumer, congressional GOP leaders and Treasury Secretary Steven Mnuchin to a 4 p.m. meeting to discuss a potential stimulus package, as well as a spending bill that both chambers must pass by Friday to avoid a government shutdown.

Meanwhile, a Food and Drug Administration review of Moderna's (MRNA, -5.1%) COVID vaccine confirmed its high efficacy rate, setting the stage for a potential approval soon.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average jumped 1.1% with some help from Apple (AAPL, +5.0%), which boomed on the back of a Nikkei report, citing unnamed sources, saying the company would ramp up iPhone manufacturing by 30% during 2021's first half.

But the stars of the day were the Nasdaq Composite (+1.3% to 12,595) and small-cap Russell 2000 (+2.4% to 1,959), both of which eclipsed their prior highs.

Other action in the stock market today:

- The S&P 500 gained 1.3% to 3,694.

- Gold futures improved by 1.3% to settle at $1,855.30 per ounce.

- U.S. crude oil futures closed up 1.3% to $47.62 per barrel.

The Best ETFs for 2021

But even some with a bullish outlook for 2021 think the market is ready for at least a short-term breather.

"We believe there is still a little too much enthusiasm in an otherwise healthy environment," says Canaccord Genuity equity strategist Tony Dwyer. "The combination of extreme bullishness, broad acceptance of the economic recovery rotation, and a historic ramp in our favored areas have us looking for a near-term pause in the upside."

Naturally, investors can feel free to use any such pause (or more specifically, any such dip) to settle into positions they believe will help them generate a little more "oomph" in 2021.

We've already begun looking at high-potential stocks across the market's many sectors and industries -- including our best overall picks for 2021 -- and we'll continue to identify opportunities for the new year across the next several weeks. But stocks aren't the only way you can leverage the major themes expected to play out in 2021.

Exchange-traded funds (ETFs) are more nimble and targeted as ever, allowing investors to achieve just about any objective, wide or narrow. Read on, then, as we share our annual look at the best ETFs for the year to come. Whether you're looking for core portfolio holdings, red-hot growth plays or safety valves, this list has something for every investor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.