Stock Market Today: Nasdaq Sets Fresh Record, But Confidence Is Flagging

While COVID stimulus is all but a done deal, concerns about America's extended second wave and U.K.'s mutant strain weighed during a mixed Tuesday session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

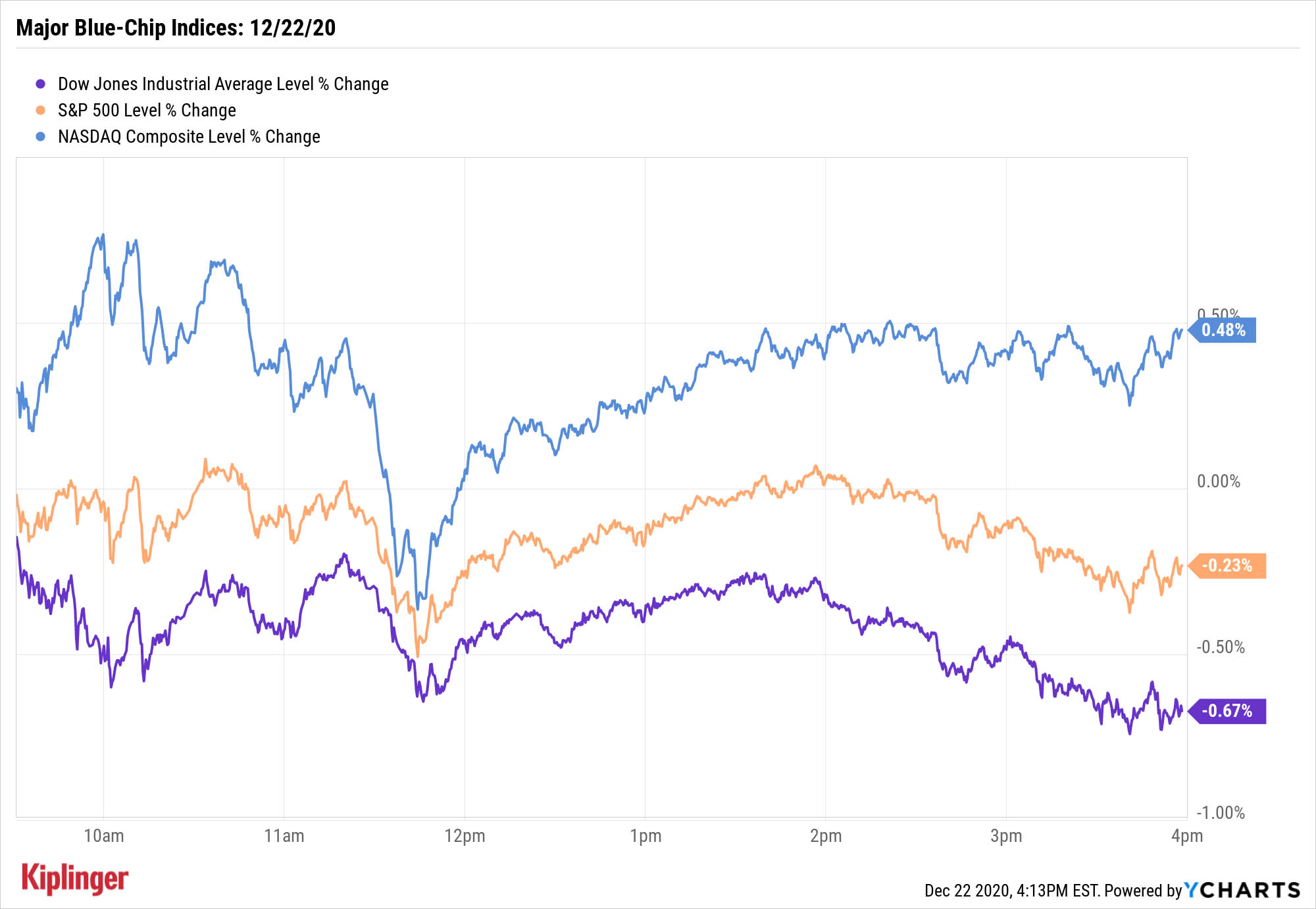

The markets put up mixed results Tuesday as investors continued to digest the imminent passage of a last-minute COVID rescue bill, which both houses of Congress have now green-lit, and weighed long-term vaccine hopes against the world's current coronavirus difficulties.

The U.K. piled on additional lockdown measures in the face of a more contagious strain of COVID-19 – a strain that vaccine makers tried to assure the world could still be battled with their recently approved products.

Here in the U.S., COVID hospitalizations set a new record, and Monday's 1,962 deaths, while far from previous highs, represented a renewed rise.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, the December reading of the Conference Board's consumer confidence index dropped to 88.6, a 4.3-point decline from November.

"Consumers' assessments of the present situation dipped significantly in December," says Pooja Sriram, vice president, US Economist at Barclays Investment Bank. "The index fell 15.6pts, to 90.3, as consumers viewed current conditions as the least favorable since June 2020. The labor market differential, which captures 'jobs plentiful less jobs hard to get,' slipped back into negative territory for the first time since August."

That weighed on the Dow Jones Industrial Average, which slipped 0.7% to 30,015. But Apple's (AAPL, +2.9%) surge – on the back of a Reuters report saying the iPhone maker plans to begin producing an EV car by 2024 – lifted the Nasdaq Composite 0.5% to a record 12,807, and the small-cap Russell 2000 (+1.0% to 1,989) also reached new heights.

Other action in the stock market today:

- The S&P 500 declined 0.2% to 3,687.

- Gold futures lost 0.6% to settle at $1,870.30 per ounce.

- U.S. crude oil futures slumped for a second straight day, losing 2.0% to $47.97 per barrel.

Will the Market Keep Struggling at These Heights?

The market is starting to show a few signs of a short-term market top.

Tony Dwyer, Canaccord Genuity equity analyst, notes that "the market is set up for a period of consolidation/correction given the euphoric sentiment and overbought condition." Based on numerous indicators, stocks are "ripe for a correction from an unexpected news item, and the new COVID-19 strain in the U.K. is providing the news item."

Dwyer says any weakness should be temporary, but it underscores the importance of dividend stocks – whose cash distributions can act as ballast during fits of volatility – in most equity portfolios.

As part of our continued look-ahead to 2021, we've explored a wide range of dividend payers that Wall Street is hot on heading into the new year. But it's one thing to pay a dividend – it's another to actually offer substantial income.

For investors insistent on the latter, we've narrowed our search to 25 highly rated dividend stocks that yield at least 3%. Read on as we help you get to know this group of generous payers (which is oh-so-heavy in energy-sector exposure), including analysis from the pros themselves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.