Stock Market Today: Stocks Slide as They Look for Their Next Spark

Congress battled over whether to upgrade $600 stimulus checks to $2,000 payments Tuesday, but stocks didn't seem to take their cue from Washington.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stimulus was in the news today, but, for the first time in a long time, it wasn't the news.

With $600 direct payments to Americans green-lit, the House on Monday passed a bill that would upgrade those checks to $2,000. Then on Tuesday, Senate Majority Leader Mitch McConnell blocked Minority Leader Chuck Schumer's bid to unanimously advance the bill, though he conceded larger checks might eventually be tied to actions on other GOP priorities – namely, Section 230 legal protection for internet platforms and unsubstantiated voter fraud claims.

But the market's slight losses today didn't appear tied to McConnell's announcement, which was widely anticipated. Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, points out that the markets simply appear ripe for profit-taking:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"U.S. equities in particular are vulnerable to a correction as we enter 2021," he says, adding that small caps specifically are overbought and could lose some steam as investors return to large caps.

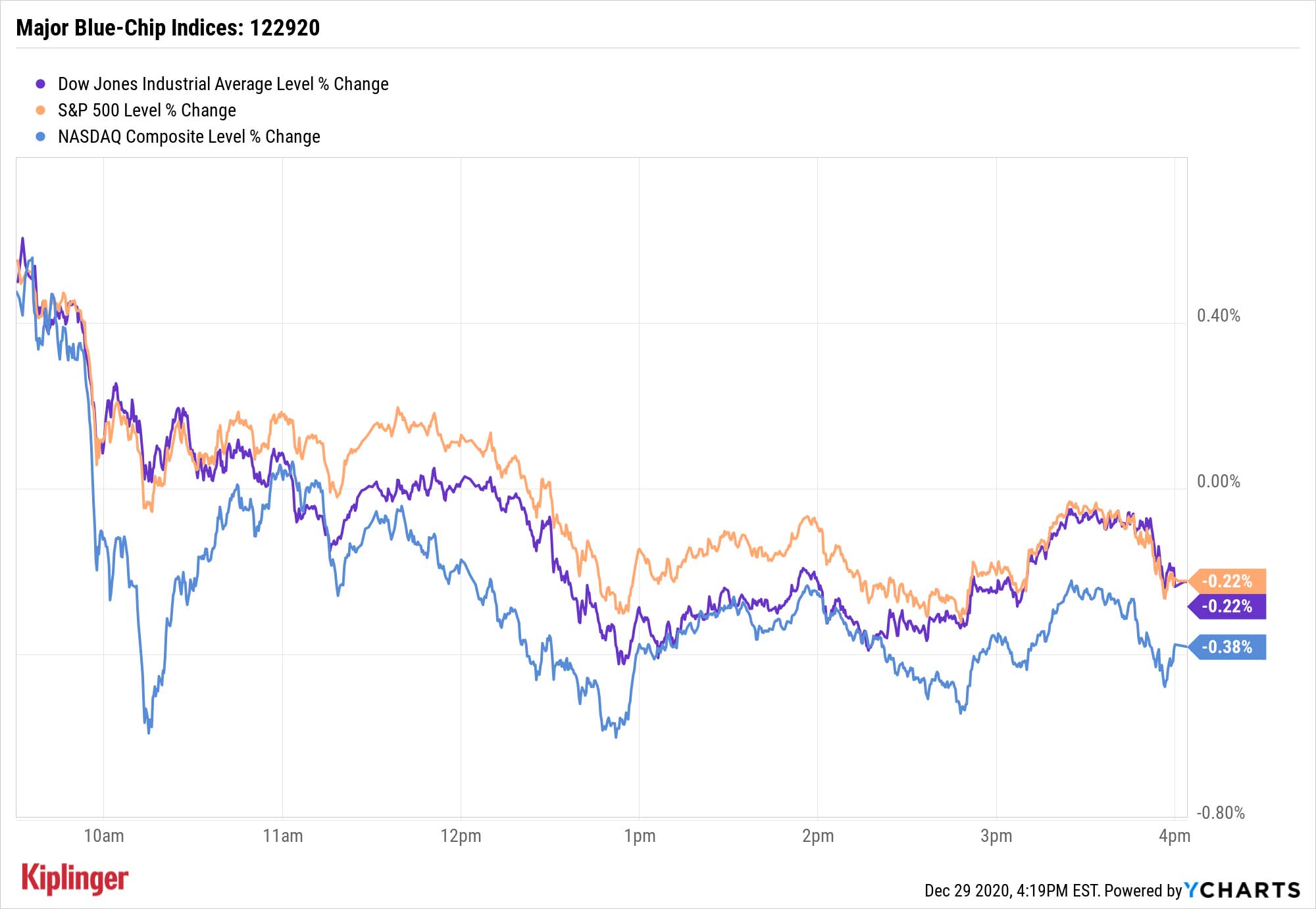

Indeed, the Dow Jones Industrial Average slipped a mere 0.2% to 30,335 on Tuesday, buoyed somewhat by Intel (INTC, +4.9%), which soared after activist hedge fund Third Point LLC's CEO, Daniel Loeb, told the company it had taken "a significant stake" and suggested it "evaluate strategic alternatives."

The small-cap Russell 2000, meanwhile, suffered a much larger 1.9% spill to 1,959.

Other action in the stock market today:

- The S&P 500 declined 0.2% to 3,727.

- The Nasdaq Composite also fell, by 0.4%, to 12,850.

- U.S. crude oil futures gained 0.6% to close at $47.88 per barrel.

- Gold futures eked out a 0.1% gain to $1,882.90 per ounce.

The Best Mutual Funds for Your 401(k)

We have four words for you as we near the end of 2020: Don't neglect your 401(k).

Yes, 401(k)s don't leave a lot of room for active management, so it's easy to set them and forget them – but after the ups and downs of 2020, and given what appears to be a starkly different 2021 market environment compared to this year, your 401(k) could probably use a fresh assessment, and perhaps a few changes.

We've spent the past couple months helping investors become more familiar with the most popular 401(k) mutual funds their plans are likely to offer, including providing Buy-Hold-Sell assessments of products from ubiquitous providers such as Vanguard, Fidelity, T. Rowe Price and American Funds.

But if you're merely interested in the best of the best, regardless of the provider, we've got you covered too.

Of the 100 most popular 401(k) funds, only 23 individual actively managed funds (not including target-date series) earned a Buy rating this year. Read on as we outline 2021's best mutual funds for 401(k) investors, including what it is that puts them above the rest.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.